Another night staring out the window from a dark airport terminal. I squint to look at the terminal monitor hoping that the two-hour flight delay changes. I brace myself for a late flight for a 2:00 AM arrival as the clock ticks: echoing time lost.

Today, I ended a 45-day speaking tour. As COVID restrictions lift, I am back on the road, albeit not as wild and crazy as pre-Covid days, but I am dragging. I am also struggling. I find companies having the wrong discussions.

Investments in Data-Driven Capabilities May Not Yield Better Decisions

On this tour, I heard Jeff Ma, a former member of the MIT blackjack team, speak on the use of analytics to make better decisions in “beating the house.” I also heard Michael Lewis, author of Moneyball, speak on using data to improve the odds of player selection in Baseball. Both are compelling speakers espousing the use of data and mathematical insights to help beat the odds.

I love the stories but question the fit of the metaphor(s) for a supply chain conference. The reason? In both cases, there is a clear definition of “winning.” The rules of the game and associated outcomes are clear in both Black Jack and Baseball. In the world of supply chain management following 33 months of disruption, this is not the case. We are re-writing the rules. The outcomes are less predictable or clear.

Why are the rules not clear? While shipping craziness is abating, the issues and implications of the Russian-Ukrainian war, energy shortages in China and Europe, food instability in Africa, and the global water crisis reverberate as disruption after disruption in the supply chain.

While one might argue that the availability of better data and insights can help companies make better decisions, let me share why I struggle with the analogy. The issues of process latency—a company’s ability to align on data to make a decision—are greater with the heightened levels of disruption. The larger the organizational alignment issues, the longer the decision-making time. Process latency can range from days to weeks. In an organization, bad news travels slowly, while good news tends to travel quickly. As a result, in a market downturn, process latency increases. The larger the organization, the more tension with conflicting functional metrics making decisions more difficult.

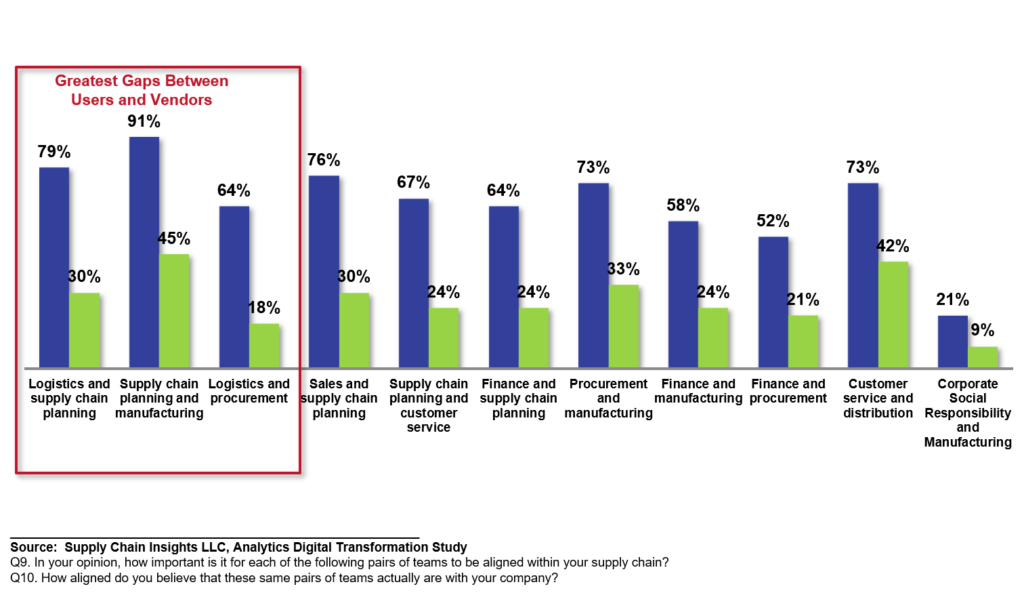

Note in Figure 1 the gaps from recent research between supply chain planning and manufacturing, logistics, and sales. The gap between logistics and procurement; and logistics and customer service increases process latency. The gaps are large and growing as organizations become more reactive.

