It is 2:00 AM. I cannot sleep. The thoughts for this blog post are rolling around in my brain, so to fight insomnia, I reach for my keyboard and slowly type.

With Pandora playing in the background and my feet slowly tapping to the beat, my fingers find comfort in the rhythm of typing on the keyboard. This morning, I want to tell you my story of a supply chain leader’s journey from focusing on cost to understanding value. The journey is mine.

Background

The traditional supply chain leader focuses on cost reduction. The focus is myopic. Most efforts center on improving functional behavior to drive efficiency (lowest cost per unit). The conventional belief is that saving money in the back office translates to margin. My learning after twenty years as an industry analyst is that this is not a true statement.

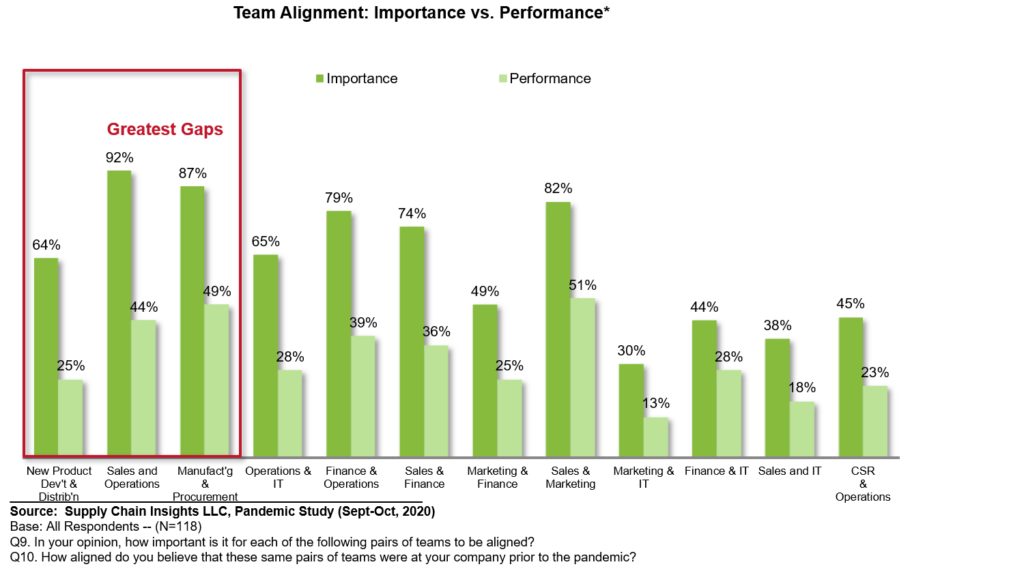

The gap between commercial and operations teams creates waste. The gap shown in Figure 1 is from a research study completed in 2020 before the pandemic declaration. The alignment issue between commercial and operations teams grew three-fold between the end of the Great Recession and the pandemic’s beginning. So, while consultants waft eloquently on the growing volatility and variability in supply chains, market volatility was low (measured by GDP and commodity indexes).

In my research, I found that from 2013 to 2020, most of the variability in supply chains was self-induced. You might say, how so? Think back to the growth of corporate politics in global supply chains, the unabated increase in the complexity of product portfolios, and the focus on siloed-based projects to improve efficiency without clarity on the definition of supply chain excellence. In this period, companies that outperformed invested in centers of analytics. Few investments in centers of supply chain excellence yielded the expected results. The reason centers on the need to migrate from the paradigm of managing costs in silos in the back office while driving growth in commercial processes. The organization is not aligned, and complexity makes this worse.

The rise of social marketing helped companies “yell” their message to micro-markets, but organizations did not improve their ability to listen or learn. The root issues? The focus is on marketing-driven strategies and IT standardization. The answer? Shift to a market-driven agenda based on translating and understanding market drivers and opportunities. Unlock the power of data to help the organization and listen and learn.

Figure 1. Organizational Alignment Research 2020: Pre-Pandemic

Reflection

Last week, while at the Consumer Goods Forum, I rode the elevator with many C-level executives from consumer value chains. Standing in the back of the elevator, I asked them, “What did you learn today?” When asked, most in the elevator would look at this old gal with a puzzled look. My favorite answer was from a short CEO in a gray suit, “The answer to our problems for sustainability and market growth seem simple, but they are very complex.” As he spoke, I smiled. I agree.

The event is a posh affair. Replete with beautiful videos, polished speakers, high levels of security, and elevated bravado, the agenda is a capstone event for the marketing-driven value chain. The value of the mainstage content is low. The main event happens behind closed-door meetings between manufacturing sales teams and retailers. I abhor glitzy events. I miss the GMA and CGT working groups to improve value in value chains.

I harken back to my elevator discussions at this event, “Where are the answers? How do we improve value?”

My takeaway is the answer is not doing more of the same. We need to focus on providing value in value chains. This requires the rewiring of the organization from a focus on inside-out agendas to a focus on reducing waste and improving value for customers outside-in. Marketing-driven value chains are very different than market-driven organizational behavior. To be clear, here I share some definitions:

- Sales-Driven: Alignment to a sales-driven forecast. Focus on volume growth.

