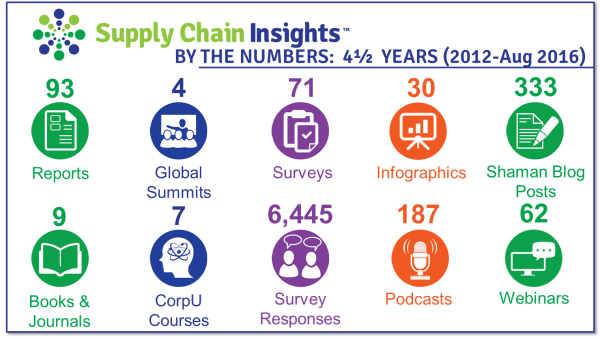

It is Sunday. Today I assume a familiar position. Now a ritual, with coffee in one hand and country music blaring, I sit in my faded green chair to write a blog post. I have done this for seven years. This afternoon I am writing my 334th blog post. I will also pen my 95th report for this week’s Supply Chain Insights newsletter. We now reach 23,000 supply chain leaders globally with our newsletter and have over 50,000 views/month on Slideshare. The open content research model is working.

When I was in high school I never thought I would be a writer, but writing is now a large part of my life. Fiercely independent and data-driven, I am never paid for my ink (either advertising or endorsements).

Figure 1. Driving Open Content Research

In the course of the cycle of building content–research, writing and speaking–I get many questions. I make it a point to always answer each question, either in writing or by phone. From time to time I share the questions and answers in a blog post. Here I want to answer a question I got this week. It is one that is often asked: “S&OP. How Do I Get Started?”

S&OP: How Do I Get Started?

The caller on the other end of the line was in northern Europe. Frustrated that my upcoming Supply Chain Insights Global Summit was in Phoenix, he asked if I ever came to Europe. He wanted to come to the event, but the trip was just too far for him to justify. We agreed to meet on my next trip to Europe. Excited that he could follow the Global Summit through the livestream conference broadcast and follow the twitter feed for the event using the hashtag #imagine2030, I expect to see him online on September 7-9, 2016. He was enjoying the podcast series of the speakers, and wanted to participate.

The caller on the other end of the line was in northern Europe. Frustrated that my upcoming Supply Chain Insights Global Summit was in Phoenix, he asked if I ever came to Europe. He wanted to come to the event, but the trip was just too far for him to justify. We agreed to meet on my next trip to Europe. Excited that he could follow the Global Summit through the livestream conference broadcast and follow the twitter feed for the event using the hashtag #imagine2030, I expect to see him online on September 7-9, 2016. He was enjoying the podcast series of the speakers, and wanted to participate.

The caller had prior experience with a major household products company and recently transitioned to a smaller, but global, discrete manufacturer. His statement was, “I think that our organization is at Stage 2 on S&OP, and I want to transition to Stage 4 or 5. How do I get started?”

I smiled. This is a frequent question. To get grounded, we talked. I asked, “Why is S&OP important to your business?” (This is an important question.) The answer was long-winded, but boiled down to a discussion on functional alignment. As a leader of S&OP at his previous company, he felt quite comfortable with his expertise in the area of S&OP, but he was feeling more and more uncomfortable by the day in his new job. I encouraged him to feel more and more uncomfortable. The processes and the requirements of the two companies were quite different. Unilever is different from Goodyear. Apple’s requirements are slightly different from BASF, and Logitech is dissimilar to Eastman Chemical. Too frequently I see leaders broad-brush their experiences with their prior employer and not understand the needs of their current organization.

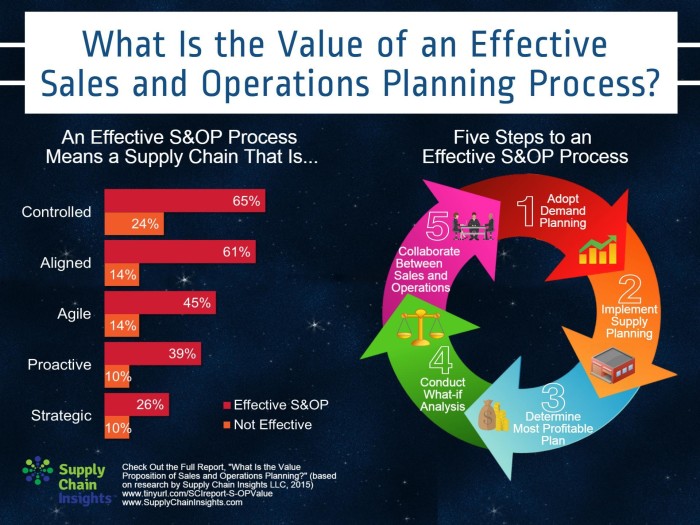

Step 1. Map to Profit Center Leadership. Drive Alignment to Business Goals. The starting place is to build an organizational map by profit center. For the greatest success, the S&OP process should report to a profit center manager. The number of S&OP processes align to the profit center mapping. (The average company has five to six processes, and the greatest progress happens when there is alignment at a profit center manager level.) I urged him to take his corporate strategy document and set up a meeting with each profit center manager. I asked him to not be constrained by a discussion of maturity models. Instead, I wanted him to discover what each profit center manager would like to accomplish through cross-functional alignment. I shared the research in Figure 2.

