Sales and Operations Planning (S&OP) is in a renaissance. The reason? With growth slowing and complexity rising, S&OP is more important than ever. It is not sexy, and it requires hard work; but the greatest value of S&OP is profitable growth.

Sales and Operations Planning (S&OP) is in a renaissance. The reason? With growth slowing and complexity rising, S&OP is more important than ever. It is not sexy, and it requires hard work; but the greatest value of S&OP is profitable growth.

The technology market is rife with unsubstantiated claims and myths. Like a hammer looking for a nail, it seems like every vendor I meet now has an S&OP solution. It is comical. For many, I shake my head and smile. Putting a name S&OP on a piece of collateral does not help a vendor make my list. Each year, I publish a report analyzing the technologies in the S&OP space. Finishing this report was my focus this week. It took me six months to do the research and sixty hours to write the report.

Needless to say, completing the report was a lot of work. I sent the report to technology vendors listed in the appendix with a deadline for feedback on factual accuracy for 5:00 PM EST on Wednesday. Only 15% met the deadline and 60% gave me far more information than a factual review. I smiled as I read the multiple opinions.

Squeezing in this much time to write this deep report between working on the Supply Chain Insights Global Summit and finishing customer deliverables is tough. However, I think that it is important work. Many clients ask me about the vendors and I think that it deserves a comprehensive review. I find it easier and more comprehensive to send a report for review than to answer each email.

The analysis is too complex to use one of those sexy and over-marketed magic four-box charts. It is about more than magic. The technology choices are not black and white. In analyzing the options, there are many subtleties and contextual issues. In my view, a four-box model by an analyst firm is a cop-out. It is just too easy. In this report, I list 35 vendors and share the strengths and considerations based on demonstrations, discussions with references and my discussions with clients. I will watch the comments on this new one closely to see how to improve the report.

What Is New?

I have done this report twice before–once in 2012 and again in 2013. It is a rewrite. Why do it again? It is a well-read report. Business leaders request it. The last one on slideshare had over 3700 views.

The news? Here is my take:

- New Solutions. New vendors. New technology is evolving. The entrepreneurial spirit is attracting new vendors to this space. This year, I added Anaplan, Exceedra, o9, and Orchestr8 to the report. Technologies natively written as Software as a Service (SaaS) solutions are entering the market.

- For the Love of the Cloud. Only three vendors on the technology list do not offer a cloud-enabled service. This is a major turnaround. When I wrote a summary report at AMR Research in 2007 and 2009, there were two or 6% of the market. While we may argue the definitions–I define hosted as a solution that operated in the cloud for the client and SaaS as a more stringent definition including automatic software updates–the primary deployment today for S&OP is cloud-based services. In the report, 95% of the solution providers offer hosted solutions and some version of SaaS. S&OP is moving to the cloud. I think that this is great for line-of-business users.

- Financial Ownership. Like musical chairs, the ownership structure of the vendors is changing. Since the last report, Kinaxis successfully launched an IPO on the Toronto Stock Exchange, E2open launched an IPO and then went private with a buy out by Insights, IBS and Steelwedge sought new rounds of capital, and WAM Systems and Acorn Systems have new owners. In addition, 85% of the vendors in the multi-tier inventory optimization market that I wrote about in 1995, are now part of larger platforms.

- Visualization. Visualization is improving. Two vendors –Tagetik and Terra Technology–adopted QlikView into their solution, Logility introduced a visualization application that crosses over applications in a heterogeneous environment. JDA’s interface is greatly improved. Data visualization is quickly advancing in the tools.

- User-based Configuration. One of the issues that clients face is the ability to configure the application to meet their needs. In the case of Anaplan and o9, user-based configuration becomes easier. In these applications, the user can configure the solution more readily.

- Evolution of S&OP Options for SAP. I like what SAP is doing for SAP IBP. In many organizations, SAP is a planning system of record for hundreds and thousands of planners. The needs for collaboration and visibility of these planners are high. In my opinion, the design of the solution is ideal for the more casual and line-of-business user. (This perspective is not shared by SAP.)

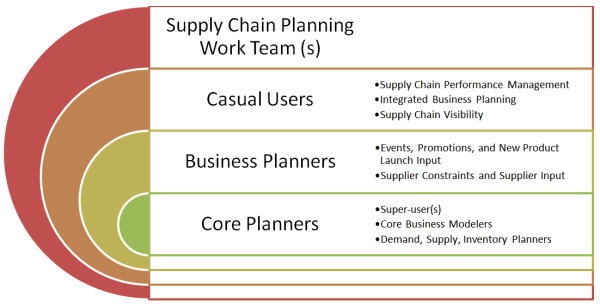

A planner is not a planner. In these larger organizations, as shown in Figure 1, the needs for integration, collaboration, and role-based security are high. This is especially true for the casual and business planners. While SAP still has not proven itself to me as the right technology for core planning (either SAP HANA or SAP APO), I like the concept of SAP IBP for the casual users and business planners to improve collaboration and visibility. The problem is that it is new, and in reference calls with users, companies are still working out the kinks. This is not unusual. It happens with all systems. The solution needs to mature, but the good news is that SAP is investing in supply chain.