- Marketing-Driven: Organizational execution of marketing plans centered on gaining market share and driving growth.

- Budget-Driven. The budget defines plans as a constraint to the organization. Discussions center on compliance with the budget

- Market-Driven: Plans driven by market signals outside-in with organizational alignment to delight customers while meeting the goals of a balanced scorecard, including Growth, Operating Margin, Inventory Turns, Return on Invested Capital (ROIC), and Order Fulfillment objectives.

What Is Value?

Let’s start the rewiring with a discussion of what is value?

When you search the literature, the word value is often used, and seldom defined. My journey is to define value in value chains. The supply chain is a complex, non-linear system that starts with the customer and flows bi-directionally from the channel to suppliers. The delivery of value hinges on building effective channel and supply network relationships. Being a good trading partner is essential. I believe that it is only when we focus on value that we can start to solve the tough problems and throw away the hubris of organizations attempting to align through functionally driven agendas.

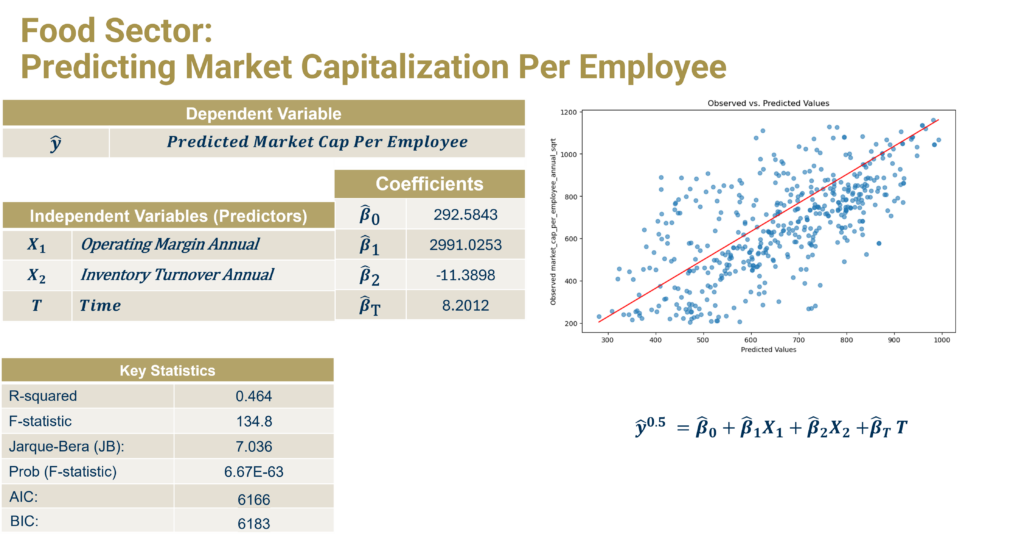

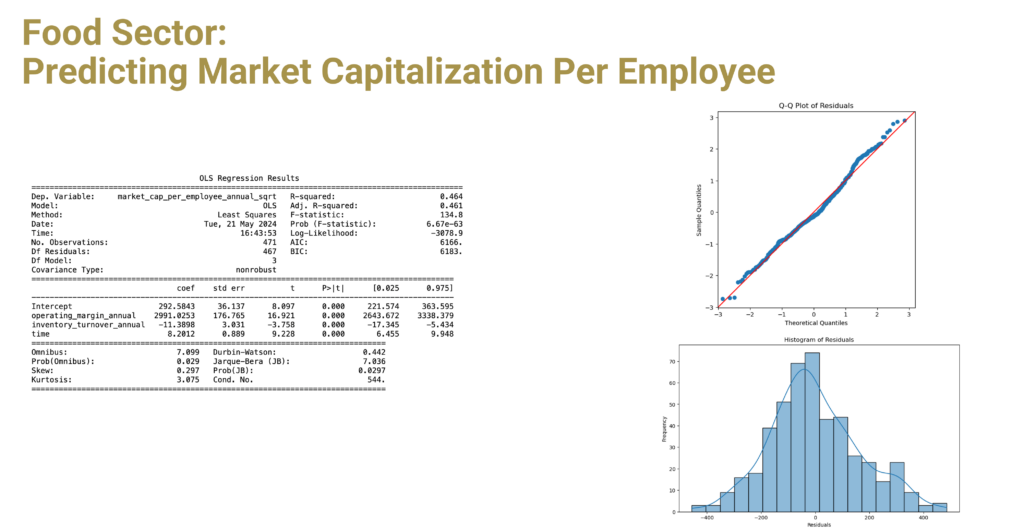

Over the last year, I worked with Georgia Tech to build predictive models by industry using market capitalization by employee as the definition of value. The study is based on data sourced from Y charts for the period of 1982-2023. The regression analysis uses 114 dependent and independent factors by industry. The food sector has thirty-one public companies.

