Definition

Bookends: To be positioned at the end or on either side of (something).

Colgate. Procter & Gamble. Kimberly-Clark. Unilever. These consumer products global leaders paved the road for supply chain excellence by defining new supply chain practices. Over the last decade each company took a different path to power global growth. With different cultures and competitive natures, tension exists between these leaders. Today, each leader wants to take their empowered team to new supply chain heights. Who is poised to win? The answer lies ahead. In this blog, I share insights on current results.

A Look Back

With slowing growth and rising item complexity, it has not been easy. At Supply Chain Insights we published a report card yesterday. The report analyzes supply chain performance and improvement by the Consumer Products leaders in the period of 2006-2014. In the selection of time frames to analyze, we look at the long-term view, including the recessionary period of 2006-2009, the post-recessionary period of 2009-2014, and the more recent time period of 2011-2014. This analysis helps us to see the trends. It is a study of year-over-year progress. Supply chain leaders make progress in three to five years. It is seldom a step change.

In Figure 1, better than average performance for the peer group is highlighted in light green.

Figure 1. Overall Results on the Supply Chain Metrics That Matter

How Have They Done?

In the last five years, consumer products and food/beverage leaders faced different challenges. It was an easier road for the consumer products giants. Overall, in the industry there is more forward momentum in the consumer products sector than the food/beverage peer groups. These giants drove slight improvements in operating margin, inventory turns and Return on Invested Capital (ROIC) despite a slowing economy. Consumer products companies experienced slow growth while the food and beverage leaders faced declining, often sharp, market trends. They cannot be grouped together. The industries have different drivers.

The Supply Chain Index is a measurement of supply chain improvement. It is a stacked ranking where the low number indicates the greatest improvement.

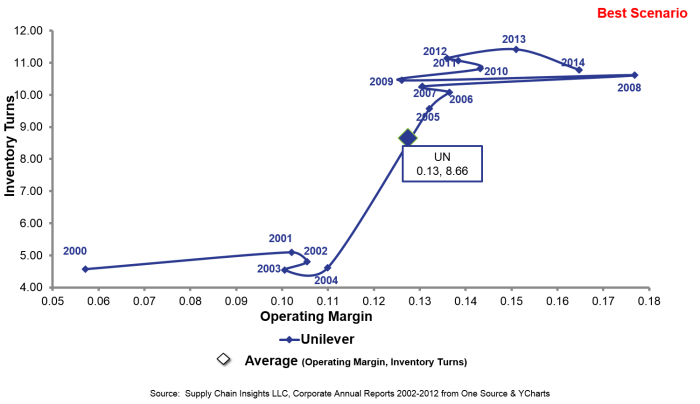

Figure 2. Unilever Year-Over-Year Performance

WOW! Take a look at the pattern in Figure 2. In the period, Unilever drove impressive improvement. The shift from 2004 to 2006 is impressive. This is when Unilever was working on their demand-driven initiatives.

Today, Unilever fails to meet the average performance of the peer group for operating margin. There is still room to go for Unilever to equal P&G and Colgate in cost management. Over the past two years P&G made impressive gains in operating margin and inventory turns, but the company failed to equal the ROIC test for asset utilization.

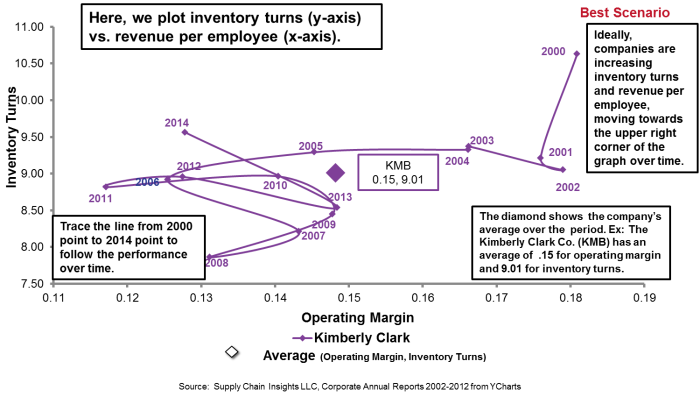

Figure 3. Kimberly-Clark Year-Over-Year Performance

As shown in Figure 3, Kimberly-Clark posts the worst performance in the sector. Facing flattening volumes, the company failed to regain supply chain momentum post recession. It is a strong downward trend.

Why did Unilever make progress and Kimberly-Clark falter? We will never know for sure, but let me share my observations. In the period of 2008-2009, both supply chains made some major shifts. Unilever, for the first time, announced a global supply chain director. With a strong regional culture, the company, up until the selection of Pier Luigi Sigismondi as the Chief Supply Chain Officer, lacked global leadership. Pier pushed a number of important programs, but has failed to break down the functional silos.

