Over the last three years, these three fundamental assumptions unraveled: they are no longer valid. The impact varies by supply chain sector and value chain. Concurrent macro forces–material shortages, war, shifts in consumer buying patterns, logistics constraints, inflation/recession, and climate change– are reshaping today’s reality necessitating the need for a supply chain reset button. We can no longer assume that government policy is rational, variability is low or logistics are available. This reset is not an evolution. We cannot drive progress by doing more of the same. Business continuity requires a redesign: a rethinking of the basics.

Reflection

This morning, I was a guest speaker on a call with institutional investors. The call was a Q&A format. I was struck by the naivety of their questions. Here is a sample.

I share the questions in bold and my answers follow.

Q. We have heard that there is a focus on near-shoring, reshoring, and local manufacturing. Does this solve the problem? When I get this question, I swallow hard. It is such a simplistic view of the world. My answer, “The decisions are not that simple. Asset relocation takes time. The availability of capacity in industries like the semiconductor industry is tight. Building a fab (manufacturing site) takes two-to-four years and requires the availability of water and trained labor.”

A chip is not a chip and a foundry is not a foundry. The proliferation of products and capabilities is exponential with over 60% of capacity in Taiwan. This small island is currently in the middle of political tensions between the US and China and represents 90% of the most sophisticated chips, such as those based on gallium nitride and gallium arsenide, which are used in the defense and aerospace sector.

According to figures published last November by the World Semiconductor Trade Statistics (WSTS), the global semiconductor market growth rose from 6.8% in 2020 to 25.6 % in 2021, reaching a market size of $553 billion. This was the biggest escalation since the 31.8% increase in 2010, eleven years ago.

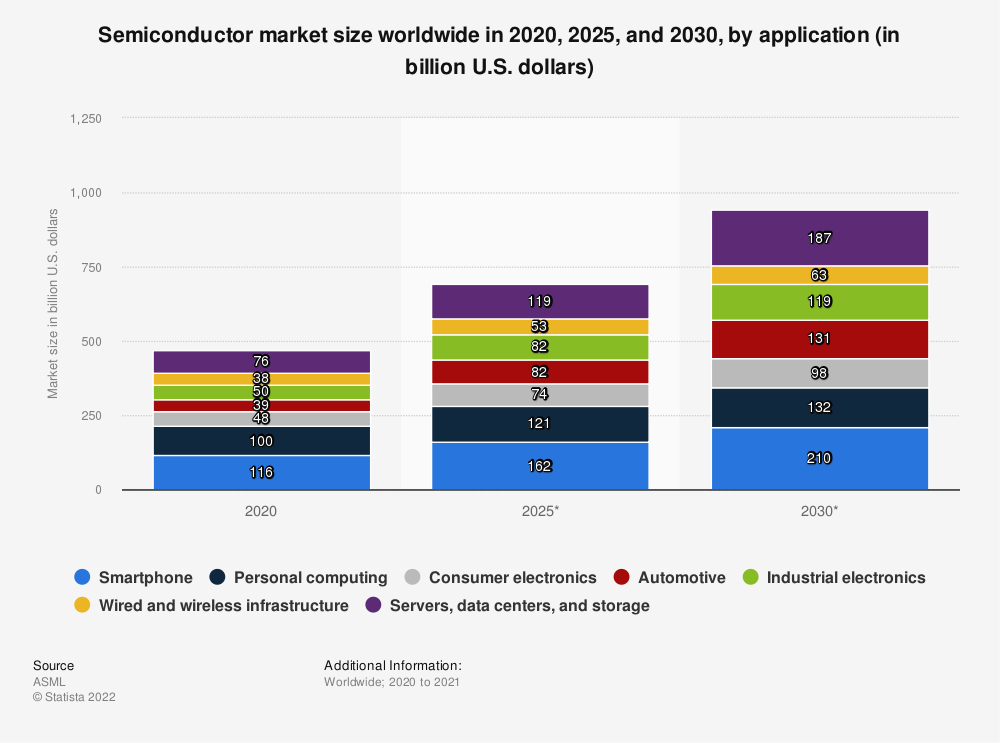

The increase in defense spending will increase the shortages. While the shift from products to services will decrease consumer-centric manufacturing, the rapid escalation of defense will put unprecedented pressure on this supply chain. The automotive industries–with the poorest capabilities to plan and manage suppliers–will suffer the most. Figure A shows the projections before the newer spending for defense.

Figure A. Shifts in the Semiconductor Market

What to do? This is not a question of near-shoring or reshoring. Instead, supply chain leaders need to focus on the minimization of waste, and the alignment of signals. Prepare for a slog. The answers lie in investments in supplier development teams, the simplification of the bill of materials and product platforms, and analytics to forecast requirements based on consumption.

