I remember the call like it was yesterday. Four years have passed. On this cold day, I would like to walk on the beach with my friend Maddy. She is there. I am not. Let me tell you the story.

I remember the call like it was yesterday. Four years have passed. On this cold day, I would like to walk on the beach with my friend Maddy. She is there. I am not. Let me tell you the story.

In 2014, while sipping on an early morning coffee, Maddy called to ask me a question. It sounded simple, but she was frantic. Working for a large manufacturer, she was trying hard; but failing, to integrate Ariba, Elemica, and GT Nexus. (These are three different Supply Chain Operating Networks.) Confused on solution capabilities–the differences and commonalities of these solutions– she had no idea where to start to connect them together.

I also did not know the answer, but was up for the challenge. To help, I set up a series of dinner meetings for Maddy to speak to other manufacturers working on similar problems. None had the answer. Answering the question was the genesis of the network of networks share group.

Today, retired and tan, Maddy calls me from time-to-time from Florida. Building the network of networks is no longer her priority. We talk about cooking or the weather. Me? I continue the work on building the network of networks. It is a slow and tedious journey. You would think that it would be easy. After all isn’t the internet the defacto network of networks? And, haven’t we made a lot of progress on B2C e-commerce? The answer to both questions is “yes.” The answer of how to build B2B interoperability is not so easy.

The Story of the Network of Networks Share Group

A share group is a joint initiative between manufacturers and technologists to work together to solve a supply chain problem that does not have a clear answer today. The focus of this group is to define multi-tier processes for B2B connectivity. When I started, I believed that I could put “the smartest business leaders” and “technology innovators” in a room and learn through a series of pilots and group sharing. I was wrong. While we did learn and make significant steps forward, I quickly learned that no technology provider would step forward to drive interoperability between existing networks. The reason? Existing business models are self-serving. By definition, there is a resistance to work together. It is an intractable barrier.  Here is Maddy’s vision in a picture of what a network of networks would look like.

Here is Maddy’s vision in a picture of what a network of networks would look like.

The focus of existing technology companies is deeply rooted in traditional sales activities. Companies are sales-driven. (As opposed to market-driven or value-driven business models.) Today, there is no incentive for any technologist to develop/improve B2B interoperability. As a result, do not expect to see technology companies to work together to build the network of networks. As shown in Figure 1, while all technologists claim to have the perfect “answer” they are pieces of a puzzle that does not fit together. Each technology solution operates within well-defined functional silos. There is no technology solution that stretches across industries to automate the processes of source, make and deliver. While each of these technology companies claim more capabilities than my short description in Figure 1, I have tried to represent the functionality very succinctly. (Here is the latest report outlining the capabilities. I am updating this report.)

Figure 1. Existing Supply Chain Networks

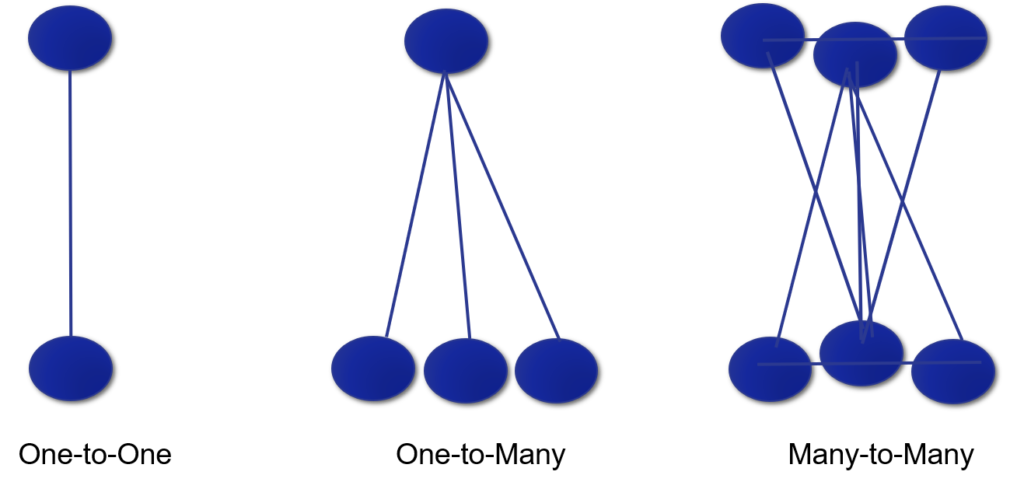

Today network deployment is one-to-one connectivity or one-to-many connectivity. The focus is on supply. Seldom is it demand. Mature companies have EDI groups that work on one-to-one or one-to-many models. The concept of many trading partners inter-operating with many trading partners is quite new. While we talk about value networks in conferences and boardrooms, the reality is that the architectures are not clear. For clarity, Figure 2 is a simple representation of one-to-one, one-to-many and many-to-many architectures. In the drawing, imagine that each of the circles is a trading partner and that the lines represent business flows. I know of no true many-to-many network in supply chain. In contrast, many-to-many networks exist in banking. The financial industry is easier. Routing numbers and account numbers are clear identifier and there is clear governance between banks on the transfer of funds.

