I remember the evening well. A requirement to apply as an analyst position for AMR Research was to write an opinion piece and defend the article in an interview. My PC was in the shop, and I quickly grabbed a coffee as I headed into the hotel lobby to type the opinion, which I hoped would take less than an hour. My assigned topic was demand visibility. My thinking on outside-in processes started that evening as the black coffee turned cold in the cup in my hand. I found the topic–so simply expressed–required deep thought. I pulled up my covers to go to sleep four hours later.

However, two decades later, there is still no technology solution to enable demand visibility or help companies use channel data to translate demand into an inventory, replenishment, or manufacturing strategy. My question is, “Why?”

I am a fan of the five why methodology to understand the root cause of an issue. Here I want to address the question, “Why is the focus on the basics of supply chain a barrier to adopting new forms of analytics and supply chain processes? Why have we not improved our use of channel data in supply chain processes?” (The use of the term “basics” is usually code for the implementation of Enterprise Resource Planning (ERP) to improve order-to-cash and procure-to-pay.)

The technique defined by Taiichi Ohno is to ask “Why?” exactly five times, to find exactly one root cause.

Wikipedia

Background

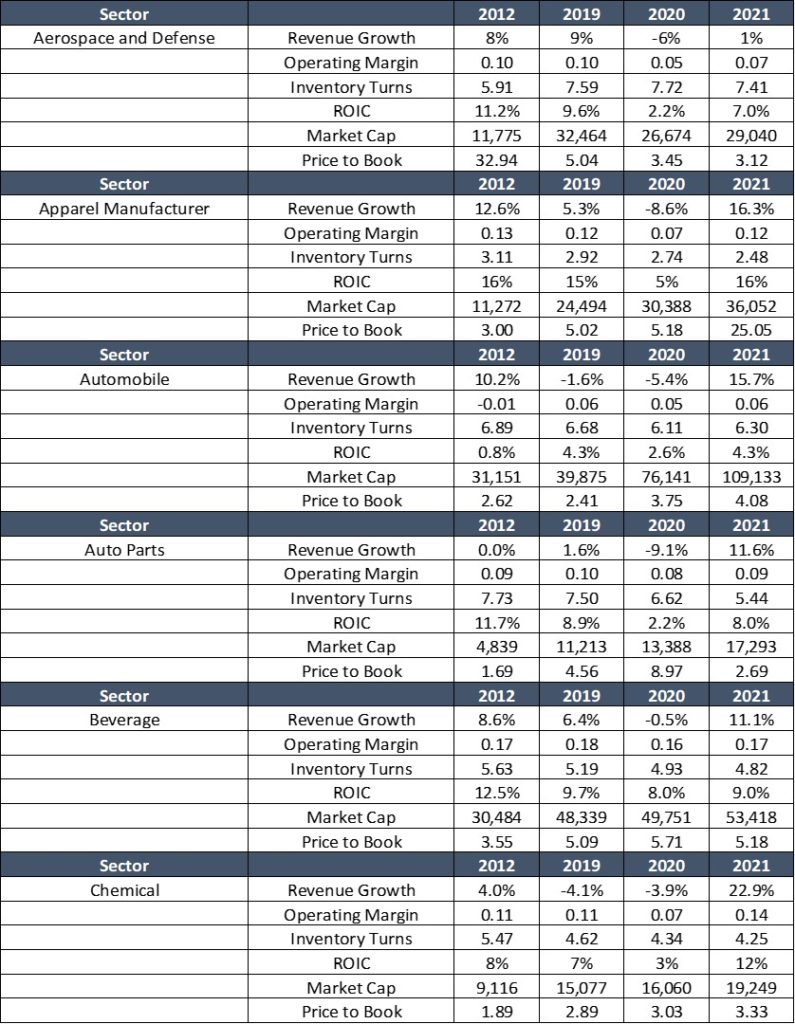

In each industry sector, companies face unprecedented variability. Variability is today’s new normal. To understand the magnitude of the shifts, I encourage you to glance through the industry sector averages outlined in Table 1.

The shifts in growth from 2019-2021 are dramatic. Growth requires cash. The decline in inventory turns uses cash. The scarcity of materials and labor requires the rethinking of payables and the shortening of terms to ensure supply also increases the pressure on cash. These market shifts are adversely pulling all three levers of cash in a business simultaneously. This is happening as businesses rationalize the impacts of the current inflationary cycle, climate change impacts, and prepare for what many believe will be a double-dip recession.

