Market-Driven Value Networks: An adaptive network focused on a value-based outcomes. The network senses, translates, and orchestrates market changes (buy- and sell-side markets) bidirectionally with near real-time data to align sell, deliver, make and sourcing organizations outside-in.

Market-Driven Value Networks: An adaptive network focused on a value-based outcomes. The network senses, translates, and orchestrates market changes (buy- and sell-side markets) bidirectionally with near real-time data to align sell, deliver, make and sourcing organizations outside-in.

Today’s supply chain processes are inside-out with a focus on orders and shipments. We have automated transactional data; but there are no systems available to take independent demand data (channel data) and move it through a multi-tier supply chain planning system. These concepts, radically different from the traditional planning systems in the market, fly in the face of tradition. The concepts of market-driven value networks are evolving, but only for the early adopter.

The industry providers of Supply Chain Operating Networks (to enable many-to-many process flows) are consolidating. This puts unlikely assets together; and as a result, market confusion reigns. For example, Infor purchased GT Nexus in 2015; OpenText purchased GXS in 2014, GHX purchased H-Card, LLC today; E2open purchased Terra Technology in May 2016 and Orchestro on Monday. Thoma Bravo purchased Elemica in June 2016. Thoma Bravo now owns Elemica and GHX, and Insight Venture Partners owns E2open.

The solutions evolved from different funding models. GHX, E2open and Elemica started as consortia infrastructures at the beginning of the last decade. GT Nexus evolved as a Software as a Service (SaaS) application for transportation while GXS/OpenText evolved from the EDI VAN technologies. The history of the solutions drives different market behaviors. For example, the consortia players are conservative and struggle with board alignment. (The profitability of the consortia initiative is in opposition to the needs of the technology provider. The consortia board member wants low-cost solutions quickly while the network-based technology provider needs to invest in a product roadmap using new technologies that are evolving in the market.) The legacy EDI VANs struggle with maintenance of existing clients while trying to evolve the architectures for global visibility. The ERP providers struggle to shift the paradigm to outside-in processes supported by many-to-many data models versus the inside-out processes with one-to-one connectivity of the legacy ERP market.

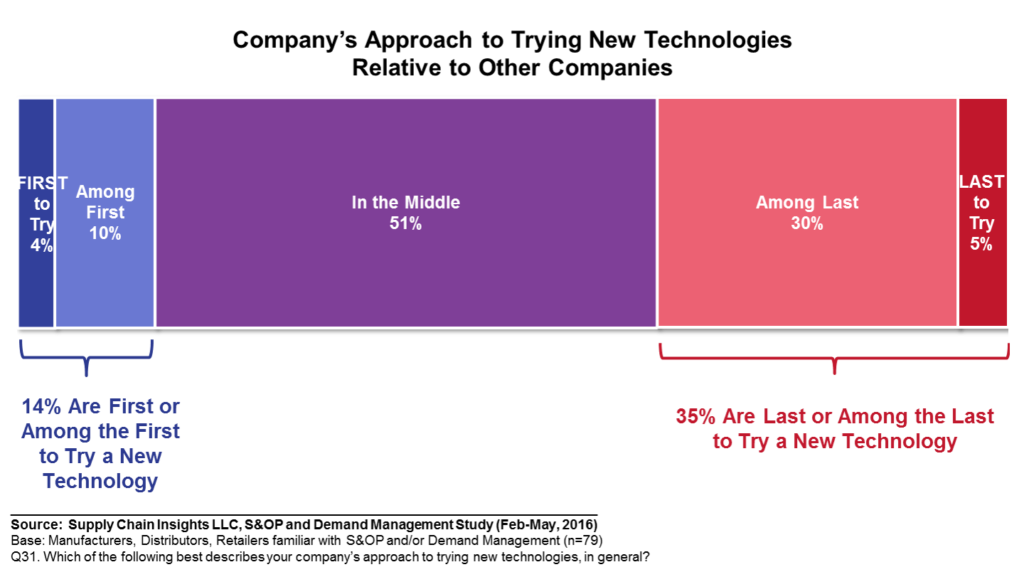

Confusion reigns. The greatest barrier to adoption is “do nothing.” The concepts of cloud-based and streaming data architectures are fuzzy to the average buyer, and the evolution of new forms of analytics, while exciting, are tough to fund in a slow-growth economy with tightening budgets. Only 14% of buyers are early adopters. As a result, most line-of-business buyers have a “wait and see” mentality. A mistake that many of these technology vendors are making is the reporting relationship of marketing to sales. This is a missionary buying market where taxonomies and technologies are not clear. As a result, the vendors need to educate, not just sell to the market. All will compete for the early-adopter mind share. There are fewer early adopters than a decade ago.

Figure 1. Classification of the Market

With this as background, let’s examine the current acquisitions.

On Monday, E2open announced the acquisition of a Demand Signal Repository (DSR) technology provider–Orchestro–for an undisclosed sum. The acquisition, designed to complement the multi-tier demand sensing and long-term demand sensing (forecasting) solutions purchased in the acquisition of Terra Technology by E2open in April 2016, requires development. E2open, following a rough 2014, was purchased by Insight Venture Partners in 2015. The infusion of cash into E2open, coupled with better operating performance, is enabling the roll-up of supply chain assets. The question is will this enable E2open to build a solution to deliver on the promise of Market-driven Value Networks (see definition above)? The market struggles to use independent demand, and the lack of use of Point-of-Sale data into enterprise applications is a market opportunity for consumer-facing value chains. Orchestro struggled with changing leadership and board structures which reduced its ability to compete in the last decade. Terra Technology’s vision can greatly benefit from Orchestro’s understanding of downstream data and the use of the data into demand planning. It has been too long coming. While the promise sounds good, let’s calibrate. The problems are many. The market, wedded to supply-centric demand planning applications, struggles to understand. While the larger consulting market pushes multi-year enterprise resource planning (ERP) applications that are inside-out and not supporting multi-tier planning, the market does not know the difference. So while there is great promise, E2open’s lack of marketing expertise and the ability to move past a sales-driven approach will limit market adoption.