Figure 2. Types of Business Networks

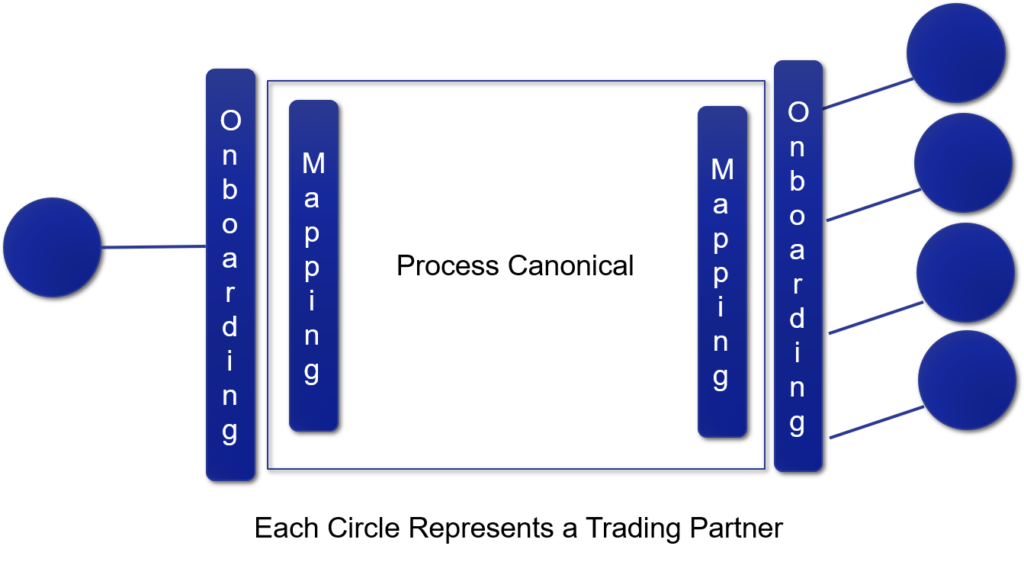

The functionality of a supply chain operating network simplifies the mapping and onboarding for one-to-many networks. In short, a Supply Chain Operating Network reduces latency and improves specific processes. Each Supply Chain Operating Network outlined in Figure 1, has onboarding, mapping and business process canonicals. However, the definitions of data, process and onboarding are very different in each network. In Figure 3, we share the definition of a Supply Chain Operating Network.

Figure 3. Definition of a Supply Chain Operating Network

While many think that blockchain offers a solution. There is much more unknown than known about blockchain usage. The focus for most of the existing blockchain deployments that we are tracking is on warranty/returns, transportation and lineage. There is much hype and there are issues with scalability.

Each blockchain technology–Hyperledger, R3’s Corda, and Ethereum–also operates very differently. There are issues of interoperability between blockchain technologies. Each protocol is fundamentally different in the definition of permissions. We are not clear on the role of a node and the fit of public versus private blockchain technology. The most advanced work is in India and Japan.

Why Is It Important?

Companies are busy with enterprise initiatives. IT organizations consumed with upgrades of existing software have very little time for the topic. So, why should you care?

If you care about any of the initiatives listed below, you must realize that solving the problem requires cracking the code of how to automate and run a multi-tier network on both the demand and supply side of enterprise processes. This enablement will not come from ERP providers.

- Affirmative ETA (Estimated Time for Arrival). Knowledge of arrival times improves transportation routing and reduces fines/penalities.

- Collaborative Logistics. Logistics costs increased greatly in 2018; yet, 40% of trucks are empty. If we could combine orders and ship more collaboratively, we could improve flow.

- Corporate Social Responsibility (CSR). Knowledge of origin and handling is essential to improving CSR initiatives.

- Fair Labor. Focus is on sensing labor input from second and third supplier operations to understand the impacts of fair labor.

- Ethical Sourcing. Congo Metals. Use of Slave Labor. These are all issues in ethical sourcing initiatives.

- Prevention and Sensing of Counterfeit Goods. Track and trace and authoritative identifiers help to prevent counterfeit goods.

- Time-to-Market for New Products. Improving data flow to contract manufacturers improves cycles to get products to market.

