Mine sweeping is essential to warfare. Soldiers use special devices to detect underground mines and disarm them, keeping them from exploding before they cause harm.

Mine sweeping is essential to warfare. Soldiers use special devices to detect underground mines and disarm them, keeping them from exploding before they cause harm.

At Supply Chain Insights we have been actively working on our own mine sweeping project. Over the course of the last quarter, with help from Cloudera, we built a data lake with information from 1449 public companies (these are mainly North American-based manufacturers, distributors and retailers). We loaded 493 financial metrics from balance sheets and income statements for each company into the data lake for the period of 2004-2016 using YCharts data (YCharts is a provider of syndicated balance sheet and income statement data). In addition, we enriched the data lake with 20 market indexes on cost, growth and economic trends. Our goal was to understand the characteristics of companies outperforming on growth, cost, and value.

The analysis was industry-specific. To complete the research, we assigned each company in the analysis a unique company ID to reduce bias. The company was then assigned to one of 37 peer groups based on the Supply Chains to Admire methodology. In the case of a company spanning multiple industries, we used our judgment to drive the assignment. For example, Johnson & Johnson spans multiple industries (pharmaceutical, medical device and household products manufacturing). For this analysis, J&J was assigned to the pharmaceutical industry. While it would be great to compare J&J to multiple peer groups by division, this data is not available. Unfortunately, we do not have access to the level of data required to perform a more granular analysis of industry-specific assignments based on divisions within a company.

We then mined the data in different ways to understand market impacts.

Does Supply Chain Planning Drive Value?

If you are like me, you pour yourself another cup of coffee to stay awake for a supply chain planning technology briefing. Why? They all sound alike and each company makes similar claims of how the implementation of supply chain planning improves costs, lowers inventory and improves the return on assets. While I believe that these results can happen, I also believe that they usually do not. Over the course of the last decade, I feel that we have gone backwards in the industry driving business results through supply chain planning.

So, what did the data tell us? (I love it when data speaks.)

Supply chain planning implementations having a positive impact on balance sheet resiliency. Let me explain. Resiliency is the ability to drive reliable results at the intersection of inventory turns and operating margin. This is measured by a vector analysis at the intersection of the two metrics for the period of 2010-2016. It is an inverse correlation because the larger the resiliency number the larger the pattern with less reliability.

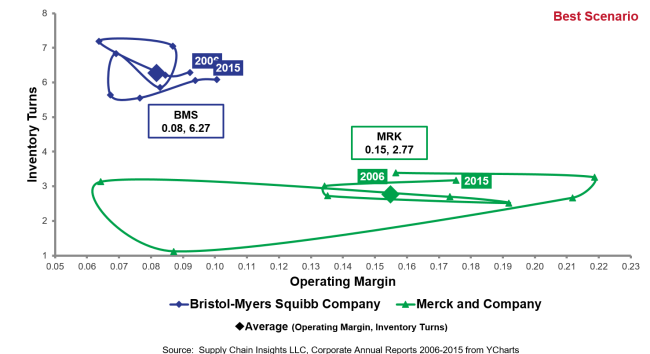

Shown in Figure 1 is an example of resiliency. Note the difference in orbit chart patterns of Bristol-Meyers Squibb and Merck for the period of 2006-2015. While Merck has a better operating margin at 15% as compared to BMS’ operating margin of 8%, BMS’ pattern is tighter and more resilient. The better supply chain planning implementations produce tighter and more reliable patterns at this important metrics intersection.

Figure 1. Resiliency of Bristol-Myers Squibb Company and Merck

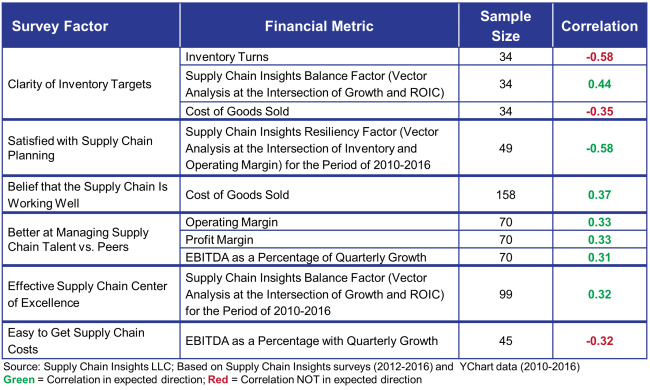

Now let’s have a closer look at the data in Figure 2. Note that there is an inverse relationship between inventory turns and inventory targets. There is also an inverse relationship between inventory turns and cost of goods sold. So, you might be saying, “WOAH! What happened?”

