It is a beautiful fall day in Philadelphia. This afternoon I put the finishing touches on a new report, “What Is the Value Proposition for Sales and Operations Planning?” I think it is the most complete assessment of the S&OP value proposition I have seen in the industry.

It is always fun to write great research. I am so excited about it that I thought I would repurpose some of the recommendations into a quick post before I bolt for ballet.

Background: More to It Than a Name

Sales and Operations Planning is a cross-functional process to make trade-offs between go-to-market strategies and operational plans. The processes are very different by company. In the research of 73 respondents, we asked companies to classify themselves on a 1-7 scale of effectiveness, and the report is a study of the characteristics of those rating themselves effective when compared to those who rate themselves less effective.

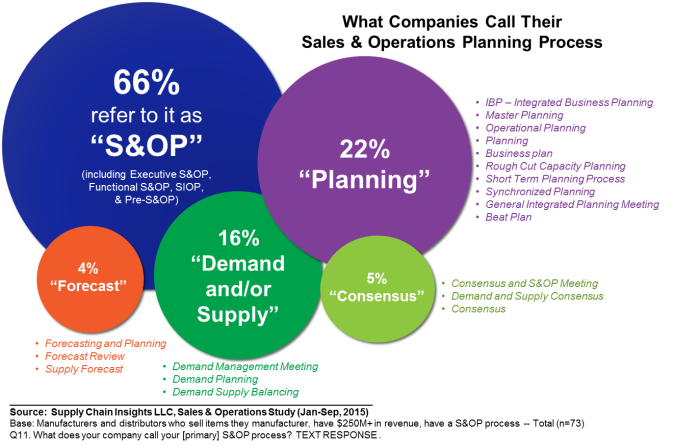

While many consultants argue on the name–the debate rages with strong arguments of “Should it be Integrated Business Planning (IBP), Sales Inventory and Operations Planning (SIOP), or consensus planning?”–the most common name for the process, as shown in Figure 1, is still Sales and Operations Planning.

Figure 1. Names for the Cross-Functional Process to Align Demand and Supply

Building S&OP maturity takes time, discipline and focus. While the debate rages on the right name to call the process, we find that there is no correlation to the name of the process and maturity or value gained. As companies focus on improving the maturity and effectiveness of Sales and Operations Planning, there are three recommendations embedded in the research for consideration:

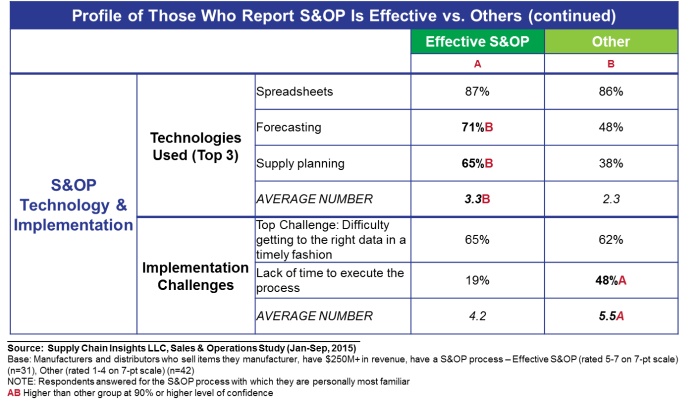

1. Give Planners Time to Plan. As shown in Table 1, one of the distinguishing characteristics of an effective S&OP plan is the time for planners to plan. This is not trivial. Many companies struggle on how to evaluate planning effectiveness and productivity. No two companies are the same, and there are many technologies used. However, companies that do S&OP well give their planners time to plan. They make it a priority.