In parallel, Kimberly-Clark also made some shifts. Kimberly-Clark moved office locations and did more business process outsourcing than any other peer. (I believe that business process outsourcing shows short-term gains and longer-term detrimental impact.) There was also no one at Kimberly-Clark guiding the three divisions–consumer, professional and hospital–to gain synergies and economy of scale at a corporate operating level. With a strong manufacturing culture, much of the focus was on Lean production systems. The company struggled to break down functional silos which is so important in orchestrating supply chain excellence journeys.

Likewise, while Colgate, Unilever and P&G have built strong supply chain cultures with a focus on training, career moves and technical training, Kimberly-Clark is a laggard. This is especially true in the focus of building global talent in the regions that they serve. The KC teams in Africa, Asia, Australia and Europe are just not equal to that of their peers. While they are great people, they lack the training and skill development equal to the industry. It is clear. This is a global market. The race for excellence will be won on continents other than North America and mainland Europe.

Who Does the Best?

Before beginning this analysis, I must admit that I was a P&G bigot. You can see this in my writing during the period of 2000-2010. I was challenged on this by a client in 2012, and it forced me to do deeper research.

All researchers have biases that must be fought. I was hired into supply chain by P&G, and I had been taught by my colleagues at AMR Research that P&G was the clear supply chain leader. Clearly, I did not question my own bias enough. Throughout industry writing where the term top performer is used, I find that most analysts/consultants/press do not do the hard work to really understand how supply chain performance ties to balance sheet performance. I started this research in 2012 with the writing of Bricks Matter, and it continues today.

Now, based on this analysis, I can clearly see that P&G made incredible gains over competitors until 2005; but this performance could not be sustained. With the acquisition of Gillette and other business units, P&G struggled. As an $82 billion business, building a global team with changing products was a tall order. (Unilever is about 1/2 the size of P&G.) In interviews with the P&G team, I strongly feel that item and business complexity bogged down results. Complexity can easily throw the supply chain out of balance.

In contrast, Colgate built core capabilities in the period of 2005-2012 which drove highly performing supply chain capabilities for cost and ROIC. (Colgate is about 1/5 the size of P&G.) In the past two years, while progress has slipped on inventory and cost to peer group, the Colgate team still posts the strongest performance. The global team infrastructure and training is an enabler. Colgate is a strong global player. Few companies have the competence in global/regional governance and business decision making capabilities of the Colgate team.

Figure 4. Comparison of Colgate and Procter and Gamble for the Period of 2006-2014

The question for me is, “Will P&G overtake Colgate in supply chain performance in the next two years?” The race is on. Both companies are deeply invested in new programs and processes intended to take supply chain improvement to a different level. The paths are different, but the focus is on embracing outside-in processes.

New Bookends

In 2013 I wrote a post on the “Two bookends of supply chain excellence in consumer packaged goods.” Times have changed. At that time I declared Colgate the winner and Unilever the laggard. While the positions have shifted, the race continues. While today, Kimberly-Clark is the clear laggard and Colgate is still the leader, Colgate must reverse the current trend to continue to be the top performer.

Good Times Ahead

I am writing this post from Egypt. Tomorrow, I will be witnessing the Grand Opening of the newly-expanded Suez Canal. It is exciting to see a country so excited about building global transportation infrastructure. I hope this exuberance spills over to North America to rethink the port systems. I will place these posts on Forbes and Linkedin.

Meanwhile, on the plane back and forth between continents, I will be working on deep, new, provocative content. There is nothing like plane time to write. My goal is to pen great materials for the supply chain visionary.

Look for a new report each week as we prepare for the launch of the Supply Chain Insights Global Summit and our new work on the 2015 Supply Chains to Admire. We post this content openly on slideshare and on our website. The work is independent and deeply rooted in research and analysis. Our goal is to help the world build better supply chains. I just don’t think that this is possible by putting research behind a paywall.

I look forward to hearing from you and getting your feedback on the work that we are doing. We would also love to see you at our upcoming Supply Chain Insights Global Summit. Spark a new conversation, network with a supply chain visionary, and build a new strategy. These network interactions at the Global Summit make this happen.

_____________

Life is busy at Supply Chain Insights. We are working on the completion of our new game—SCI Impact!—for the public training in Philadelphia in August and developing the content for the Supply Chain Insights Global Summit in September. Our goal is to help supply chain visionaries around the world break the mold and drive higher levels of financial improvement.

Life is busy at Supply Chain Insights. We are working on the completion of our new game—SCI Impact!—for the public training in Philadelphia in August and developing the content for the Supply Chain Insights Global Summit in September. Our goal is to help supply chain visionaries around the world break the mold and drive higher levels of financial improvement.

About the Author:  Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push an organization harder to improve performance.

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push an organization harder to improve performance.