For most, it is the end of the quarter. While for others, the end of the fiscal year is looming. The end of any fiscal period is a good time to take stock, and reflect. So, I thought, what would be a better time to write an open letter to the CFO? My goal is to help companies perform better in future quarters by improving alignment.

Let me share some background. Four years ago I was in Europe attending a conference. I walked into the event early, before my speaking slot, and sat down to listen to the CFO of Samsung Europe wrap up his speech about his supply chain. After his presentation there was a facilitated networking session on the role of the CFO in supply chain. Animated dialogue followed. For many, the tension between the financial and supply chain teams is contentious.

Never one to sidestep a good argument, I sat back and watched a fascinating debate between attendees on the role of the CFO in driving supply chain excellence. Some were disparaging feeling that their CFO was too heavy-handed in managing operational processes. Their point of view was that the CFO became the self-proclaimed protectorate of the balance sheet. The attendees believed that they did not need a big brother. Instead, they wanted team work and joint ownership of fiscal results.

Others contended that their issue was that the CFO did not know enough about the supply chain. The business pain was dictation of unrealistic targets and continued manipulation of the balance sheet at the end of the fiscal period. In my work with clients, I find that both issues are real. As a result, to celebrate the end of the fiscal period, I have penned an open letter to the CFO:

Dear CFO

Congratulations on reaching another milestone and posting new results for a new quarter. I hope that they met your expectations. For many, there are issues.

Today, in this world of rising commodity prices, and scarce resources, supply chain performance matters more than ever. If you are like most CFOs this week, frustration abounds. Growth is difficult with stalled financial results. Supply chain capabilities disappoint.

You are not alone. Most companies are stuck. In our research for the book Supply Chain Metrics That Matter, we find that this is the case for 90% of companies. While companies want to improve costs and inventory, most are going backwards.

You can help. Here we offer five thoughts that defy convention. What can you do? Here is our advice:

1. The Supply Chain Is a Complex System with Increasing Complexity. Each company has its own unique potential. To improve the supply chain, you need to increase the potential of the supply chain to perform. It is analogous to athletic training. Every athlete performs at their own potential. This is the case with your supply chain. Just as an athlete needs strength, balance and flexibility, so does a supply chain….

This is an important concept that is largely ignored by many consultants. Be wary in setting targets. While many consultants will wave their hands and promise improvements in costs and inventory through projects, take pause. Instead, invest in a network design group to understand your potential. Model the dynamics of your supply chain and gain an understanding of the non-linear relationships between cost, customer service and inventory. You cannot get this same understanding of looking at the supply chain in a spreadsheet.

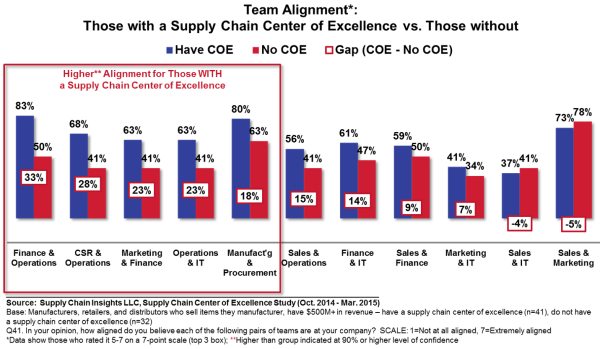

Invest in a Supply Chain Center of Excellence to model and define supply chain processes to build organizational alignment. Ask the team to use supply chain network design models to determine what is possible in the supply chain. Use this data to set realistic targets and goals. When this happens, as seen in Figure 1, companies improve alignment between operational and financial teams.

Figure 1. Organizational Alignment Improvements with a Center of Excellence

Every time that you set artificial targets that are not in alignment with the potential of the supply chain, you will throw the supply chain out of balance and reduce the overall potential. Let us give you some examples.

- Unchecked Rise Is Complexity. As growth has slowed, many companies have added items and services to try to stimulate growth. This adds to supply chain complexity and will reduce the potential. So, as you rationalize product offerings and go-to-market strategies, model the impact of complexity on customer service, inventory and costs.