- Lineage and Track & Trace. This is the cornerstone of the safe and secure supply chain.

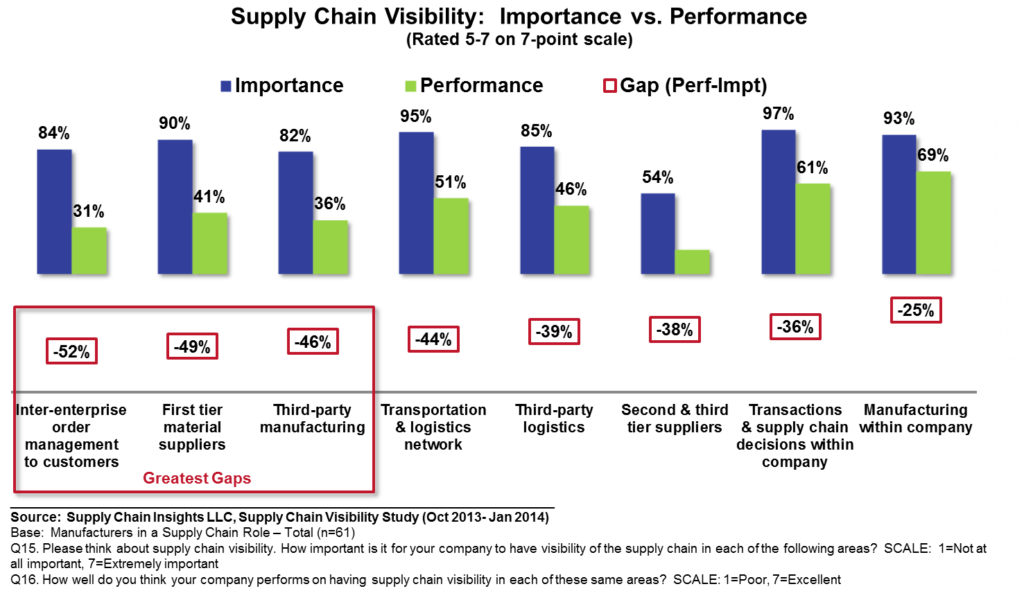

Today, the term “visibility” often bandied about in boardrooms is the stated goal, but companies lack visibility across source, make and deliver as shown in Figure 4.

We have asked this question on visibility for the past five years with the same results. The gaps in visibility are large. Demand is larger than supply. The processes of VMI, data sharing and CPFR are insufficient.

Figure 4. Gaps in Visibility Capabilities

My Advice for the Supply Chain Business Leaders….

So, what to do? How to get started?

Last week, I facilitated my tenth face-to-face network of networks meeting. As I facilitated the meeting, I reflected on how much I had learned and how much there was left to do. In the middle of the meeting, I got up an started writing on a whiteboard my advice for business leaders. I asked others in the room to collaborate. Here is the list that we developed together:

- Manage Your Ego. Focus on using the technologies that you have. Don’t fall for the trap of being courted by technology sales teams with “pretty power points.” Recognize that large consultants and technology providers focus on selling to business leaders’ egos. In buying solutions, trust, but verify. Ask the hard questions of how the business solution ties to goals. Don’t be afraid to ask hard questions and get clarity on definitions for words you do not know.

- Govern by Value. Be clear on purpose. Focus on driving business results based on definitive goals. Get clear on data definitions and process requirements. Don’t speak in abstract terms.

- Build Capabilities. Within your team, build capabilities. Many of the knowledgeable EDI employees are retiring. Marry EDI gurus with digital innovation efforts to try to build deeper understanding of B2B capabilities. Be patient. They speak different languages and operate in different paradigms at different speeds. Moving forward takes dogged facilitation.

- Avoid Shiny Objects. There are many very cool and new technologies swirling in the market now. Cognitive computing, blockchain, new networks….. I could go on and on…. Sidestep te hype and focus on the known. Follow the recommendations in the next steps of this blog on how to get started.

- Ground the Effort in Clear Definitions. One of the most important first steps is to get grounded in clear definitions. For example, last week I did a session on demand sensing. There were twenty people in the room with ten different definitions. People in the organization were nice. They let conversations progress without getting clear on definitions. As a result, they spoke in circles. Be diligent to ground in definitions. Start by getting clear.

Where to Place Your Energy.

Currently, there is a lot of buzz on B2B networks. Understand that today, there is more hype than capabilities. While vendors use the term network of networks frequently, buyer beware. No technology company offers capabilities to enable interoperability across and between many trading partners to many trading partners. However, the network of networks is still a worthy goal. To drive forward, place your internal energy in these five areas:

Pressure Technology Partners to Step-up. Don’t accept the current limitations. If you buy a Supply Chain Operating Network pressure the technology provider to work with other networks. This is especially important with intractable providers like SAP.

