Platitude: a flat, dull, or trite remark, especially one uttered as if it were fresh or profound. Source: Dictionary.com

During the year I go to a lot of conferences. In the process I get to hear the views of many thought leaders. As I sit on the back row I hear platitudes (a number of concepts positioned at a high level without clarity on how to execute). As supply chain clichés take flight clients struggle with execution. One of these concepts that I hear a lot, but see few tangible examples of, is the idea of a “customer-segmented supply chain.”

The discussion of customer-segmented supply chains happens often. When I hear companies discussing the implementation of a customer segmentation strategy, I ask a series of questions:

- Who is your customer? How do they buy from you?

- What are you trying to accomplish through the execution of a customer segmentation strategy? Why does it matter to you?

- How will the policy be executed? Over time, as the business evolves, how will it adapt?

- In the process, how will you measure success?

- Through the evolution, how will you ensure alignment with the commercial teams?

When I ask these questions they look at me like I am the dumbest analyst in the world. I find that most of the time companies cannot answer the first question of “Who is your customer? How do they buy from you?” Currently working on a series of surveys to help clients answer these two questions, I struggle with the current state. Most supply chain planning teams do not know their customers.

I find in this world of the global multinational that procurement processes have become convoluted and increasingly complex. (In my opinion we have made procurement increasingly complex without adding value. I could go off on a rant, but I will save you from this. Most clients are well-served to begin their customer-centric discussion by trying to do business with themselves. In my research I find that the companies with the most progressive procurement processes also have the most advanced customer supply chain process evolution.) Without answering this question of “Who is the customer?” the rest of the discussion is moot.

Today, there is not a well-defined template on how to build and operate a supply chain defined by customer policy and segmentation strategy. I often find that it is a whiteboard activity with good intentions that cannot be actualized. This makes me yawn. I am after real insights for real people making a real difference. Platitudes make me crazy. When I hear them at a conference I squirm uncontrollably in my seat. It is for this reason that I write this post on this beautiful Sunday afternoon.

My journey to understand SanDisk started in June 2015. Spinnaker Management Group asked me to co-present on a demand-driven webinar with SanDisk. When I heard their story I scratched my head. For me it was ironic because SanDisk’s journey is not about demand. In fact, the teams ignore the forecast. Instead, in the SanDisk journey , they adjusted the speed of response to their customer segments, and actively designed inventory postponement strategies. It is systemic. While I do not consider this case study as a good example of demand-driven processes, I do believe they have done some great work on implementing a customer-segmented supply chain based on postponement. For many companies starting a demand-driven journey, adopting SanDisk’s customer-centric strategies would be a great starting point to improve supply chain performance.

SanDisk’s Journey to Build a Supply Chain Customer Segmentation Strategy

SanDisk Corporation designs, develops and manufactures flash memory storage devices and software. The company is the third largest manufacturer of flash memory in the world. Founded in 1988 in Milpitas, California, SanDisk is publicly traded on NASDAQ with 8,600 employees globally, and market capitalization in 2015 over $13 billion. Currently the company is $6.1B (trailing four quarter financials) with $1.5B in Net Cash on Hand. The company is a Fortune 500 company serving four major markets: Data Centers, Client Computing, Mobile and Connected Devices and the Consumer Markets. The supply chain is vertically integrated and global shipping almost 2 million units daily.

At the Supply Chain Insights Global Summit, I asked Kehat Shahar, Vice President of Supply Chain Planning at the SanDisk Corporation, to speak on the SanDisk journey. I had the opportunity to visit with the SanDisk team in July 2015. As I sat with the team and discussed the future of supply chain, they impressed me with their by their use of planning tools and their process diligence on building inventory strategies to enable a customer-segmented supply chain. The journey began with a one-size-fits-all approach in 2008, and the policies evolved over the course of the last seven years.

At the Supply Chain Insights Global Summit, I asked Kehat Shahar, Vice President of Supply Chain Planning at the SanDisk Corporation, to speak on the SanDisk journey. I had the opportunity to visit with the SanDisk team in July 2015. As I sat with the team and discussed the future of supply chain, they impressed me with their by their use of planning tools and their process diligence on building inventory strategies to enable a customer-segmented supply chain. The journey began with a one-size-fits-all approach in 2008, and the policies evolved over the course of the last seven years.

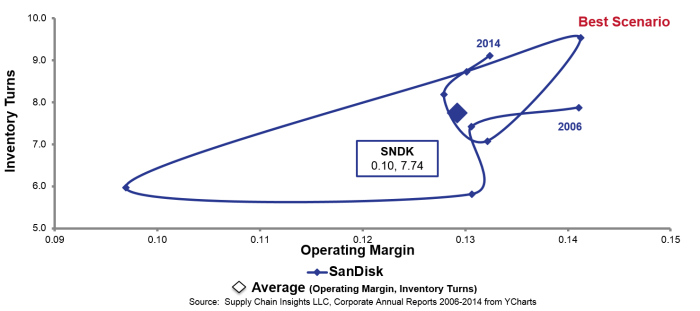

Figure 1. Orbit Chart for SanDisk for 2006-2014

This is a story of a supply chain turnaround. With the downturn of volume in 2008 with the recession, the company shifted to sales incentives based on channel sell-through, implemented cost-to-serve strategies, and actively began the journey to design and implement customer segmentation strategies. This included monthly reviews between business units and central operations teams and adaptive inventory segmentation policies.