Where are the issues? Currently references report issues with the HANA Cloud Integrator and HANA support. When clients call for support there are two desks: one for the SAP IBP S&OP application and one for the HANA cloud integrator. While clients report great support from the SAP S&OP team (strong accolades) , there are struggles with the second customer support team to support the HANA integrator. Working through it takes time. It is not insurmountable. The documentation is evolving and there are few trained consultants. This is all normal. Vendors have issues with new solutions. This is why they are best adopted by companies with a high threshold for business pain and a strong understanding of new solutions.

In the development of the report, I spoke to six SAP Client References now using SAP IBP for S&OP. SAP supplied none of the references. Instead, the references came from my client contacts and through connections with systems integrators. (I often find that references from the technology client are the worst references. They are typically groomed by the vendor.) In summary, I think SAP IBP S&OP is promising, but it is only for the early adopter with strong SAP skills. It is costly, and evolving, but I think promising. (For more, please read the report and let me know your thoughts.)

What Are the Myths?

Despite the hype and the hoopla, nine myths in S&OP technology remain. I detail these myths in the report, but I think that they are worth noting here.

Myth#1: Companies don’t need a technology to drive an effective S&OP process. In my research each and every day, I am constantly reminded that you cannot start and end with technology. S&OP is 60% change management/organizational culture, 30% process and 10% technology, but you cannot reach your goals without a technology. The reason? It is just too complicated.

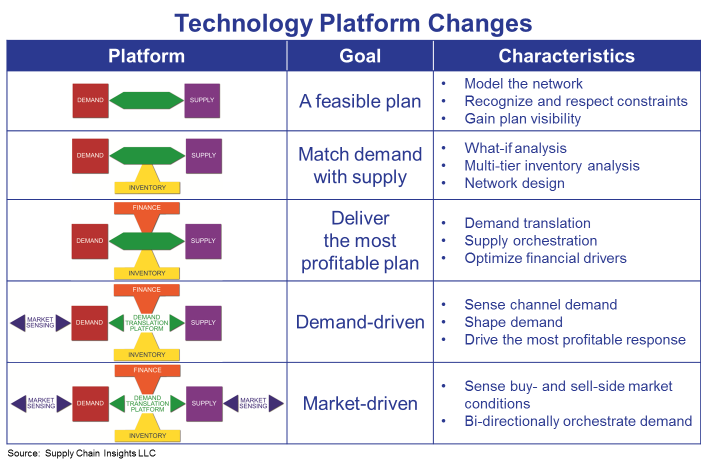

The technologies evolve over time, and move through stages. Companies have to put together the pieces to drive a solution. The definition of demand translation is the understanding of changes in product mix and management of demand changes, It is the green arrow in Figure 2. The ability to translate–not just integrate–mix changes and understand the impacts is an important criteria for building the S&OP foundation.

Figure 2. Stages of Technology Evolution with Process Maturity

Myth #2: S&OP can be effectively modeled using a spreadsheet. Many companies over the last decade built Excel ghettos and implemented reward systems for spreadsheet jockey(s). When I go to meetings, I laugh as companies argue about which spreadsheet is accurate. I am convinced that the complexity of today’s supply chain as a complex system cannot be modeled using an Excel spreadsheet. Additionally, I believe that the use of multiple spreadsheets creates uncontrolled chaos and unnecessary work.

Myth #3: An 80% technology fit is good enough to drive a successful S&OP process. I have heard this a lot from the consulting providers, and I used to believe it. I do not anymore. The devil is in the details, especially in the area of supply. Modeling supply to develop a feasible plan requires the right technology. The problems are tough: issues like alternate bill of materials, floating bottlenecks, constraints, customer segmentation strategies and multi-tier inventory optimization requires robust technology.

Myth #4: Standardize: One solution provider is all one company needs. Organizations are bigger and bigger with over 2700 mergers and acquisitions in the process industries within the last seven years. Deep inside the business are many supply chains: each with a different need. While IT standardization sounds like the right thing to do lowering IT costs and better focusing IT resources, there is an opportunity cost. To do S&OP well, which leads to cost savings, improved customer service and better inventory, the company must effectively model supply. While demand technologies are more ubiquitous–with one solution having a better chance of meeting the needs of multiple businesses, the supply technologies are different. Supply modeling requires careful tailoring based on business modeling to drive the value.

