E2open is acquiring INTTRA pending federal approval. Is this a knot to be tied? Does this deserve congratulations or concern? Here I share some thoughts.

Reflections

Three decades ago, I was sitting on a hotel bed with my friend Ellen Chen. Ellen currently works as a consultant at Cap Gemini. I consider her the best in the biz for transportation management consulting. At the time, we were both deployed as consultants for Manugistics to help a manufacturing company to implement end-to-end planning. (Manugistics is now owned by JDA.)

Together, we struggled to put together the pieces. My goal was to implement demand and supply planning. Ellen’s was to design and execute the transportation planning logic. Together, we sat on the bed and tried to map the process flows from supply planning. (The output for planned orders needs to connect somewhere. in to transportation management to drive routing information and booking optimization). After a long night, much coffee, and a lot of laughter, we realized that it was impossible to connect disconnected flows.)

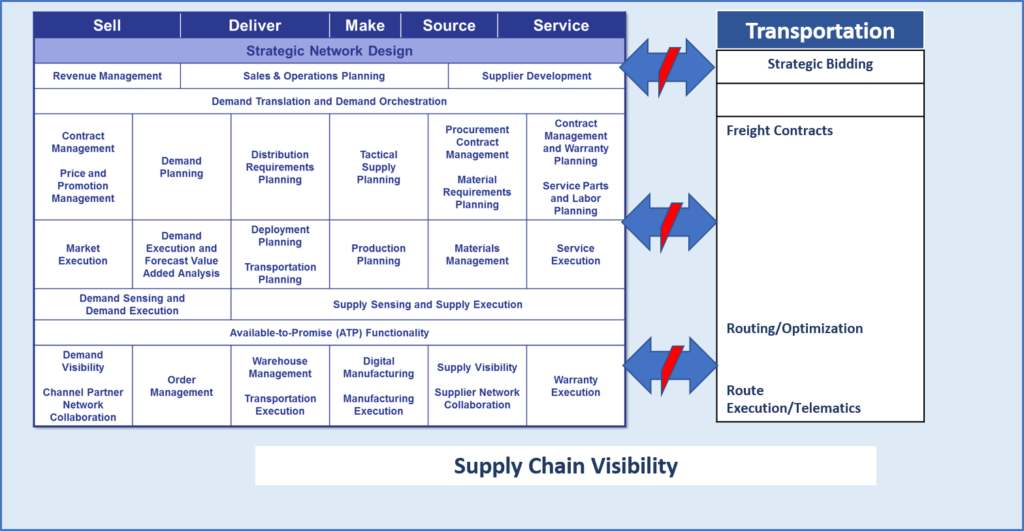

Figure 1. How Do We Connect Supply Chain Planning Architectures to Transportation Planning?

Not much has changed. The software planning footprints are reminiscent of the work done in the 1990s when we struggled with insufficient memory using 32-bit hardware. Using the same footprints, the industry moved client/server to the cloud and started the processes of consolidation. There is no solution to optimize source, make and deliver together or drive bidirectional orchestration to execute trade-offs between functions automatically. This is true of both an enterprise and a network architecture. (Examples include alternate sourcing, bill of material changes or alternate modes/routing between the planning, procurement and transportation.) The groups of supply planning, procurement and logistics operate within silos. So, much so, that I often introduce people to each other within their own companies.

Not much has changed. The software planning footprints are reminiscent of the work done in the 1990s when we struggled with insufficient memory using 32-bit hardware. Using the same footprints, the industry moved client/server to the cloud and started the processes of consolidation. There is no solution to optimize source, make and deliver together or drive bidirectional orchestration to execute trade-offs between functions automatically. This is true of both an enterprise and a network architecture. (Examples include alternate sourcing, bill of material changes or alternate modes/routing between the planning, procurement and transportation.) The groups of supply planning, procurement and logistics operate within silos. So, much so, that I often introduce people to each other within their own companies.