The competitive landscape and customer replenishment needs defined the customer-segmentation strategies. While they have actively worked on the implementation of a cost-to-serve analysis, Kehat’s feedback is “Getting management buy-in for the implementation of cost-to-serve process is easy, but the implementation is difficult.” Where they have had the most success is in the design of inventory strategies to buffer segmented demand and supply streams based on an understanding of the customer. The evolution was incremental and includes the design of products to enable postponement based on five principles:

- Postpone inventory while meeting customer service level requirements.

- Delay product differentiation without adding significant cycle time or cost.

- Reduce cycle time without compromising flexibility.

- Understand, measure and design buffers to reduce variability

- Implement customer-centric policies to maximize $/GB shipped while effectively balancing service levels and inventory levels.

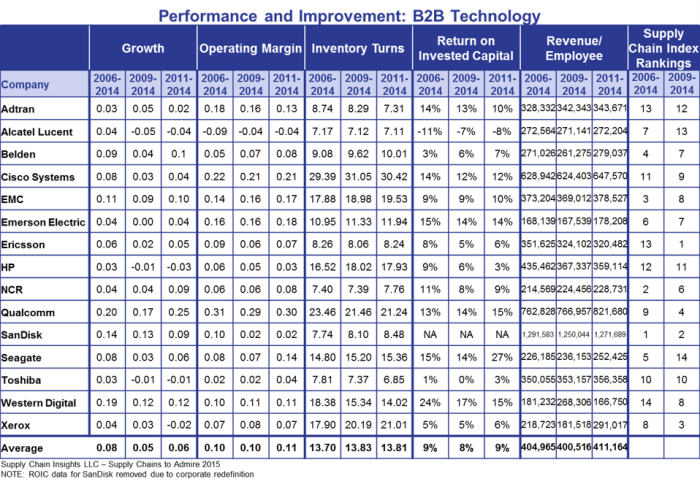

Does it work? The Supply Chains To Admire Report analysis, as shown in Figure 2, illustrates that while SanDisk is driving significant improvement they are not the B2B leader. This honor goes to Cisco Systems, EMC, and Western Digital. So, why did I ask SanDisk to present? The answer is simple: it is a story of improvement. Both improvement and performance define supply chain excellence.

Figure 2. SanDisk’s Performance Within the B2B Technology Sector

I like what Kehat has accomplished in three areas:

- SandDisk Uses Their Planning Technologies. When I visited the SanDisk team, their use of supply chain technologies impressed me. While many companies purchase supply chain planning technologies, few use them actively. The SanDisk team has a very accomplished team using the technologies. They have abandoned their spreadsheet ghettos. The team understands the inadequacy of the spreadsheet to do supply chain modeling.

- There Is Active Focus to Close the Gap Between Commercial and Operating Teams. The monthly meetings focused on the customer at SanDisk helps the planning teams to understand the customer. While many planning teams struggle to answer my questions, this was not the case at SanDisk. The teams engaged in enlightened dialogue on the drivers of the customer and the use of segmentation strategies.

- The Team Not Only Talks Customer Segmentation: They Act to Make It Happen. The use of inventory postponement strategies and the design of buffers was the focus of Kehat’s presentation. I love the detail and insights in Figure 3. This figure outlines the flows. This is a true execution of a customer segmentation strategy.

Figure 3. SanDisk’s Flows and Drivers

The Supply Chain Insights Global Summit is different for many reasons. First, it is a conference designed for supply chain leaders. Secondly, at the conference supply chain leaders tell their stories of transformation. The Supply Chain Insights’ annual analysis of the Supply Chains to Admire drives the selection of speakers. This work analyzes both supply chain performance and improvement over the period of the last eight years. To listen to Kehat’s story and view his slides follow this link.

I like Kehat’s story. What do you think? Listen to his presentation and let me know. We hope to see you at next year’s Supply Chain Insights Global Summit on September 12-15 in Scottsdale, AZ at the Phoenician. One thing is for sure, the Supply Chain Insights Global Summit agenda is never about platitudes.

About the Author:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora wrote the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. As a frequent contributor of supply chain content to the industry, Lora writes by-line monthly columns for SCM Quarterly, Consumer Goods Technology, Supply Chain Movement and Supply Chain Brain. She also actively blogs on her Supply Chain Insights website, for Linkedin, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research at Temple or knitting and quilting for her new granddaughter. In between writing and training, Lora is actively doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. She thinks that we are never too old to learn or to push an organization harder to improve performance.

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora wrote the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. As a frequent contributor of supply chain content to the industry, Lora writes by-line monthly columns for SCM Quarterly, Consumer Goods Technology, Supply Chain Movement and Supply Chain Brain. She also actively blogs on her Supply Chain Insights website, for Linkedin, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research at Temple or knitting and quilting for her new granddaughter. In between writing and training, Lora is actively doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. She thinks that we are never too old to learn or to push an organization harder to improve performance.