Woolly descriptions. Fuzzy definitions. Over-arching superlatives. Last week as I spoke at an European event, I struggled to gain clarity in a world of increased confusion. If I struggled, I am sure that others face the same challenges. Together, we walk in a fog.

Let’s reflect. Supply chain innovation is slowly simmering in the face of radical disruption. The supply chain visionary wants novel and new. I find technology providers pitching old–often wrapped in the cloak of ‘digital transformation.’ As a result, supply chain leaders continuously ask me to unravel market confusion. The goal of this post is to provide clarity.

Background

Supply chain planning– decision support for business leaders– evolved in the 1980s. Over the last four decades, not much changed. Recent releases of Advanced Planning Solutions (APS) refined but did not transform initial software concepts. Little modernization despite the evolution of new technologies to enable:

1) Demand Sensing. Despite a 2-3X increase in demand latency, there is still a strong belief that the order represents market demand. It does not. Companies talk about customer-centric supply chains, but most leaders are more comfortable in the world of supply than demand. While there is much hype on DDMRP and the use of orders as a proxy for demand, companies need to remember that orders carry latency: they are out-of-step with market purchase behavior. The further back in the supply chain that companies find themselves, the greater the order latency, the less that the order reflects market behaviors.

2) Insights Using Non-Relational Database Technologies. When e-commerce giants like Amazon and eBay could not scale using relational database technologies new approaches termed nonSQL evolved. NonSQL enabled schema-on-read capabilities and accelerates cognitive computing to improve supply chain decisions. Examples include Hadoop, Kafka, and Apache Spark.

3) Outside-in Processes. New forms of data abound–weather data, consumer insights, rating/review information, sentiment analysis—but they are not used. There is no place to put this data in traditional supply chain planning software, and companies are slow to change existing concepts.

4) Real-Time Decisions Using Streaming Data. Traditional planning is batch. Data is latent–often out-of-step with current processes. Black holes abound. New forms of Internet-of-Thing (IOT) data enables information at the speed of business, but companies struggle to build streaming data architectures.

5) Shift from Selling Products to Selling Services Focused on Outcomes. What should we sell? There is a shift from selling traditional products to a focus on outcomes? It redefined the music industry: from selling CDs/records to online music. The transformational wave is slowly transforming the automotive industry from a focus on selling “rides” versus the purchase of an automobile. There is a focus from efficient sickness in healthcare to health and wellness. Service supply chains are shifting to use 3D-printing services for on-demand availability of parts.

These shifts are profound making many of the methods from the last decade obsolete. We struggle with the appropriate naming conventions for this transformation. Is this Industry 4.0? A Digital Supply Chain? Autonomous supply chains? All I know is that descriptions like this one from Gartner are not helpful:

“Digital business transformation is the process of exploiting digital technologies and supporting capabilities to create a robust new digital business model.” Gartner (Are you laughing? Do you think that this definition could contain a few more references to digital?)

There was a better definition by Michael Burkett in a later press release: “…an intelligent supply chain that makes decisions as it interacts across an ecosystem of digitally connected partners.” Mike Burkett, Gartner

I define the digital transformation as the redefinition of the atoms and electrons of the supply chain to drive improved outcomes. Is this right? Nope, my definition is one of many. The key point is to get clear on a definition for you.

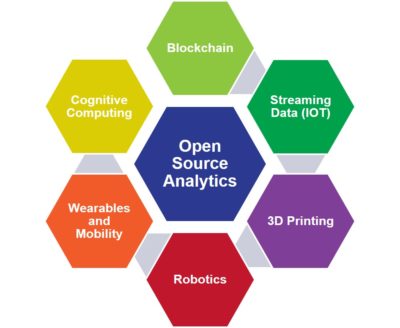

In my definition, the atoms of the supply chain being re-defined by 3D printing, use of algae and fermentation processes to create value from waste streams and recycling. Makes us wonder if we should even manufacturer products in traditional ways? Increasingly, there is a shift from products to services. Electrons? The many examples include streaming data, Internet of Things (IOT), new forms of analytics, software robots, wearables and robotics increasingly add value as computing power increases. A confluence of technology drives innovation.