Market capitalization/employee is the value metric used as an objective function for the regression. (This selection could be a subject of a long blog post but is based on eight months of testing.)

The conclusion? In the food industry, 46% of market capitalization/employee is driven by the improvement of two metrics: operating margin and inventory turns. Neither improves if the organization is not aligned. Conventional thinking degrades value by pulling commercial and operational teams apart. My takeaway? A focus on costs by supply chain in a self-serving agenda. The drive for marketing-driven initiatives does not drive value. The answer lies in rewiring the value chain.

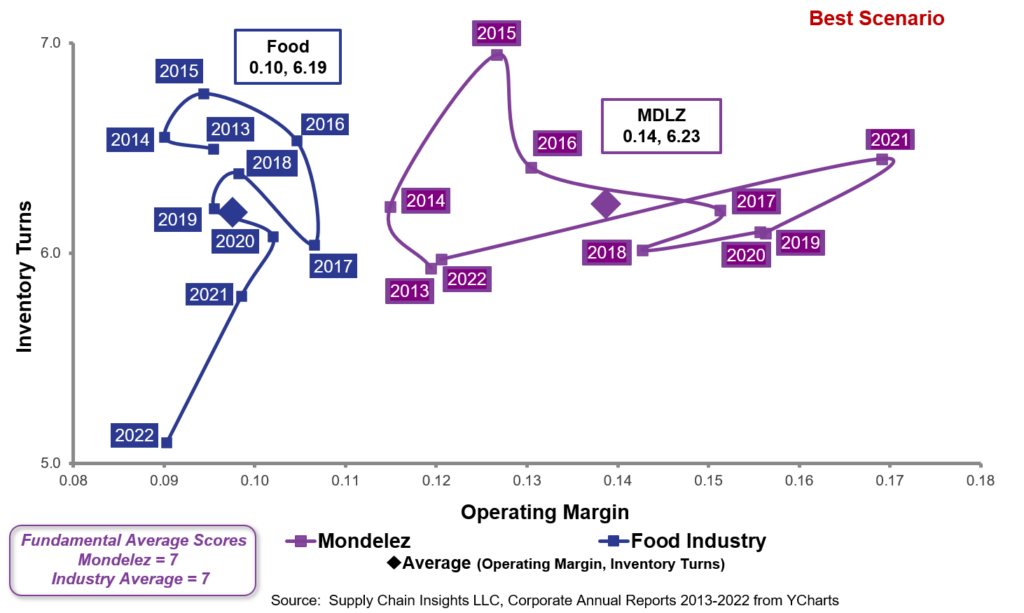

Most of the orbit charts in the food industry look like Mondelez. Industry performance on inventory management and margin declined. As shown in Figure 3, Mondelez beats the food peer group, but the 2022 performance is the same as in 2013. The organizational performance is not resilient. (Note the size of the pattern.)

Figure 3. Mondelez Performance to Peer Group

How To Improve Value in Value Chains

The answer to driving value in value chains is not doing more of the same. We must move from talking heads on panels speaking in high-level superlatives to doing real work. The answer lies in redefining the relationship between the business leader and data. We need to help business leaders listen to and learn from market data collaboratively with peers.

Don’t get caught in the AI everywhere hype cycle trap. At the event, someone shared that AI is like high school sex—lots of talk and little action. I laughed and thought this was very true.

We need to build outside-in processes with minimal latency while embracing new technologies to accomplish this goal. There is a need for a collaborative layer between conventional IT applications and market data to help organizations listen and learn, and then respond effectively. If I was leading this effort within the food industry, here are the steps that I would take:

- Rewire Demand Planning Architectures to Use Market Data and Focus on Flow. Demand management needs to be redefined outside-in based on flow. Current approaches are not sufficient. Companies typically have five to seven demand flows, not one. In the process, focus on sensing baseline demand (market potential) and the impact of artificially shaping/shifting demand patterns. Reduce demand and process latency. To accomplish this objective, eliminate the current processes focused on revenue management. Use the new approach to challenge trade spend that does not increase baseline lift. Help teams visualize/dollarize the waste and profit drain of shifting demand from period to period without improving market potential.

- Invest in Value Chain Improvement. Channel funds are focused on improving order-to-cash and procure-to-pay (transactional systems) systems to sense and use supply network signals. Recognize that no “R” (relationship management) exists in either CRM or SRM. Get serious about network management. Focus less on RFP and RFQ capabilities and use network data to improve reliability and eliminate waste. Redefine processes to be a good trading partner. Evaluate your processes to understand how easy you are to do business with. Build supply chain planning master data systems to align decision support systems with supply variability. Focus on improving reliability.

- Align the Organization to a Balanced Scorecard. Measurement drives behavior. Build a balanced scorecard focusing on the intersection of margin and inventory. Align the bonus incentives of all functions to the balanced scorecard.

These are my thoughts. I welcome yours. So, my question for you is, “How do we improve value in value chains?”