‘Chin Music’ Definition: Idle Chatter, Idle Talk or Vague Explanations

Urban Dictionary

In my work as a supply chain analyst, and Founder of Supply Chain Insights, I attend many supply chain conferences. On a day like today, when I am struggling with jet lag and recovering from sleep deprivation, I tell my friends that I attend more conferences than I would like to attend. However, when I am well-rested and in a better state of mind, I remind myself that supply chain conferences are a great way to connect with people in a meaningful way. I treasure the dialogue and the connections. This is true even though it is a wicked toll on my body. (The impact of late planes with rain delays and a midnight arrival is slowly dissipating as I write this article.)

In my work as a supply chain analyst, and Founder of Supply Chain Insights, I attend many supply chain conferences. On a day like today, when I am struggling with jet lag and recovering from sleep deprivation, I tell my friends that I attend more conferences than I would like to attend. However, when I am well-rested and in a better state of mind, I remind myself that supply chain conferences are a great way to connect with people in a meaningful way. I treasure the dialogue and the connections. This is true even though it is a wicked toll on my body. (The impact of late planes with rain delays and a midnight arrival is slowly dissipating as I write this article.)

Customer segmentation, and building a customer-centric supply chain, is a popular topic at conferences. When I sit through sessions on building a customer-centric supply chain, I am looking for case studies on how companies have applied the concepts to drive greater value. The words from the speakers sound good. The audience interest is high. However, I usually leave the room disappointed. How come? The explanations are vague and largely not implementable. “Chin music,” I mutter, as I hear hollow words without concrete advise. To help, and to start a more meaningful dialogue, in this blog post I share my thoughts on building a customer-centric supply chain organization.

Reflections

My insights on the topic are now a decade old. In the fall of 2008 I attended a major consumer packaged goods company’s global customer team meeting. The topic was “Customer First.” Excited to attend, I volunteered for the assignment. Few companies have global customer councils. When I showed up as a speaker my first red flag was that there was no sales or marketing representation in the room. My second signal was that the group was not clear on who was their customer.

As the session progressed it became clear to me that the leader’s vision was do whatever the customer wanted, when they wanted it, at whatever cost. (Sales-driven and customer-driven concepts are often wrongfully used interchangeably. They are distinctly different.) It was a very regional, sales-driven culture, and there was no clarity between a sales request and a customer requirement. As the session progressed I became very uncomfortable. Why? The organization had intense pressure from their financial team on costs, their customer service (on-time delivery and case fill) was unreliable, and the supply chain systems were not designed to manage one-off customer requests.

The First Step in Building the Customer-Centric Supply Chain Is Reliability

A frequent mistake on the journey is selecting the starting point. I am firmly convinced that the first step in the delivery of a customer-centric supply chain is reliability. A supply chain that cannot fulfill promises will never get high marks for customer service. Let me illustrate why with a story.

A month after completing this strategy session I was doing a series of strategy days with two chemical companies in Houston. They were competitors. (The names are not shared due to NDA restrictions.) When it came to shipments, one company (Company A) did whatever the customer requested, while the second company (Company B) held the customer to the contractual requirements. Company B, not Company A, won the award for the most valuable supplier of the year. Company B, not Company A, had the lowest costs. This may sound illogical, but simply put, if a supply chain promises to deliver many “one-off requests” and cannot deliver, it is worse than ever saying “Yes” at all.

Company A got all the rush shipments and one-off requests while Company B delivered reliably during normal cycles and charged a higher rate for one-off hot-shot and team shipments. Reliability matters. In my work with supply chain leaders I am firmly convinced that the leader must start the customer-centric journey with a focus on reliability and then execute the outside-in customer segmentation strategy.

The Second Step Is Understanding the Customer. Map the Supply Chain from the Customer/Channel Back.

Unfortunately, our inside-out enterprise architectures constrict the flow of customer data to the supply chain organization. In the words of a supply chain leader that I had lunch with yesterday, “The pipes of the organization from the customer to the supply chain are constricted. It is hard to get good information on the customer.” What do I mean by mapping customer processes? Here we share seven places to start.

1) An Order Is Not an Order. A Customer Is Not a Customer. Visibility Is Key.

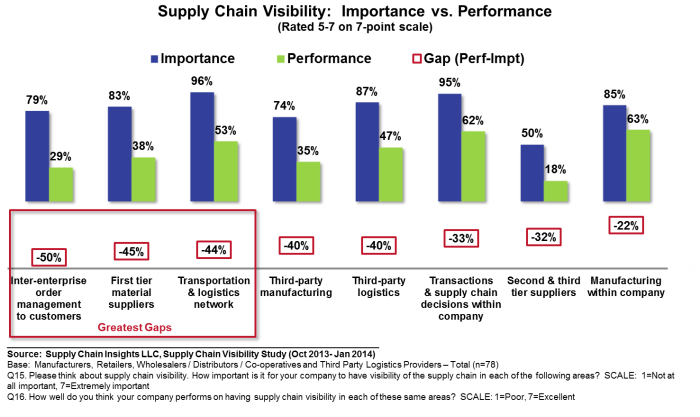

In Figure 1 I share recent research on supply chain visibility. Channel visibility is an issue for most supply chain leaders. An order is not an order. A customer is not a customer. However the differences are not clear in today’s normal technology implementation. An order has many types: a rush order, a turn order, new product launch fulfillment, a special order, or a sales order to stuff the channel to fulfill a sales bonus target. Each should have a different priority; but, it is hard to have an operational discussion without visibility.

Improving order visibility to enable action is one of the first steps to improving reliability.

Figure 1. Current State of Supply Chain Visibility

2) Define What Matters to the Customer. Align the Organization on the Tension between Special Requests versus Delivery Reliability.

Sales teams are incented on volume. In contrast, the supply chain team is typically incented on costs. The two organizations do not naturally align.

One-off campaigns add to supply chain complexity. The greater the complexity of the campaign, the greater the challenge to deliver reliability. The dilemma is how to manage through the issue. Many supply chain leaders feel like they are in the vice-grips of special requests. If the supply chain leader consistently turns down “special requests,” the organization sees the supply chain group as always saying “No” in the face of the need for volume growth. Being “Dr. No,” and seen as an obstacle to overcome, is problematic. It is less than career enhancing.

How to get around the issue? Don’t hit this political issue head first. Instead, go outside-in and learn from the customer. Complete a customer assessment to understand the importance of one-off campaigns versus delivery reliability. After the assessment, try to focus groups cross-functionally on what really matters to the customer. Facilitate a clear understanding of the choice between responding to customer requests versus sales programs. Then execute a program on what really matters to a customer.

On this journey you will clearly see customer segments–industries you serve, the size of customers, regions/geographies–have different requirements and expectations. Try to define customer service policies around these “need states.” Examples are lead times, minimum order quantities, type of delivery service, return policies, and ASN documentation. In the definition of policies, think creatively about incenting the customer for good behavior. Here are some examples I have encountered:

- Data Sharing. A major food company gives discount pricing for data sharing by retailers. The greater the frequency and data granularity, the deeper the discount.

- Forecast Accuracy. A contract manufacturer shares discount pricing based on forecast accuracy of the customer. Forecast accuracy, and compliance to the projected order pulls, is the basis for pricing.

- Shipping Standards. A major consumer packaged goods company gives discounts for full trucks, even layers, and preferential timing for dock door acceptance. Others provide discounts for slip sheets to avoid the hassle of pallets.

- Pay-on-Performance Promotions. Pay-for-performance promotions, or gain sharing, in the execution of trade promotions drives pricing.

- Hands-Free Orders. A discount is given if the order can flow hands-free with no touches.

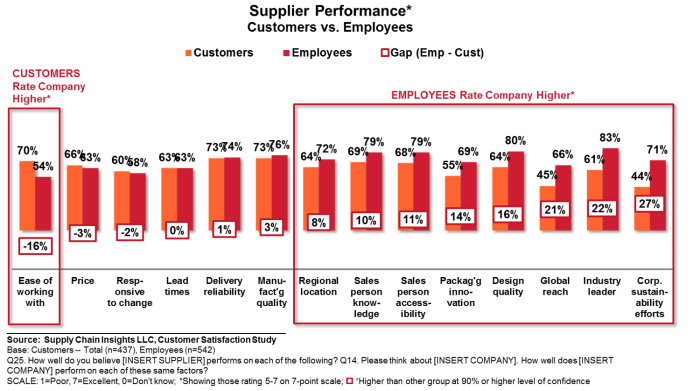

To help companies with ISO 9001 compliance, and what matters to the customer, we have been doing customer assessments and comparing the voice of the customer to internal belief structures. An example, shown in Figure 2, demonstrates the differences between the internal views of the supply chain teams and the customer. (If interested in doing this type of survey, check out our capabilities on the Supply Chain Insights website.)

Figure 2. Customer Assessment by a Supplier (Comparison of Customer and Employee Views)

3) Use Scorecards Cross-Functionally.

Scorecards are a valuable piece of customer information. In our research on scorecard usage, we find 2/3 of suppliers actively review scorecard results cross-functionally. It is a mistake to hold the scorecard within the sales or commercial organizations.

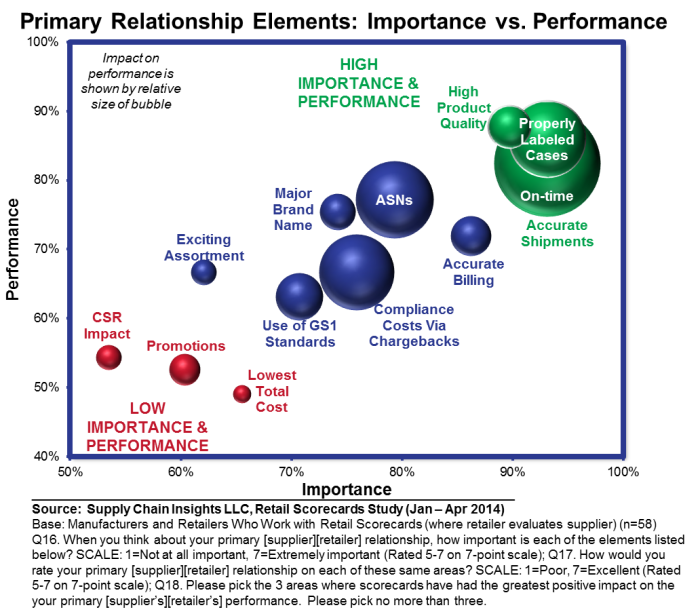

When I review scorecards I find it a useful to keep the key elements of Figure 3 in mind. Why? In consumer products, despite two decades of retail scorecard sharing, we have only improved on-time delivery and shipment conformance. Companies still have a long way to go in resolving billing/deductions, providing excitement in assortment, and reducing costs. Like retail, in most industries the scorecards are a great starting point for a discussion and yield great input, but do not give teams a complete answer.

While scorecards are useful, they are not sufficient. A more complete answer to manage/implement a customer-centric supply chain is mapping the processes outside-in, and gaining/using customer insight to drive supply chain design and policy development.

Figure 3. Current State of Retail Scorecards

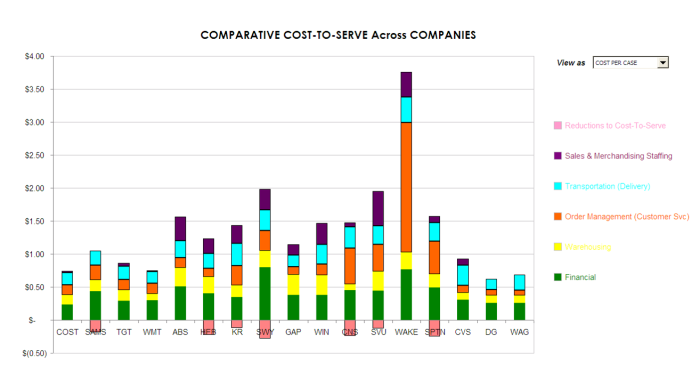

4) Implement Cost-to-Serve Analysis to Drive Actionable Results. An effective way to align commercial and operational teams is the implementation of cost-to-serve analysis. I firmly believe that the successful implementation of cost-to-serve analysis is one of the reasons for L’Oreal’s improvement.

What is cost-to-serve analysis? It is the analysis of supply chain cost drivers by customer. An example, as shown in Figure 4, demonstrates that the elements of supply chain costs vary widely by customer. In the evaluation and alignment of these cost differences teams can align and start to build the framework for a customer-centric supply chain.

The implementation of a cost-to-serve analysis in conjunction with a Sales and Operations planning effort improves sales and operational alignment and helps to balance one-off programs with customer needs.

Figure 4. An Example of a Cost-To-Serve Analysis

5) Get Good at Available-To-Promise (ATP). ATP is an important element in ensuring reliability in customer shipments. It sets the expectation on product arrival with the customer. As the organization grows, and covers more geographies, a good ATP signal becomes more critical.

To understand reliability compare the ATP given on an order to actual performance and chart the reason codes for deviations.

6) Establish Listening Posts. Social data, rating and review data, warranty data, customer comment data, and distributor data comes to the organization but is not used by most supply chain leaders. The design and use of listening posts, to mine and use unstructured data, helps in market sensing for new products and channel programs. While the techniques to use Sentiment Analytics are new, they are very promising. Anthony Volpe shared a great presentation on this topic at our recent conference. Reference our recent work with Lenovo to gain an understanding of how this approach can help you.

7) Recognize the Differences in Supply Chains and Design Buffers. Within a company there are usually 5-7 supply chains with distinctly different rhythms and cycles. In the mapping of these differences use supply chain design technologies. This analysis will use the cost-to-serve data as an input and will evolve over time into customer-centric supply chain policies.

In this process use customer data; but in this process, trust, but verify. What do I mean? Don’t use customer data blindly. For example, use customer forecasts only when you understand the error and bias. As companies mature, network design activities using customer data becomes a monthly process.

I hope as you read this blog post that you believe these seven points are more than just “chin music.” Building a customer-centric supply chain happens through hard work, understanding what matters by customer segment, and building customer-centric policies. We want to help. Let us know your thoughts. We would love to continue the discussion in the Beet Fusion community.

What is Beet Fusion? Beet Fusion is a community designed for supply chain leaders around the world to have healthy conversations on the evolution of supply chain practices. Our goal is to make it the Facebook, LinkedIn, Yelp, and Monster for the supply chain community. We launched it in a Beta format two weeks ago and we currently have over 600 community members. Feel free to post jobs in the community, engage in a discussion, or add content. This week we are starting ratings and reviews of technology providers. (We think this assessment should be by supply chain leaders as opposed to analysts in conference rooms on white boards.)

In addition, we are putting the finishing touches on our agenda for the Supply Chain Insights Global Summit in September. We have confirmed four speakers. The dates are September 8-10 at the Phoenician in Scottsdale, AZ. We hope to see you there!

About the Author:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora wrote the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. As a frequent contributor of supply chain content to the industry, Lora writes by-line monthly columns for SCM Quarterly, Consumer Goods Technology, Supply Chain Movement and Supply Chain Brain. She also actively blogs on her Supply Chain Insights website, for Linkedin, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research at Temple or knitting and quilting for her new granddaughter. In between writing and training, Lora is actively doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. She thinks that we are never too old to learn or to push an organization harder to improve performance.

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora wrote the books Supply Chain Metrics That Matter and Bricks Matter, and is currently working on her third book, Leadership Matters. As a frequent contributor of supply chain content to the industry, Lora writes by-line monthly columns for SCM Quarterly, Consumer Goods Technology, Supply Chain Movement and Supply Chain Brain. She also actively blogs on her Supply Chain Insights website, for Linkedin, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research at Temple or knitting and quilting for her new granddaughter. In between writing and training, Lora is actively doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. She thinks that we are never too old to learn or to push an organization harder to improve performance.