Figure 1. Evolving Technologies Driving Digital Transformation

In your role as a supply chain leader, to get started, focus on outcomes. Define a journey consistent with your organization’s cultural bias. For example, if you are an innovator, roll-up your sleeves and test and learn using new technologies. Fail fast and drive forward momentum. However, not all companies are comfortable to forge new paths using bleeding-edge technologies. If you are a late follower, be consistent in your approach. Learn from others and adopt when comfortable.

In your role as a supply chain leader, to get started, focus on outcomes. Define a journey consistent with your organization’s cultural bias. For example, if you are an innovator, roll-up your sleeves and test and learn using new technologies. Fail fast and drive forward momentum. However, not all companies are comfortable to forge new paths using bleeding-edge technologies. If you are a late follower, be consistent in your approach. Learn from others and adopt when comfortable.

Unraveling the New Landscape

As a new world of analytics unfolds, the technology landscape is becoming less ERP-centric. Innovation is redefining business processes. There is normal confusion as technology providers jockey for position on a moving stage.

One of the reasons for the confusion is that most of the presentations from solution providers sound the same. The fact that companies use the same words, pictures, logos and approach to the market leaves the buyer scratching their head. In an attempt to help, here are some thoughts:

Anaplan. I think that in the future Anaplan becomes the Salesforce.com of the supply chain; however, the fit for most buyers today is not clear. The company markets the promise of “connected planning.” However, if not careful, Anaplan becomes the substitute for Excel spreadsheets and accelerates silo’ d-based planning. This reality? Disconnected planning.

Figure 2. Connecting Planning Information to the Back Office

Let me explain. Today, Anaplan does not have a deep-modeling capability nor do they have a strong understanding of supply chain management. The origins of the product are in finance and the promise is quite different. Anaplan offers capabilities to connect the work of supply chain planners with the larger organization through “what-if analysis” and collaboration. For example, one organization that I work with has 660 planners and 24,000 employees in the back office that need planning information. Anaplan is the natural solution to connect core planners to other individuals within the organization that need planning information. However, Anaplan isn’t a core planning tool. Instead, as shown in Figure 2, use Anaplan to connect business managers, key leaders and back office personnel together, but avoid using Anaplan for core planners.

Let me explain. Today, Anaplan does not have a deep-modeling capability nor do they have a strong understanding of supply chain management. The origins of the product are in finance and the promise is quite different. Anaplan offers capabilities to connect the work of supply chain planners with the larger organization through “what-if analysis” and collaboration. For example, one organization that I work with has 660 planners and 24,000 employees in the back office that need planning information. Anaplan is the natural solution to connect core planners to other individuals within the organization that need planning information. However, Anaplan isn’t a core planning tool. Instead, as shown in Figure 2, use Anaplan to connect business managers, key leaders and back office personnel together, but avoid using Anaplan for core planners.

Evolution of Core Planning. The supply chain planning world–modeling for the core planners shown in the green circle in Figure 2– is shifting. Kinaxis and OM Partners are gaining market share as more and more companies experience issues with the depth and functionality of APS solutions from INFOR, Oracle, and SAP. Llamasoft, the market leader in strategic planning modeling, is also attempting to widen their footprint in move from strategic to tactical/operational planning.

Figure 3. Planning Frameworks

The original models shown in Figure 3 evolved four decades ago, and there is an intense debate in the industry on the need for tactical planning. The debate is often termed on concurrent planning—combining operational and tactical planning—rages. (The average company has 2-3 APS technologies and hence the proliferation of boxes in Figure 3.) My view is that the need depends on the size/focus of the company. In global companies aligning asset strategies with business shifts tactical planning is critical. However, in regional supply chains where manufacturing assignments are more fixed with less change. As a result, tactical supply planning is not always needed. Before you join the debate ask yourself, “What does your supply chain require?” If you need to move manufacturing load across manufacturing facilities then you need tactical planning.

The original models shown in Figure 3 evolved four decades ago, and there is an intense debate in the industry on the need for tactical planning. The debate is often termed on concurrent planning—combining operational and tactical planning—rages. (The average company has 2-3 APS technologies and hence the proliferation of boxes in Figure 3.) My view is that the need depends on the size/focus of the company. In global companies aligning asset strategies with business shifts tactical planning is critical. However, in regional supply chains where manufacturing assignments are more fixed with less change. As a result, tactical supply planning is not always needed. Before you join the debate ask yourself, “What does your supply chain require?” If you need to move manufacturing load across manufacturing facilities then you need tactical planning.