Cash-to-Cash: Days of Accounts Receivable + Days of Inventory-Days of Accounts Payable

Business continuity is the discussion dejour for a supply chain team. As port congestion continues, a major issue is unloading containers. The problem is that warehouses are full. Not only are they full, but they contain the wrong products. As defined by conventional thinking, a supply-centric process cannot respond to heightened demand variability. Driving resilience and weathering the severe market shifts requires a supply chain re-set.

Table 1. Market Shifts by Industry Sector

Within organizations, there is a dangerous pull on cash impacting business continuity. Over 90% of companies have a corporate social responsibility policy, but there is no inertia to move to outside-in processes to decrease landfill and waste. Or redefine planning to be less reactive. (In our research, we find that companies became statistically more reactive with the use of the planning technologies during the pandemic (80% confidence level.))

Surprisingly, I do not see companies adapting to the new normal. Instead, I see reactive behavior. In Table 2, I outline the difference.

| Area | Reactive Behavior | Proactive Focus |

| Supply Chain Focus | Focus on speed of response. Investment in control towers. | Automation of insights: sensing and learning. |

| End-to-End Definition | Implementation of enterprise data architectures to improve order-to-cash and procure-to-pay. | Insights from market data to drive bi-directional orchestration. |

| Work of Data Management Teams | Groups targeting transactional master data | Embracing disparate data |

| IT Team Focus | Integration | Interoperability |

| Planning Focus | Demand plans focused on error reduction. Attempting to drive perfection from imperfect data. | Demand plans focused on understanding market flows and decreasing latency. |

| Inventory Management | Focus on the minimization of safety stock | Active design of the supply chain with a focus on the form & function of inventory |

| Reward Systems | Functional metrics | Balanced scorecard |

| Structure | The supply chain organization is limited in scope focused on delivery | An organization focused on the flows/process design from the customer’s customer to the supplier’s supplier, with the delivery, manufacturing, and procurement teams reporting to a central leader. |

Why are companies not adapting to align to a more prescriptive and sensing-based set of processes? I have the same question. To understand, let’s apply the five-why methodology.

Observations: Applying the Five Why Methodology

The order is a poor proxy for market demand.

In the 1980s, in the genesis of supply chain software, supply chains were regional, and product lines and channels were less complex. In this scenario, order latency–the time from channel purchase to the translation of the purchase to a manufacturing order for replenishment–was shorter. The reason? In a channel with fewer products with higher velocity across fewer nodes, the translation of a channel purchase to a manufacturing order is days. However, as the channel becomes more complex and the product line grows–especially when there is a long tail–the time to translate channel consumption into a manufacturing order becomes weeks and often months. For example, an over-the-counter allergy product has an order latency of 180-280 days, while a popular product like Tide has an order latency of 15-45 days. The range depends on sales velocity, replenishment policy, and shelf assortment.

Consumer products data abounds, yet, I know of no company that has successfully used point of sale data in supply chain planning, even though bar code scanning is now nearing a fifty-year anniversary. This is so even though data is available for 60-80% of the channel.

Using consumption data as a demand signal reduces the time to sense market shifts by 80-90% and improves supply chain capabilities to improve shelf-level replenishment. In this time of high market variability, “Why do companies not use channel data as a market signal for supply chain planning?” (Most of the data is used by the sales account teams that operate as an island disconnected from replenishment. Similarly, Vendor Managed Inventory (VMI) programs, once touted as a savior for replenishment, are also not connected to planning. Instead, the integration is to order management.)

Companies do not sense shifts at the speed of markets. The demand latency for a semiconductor manufacturer is 180-220 days, while a chemical manufacturer has a latency of 150-280 days. The modeling of channel data along with the order, enables a more nimble response, helping companies sense and respond to market shifts quicker. Yet, it does not happen. In light of the current market, should it? I think so, but most companies focus on a traditional supply-centric response.

Let’s use the Five-Why Methodology to see if we can understand the root cause.

- Why? With the increase in market variability, why do companies not use channel data to model demand patterns to decrease demand latency? Answer. The concept of demand latency is not well-understood. Most companies do not analyze the coefficient of variation (how forecastable the data is), the quality of the demand forecast (Forecast Value-Added) ,or the impact of the latency from the dependency on the order signal in the distortion and amplification of the supply signal (bullwhip effect).