History of E2open

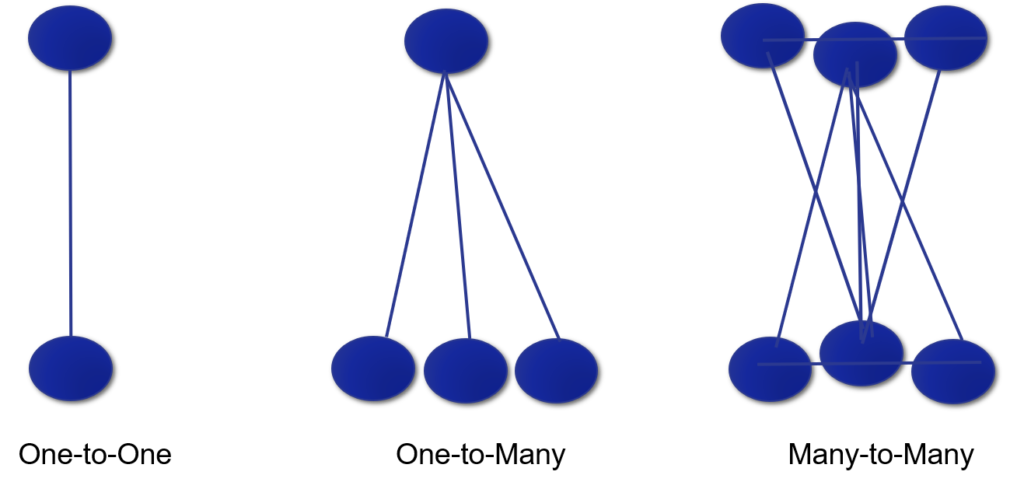

Founded in 2000 as a high-tech consortium, the focus was the automation of procurement using a one-to-many network. In the process, each of the founding partners–Hitachi, Matsushita, LG Electronics, Nortel Networks, Seagate Technology, Solectron and Toshiba–created their own processes. Over the decade, E2open became a powerful one-to-many network accounting for more than $700 billion in goods and services bought and sold in the worldwide electronics industry’s supply chain. The interactions were between a brand owner and their suppliers. There was little interaction between suppliers and logistics providers or amongst and in between these parties.

In the next decade, in the evolution of E2open, there were many twists and turns. E2open’s initial public offering, pushed with great ballyhoo was in July 2012. I celebrated a supply chain IPO. The offering was 4,687,500 shares of common stock, including 3,750,000 shares from the company and 937,500 shares from the selling stockholders, at a price to the public of $15 per share. However, when the stock did not meet shareholder expectations—management of costs– the company went private. On March 26, 2015, Insight Venture Partners (“Insight”) purchased E2open for $8.60 per share. Investors moaned. Taking E2open private put a black mark on the company in the public markets that the current management team is still trying to shake off. The current management team has returned the company to profitability and is aggressively pursuing a growth strategy. While the exit strategy is unclear, a new IPO is certainly an option.

Taking the company private with the investment by Insight Venture Partners gave E2open capital to purchase complimentary technologies. The company is now an aggregator of legacy technologies acquired the undervalued assets of Birch Worldwide, Cloud Logistics, Entomo, ICON-SCM, Orchestro, Serus, Terra Technology, Steelwedge, Zyme, Cloud Logistics, and now INTRRA. (The purchase of ICON-SCM and Serus were prior to the purchase by Insight Venture Partners.) Each public announcement is upbeat with much fanfare and the company currently has a 36% CAGR while forecasting 2018 revenues north of $200M.

History of INTTRA

Founded in 2001, INTTRA was a joint venture between CMA-CGM, Hamburg Sud, Hapag-Lloyd, Maersk Line, MSC, and UASC. The goal? To create a standard electronic booking system for the ocean freight industry. INTTRA is now a network for container booking connecting with over 30,000 active shippers across more than 200 countries, over 60 carriers and NVOCCs, and more than 150 integrations with transportation management and port system software partners. The INTTRA Platform is used to book one in four ocean shipments.

The good news is the availability of data that could be used in planning. However, the use cases require a rewrite of existing systems.

Summary

The promise of combining networks and coupling the network functionality of INTTRA and E2open with the prior software planning is interesting, but I say not so fast. As I listen, there is a flashback of the night I spent with Ellen thinking hard about how to connect planning software to transportation. My mind is now full of new insights from facilitating the network of networks share group. (In this effort, E2open has not been an active player in trying to define many-to-many open network flows.)

