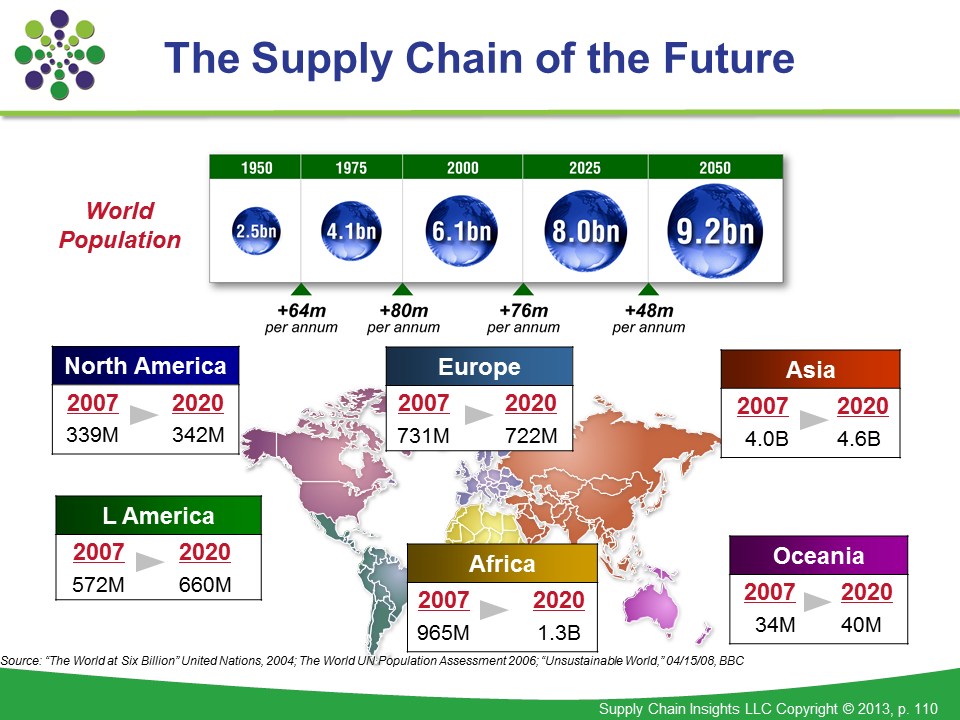

Global multinational companies have a dilemma. Supply chain talent is primarily coming from North America and Europe, but these are the continents that represent the lowest levels of growth for supply chain 2020 (see figure 1). Most global multinational companies have a solid base now in South America and Asia, but the race is on for Africa.

I spent this week at SAPICS in South Africa. At over 1,000 delegates, the conference is a large supply chain event. There are few global conferences that can boast this level of attendance.

At the end of my talk on the first day, I was asked by the audience to share what I would recommend as action steps for South African supply chains. So in this blog, I want to share my recommendations.

SAPICS Has a Unique Opportunity. South Africa is uniquely positioned to gain benefit in the race for supply chain modernization of Africa. However, it requires new forms of corporate/government partnerships. The conference was heavily dominated by third-party logistics firms, consultants and technology providers. SAPICS needs to form deep roots with global multinationals and government agencies to drive talent development. In a population with 29% unemployment, it needs to be about much more than certification. I would love to see it evolve into a program of research grants, co-op and student programs, and educational funding.

However, to capitalize on this opportunity, manufacturers need to step up. The presence of large South African manufacturers was limited at the conference (as was the thought leadership of global multinationals with operations in Africa). It needs to be about industry/government/community partnership. South Africa is in a unique position to capitalize on the growing opportunity, and SAPICS has an opportunity to lead.

It Could Be a Step Change. Map Outside-in. Leverage Mobility. I love what is happening in Africa on mobile application development. Most African households will never know a wire in the wall for a conventional phone. Instead, they are innovating in new ways on mobile devices.

One of my favorite presentations at the event was by Francis Marabula, Executive head of Supply Chain, Safaricom, Kenya. He spoke of M-Pesa and the evolution of new models for mobile commerce in Kenya. Mobile penetration is forecasted to be 85% of the households in Afria by 2015. In contrast, commercial banking will be 25% of households. The M-Pesa service allows users to deposit money into an account stored on their cell phones, and to send balances using SMS technology to other users (including sellers of goods and services), and to redeem deposits for regular money. Users are charged a fee for sending and withdrawing money using the service. It has spread quickly, and has become the most successful mobile phone based financial service in the developing world. It started with simple money transfers in 2007 and now includes a range of services. The M-Pesa mobile application now represents 30% of GDP in Kenya with 60,000 outlets.

Mobility and the direct connection to the shopper is a wonderful opportunity for the supply chain innovator to create new business models for the supply chain OUTSIDE-IN. Just as the African household will never know a conventional phone, there is no reason for them to know a conventional INSIDE-OUT supply chain.

Internet of Things As an Enabler. The conference kicked off with a presentation on robotics. Tom Bonkenburg, Director of European Operations for St. Onge, Netherlands, presented a very compelling picture of robotics. He forecasted that today, robotics could save 10% of logistics labor costs. He also believes that in five years, robotics and smart vehicles could reduce total logistics costs by 48%. It was a brilliant presentation, but I don’t think that robotics with the high unemployment rate, and the low wage rates, is the answer for Africa. Instead, I think that the answer for Africa is about mobility, new forms of analytics, and The Internet of Things.

What do I mean by The Internet of Things? It is the use of real-time sensing to power the supply chain outside-in. For example, Africa is constructing new infrastructure. Investment is happening in pumps for water, turbines for electricity, windmills, tollgates for roads, and modern factories with Programmable Logic Controllers (PLCs) and equipment sensing. The common thread is The Internet of Things: Sensors that can transmit and share real-time status. This has two impacts on the supply chain: improvement of signaling for outside-in processes and the movement from mean-time failure on service supply chains to real-time sensing of equipment. It is my hope that the African supply chain leaders never know demand latency because they have the opportunity to design the supply chain to capture useage real-time. I hope that they can bypass the conventional licensed Advanced Planning Systems and leapfrog into cloud-based computing with learning systems and automated benchmarking. If I had a magic wand, I would love to see SAPICS invest in a shared vision for industry leaders in Africa to combine mobility, Internet of Things, and new forms of anlaytics to build OUTSIDE-IN supply chain processes to leapfrog and improve current thinking.

In summary, I appreciate SAPICS invitation. I can now say that I have been to Africa. It is impressive to see such a large gathering of supply chain professionals in a small country at a time where unemployment is 29%. Congratulations on a successful event, but can we take it to the next level? SAPICS, be a leader. I believe that outside-in supply chain process thinking can happen out of Africa.

The Orchestration Shuffle

As approaches in Artificial Intelligence mature, we have the opportunity to orchestrate the supply chain response. Accomplishing this goal, requires the rethinking of work holistically.