In parallel, some will use the term ‘connected planning’ in a very different way–the use of cloud to enable planners to see entries/changes in the plan in real-time. One thing is for sure, there is no consistent definition of concurrent planning. I also see great advantages for global supply chains in orchestrating tactical planning processes. Tactical planning is less important in regional supply chain planning.

New Form of Analytics. Cognitive computing capabilities from Aera, Enterra Solutions, Gains Systems, and Noodle AI help with improve plans. Traditional solution providers find themselves squeezed in the middle between ERP-based solutions and new forms of analytics. JDA’s purchase of Blue Yonder and Logility’s purchase of Halo are promising, but both companies struggle to make progress in the face of supporting traditional business models.

Cloud. Cloud is making APS more affordable. The entrance of lower-cost options for supply chain planning is exciting. These are ideal for smaller more regional companies. Solutions like Demand Works, John Galt, Optimity and Orchestr8 offer increased depth of capabilities with more personalized and value-priced solutions.

Planning Master Data and Testing of Sensitivity for Planning Outcomes. The term digital twin is sexy. However, it lacks a common definition in the industry. At recent events, I was able to gain insights into three versions of digital twin modeling. The products consume market drivers and ERP data yielding a modeling platform to understand the impact of planning master data –lead times, cycles, yields, etc.—on process excellence. This enables sensitivity analysis and the testing of planning parameters that are often out-of-date and inaccurate. Bad planning master data yields bad results.

DDMRP. The Demand-driven Institute under the leadership of Chad Smith and Carol Pak advances a very different definition of demand-driven than the prior models Demand-Driven Models defined by AMR Research (now Gartner). DDMRP is a form of demand translation—order pattern translation into material buffer strategies. The tactic rectifies the close coupling of the forecast into material requirements (which was sorely needed). The technique is appropriate for material-centric supply chains. While it is an important technique, it is one of many approaches to improve agility. It is a tactic not the end state of a demand-driven strategy.

DDMRP It is less appropriate for asset-intensive and customer-focused supply chains and it should never replace tactical supply planning. Instead, as shown in Figure 4, DDMRP is one of many tactics woven into the digital transformation.

Figure 4. Demand-driven Models

Redefinition of Transportation Management. Blume Global, Four Kites, Gatehouse, Macropoint, Project 44, Supplystack. Shippeo. Trimble, etc. The list goes on and on. The promise is the delivery of logistics status information along with analytics to predict a more reliable ETA. Termed the dynamic ETA the shift is to streaming data driving a more definitive ETA based on sensor data.. This is the start of the definition of outside-in transportation processes. Today, the real-time visibility solutions are outside-in and the enterprise TMS solutions are inside-out. As a result, there is no place to put a dynamic ETA. There is a need to redefine processes. Overtime companies will redefine a new transportation planning market that is outside-in making the current applications obsolete. For me, this is an exciting development.

Redefinition of Transportation Management. Blume Global, Four Kites, Gatehouse, Macropoint, Project 44, Supplystack. Shippeo. Trimble, etc. The list goes on and on. The promise is the delivery of logistics status information along with analytics to predict a more reliable ETA. Termed the dynamic ETA the shift is to streaming data driving a more definitive ETA based on sensor data.. This is the start of the definition of outside-in transportation processes. Today, the real-time visibility solutions are outside-in and the enterprise TMS solutions are inside-out. As a result, there is no place to put a dynamic ETA. There is a need to redefine processes. Overtime companies will redefine a new transportation planning market that is outside-in making the current applications obsolete. For me, this is an exciting development.

Business Networks. The focus of the last four decades focused on enterprise solutions. While there was a brief flurry of activities in the building of trading exchanges in 2001-2003, but only 10% survived. Today, these are becoming Supply Chain Operating Networks with mapping, onboarding and process canonicals. The problem is that there is no easy way to stitch the flows together. As shown in Figure 3. the current flows are one to one mainly via documents. One of the barriers is focus. Companies attempted to integrate data without defining master data portability. With the evolution of the ISO-8000 standards for ALEI (company), SFx (item) and ELNI (location) the data becomes more portable enabling less mapping and process enablement. Today’s Supply Chain Operating Networks operate within islands. Ariba for procurement, GT Nexus for transportation/trade finance, E2open for High-tech, Elemica for the chemical industry, Exostar for A&D, SupplyOn for consumer durables/ discrete manufacturing. While E2open buys enterprise solutions and GTNexus focuses on Infor integration, we starting to see some promise through the network of networks work between Ariba and Elemica. It is clear to me that progress in this area only happens when business users force inter-operability. Integration is not the answer, instead it requires the defining of data to improve interoperability through portability using the ISO-8000 standards for master data.