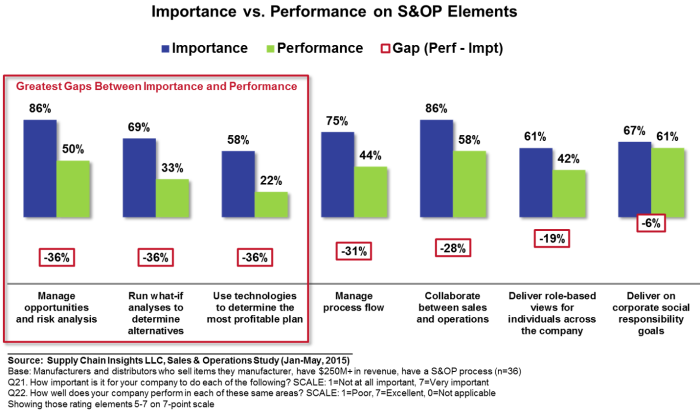

Myth #5: S&OP is dead. Integrated Business Planning (IBP) is the new solution. I frankly have little time to argue the names. Many people do. Many consultants have made IBP the horse to ride to drive new revenue. I feel that IBP aligns the organization cross-functionally to move the organization faster to maximize opportunity and mitigate risk; but as shown in Figure 1, I think that it is a stage in maturity, not the end state. I think that the end state is the outside-in value chain process that senses and adapts with the market. All companies should start with the building of a feasible plan–a plan that can accurately model supply constraints. As seen in Figure 3, one of the greatest performance gaps is developing and managing a profitable plan analysis. However, this is not the starting place on process evolution. Companies must build to this stage.

Figure 3. Process Gaps in Sales and Operations Planning

Myth #6: Real-time S&OP is the desired outcome. While the clock speed and cadence of business is increasing, there is still the need for planning. Planning looks at a longer-term view: evaluating and looking at business in the future for months 12-18 months out. It takes time and focus to plan. When organizations are head-over heels reacting, they lose the benefits of planning. Organizations must not confuse the urgent with the important. The most effective S&OP plans are monthly with weekly execution processes.

Myth #7: Tight integration with Enterprise Resource Planning (ERP) improves the S&OP process. While transactional systems need to be tightly integrated with operational systems, I don’t think that it is as necessary with planning. (Operational systems are warehouse management, available to promise, and transportation planning.) It is less important for planning. The transfer of data is more periodic with weekly and monthly updates of the optimization data tables, and all technology vendors have built standard APIs for data transfer.

Also, just because the data comes from the same vendor–Oracle, SAP or Infor–does not mean that the data is cleaner. Data cleanliness takes rigor and discipline. It is an organizational characteristic.

Myth #8: Tight integration with the financial budget drives the best results. A financial budget is quickly out of date, but it is an important baseline for business management. In the most mature S&OP processes, S&OP is an update to budget forecasts updates. However, if the goal is to maximize value, the S&OP process should never be constrained by the budget. This is an area of tension.

These are my thoughts. I would love to hear from you. Next week, I am on the road working with clients. I am glad to be back in the United States. Travel in Egypt for the Grand Opening of the Suez Canal was exciting to see, but Egypt in August is very hot.

_____________

Life is busy at Supply Chain Insights. We are working on the completion of our new game—SCI Impact!—for the Supply Chain Insights Global Summit in September. We would love to see you there! Our goal is to help supply chain visionaries around the world break the mold and drive higher levels of financial improvement.

Life is busy at Supply Chain Insights. We are working on the completion of our new game—SCI Impact!—for the Supply Chain Insights Global Summit in September. We would love to see you there! Our goal is to help supply chain visionaries around the world break the mold and drive higher levels of financial improvement.

About the Author:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora wrote the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. As a frequent contributor of supply chain content to the industry, Lora writes by-line monthly columns for SCM Quarterly, Consumer Goods Technology, Supply Chain Movement and Supply Chain Brain. She also actively blogs on her Supply Chain Insights website, for Linkedin, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research at Temple or knitting and quilting for her new granddaughter. In between writing and training, Lora is actively doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. She thinks that we are never too old to learn or to push an organization harder to improve performance.

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora wrote the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. As a frequent contributor of supply chain content to the industry, Lora writes by-line monthly columns for SCM Quarterly, Consumer Goods Technology, Supply Chain Movement and Supply Chain Brain. She also actively blogs on her Supply Chain Insights website, for Linkedin, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research at Temple or knitting and quilting for her new granddaughter. In between writing and training, Lora is actively doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. She thinks that we are never too old to learn or to push an organization harder to improve performance.