Building a Team. Combine old-school EDI experts with digital natives to imagine the supply chain of the future. Understand the basics and limitations of protocols and standards. Network extensively with other companies to maximize learning. All too often I see these groups working separately and at cross-purposes.

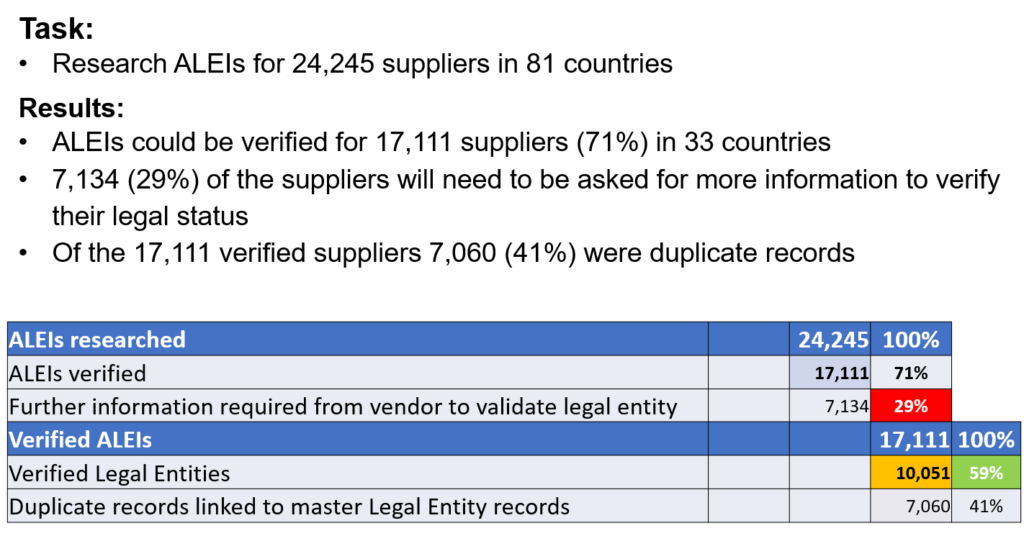

Use Authoritative Identifiers. A social security number is an authoritative identifier for an individual. In banking it is a combination of bank routing and account number. For company information, the authoritative identifier is the ALEI or the corporate registration is the authoritative identifier. A DUNS number is not an authoritative identifier.

Let me give you an example. In the case study below, a major manufacturer worked for six months to try to validate over 24,000 suppliers. They could identify slightly over 17,000. Why does it matter? In company data, often there are duplicate entries for the same company leading to confusion. For example, The Procter & Gamble Company could be listed as P&G, Procter & Gamble or Procter. In addition, authoritative identifiers eliminate the potential of fraud. When I was 28, a person working for me in a well-known company set-up a company in the name of his girlfriend and over the course of eight years stole over 1M$. He wrote the invoice to the fake company and signed the receiving documents without physically receiving the merchandise. In this case, the purchase was wooden pallets. Items like pallets and supplies are easy targets for fraud.

The network of networks group is currently developing a onboarding form. The use of this form–either the paper or the online version–helps companies obtain authoritative identifiers.

Listed below in Figure 5 are the results from the test:

ListFocus on Data Portability. To achieve data portability, format data using an agreed and known syntax and explicit semantic encoding. In this definition, ensure that the lineage/origin of data is known. Don’t just say “integration.” Instead, define data portability and ensure that there is discipline in the building of data packets for sharing. The ISO standards help.

ListFocus on Data Portability. To achieve data portability, format data using an agreed and known syntax and explicit semantic encoding. In this definition, ensure that the lineage/origin of data is known. Don’t just say “integration.” Instead, define data portability and ensure that there is discipline in the building of data packets for sharing. The ISO standards help.

Build Quality Blockchain Infrastructure. Use the ISO standards to build a quality blockchain infrastructure for testing. Stay current on this definition as the technologies mature.

The network of networks share group meets monthly (through a conference call) and 2-3 times a year in a face-to-face meeting (one in Europe and one in the Americas). The goal is to discuss the work on the development of ongoing pilots. I facilitate these meetings. Drop me a line at lora.cecere@supplychaininsights.com if you would like to join the effort. It takes a village.

Until next time…..

For additional reading on building the Network of Networks and Supply Chain Visibility check out these articles:

Infor’s Acquisition of GT Nexus

Building the Network of Networks

Building the Network of Networks: A Call for Help

Supply Chain Visibility in Business Operating Networks