- Avoid Artificially Constraining Inventory Levels. We know that it is tempting to want to reduce inventory to make quarterly results, but please use restraint. Inventory is the most important supply chain buffer for demand and supply volatility. For most companies, demand and supply volatility is increasing. As a result, if inventory is is arbitrarily reduced you can hurt the company’s ability to meet orders. This will throw the supply chain out of balance. The longer the supply chain, the more difficult it is to regain balance. It can take weeks and months if the supply chain is complex.

- Be Careful on Pushing into the Channel to Meet Quarterly Commitments. It is also very tempting to push inventory into the channel at the end of the quarter to meet financial commitments. This can also throw the supply chain out of balance. Instead of reactive, knee-jerk reactions, your supply chain results will be higher if you can work with the team on a monthly basis and improve cross-functional processes like new product launch, revenue management, Sales and Operations Planning (S&OP) and supplier development.

So, just as an athlete trains to improve potential, and understands that they must recognize the constraints and limitations of their body, we would like for you to apply the same concepts to your supply chain. Partner with an active group within your organization to design the supply chain and improve supply chain potential.

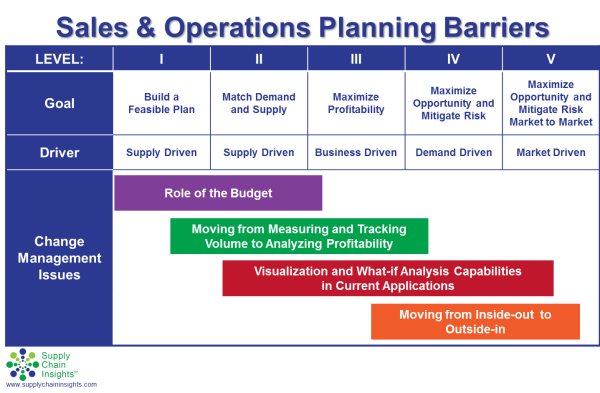

2. Rethink the Role of the Budget. The financial department uses the budget as a control mechanism to allocate resources and set targets. We all know–based on shifts in the market potential and shopper preferences–that things change. As a result, the budget is out-of-date when built. As a result, use the S&OP process as an input for budget revisions, but do not constrain the S&OP process based on the budget.

Figure 2. S&OP Change Management Issues

Our advice is simple:

- Be Careful. Be Market-Driven. Never constrain the S&OP and supply chain processes by the budget. Instead, use market signals (sell through and competitive information) to understand true demand and then use network design tools and the planning processes to update budget goals.

- Understand the Options. Focus on “What-if ” Analysis. While good news travels fast within the organization –success in new product launch or market launch– bad news travels slowly. Sales and marketing are slow to admit market failure. As a result, look for early warning signals and understand your options based on “what-if” analysis. Select planning technologies based upon “what-if” analysis. Only 33% of companies have this capability.

- Sidestep Functional Goals. Functions compete. They are not aligned. Only 12% of companies can see total costs. Go beyond the budget discussion and drive team work to ensure that the company can work together to minimize total costs while improving customer service and inventory levels.

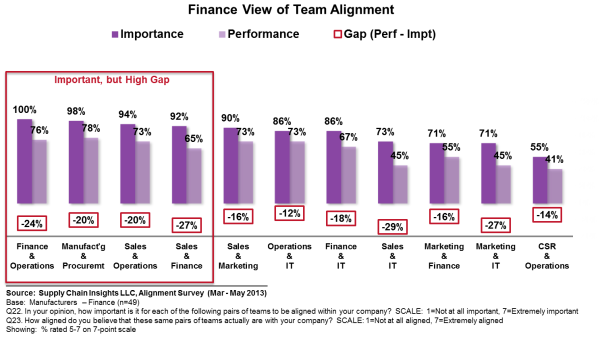

3. Alignment. While all groups will speak about the need for alignment, the gaps in functional team alignment are felt more intensely by the supply chain leader than by you. Try to help, by driving an understanding of what is possible in the supply chain when managed as a complex system.