Figure 1. Alignment in Organizations in the Summer of 2022

The impetus to Re-Write the Rules

Last week, Nike reported first quarter 2023 results. With the announcement, the stock market tumbled. While revenues increased 4% year-over-year, gross margin decreased by 44.3%. Inventories increased by 44% due to supply chain volatility. While the North American market sales grew by double-digit, they did not offset the declines in sales in China.

Nike’s supply chain capabilities –as verified by being a Supply Chains to Admire Award Winner for two consecutive years– are above average. These results herald upcoming issues for future manufacturing reporting earnings calls. Nike’s results follow the announcement by Ford for the 1M$ shortfall due to the increase in supply costs last week.

One day later, Levi reported net revenue growth of 6.7%, while net earnings fell to $173 million, or 43 cents a share, from $193 million, or 47 cents, a year ago. Inventories grew year-over-year by 43%. See the pattern? Companies don’t have a revenue problem. Coming off a period of high growth, companies are struggling with margins and inventory. The timing is unsettling we face a new wave of market uncertainty—a cooling economy and potential recession lie ahead. In the face of future demand and rising inflation, now is not the time for companies to hold excess inventory. (On a side note, in qualitative interviews, companies share that their worst customer service levels happen when inventories are the highest. A stuffed warehouse is inefficient, and most companies have the wrong inventories.)

The balance sheet shortfalls and the subsequent boardroom discussions will redefine the rules for the supply chain. These discussions will also educate the executive team. (One of the largest gaps in supply chain management is the executive understanding of supply chain management).

While ocean container volume fell 8% in September and ocean transportation prices are 71% lower year-over-year, don’t get lulled to sleep. The issue is not revenue. Consumer spending remains above 2019 levels. While demand is cooling from the overheated state of the last 20 months, history is not a good predictor of demand, making traditional demand planning techniques useless. Demand continues to be uneven and unpredictable.

Why Does This Matter?

The failure to manage margins and inventories in the face of variability changes the discussion at the board level. The rules are changing:

- Demand. The order is not a good proxy for demand. With heightened disruption, there is a need to focus outside-in to translate market changes and align the organization quickly.

- Metrics. Functional metrics need to be abandoned to focus on balanced scorecard outputs. The functions need to be aligned to reliability while managing balance sheet trade-offs. A focus on functional metrics throws the supply chain out of balance.

- Planning. Traditional definitions of planning are not sufficient. As shown in Figure 1, the planning groups are not serving any part of the organization well.

- Closed Loop. The goal to tie planning to execution remains, but the gaps in planning are a barrier.

- Redefinition of Supply Chain Execution. The growth in analytics for real-time warehouse and distribution data will redefine supply chain execution taxonomies to better synchronize markets to organizational outcomes making traditional TMS and WMS solutions obsolete. The lynchpin is the value of a real-time perpetual inventory signal. A real-time perpetual inventory signal offers great promise. The barrier is redefining supply chain fulfillment processes to use real-time data effectively.

- The Role of Enterprise Data. The promise of tightly integrated ERP to planning is failing in the face of variability. Companies relying on planning solutions from ERP expansionists—Infor, Oracle, SAP, etc.—struggle to a greater degree than their peer groups in the face of the intense variability.