Today, GHX, a healthcare consortia, acquired Omaha, NE-based, privately held H-Card, LLC, known as Hap-X. Hap-X is a payment management solution for healthcare. The Hap-X payment exchange enables healthcare providers and suppliers to select the best value payment type per trading partner through a multi-mode payment platform providing balanced/mutual benefit to each party. This advances the concepts of supply chain finance and disintermediation of traditional banking institutions into the supply chain. Hap-X is a cloud-based company with an Exchange for payments. Payment is the last step in the demand-to-pay (provider) or order-to-cash (supplier) process. Combining ordering, contract price validation, invoicing and payment creates visibility across the entire order to cash cycle for both providers and suppliers. Currently, Hap-X solutions are only available in the U.S. GHX will evaluate expanding these solutions into Canada and Europe. The only other Supply Chain Operating network offering payment and supply chain finance capabilities is the Infor product GT Nexus with the ability to fund apparel via the assets acquired through Tradecard.

Is the market ready for supply chain finance enablement? My view? There is a greater need in healthcare and B2B e-commerce than other parts of the value chain. The mainstream supply chain leader is not ready for a supply chain finance discussion. Instead, most supply chains continue to push cost and waste backwards in the supply chain. As a result, payables to suppliers extended without thinking about the relative increase in the cost of capital. Only 40% of companies have a supplier development program, and only 9% include a focus on supply chain finance. The lack of the market’s readiness for supply chain finance slowed the adoption that GT Nexus was expecting with TradeCard.

So will these assets/acquisition strategies be valuable by the line-of-business leader? I think that the answer is yes, but proceed with caution. Here are some guidelines to consider:

1. Education Is Key. Most business leaders and technology providers are not clear on many-to-many architectures for multi-tier processes. The current focus of investments are on single tier, one-to-one processes. Current technology messaging confuses the market. Stay clear on the value proposition. As a business user, test and validate new approaches. If you are a technology provider, focus on missionary marketing. Don’t assume that the market is ready for your solution.

2. Build a Transition Strategy. If you are a user of one of these solutions, stay very involved with the technology vendor through the assimilation of the technology. Provide business leader input on what drives success and guide the product development roadmap. Expect slow development. These parties are new at working together, and have different concepts which need to merge. Melding the vision takes time.

3. Progress Will Be Slow. Temper expectations. We are making a paradigm shift. Build a guiding coalition to define outside-in processes, but realize this is a major transition in a conservative market. Today’s supply chain is functional. The traditional focus is to drive efficiency in functional processes. As a result, finding funding and commitment for these new solutions will require the rationalization of IT projects that cover multiple years. Start small, build business momentum, and evolve.

4. Expect the Unlikely. The infusion of cash into this market and the push for technology acquisitions will create strange bedfellows. It will take us a while to figure it out. This is both exciting and confusing. Don’t expect Oracle and SAP to stand on the sidelines twiddling their thumbs.

5. Throw Away Traditional Views of Planning. We are moving to multi-tier, outside-in processes. Brainstorm on what this could look like for you, and be ready for the discussion with these new solution providers.

So, are we taking a step forward in building market-driven value network solutions? My answer is yes, but my caution is that the pace will be slow. I think both of these acquisitions are good for the market, but we will have more confusion before we have clarity. Hard work lays ahead of us, and I find this evolution exciting, but I would love to hear from you.

Take Us With You for the Holiday

Last month we published our new Shaman’s Journal. The Shaman blog is now read by 15,000 readers globally. The journal is a collection of best read posts organized in more readable format. Order your copy today to learn more about our research on building the global supply chain. Tuck it into your bag as you leave on your 4th of July holiday.

Last month we published our new Shaman’s Journal. The Shaman blog is now read by 15,000 readers globally. The journal is a collection of best read posts organized in more readable format. Order your copy today to learn more about our research on building the global supply chain. Tuck it into your bag as you leave on your 4th of July holiday.

Also, listen to our podcasts. Download the Straight Talk with Supply Chain Insights app on your iPhone to listen to the testimonials of this year’s Supply Chain to Admire winners on your phone as you travel We announce the winners on July 20th and are busy writing the industry summaries.

Continue the Discussion at the Supply Chain Insights Global Summit

We will continue this discussion at the Supply Chain Insights Global Summit. (Registration is open for the first 125 participants. We limit the number of technology providers to 25% of the audience.) The conference will be live-streamed. We will be discussing five themes:

- Supply Chains to Admire. Financial Results. A critical look at supply chain processes impacting financial results through the Supply Chains to Admire research.

- Economic Vision of Supply Chain 2030. It is hard to know where we are going if we are not clear on the end state. Join us for a critical view of supply chain 2030 through the insights of leading economists.

- New Business Models. Making the Digital Pivot. Sit back and listen as companies share insights on the adoption of robotics, the Internet of Things, 3D printing, manless vehicles, new forms of analytics, and the emergence of new business models.

- Supply Chain 2030. Building Outside-In Processes. Experience the difference between traditional inside-out and new outside-in processes through the use of new forms of analytics and the network of networks.

- Building Supply Chain Talent and Leadership. Insights on leadership, continuous improvement and talent development for emerging markets.

We hope to see you there!

About Lora:

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn.

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn.