Supply Chain Operating Networks: The building of supply chain applications using many-to-many architectures to connect multiple parties to multiple trading partners to improve multi-tier supply chain visibility, planning and execution to improve relationships in extended value chains.

The winds of a recession are whipping. Trade winds are changing. Globalization and localization are happening simultaneously. Growth has slowed and customers are more fickle. Yet, the supply chain organization cannot see. The supply chain is safely tucked behind the firewall, operating on data that is late and out of sync with the market.

My time on the European continent is busy. I am struggling with jet lag. Last Thursday I flew to Munich to meet with SupplyOn. The company is a B2B Supply Chain Operating Network supporting the automotive and aerospace industries. I like the SupplyOn functionality; and with great references, I wanted to know more. My goal of the trip was to gain new insights.

Today and Friday I met with large European consulting firms. Each are pushing very functional visions of the future under the guise of the digital enterprise. Each sees supply chain as a function within a functional enterprise. The vision of the extended effective value network from the customer’s customer to the supplier’s supplier is lost. The lack of vision saddens me.

The large consulting partners are reeling, looking for significance with the downturn of the ERP market. Each has a bench of ERP consultants and they are seeking the next new thing. They are also struggling with internal politics. With strong Indian outsourcing capabilities, they are pushing the automation of processes through labor arbitrage strategies for cheap labor for manual data manipulation. They are not driving new insights through the automation of the burgeoning opportunities with new data types and technologies that enable streaming data and cognitive learning. Sadly, I find each to have a limited view of supply chain analytics. BPO concepts limits their thinking.

An Old Gal on a Mission

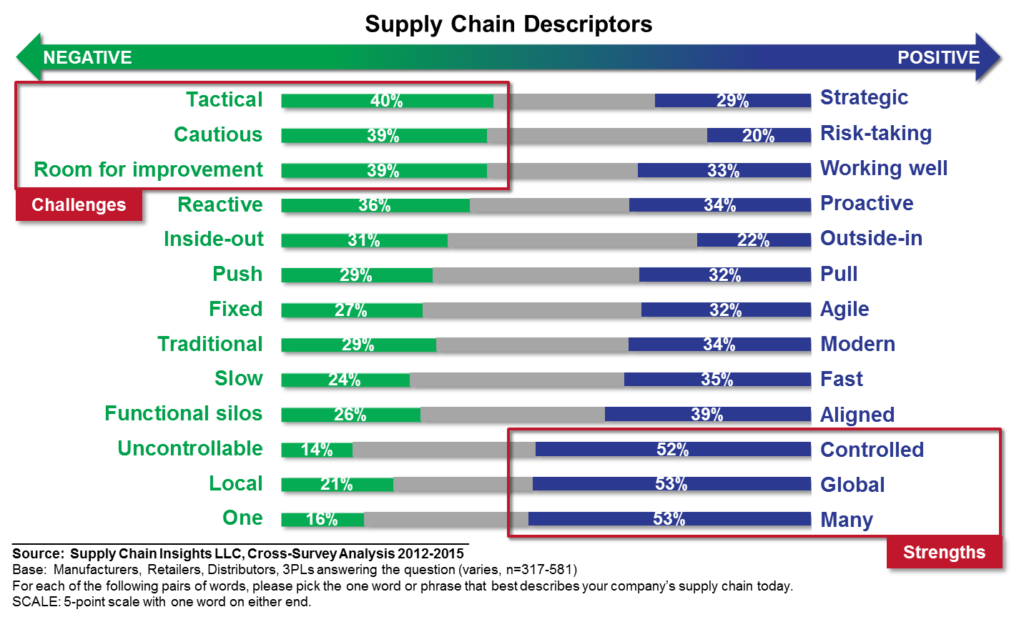

I am on a mission to spark a new discussion to evolve supply chain concepts. In the next three months I will speak at over 20 events. The majority of manufacturing and retail companies want better performing supply chains. The desire and focus are to drive alignment, proactive processes and agility. The current state is reactive, slow and inside-out. The vision of the tightly integrated efficient supply chain has failed. The statement of, “Doing the same thing over and over and expecting new and different results is insanity” is attributed to both Franklin and Einstein, but I think is relevant to this discussion.

I am on a mission to spark a new discussion to evolve supply chain concepts. In the next three months I will speak at over 20 events. The majority of manufacturing and retail companies want better performing supply chains. The desire and focus are to drive alignment, proactive processes and agility. The current state is reactive, slow and inside-out. The vision of the tightly integrated efficient supply chain has failed. The statement of, “Doing the same thing over and over and expecting new and different results is insanity” is attributed to both Franklin and Einstein, but I think is relevant to this discussion.

Figure 1. Current State of Supply Chains

Current State

Today the supply chain is evolving into a value network. Companies are more dependent on third-party relationships. However, automation enables enterprise efficiency, not value network effectiveness. Most companies cannot see beyond their firewalls. I feel it is time to rewire our supply chain thinking. This does not happen through conventional thinking. Instead, it happens through the adoption of new technologies and outside-in thinking.

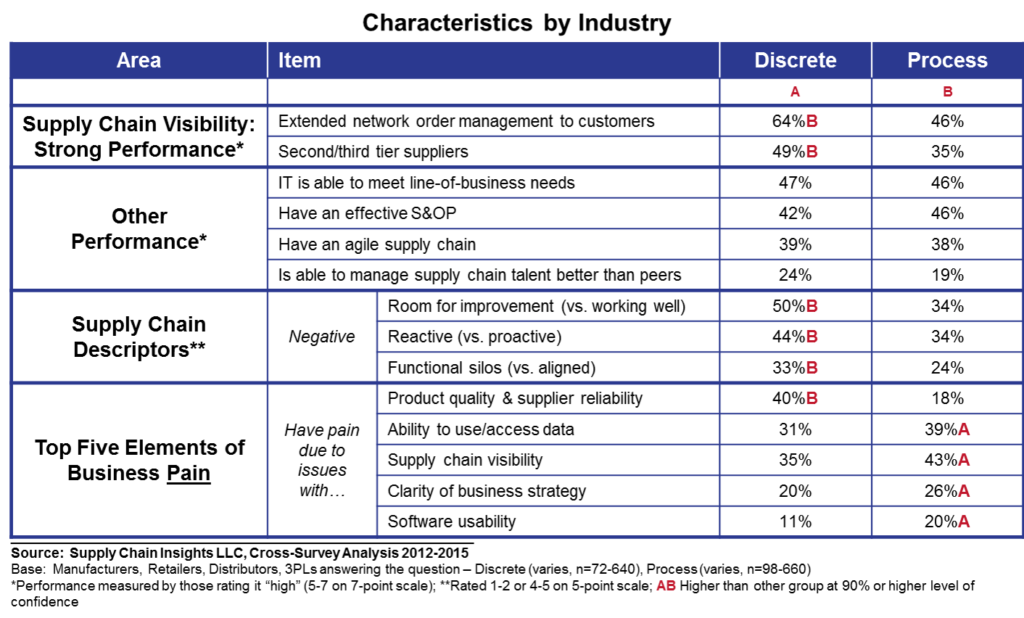

In our research, discrete industries–aerospace, automotive, hi-tech, and semiconductor– rate themselves as performing better, being more proactive, and having greater alignment. They are more mature on supply chain visibility. Process industry leaders–chemical, consumer packaged goods, food/beverage–have greater issues using data, with software usability, and building effective connections to align and build effective relationships with trading partners. Is it a coincidence that process industry leaders have standardized on SAP and blindly followed the SAP IT-centric definition of supply chain automation without holding SAP accountable to build effective supply chain solutions for the extended value network? I will let you draw your own conclusions. My view is that both SAP and the large consulting organizations perpetuate a very functional view of supply chain management which is detrimental to building effective value networks.

Table 1. State of Industries

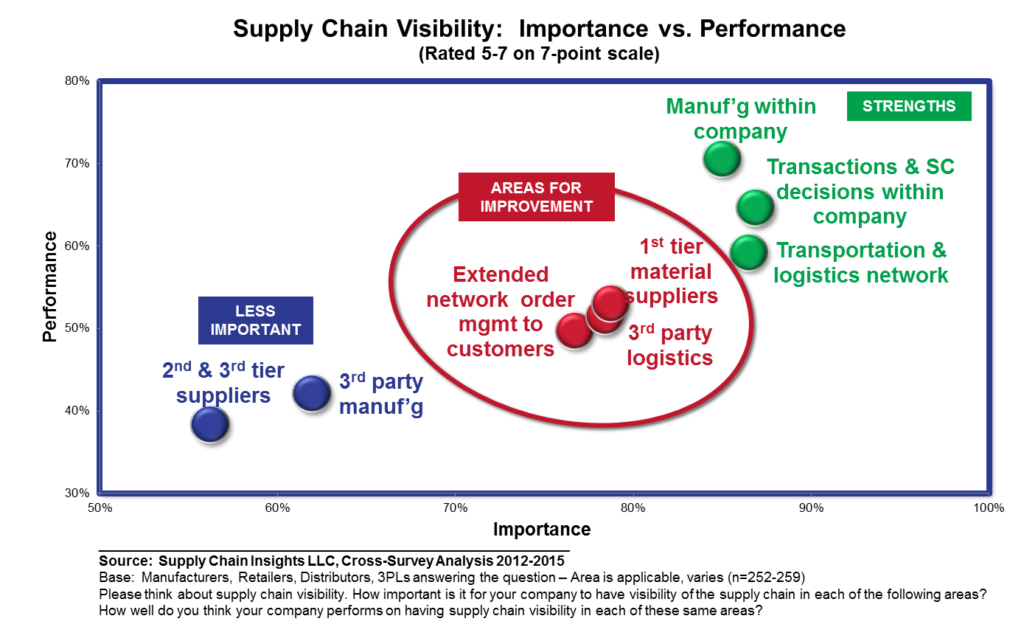

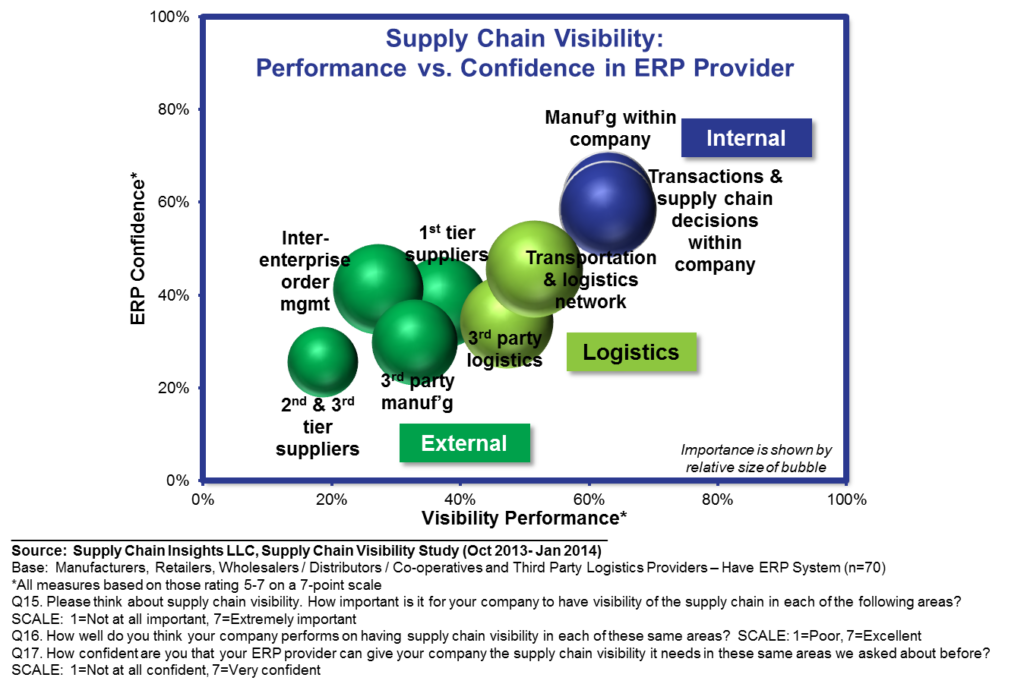

Since most companies invested in the automation of the enterprise, not the value network, visibility within the company and the transportation network is a strength. However, visibility of channel relationships–customer orders and consumption/purchase–in the demand network, or the use and consumption of materials in the extended supplier network, is an ongoing issue. Consequently, the supply chain is out of step with the market. The processes are largely batch, using data with great latency (orders and purchase orders). We have automated the enterprise but not the network. As a result we have induced and exaggerated the Bullwhip Effect in the value chain: there is great waste and opportunity for automation of effective value networks.

Figure 2. Current State of Supply Chain Network Visibility

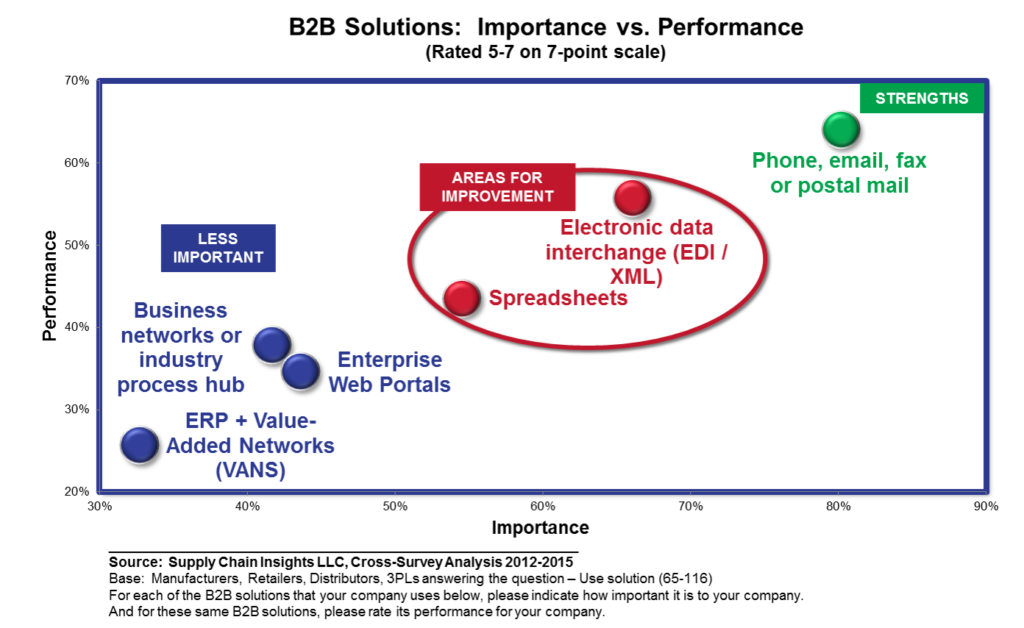

How sad of a statement is Figure 3? Despite two decades of investment in enterprise solutions, companies today are only good at email, fax or postal mail, but not in the automation of the extended network. Let’s say this again. Good at email? Spreadsheets? How sad is this?

Many companies which have depended on the extension of ERP architectures to build value networks are dependent on ERP messaging and portals, but this form of B2B automation lacks bidirectional communication and an inter-enterprise system of record. Let me explain the issue. Macy’s is under market attack. They are pushing back on suppliers. It is a brutal environment. The changes for supplier trade are ever-changing with greater punitive implications. However, Macy’s communicates to suppliers through portals. The information changes daily. As a result, without a persistence layer, it is tough for suppliers to work through issues and track needs. Macy’s feels good about their portal strategy, but it is ineffective for supplier coordination. As a result, out-of-stocks reign and supplier teams spend endless hours debating deductions.

Let me give you another example: I was speaking to a supplier critical to delivering materials to the Caterpillar heavy loader division last week. The supplier commented that it is was impossible to know what Caterpillar needs for direct materials requirements at their factories. Why? They get over 5000 spreadsheets daily with each plant changing the requirements multiple times a day. The issue? There is no system of record with bidirectional agreements on supply.

Figure 3. Current State of B2B Connectivity

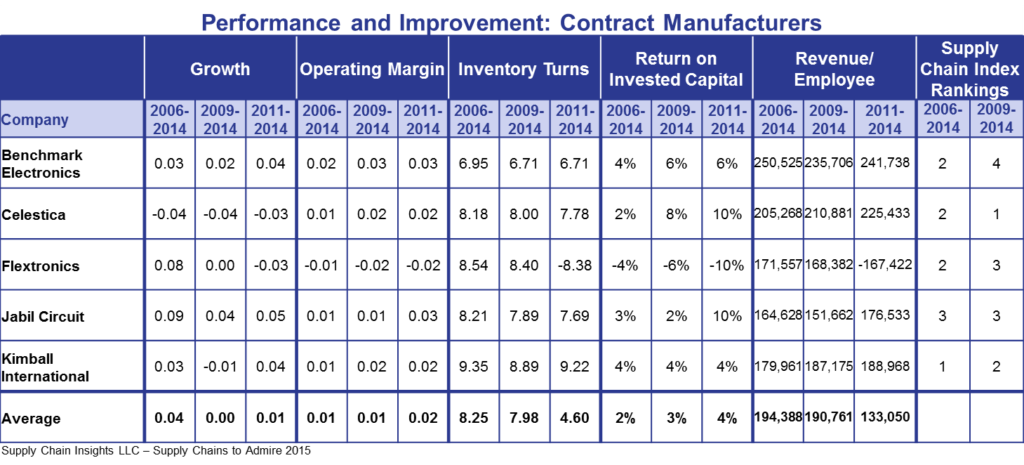

Strong value networks and strong relationships go hand-in-hand. In the building of global supply chains, in the last decade, across value networks, outsourcing to third-party logistics, and contract manufacturing accelerated. While the leaders that forged these relationships promised innovation and acceleration of B2B networks, what happened was quite different. As shown in Table 2, the contract manufacturing industry is a weak model, and a risk for the high-tech value chain. In the building of the contract manufacturing model, brand owners in the high-tech value chain pushed cost and waste backward into the value network creating issues with fair labor and social responsibility. They did not automate the value network or take ownership for their demand signal. The low margins, the transactional nature of the relationships, and the lack of innovation is a barrier for the high-tech value network to move forward. The process industry’s reliance on the 3PL transportation model is a similar dilemma.

Table 2. A Critical Review of the Contract Manufacturing Model

Why Did We Not Evolve Value Networks in the Last Decade?

There are many reasons. Let’s start with the investments in technology. In the period of 2000-2005 the trading exchange model was overhyped, and the software largely under-delivered against the business goals. In the heyday there were more than 80 trading exchange solutions. In 2000-2002 I used to get a press release weekly on the launch of new B2B network models. i2 Technologies marketed industry-specific solutions under the brand TradeMatrix that were largely hype; but in this period, industry consortia evolved to push industry-specific applications. The concept was that supply chain leaders could collaborate within an industry to deliver B2B capabilities for trade. Procter & Gamble led an initiative for Transora. The solution implemented by PWC failed. During the initial round of funding, 49 leading consumer products companies –The Coca-Cola Company, Diageo PLC, The Earthgrains Company, Kraft Foods, Inc., The Procter & Gamble Company, Sara Lee Corporation, and Unilever, NV contributed more than $250 million to fund Transora. The solution failed. In automotive, Covisint–established by American automotive manufacturers of General Motors, Ford and DaimlerChrysler– formed. In 2004 Compuware purchased Covisint. Today the company has changed the model and now focuses on OnStar automation and the Internet of Things. Similarly, the Worldwide Retail Exchange (WWRE) sold to Neogrid in 2012. I could go on and list many more industry consortia exchange models that failed, but I will not bore you. Today the remaining Supply Chain Operating Networks, funded by consortia investment, are GHX, Exostar, E2open, Elemica and SupplyOn. Hence my interest to understand what drove success in the building of the business models of the trading exchanges that are evolving in Supply Chain Operating Networks.

My first take? I think it a story of leadership. Dell drove the E2open model. Airbus, Bosch and Siemens adopted and evolved the SupplyOn model. Elemica strategies– driven by the rubber manufacturers and BASF– were more successful. I could go on and on. My second belief is that there are too few business leaders. Prove me wrong. This is my mission.

I firmly believe that the concept of Supply Chain Operating Networks (a model that connects many partners to many partners) makes sense and is the future backbone of the connected value network. However, it is also clear to me that we have had lots of starts and stops, and few successes. I want to learn why. My goal is to help business leaders sidestep the issues.

Recommendations?

Lesson #1. My first learning is that we have a blind loyalty and belief in ERP as the enabler for the extended value chain. There have been too few leaders. The Gartner vision for ERP II in 2002 was destructive.

As shown in Figure 4, despite the fact that supply chain leaders do not believe that ERP extensions will automate the value chain, they struggle to fight the ERP consolidation momentum within the enterprise led by the CIO and the CFO. The limited vision of the system integrators perpetuates the belief in ERP as the backbone for the extended value chain. We need to step back and fight this vision and invest in emerging Supply Chain Operating Networks. Traditional APS and ERP are enterprise data models and lack multi-tier capabilities. Don’t confuse the two. For example, as much as Kinaxis talks about the building of value networks and a control-tower vision, Kinaxis is an enterprise data model automating one-to-one and not one-to-many or many-to-many value networks. In contrast, E2open is a Supply Chain Operating Network.

Figure 4. Confidence in ERP to Drive B2B Connectivity

Lesson #2. Lack of Adaptors for the Extended Value Chain. The enterprise definitions of CRM and SRM do not enable the natural connection of value networks. To drive success in value networks, build multi-tier capabilities in channel and sourcing relationships, sidestepping the use of both traditional CRM and SRM concepts.

Lesson #3. Build Strong Relationships in the Value Network. Own the network and build win-win relationships. We have spent the last decade building win/lose transactional data models. Supplier viability is an issue, and currently companies give lip service to social responsibility. Over 90% of companies have a social responsibility statement, more than 70% have marketing claims on managing social issues (recycled, lower energy, less waste), but only 22% of companies are automating and owning the value network where there is consumption of 65% of non-renewable resources. Change the dynamic by owning the value network and automating bidirectional flows and enabling systems of record between trading partners. Make the world a better place. Reduce risk. Don’t just talk about reducing risk and improving collaboration. It starts with defining win/win business models and automating network flows. It is time to act. Just do it!

Where Can You Find Out More?

We are currently putting the finishing touches on the Supply Chain Insights Global Summit. (Registration is open for the first 150 participants. Technology provider attendance is limited to 25%.) This agenda will not be the traditional Yada Yada conversation of traditional best practices. Instead, we will continue to push and question the status quo. The conference will be live streamed as we discuss five themes:

We are currently putting the finishing touches on the Supply Chain Insights Global Summit. (Registration is open for the first 150 participants. Technology provider attendance is limited to 25%.) This agenda will not be the traditional Yada Yada conversation of traditional best practices. Instead, we will continue to push and question the status quo. The conference will be live streamed as we discuss five themes:

- Financial Results. A critical look at supply chain processes impacting supply chain financial results through the Supply Chains to Admire research.

- Economic Vision of Supply Chain 2030. It is hard to know where we are going if we are not clear on the end state. Join us for a critical view of supply chain 2030 through the insights of leading economists.

- New Business Models. Making the Digital Pivot. Sit back and listen as companies share insights on the adoption of robotics, the Internet of Things, 3D printing, manless vehicles, new forms of analytics, and the emergence of new business models like Alibaba, Amazon, and Uber.

- Building Supply Chain Talent and Leadership. Insights on leadership, continuous improvement and talent development for emerging markets.

- Outside-in Processes. Experience the difference between traditional inside-out and outside-in processes.

In addition, you can gain some short-term insights by attending our Network of Networks & Shaman’s Circle in Amelia Island on April 17th (invitation only), or participating in our new research. With the completion of each study we share the research results. We always keep our survey respondents and responses confidential, but share the results with business leaders in private roundtables to maximize networking.

Our philosophy is, “You give to us. We give to you.” We do this through Open Content research for supply chain leaders. Our current studies in the field are:

Companies that rate themselves higher on #supplychain effectiveness also rate higher on Sales and Operations Planning. Find out where you stand. Complete the study and join our virtual roundtable to get the results. https://lnkd.in/epC7pjR

Companies that rate themselves higher on #supplychain effectiveness also rate higher on Sales and Operations Planning. Find out where you stand. Complete the study and join our virtual roundtable to get the results. https://lnkd.in/epC7pjR

If you are a discrete manufacturer in supply chain, we would love your insights on this research study on direct material sourcing. How do you manage sourcing in innovation, compare suppliers and collaborate on design. To understand the current state of discrete manufacturing sourcing participate in the suvey. At the conclusion of the research share the results and network with leaders around the world.

About Lora:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push for supply chain excellence.

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora thinks that we are never too old to learn or to push for supply chain excellence.