Yawn.

I spent time this week completing reference calls on the use of S&OP technologies.

Seeking the next sequel in technology adoption, I want to write how the confluence of new technologies changed companies’ abilities to improve decisions. Based on the reference calls, I am not sure that this will be possible. What am I hearing? Eerily the case studies sound the same as the ones heard when I completed S&OP research in 2004. Fifteen years later, I expected more. As an analyst in the space for more than a decade, I struggle why we are not making more progress in the adoption of new technologies for an important process like S&OP.

So, to find the new sequel, I also interviewed new technology entrants. In these interviews, I find a different problem. The solution overviews littered with vagueness –terms like “digital”, “digital transformation,” and other hyperbole– pollute the positioning. As the bright teams spin their message, I struggle to understand what is new. And, when it comes to their case studies, I do not find the step change.

As a result, after three months of research, writing the sequel on S&OP technologies is a challenge. The reason? Not much has changed in technology approaches; and most companies, over the last decade, went backwards not forwards on S&OP maturity. Why? There are many reasons:

- Business Complexity. Companies average ten ERP and five Advanced Planning Solutions. Getting to data is a barrier for 60% of business users. In parallel, the movement to global processes and the elongation of the long tail of planning increased complexity making modeling more difficult.

- Dependency on Excel. Due to the shortfalls in the evolution of Advanced Planning, 68% of business users use Excel spreadsheets as the primary mechanism for planning. This is especially true for processes dependent on the ERP-based solutions from Infor, Oracle and SAP. The result? Silo’d answers. Excel–while widely used for planning–is not equal to the challenge of modeling complex supply chains.

- Clarity on Supply Chain Strategy. Driving supply chain excellence is a balancing act. Teams continuously balance cost, customer service, asset utilization and inventory. Companies making progress are clear on the definition of supply chain strategy. For most –hamstrung by silo-based strategies for source, make and deliver–there is no clear definition of supply chain strategy.

- Employee Turnover. Many organizations are in their second and decades of using advanced planning. Employee turnover eroded the knowledge base. A solution well-implemented in two decades ago is not equal to the challenge of the business today. For example, in many of my clients a well-implemented demand planning solution two decades ago is now degrading the forecast 10-15%. Companies have not maintained the engines or implemented measurement discipline.

- Hype. Terms like “connected planning” and “DDMRP” add to confusion. Sales and Operations planning is cross-functional process requiring more insights than financial budgets and/or material plans. I see the deployment of Anaplan–rich on collaboration and poor for modeling–degrading the process. Why? Direct connection of financial budget data to supply chain planning often results in “infeasible plans”. Anaplan has missed the market opportunity to build robust modeling based on constraints, buffer analysis, and material balances in a strong collaborative analytics technology.

Am I right? As a researcher, I validate observations through quantitative research. Combining qualitative interviews, quantitative studies and post study review with supply chain leaders helps me gain clarity. I am on this journey. I pulled the quantitative research on Sales and Operations planning from the field this week. I will be sharing this data from 150 respondents sourced from my Linkedin 307,000 followers over the course of the next couple of weeks. To validate the results, respondents participate in round tables to discuss the data. The question central to the research? Have we made progress over the last three years on S&OP? I will attempt to correlate the results to balance sheet data. Stay tuned. This research will publish at the end of the month in our newsletter.

What To Do?

My advice to business users?

Take a pause. Maximize the value of today’s solutions. Don’t rush to buy. Let the noise clear. We are the cusp of the redefinition of planning. The combination of cloud, cognitive computing and open source analytics is evolving. Innovation over the course of the next two years will make today’s solutions obsolete. Advice? Focus on maximizing the use of your current technologies by cleaning data, improving forecast measurement and building planning master data.