The question of near-shoring or reshoring is really a question for labor-intensive industries like apparel. But, even then, the relocation of capacity is not a snap of the fingers. The answer lies in network design, demand sensing, and the simplification of product platforms.

I am the most worried about the chemical sector. This industry is recovering from massive M&A and operates with lower margins than its customers. In the sector, the bullwhip impact is high, the inflationary pressures of crude oil prices immense, the variability from energy outages painful, and inventories relatively low. The cash-to-cash impact for debt-laden chemical companies with 2% growth and 4% margins offers little room for error. All value chains are dependent in some shape or form on the chemical industry. The focus for upstream partners making 10-12% margin (household products) or 22% margins (pharmaceutical) needs to be on business continuity. Now is the time to focus on being a good trading partner. Traditional processes push cost and waste back onto trading partners at four and five levels back in the supply chain. These are our weakest links.

Q. If ERP system input includes lead time, why is there such bloat and a problem with inventory restatements? Should we expect a fire sale?

My answer is simply, “Too many people overstated the capabilities of ERP. Yes, lead times are a factor in ERP, but few companies keep them updated.”

Most have the same values in the system as when it was installed. And, yes, lead time increases are a factor and increase safety stock, but the greater issue is variability. For example, when I used to ship ice cream by reefer container to China from the west coast, the time on the ship was 12-18 days. Today, the lead times are up 20-30%, but the variability of unloading increased 40-50%. ERP and APS technologies do not do a good job of managing in the face of variability.

Too few companies (less than 5%) have a clear inventory strategy that evaluates the form and function of inventory based on both lead times and variability. Today, we have an additional factor with inflation to add to the mix of issues, that changes the requirements for the “buy plan in procurement.” Companies that tightly tether to enterprise transactional data will never buy the right stuff. Instead, the focus needs to be on the use of outside-in signals and building bi-directional orchestration capabilities. For this definition see my last post, Companies Chained to Traditional Processes Will Experience the Whip.

Q. The port of Los Angeles shows a slowdown. Are the port issues over? Here my answer was a bit controversial. My forecast is a lumpy road to 2023 and port-related supply chain disruptions for at least a year. My reasoning? The China COVID disruption impact is ongoing creating container and chassis imbalances. In addition, the warehouses are full and containers are being used for overflow storage. Containers sit on chassis. As a result, loading in east coast ports and rail is converting to “break bulk” which is less efficient and more prone to damage/theft. The summer port labor negotiations in southern California ports typically reduce the terminal output by 40-50%. The impact is projected to impact the unloading in July.

The cycle is just beginning. Labor negotiations–assuming no strikes–will conclude in time for the winter holidays.

What can be done? Focus on right-sizing inventories. Free containers and chassis for the pool. Use network design technologies–Coupa, Logility, Optilogic, and OMP to design flows based on both lead times and variability. Feed these assumptions into other applications driving supply chain decisions.

Q. What are companies doing that is working? Industry leaders invest in analytics to better use outside-in signals. The focus is on building supplier development teams and working together–cross-functionally–to reduce complexity.

Conclusion

The answers are not simple. I am hoping that this blog helps companies understand that historically, we have been having the wrong discussions.

The fight now is for business continuity. As inflation increases working capital demands and companies realize that the elongation of payables is no longer an option in the face of tight supply, there is more and more pressure on cash-to-cash cycles. Companies in the chemical and semiconductor sectors are the most vulnerable. For many companies, as they live through supply chain case studies–their actions writing stories that they don’t necessarily want to be a part of–supply chain complexity will be better understood. Supply chain excellence happens when leaders manage complex non-linear flows. For many, this will be an ongoing learning process.

We need to change discussions to drive a reset in behavior. The core issue is business continuity and order reliability. Traditional processes can make each of these worse. We must unlearn to rethink practices to manage supply chains holistically. The days of financial supply chain reengineering are over. Instead, the focus needs to be on supply chain design, flow trade-offs, and the management of variability.

These are my thoughts. I welcome yours.

Wrap-up

Registrations are pouring in for the Supply Chain Insights Global Summit on September 6th-8th in Washington, DC. The focus of the conference is on Supply Chain 2030. This conference has a physical presence for 90-100 business leaders at the Westin near Dulles Airport and a virtual component that will be facilitated on a collaborative platform with guest speakers by Sarah Barnes Humphrey. I encourage all to sign up.

The conference is designed for extreme networking. Our goal is to build a guiding coalition of industry leaders to drive change. We need to redefine supply chain planning architectures, but it needs to start with redesigning work. To do this, we must have a different discussion and free ourselves from convention