Figure 3. Finance View of Functional Alignment

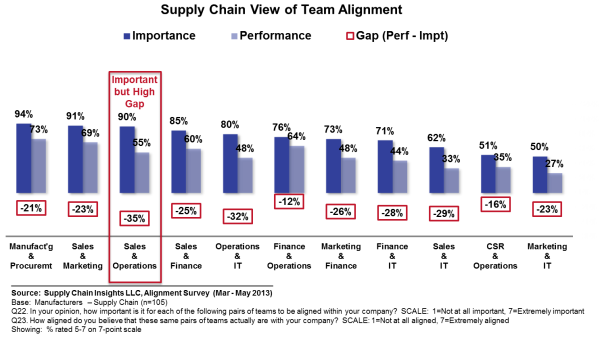

Contrast the gaps of the two roles. The supply chain leader feels the lack of functional alignment more than you do. Try to be supportive.

Figure 4. Supply Chain View of Functional Alignment

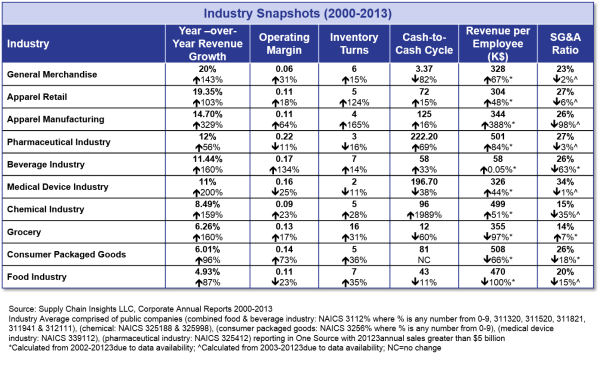

4. Rethink Cash-to-Cash Targets: The Role of Inventory and the Role of Payables. Over the last decade the average company has dramatically improved employee productivity, and driven reductions in cash-to-cash metrics. However, employee productivity has not translated into operating margin and many of the shifts of Cash-to-Cash (C2C) are not beneficial to improving supply chain performance. Artificial targets for inventory will hurt your supply chain, and lengthening payables will have long-term impact on supplier viability. Most of the progress in cash-to-cash is the result of lengthening payables. This is analogous to taking heroin. Pushing costs and waste backwards in the supply chain gives you short-term results with long-term negative impacts. Own your supply chain and build resilience. Remember that this is a marathon, not a sprint.

Figure 5. Overall Industry Performance by Industry

5. Fund Future Investments. Historically, investments in supply chain were deeply rooted in transactional systems. Enterprise Resource Planning (ERP) evolved to improve the speed of Order-to-Cash and Procure-to-Pay processes. Last decade’s investments in ERP were essential to build the global multi-national and ensure rigor and consistency in balance sheet reporting. The future of tomorrow’s supply chain hinges on taking advantage of unstructured data. Breakthrough innovation will happen through the use of a variety of data sources–examples include sensors, streaming data, Internet of Things (IOT), pictures, weather data, geolocation data/maps, telematics, sentiment data. The use of these new forms of analytics requires investment in new forms of analytics that do not come from the traditional ERP vendors. If you want to drive innovation, relax the dictate within the organization to stick to an ERP standard. Welcome the age of big data and partner with your supply chain organization to drive new insights. We share a recent infographic for your consideration on this hot holiday weekend.

Figure 6. Big Data Infographic

- Good luck on your next quarter. These recommendations will take awhile to materialize. Expect to see results within a couple of quarters, but the research supports that it works. Let us know if you need any help. I would love to hear from you!

____________________

Life is busy at Supply Chain Insights. We are working on the completion of our new game—SCI Impact!—for the public training in Philadelphia in August and the content for the Supply Chain Insights Global Summit in September. Our goal is to help supply chain visionaries, arou nd the world, break the mold and drive higher levels of financial improvement. The conference will feature case studies on supply chain transformation, digital transformation and insights from supply chain leaders on the Supply Chain to Admire analysis. We find that companies that have reached better alignment with their financial teams have higher levels of financial results.

nd the world, break the mold and drive higher levels of financial improvement. The conference will feature case studies on supply chain transformation, digital transformation and insights from supply chain leaders on the Supply Chain to Admire analysis. We find that companies that have reached better alignment with their financial teams have higher levels of financial results.

About the Author: Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push the organization harder to drive excellence.

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push the organization harder to drive excellence.