- Why? Why is it not understood? Answer. In today’s approaches, demand latency is not measured. As a result, few companies understand the value. Conventional supply chain software deployments are supply-centric consuming demand based on order patterns. The value proposition is not quantified.

- Why? Why is the market-sensing approach not tested through multiple deployments with companies to understand the value proposition? Answer. There is no incentive for the industry to change. Software companies are chasing RFPs, and business users ask for modified versions of traditional process approaches. Functional use of channel data is inadequate, but sales teams tend to be very protective of the channel data. Commercial and operational teams are not aligned. Industry events and the press perpetuate the status quo.

- Why? With technological advancements, why are companies not pushing to test new ways to model market data to improve sensing and resiliency? Answer. The capabilities in computing and new forms of analytics can now effectively product models based on channel data and show the impact of demand latency. This was not possible before. However, there is no industry standard, or well-defined process model, to help companies make the shift. Supply chain software and consulting companies are making good money by deploying traditional processes.

- Why? We have not proved the value to drive the shift. Answer. In the limited testing I have driven in the market, I find that using channel data in modeling decreases demand latency by 70-80%, with a 30-40% reduction in inventory carrying costs and write-offs. Will this be sufficient to start a change in the market? Probably not. Change takes time. Substantial change takes a village, but maybe, the test results can change the discussion. I will share the data in this blog, on Forbes, and in the upcoming conferences discussing a shift from inside-out to outside-in processes. Decreasing waste and improving response time is important to improving cash-to-cash and reducing landfill waste.

Conclusion

I have had many cups of coffee get cold as I share this story repeatedly with supply chain teams. Despite deploying multiple pilots within companies that prove the value proposition, there has never been an industry initiative to drive a step-change in thinking. This is what I am hoping to accomplish this fall. I will present the testing of outside-in processes results first at the Supply Chain Insights Global Summit, then a week later at the Blaze conference for Project Zebra, followed by a presentation at the ASCM conference and the University of Wisconsin Executive e-business Consortia at the end of September. I hope no one’s coffee gets cold before they seriously consider implementing outside-in processes.

See You At the Supply Chain Insights Global Summit?

Registrations are pouring in for the Supply Chain Insights Global Summit on September 6th-8th in Washington, DC. The focus of the conference is on Supply Chain 2030. This conference has a physical presence for 90-100 business leaders at the Westin near Dulles Airport and a virtual component that Sarah Barnes Humphrey will facilitate on a collaborative platform.

In both formats, we design the conference for extreme networking. We aim to build a guiding coalition of industry leaders to drive change. We need to redefine supply chain planning architectures, but it needs to start with redesigning work. To do this, we must have a different discussion and free ourselves from conventional thinking. Here are five reasons to attend:

- Jump Start Your Learning on the Art of the Possible and New Forms of Analytics. The event is designed for extreme networking. In both the online and in-person format, you will engage with others by learning from case studies of hand-picked speakers, sharing research-based content, fun activities, facilitated networking, and structured activities.

- Imagine Supply Chain 2030. Challenge yourself to imagine the future in an environment where technology innovators and business leaders are equals. The event has no sponsorships and no technologist or consultant sales teams. Instead, it is designed as a learning environment, the event is designed as a place where leaders learn from leaders in a structured and safe environment.

- Supply Chains to Admire. Only 4% of public companies outperformed their peer group over the last decade. At the conference, hear from five Supply Chains to Admire Award winners and brainstorm on lessons learned.

- Learn from the Past to Unlearn. In the last decade, supply chain performance declined. All companies were challenged by the pandemic. In this session, gain insights on how we better align organizations and build outside-in processes.

- Build Teams. The question is, how do we drive next-generation talent? Learn from an industry leader case study and a panel of educators.

The virtual event is hosted by Sarah Barnes-Humphrey of Let’s Talk Supply Chain. The online conference is packed full of activities and networking opportunities. Sign-up your team now to get the prep materials in the countdown to the event.

The in-person event will be at the Westin at Dulles Airport. Attendees at the in-person event will Imagine Supply Chain 2030 through a series of structured activities with learnings captured by a visual artist. The dreams will take flight in a visit to the Smithsonian Air & Space Museum in a special tour for the group.