Many companies believe that they are good at planning when they are not. Interestingly, a perceived effectiveness in supply chain planning has a negative correlation to the management of supply chain costs. While there are usually positive impacts at a project level, it does not translate to balance sheet results. We are not sure why. A working hypothesis is the decline in effectiveness of planning systems implemented in the last decade by large system integrators, and the consolidation of planning systems into ERP technology infrastructures. We also believe that it is possibly related to the number of planning systems installed, but not utilized. To be more definitive, we need to finish more analysis. Meanwhile, as a business leader, pour another cup of coffee and take all of the claims with a “grain of salt.”

So if a technology vendor in supply chain planning promises improvements in costs and inventory, be wary. Pour the coffee strong. However, do not throw the baby out with the bath water. Planning can drive results if the organization has the right DNA. Focus on defining supply chain excellence and the appropriate use of the technologies. Test and verify results and build planning into data-driven processes. Do not treat supply chain planning as a typical technology project focused on implementation. Instead, refine the data model and test outcomes.

The implementation of the technology also requires some adjustments in culture. A reactive organization cannot derive as much value as a company that understands and focuses on planning outcomes.

Figure 2. Correlations Between Survey Factors and Financial Metrics

The significant finding is on the impact of supply chain talent on costs. To win, focus on building the right stuff. Clearly identify supply chain excellence and train your teams on the business drivers. (I continue to be amazed at how few companies have defined supply chain excellence at a corporate level. Most have defined functional excellence for a vertical silo of make, source or deliver.) Organizations with clear leadership directed and established role progressions far better. Supply chain planning is not an entry-level job, and the presence of clearly-defined career paths makes a difference.

Similarly, just getting to cost data does not make a difference. Companies must use the data. Organizations need clarity on how to translate functional goals into balance sheet results. This requires leadership.

Technology Shifts

As we shift to the future, supply chain planning as we know it today will be obsolete. The use of machine learning/cognitive computing coupled with the Internet of Things (IOT) will transform decision support. At the Supply Chain Insights Global Summit, we will be discussing the impact of these trends on current practices. I hand-pick the presentations. Join us for the livecast.

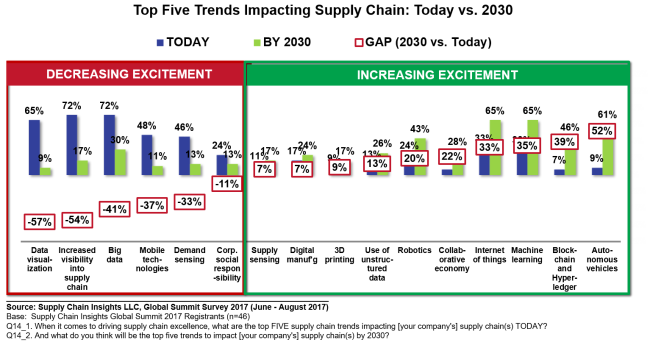

Figure 3. Shifting Trends

Note the shift from big data for big data. A data lake and data mining is not sufficient. We are moving into a world of IOT, machine learning and blockchain. Each of these technologies is new with powerful case studies. The power is in the convergence. The value lies in the use of new technologies to redefine market opportunities and enable new processes. A mistake is using the technologies to make today’s inside-out processes more efficient. What I find fascinating is the convergence of these technologies to drive the autonomous supply chain. These supply chains become value networks. They are outside-in. They sense and respond directly to the customer and adapt to market shifts. The analytics learn and drive new insights. The supply chain becomes an engine for growth and differentiation. The technologies are advancing at a faster rate than the human element to use the technologies to drive innovation and build competitive differentiation.

We hope to see you there and tweeting in a global discussion using the hashtag #imagine2030 . The event starts on September 6th and ends on the 7th. On the 8th, we will play the new discrete event simulation game built with partnership with LLamasoft. There are four learning objectives for the game. Designed to help companies understand the value of outside-in processes and the importance of balancing a cross-functional set of metrics, teams play multiple rounds of a simulated S&OP activity.. On Thursday there will be a book signing of the new soft copy book, the Shaman’s Journal. If you cannot get this year’s Shaman’s Journal book in person at the conference, order it from Amazon. It is now available in a kindle edition.