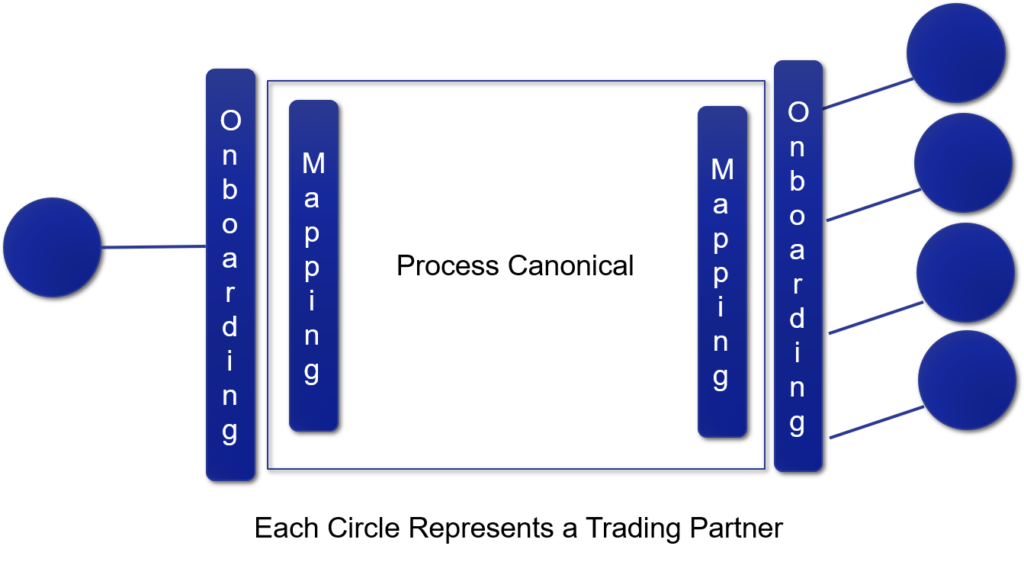

My unanswered question to E2open is “How will process flows from these two systems work?” The answer? A supply chain visibility demo. What are the challenges? The origin of both the INTTRA and E2open networks is in transaction processing– E2open in procurement/sourcing and INTTRA in ocean booking. Today, in supply chain management, there are no networks with well-defined flows across source, make and deliver. The industry does not have a common definition. Instead, they must be defined. In Supply Chain Operating Networks, process canonicals define these multi-tier flows. This is depicted in Figure 2.

Figure 2. Pictorial of a Supply Chain Operating Network

E2open’s history is a one-to-many network and INTTRA is a ocean-centric value-added network operating with trading partners connecting one to one for ocean booking arrangements. (A value-added network (VAN) is a hosted service offering that acts as an intermediary between business partners sharing standards based or proprietary data via shared business processes.) Flows from a many-to-many network enables brand owners bi-directionally and multi-tier to carriers, 3PLs, freight forwarders, and contract manufacturers.)

E2open’s history is a one-to-many network and INTTRA is a ocean-centric value-added network operating with trading partners connecting one to one for ocean booking arrangements. (A value-added network (VAN) is a hosted service offering that acts as an intermediary between business partners sharing standards based or proprietary data via shared business processes.) Flows from a many-to-many network enables brand owners bi-directionally and multi-tier to carriers, 3PLs, freight forwarders, and contract manufacturers.)

Elemica and GT Nexus (now owned by Infor) are further along in the delivery of many-to-many flows for value networks. My dilemma? While technology partners speak of “end-to-end solutions”, the reality is quite different. The industry does not have the answers. The purchase of software with different architectures with much fanfare does not guarantee the promise of value. History tells us that software acquisitions and consolidation reduces, not accelerates, innovation.

Elemica and GT Nexus (now owned by Infor) are further along in the delivery of many-to-many flows for value networks. My dilemma? While technology partners speak of “end-to-end solutions”, the reality is quite different. The industry does not have the answers. The purchase of software with different architectures with much fanfare does not guarantee the promise of value. History tells us that software acquisitions and consolidation reduces, not accelerates, innovation.

My take? This is a consolidation play. Does it connect planning with dramatic improvement to supply chain execution? I don’t think so. Will it have a dramatic impact on the market? I am a skeptic.

As E2open consolidates assets, contracts and client relationships are more sales-driven with a focus on marketing traditional supply chain process flows. In the words of one industry E2open VP recently, “the focus is to serve the market to not to lose a deal versus partnering with clients to drive innovation.”

What Should Business Users of E2open Do?

The case method is a teaching approach that attempts to put students in the shoes of real people making difficult decisions. In sharp contrast to other teaching methods, the case method requires that instructors refrain from providing their own opinion about the decision in question. When I went to business school I learned a lot about the case method of education. In school, my group would argue for hours on “what to do.” I would watch with amazement. I found it hard to get as passionate about a business case. However, I am often reminded of this experience as I watch the supply chain management market evolve. Business cases, like this one, evolve for me each week.

With this as background, what advice would you give Mike a new E2open client in the food industry thinking of purchasing Terra Technology’s demand sensing product? Or Nick a two-decade old client in high-tech? Or Vijay seeking a partner to build a high-tech demand network? These are very different personas with vastly different requirements trying to figure out E2open’s future direction. Each would like to see definitive futuristic flow to make better decisions to solve vastly different business problems. Their job is hard because today they must sort through hollow rhetoric as E2open puts together the piece parts of nine acquisitions.

I would love to see your answers. And, if you have any questions or comments, please send them my way.

As background in formulating your answer, please reference prior Relevant Blog Posts:

E2open Acquires Zyme: A Bridge Too Far?

E2open Acquires Steelwedge. Impact on Market?

My Take: E2open Buys Terra Technology

E2open Acquires icon-scm: Five Reasons Why You Should Care

Acquisition of GT Nexus: If I Had a Magic Wand

Reflections: Building the Network of Networks