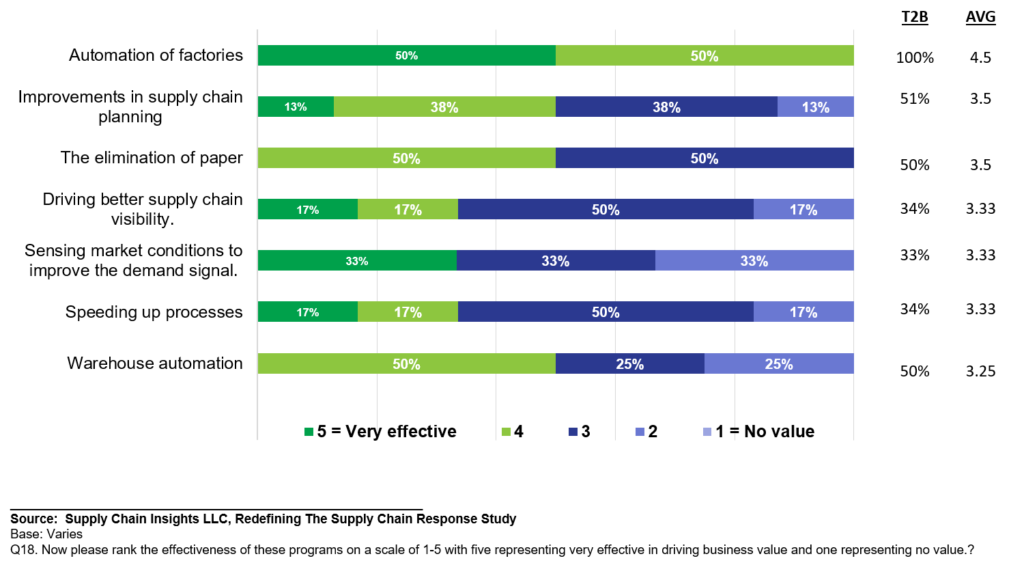

- Digital Transformation. Digital programs are full of hype and over-promise. In the industry, there is not one consistent definition. Instead, there is a multiplicity of programs. Today, investments in manufacturing automation are viewed as the most successful by business users. Continued investment in ERP programs as a digital transformation program has a lower level of business user satisfaction.

Figure 2. Current Satisfaction of Business Leaders with Digital Transformation

The Opportunity to Redefine Time

Just as Fred Smith, Founder, and CEO of FedEx, redefined time in a new model for overnight delivery, there is an opportunity to redefine time in the redefinition of supply chain planning and execution. I would like to see companies consider three case studies in their digital transformation initiatives. Here is some detail:

- Planning. The current focus of supply chain cycle management—order-to-cash, procure-to-pay, procure-to-receipt, and order-to-shipment are supply centric. The opportunity is to define and shorten the signals in the demand process: the time to understand market shifts and make a decision (market latency), consumption to order (demand latency), and the time for the response of demand to supply (process latency). In current processes, market latency is 4-6 months, demand latency is 1-3 months, demand shaping/sensing analysis to baseline lift, and process latency is 2-6 weeks. The answer? Building outside-in processes based on demand flows. The good news is that today’s technologies make this a possibility. The bad news is that there is no software to buy or consulting group that understands how to implement the concepts. While the concepts are proven through Project Zebra testing, changing processes and technologies takes time. Recently, three planning technology companies agreed to additional testing to prove the concepts. Over time, based on the compelling results, the changes will make it into the software and process definition. In January, I will be doing a series of training classes to help companies understand the principles and concepts of outside-in processes.

- Order Promising. I love the opportunity for NoSQL, no-code software, to improve perpetual inventory. Imagine the possibility of having a real-time perpetual inventory signal that is updated and accurate every fifteen minutes. Think about the power for last-mile delivery and improving the customer-centric response. The goal is to reduce the time for customer order commitment. The good news is that early adopter testing proves this approach.

- Supply Chain Visibility. I find most of the supply chain visibility solutions to be too traditional and supply-centric. But imagine a decision support framework that can analyze demand and supply variability and power an in-memory model to help companies drive bi-directional decisions at the speed of business. The goal is to reduce the time to make a cross-functional decision. While most companies speak of digital twin capabilities, they are missing the opportunity to define a decision support architecture to redefine work—collaboration on models across functions, saving and archiving what-if models, fine-tuning based on simulation, approval based on well-honed governance models, and improving the feasibility of the plan based on better planning master data. The good news is that these capabilities exist today: the barrier is the knowledge/vision to drive assembly.

Wrap-up

October 2022 is the thirty-third month of disruption. I think that we have two-to-three more years of a tough ride. As a result, I ask, “Why let a good crisis go to waste? Use this as the opportunity to redefine decision support to help the organization be more in sync with markets and make better and quicker decisions?” I firmly believe that the definition of traditional supply chain planning and execution solutions needs to change. The opportunity is to redefine time. Not real-time decisions but decisions at the speed of business.

Let’s get started. For me, there is no time like the present.

Your thoughts? Questions? As a supply chain provocateur, I hope this post stirs a debate and stimulates conversation in your organization to drive change.