Figure 5. Current State of Networks

Deadly Sins:

Deadly Sins:

The technology buyer today is held hostage by deadly sins. These are not new, but are becoming a bit more extreme over the last year. It makes me wonder what happened to clear and concise descriptions of company solutions.

- Digital White-Washing. Traditional technology providers pitch digital messages. While plastered on the websites, there is a struggle to give me a clear definition of how their solutions drive digital innovation. It is the innovator’s dilemma. To innovate the company has to kill existing products to drive digital innovation. Evolution is not the answer. The step-change in architecture and design is quite risky for a public company. Force traditional players to define digital and side-step digital white-washing.

- Gobbledygook Marketing. Buzzword Bingo. When in doubt slap an acronym or a new word on marketing collateral. We are in marketing spin zone. Bypass this issue, but asking companies to define each term. When using the term control tower ask for a definition. In a discussion of visibility, ask for clarity. The lack of clear definitions on these terms adds to the hype cycle.

- Over-Promising. Companies are not clear on what they do and what they do not do. Push for answers.

- Shift in Selling Models. Buying Software from Non-Software Companies. The business models of software companies are different from consultants and contract manufacturers. The difference? Software creation takes many years, and as a result, software companies focus on long-term software development. In contrast, it is very hard for a consulting or contract manufacturing company to stay focused on the long-term because of the pull of the urgent. As a result, only buy software from companies with a software model.

- Needing a Well-Defined ROI. First movers know that they are testing and learning with no guarantee of a guaranteed ROI. Work with promising technologists to solve the hairy problems that plague the business.

Bottom-line the supply chain planning market is changing. Best-of-breed innovators will drive the step change in thinking. The next era is market-consolidation, and maturation. Slowly companies will start to build networks and outside-in processes that will make much of the software today obsolete.

Summary

What should you do? Focus on solving use cases. Drive test and learn programs to innovate with new players to drive new answers for tough problems. Don’t make the mistake of believing that large players drive this innovation. They will be late followers.

An Aside….

On a side note, please do not send me Gartner research notes trying to make me change my mind. Those that know me realize that I am a hard-headed gal. (smile)

Recently, vendors are deluging my mailbox with them. < Wink. Wink. >

Many technology companies do not realize that as a Gartner analyst, I trained many research analysts on the Gartner methodologies. The problem with most notes I read is the violation of the first tenant of research–a clear definition. I always start a research project, or note with a clear definition of the subject. Notes need to start with a clear taxonomy aligned with the needs of the buyer. For example, who buys a planning system of record? In this note, the taxonomy is not consistent with what buyers are seeking. And, in the multi-tier enterprise note, how can you believe a note that leaves out 1/3 of the players? I could go on-and-on, but I need to go pack. I am going back on the road tomorrow to help supply chain leaders. I will leave it to others to send the expensive Gartner notes around social media touting false supremacy of their solutions.

All the best to you in your travels. I hope that this note helps.

For additional writing on this topic, check out these topics.

Anaplan: http://www.supplychainshaman.com/new-technologies/my-take-the-role-of-anaplan-in-defining-the-art-of-the-possible-in-supply-chain-planning/

Analytics: http://www.supplychainshaman.com/big-data-supply-chains-2/a-framework-for-supply-chain-leaders-to-understand-supply-chain-analytics/

Demand-Driven Transportation: http://www.supplychainshaman.com/demand/demanddriven/demand-driven-can-we-sidestep-religious-arguments/

Planning. http://www.supplychainshaman.com/supply-chain-2/supply-chain-excellence/yowza-a-nine-step-decision-process-to-help-guide-supply-chain-planning-selection/

Measuring Planning Effectiveness: http://www.supplychainshaman.com/supply-chain-excellence-2/what-value-are-you-getting-from-planning/