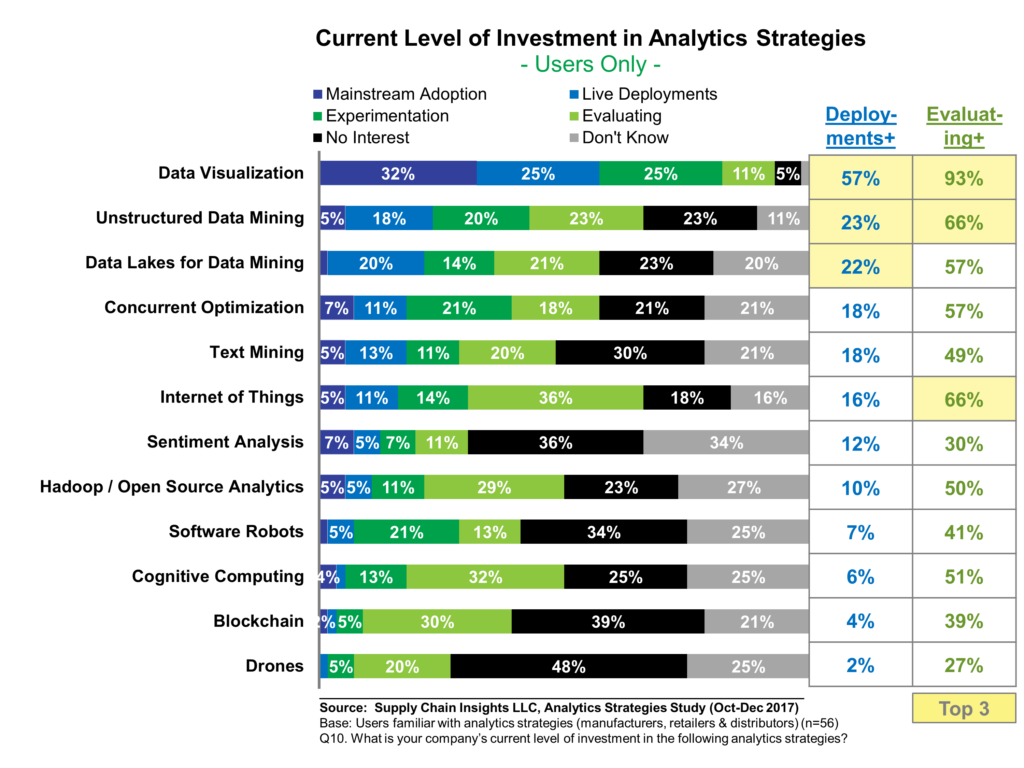

Invest in Descriptive Analytics. Allow business users access to data through the use descriptive analytics. Layer technologies like Microsoft Power BI, Qlik, Spotfire, Tableau, and Thoughtspot on top of planning technologies. To improve S&OP execution, focus on helping business users access data at the speed of business. This means less focus on traditional reporting, ERP and portal strategies. Make discussions data-driven using descriptive analytics layered on top of complex technology landscapes. The average company has five-to-seven S&OP processes and seven-to-eight advanced planning technologies. As a result, getting to data is a barrier.

Figure 1. Current Focus of Analytics

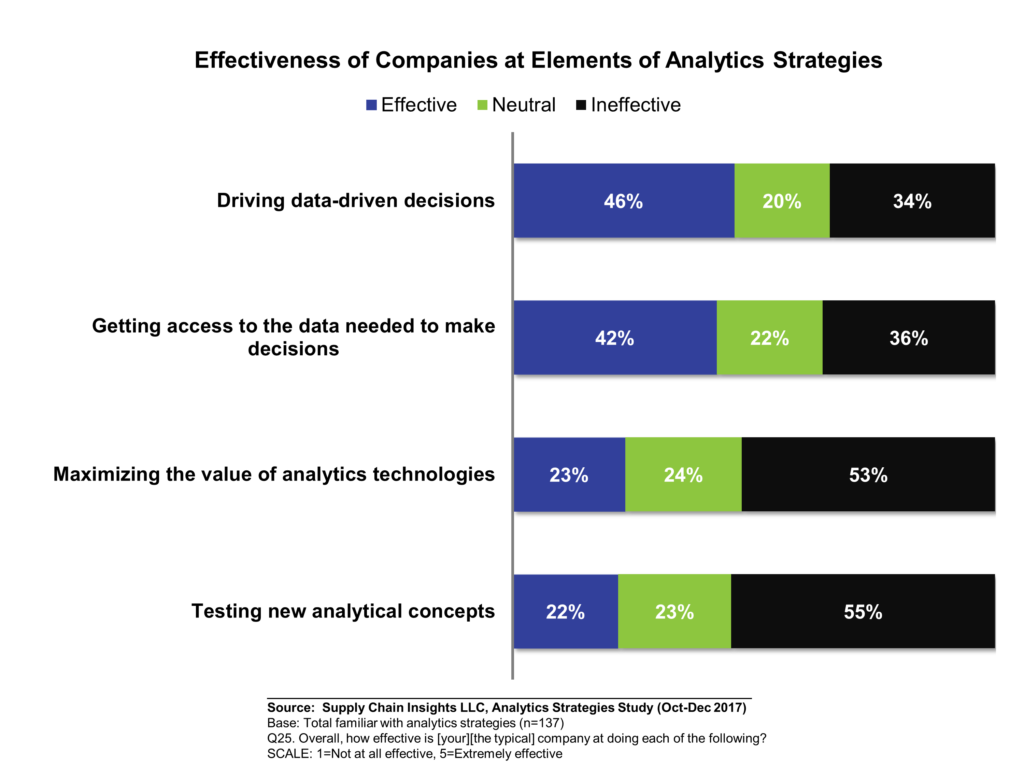

Focus on Self-Service. Using new forms of descriptive analytics, help business leaders get access to data. Focus less on traditional reporting and more on helping senior business leaders get to data at the speed of business. For most companies, this is an issue. Remove the barriers for employees to get to data. I was at a company last month with a goal of customer centricity, but struggled. The reason? Commercial teams would not share customer data with the supply chain teams. The sad reality? There are political barriers. For example, an average, companies evaluate 50% of trade promotions. Why so small? Sales does not want to make data visible. (Sales is incented on volume.) Similarly, cost-to-serve projects average six months. They are short-lived because the work creates internal tensions. Remove these barriers. Make discussions cross-functional by aligning S&OP to P&L centers and focus on delivering the business strategy.

Figure 2. Barriers in Getting Access to Data to Make Decisions

Governance. Get Clear on How to Make Decisions. As the supply chain becomes more automated and less dependent on spreadsheets, governance grows in importance. Spend time answering the question, “Who should make decisions?” In the best S&OP processes, decision-making aligns to the P&L structure based on cultural norms. For example, Unilever and J&J are regional in decision-making; whereas, P&G is focused on divisional, matrix-based decision-making. As the supply chain becomes more and more automated, governance clarity becomes more and more important.

Summary

Advancement in descriptive analytics is outpacing innovation in decision support. Maximize the value in the short-term while attempting to drive the greatest value of currently deployed solutions. Wait for the market to mature. The coalescence of cloud, cognitive computing, and open-source analytics is at its infancy, but I see promising signs.

Struggling to Stay Current?

Technology change is moving faster than process innovation. Many companies struggle to keep pace. If this is you, I welcome you to join our upcoming events. Our goal is simple: to build a guiding coalition for change in supply chain processes.

Imagine Supply Chain 2030. Supply Chain Insights Global Summit, September 3rd-6th, 2019, to be held at UI Labs, Chicago, IL. The focus is on Imagining Supply Chain 2030. What is different? The format is unique. The event has no sponsorships, paid speaking sessions or lofty analyst discussions. Designed for extreme networking, I dub this event the unconference. At the event, technologists and business leaders work shoulder-to-shoulder to Imagine Supply Chain 2030. To ensure balance of business and technology leaders, I closed the conference this week to technologists/consultants to ensure the right balance of business and technology leaders. This week, I have added speakers from Dell, Dow, Intel, and Simple Tire. I hope to see you there.

Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

To register for these events, please contact Regina.denman@supplychaininsights.com.