Table 1. Profile of S&OP Respondents

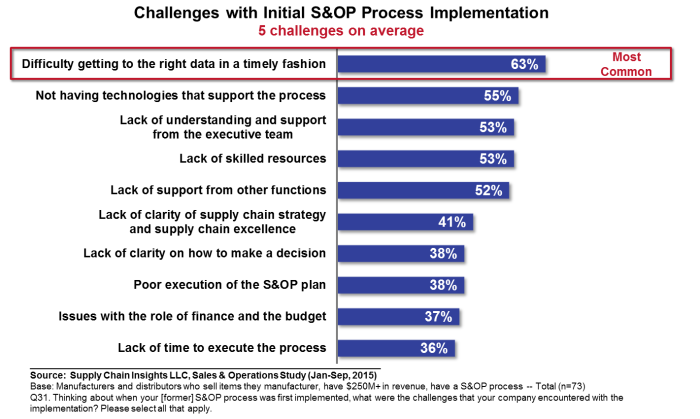

2. Focus on Helping the Right People Get to Data. When we shared this data with the roundtables of supply chain leaders who had completed the study, a number of attendees shared stories of how they had met the challenge of helping employees/planners to get to data. When it comes to data storage, every organization is different. One of the suggestions which resonated with the participants was teaching new employees tips and tricks for data storage and document sharing. Several commented they had developed this training as part of onboarding. As shown in Figure 2, S&OP processes use many technologies, but getting to data is a challenge for all companies. Make it a priority to train employees on data storage and retrieval.

Figure 2. S&OP Challenges

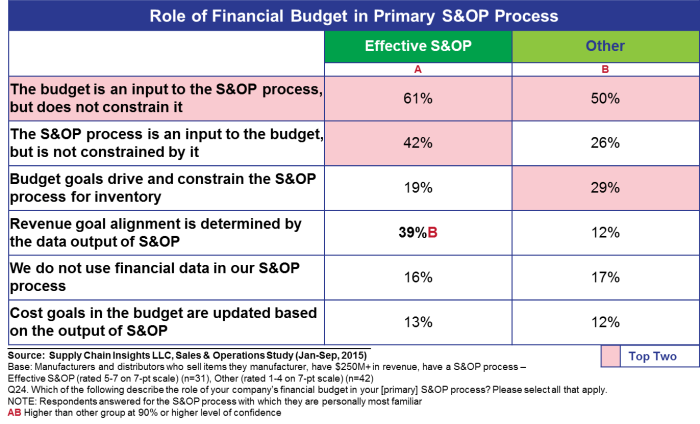

3. Educate the Financial Team on How to Use the S&OP Process in Budget Forecasting. One of the barriers in maturing S&OP processes is the role of the financial budget. While many companies believe the role of the S&OP process is to deliver on-budget processes, as companies mature they realize the S&OP plan is an input into the budget process, but that the budget process should never constrain the S&OP Process. The goal is to keep the S&OP process aligned to the market. As shown in Table 2, this is a characteristic of effective S&OP Processes. As a result, companies beginning their work on S&OP should train the financial team and hit this obstacle early.

Table 2. The Role of the Financial Budget in S&OP Processes

I hope this helps you and your team to make the leap. This week I will be speaking at a conference in Miami, and next week I will be in Rotterdam. I hope to see you in my travels. If not, I hope you enjoy the newsletter that will publish this week.

For More Join Beet Fusion!

A week ago we launched our new community Beet Fusion. Within ten days, 470 supply chain leaders joined the community. Our goal is for the community to have the features of LinkedIn, Monster, Yelp, and Facebook for the Supply Chain Community. Why the name Beet Fusion? It’s the Superfood for the supply chain.

The community is currently in Open Beta. So when you join, try to stress test the community and let us know your suggestions and concerns. We also would love your feedback in the Beta Tester’s forum.

About the Author:

About the Author:

Lora Cecere is the Founder of Supply Chain Insights. She is trying to redefine the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora wrote the books Supply Chain Metrics That Matter and Bricks Matter, and is working on her third book, Leadership Matters. As a frequent contributor of supply chain content to the industry, Lora writes by-line monthly columns for SCM Quarterly, Consumer Goods Technology, Supply Chain Movement and Supply Chain Brain. She also actively blogs on her Supply Chain Insights website, for Linkedin, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research at Temple, or knitting and quilting for her new granddaughter. In between writing and training, Lora is actively doing tendu (s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. She thinks that we are never too old to learn or to push an organization harder to improve performance.

The Deserted Mall is an Important Symbol for Supply Chain Leaders

Thinking about the pervasive shifts in the technology landscape.