Definition of Asset

A resource with economic value that an individual, corporation or country owns or controls with the expectation that it will provide future benefit.

Definition of Trash

Worthless or discarded material or objects, refuse or rubbish.

In the last year of my Wharton MBA program, the professor wrote on the board that “finance is the art of money passing hands until nothing is left.” I have found this to be a sad reality. In contrast, economic value is derived from making or growing things to be sold.

In the process of making things, companies have to account for assets. While all leaders can agree that they want more assets and less trash, there is confusion about the best metric.

There are a number of ways that companies can account for assets and align them for value. Recently, we have been studying the trends on three different measures of asset effectiveness. These three simple definitions have very different implications with far-reaching impacts. It is the goal of this blog post to explain the differences and help link you to the most impactful measurement to drive shareholder value.

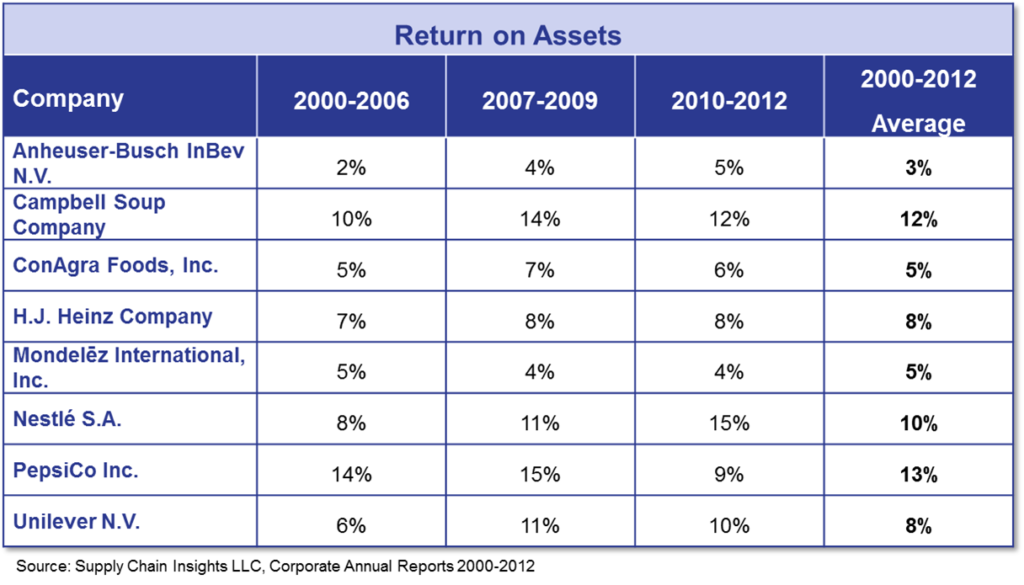

- ROA: The return on assets is equal to net income/total assets. It can vary substantially across industries and should only be used to compare a company within an industry peer group. The assets are based on both debt and equity.

- RONA: If you ask my friends at DuPont for the best asset measure, they will advocate Return on Net Assets (RONA). It is different from ROA in that it is equal to Net Income/(Fixed Assets + Net Working Capital). Fixed assets are tangible property and working capital is a measurement of current assets minus current liabilities. It is a longer-term perspective than ROA.

- ROIC: Colgate and other consumer products companies swear by the Return on Invested Capital (ROIC) metric. It is a good measure of the company’s ability to generate a profitable outcome from investments. ROIC should be greater than the market value of capital. It is equal to net income-dividends/total capital. It can also be calculated as (net operating profit after taxation)/(invested capital).