Figure 2. Driving Alignment in S&OP Processes

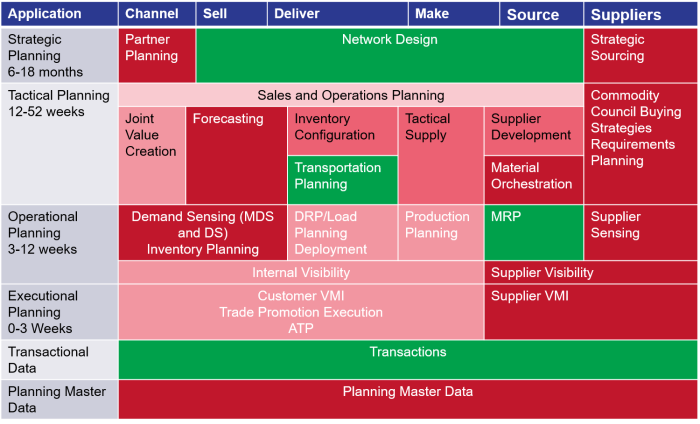

Step 2. Establish Regional/Global/Business Governance. Based on the organizational mapping, and the organizational priorities, define regional/global and business governance. In this plan, determine which groups should plan at the strategic, tactical, operational and executional levels within the organization. In the process, define what makes a good plan.

Embedded in this is a focused discussion on how the global company should make the functional pivot from local to global processes. The global pivot is a definition of the point in which the global scale of the company yields financial advantage. (For most companies, greater economy of scale is possible through the global management of procurement and transportation and local management of sales, manufacturing and customer service. However, this varies by company and the degree of cross-border and interplant shipments.) As a result, I encouraged him to map his processes using a map like the one in Figure 3. In the mapping of planning, I encouraged him to define each time horizon, the maturity level of the organization (green is mature, red is below peer group, and pink is performance at peer group) and then assign roles and responsibilities.

Figure 3. Establishing Planning Governance

One of the dilemmas within his organization was the definition of the S&OP time horizon. The company had a strong manufacturing culture, and the focus was on the urgent. The S&OP process was currently owned by manufacturing leadership, and the focus was on a short-term duration of one to three months. We discussed the need for manufacturing leadership to cede ownership to the business and the organizational need to focus on S&OP as a tactical process from one to twelve months to drive the greatest business benefit. He shared that this was a tough transition. I nodded in agreement. This is a tough transition for most organizations. Building a great planning organization is easier said than done.

3. Determine What Drives Value. The greatest benefit to the corporation happens when financial goals and the S&OP process align to deliver value. We discussed the Supply Chain Metrics That Matter research and the fact that a balanced portfolio of metrics drives a higher market capitalization than a focus on functional metrics or single metrics. We reviewed the orbit charts and progress of the recent Supply Chains to Admire Analysis for 2016. His action step was to set goals for each profit center based on a similar peer group and align this balanced portfolio to the balance sheet, and gain agreement with the financial group. (We reviewed the orbit charts for the Supply Chains to Admire Winners and discussed the pitfalls and potholes which he was experiencing in the establishment of metrics.) I shared the recent research on how an effective S&OP process improves Price to Tangible Book Value. In this research we tested 65 different factors to correlate to Price to Tangible Book Value, but found only four to correlate. (The correlation did not hold for a single type of technology or organizational definition of supply chain management. However, a successful S&OP does correlate.)

Figure 4. Improving Price to Tangible Book Value

4. Be Clear on Definitions. He admitted that many concepts swirled around the organization: demand-driven, customer-centric and outside-in supply chains. Many constituents within his organization used these word interchangeably. The organization was not clear on the base-level definitions or the implications for S&OP. We spent an hour discussing the elements of last week’s blog post as outlined in Figure 5.

Figure 5. Strategies to Augment S&OP

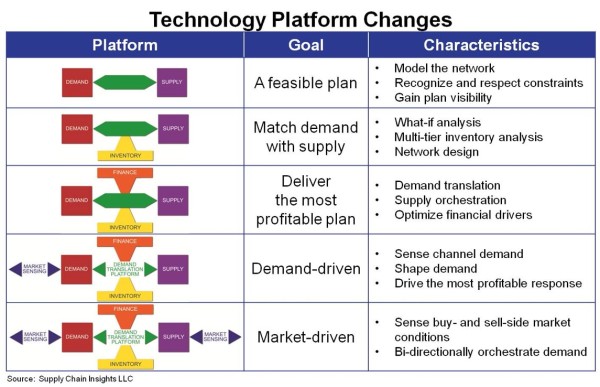

5. Then, and Only Then, Discuss Technology. We discussed the issues with technology. While most consultants want to lead with a technology discussion, I encouraged him to walk before he runs, and take his time. It is a Catch 22. While the organization will not make the progress they need without technology, the implementation of technology before organizational readiness will not lead to success. We discussed the steps in technology evolution outlined in Figure 6.

Figure 6. Technology Evolution Based on Maturity

In short, the path for a successful S&OP starts with a discussion in the business. I hope that this helps you and your team. I look forward to getting your input.

I would love to hear from you. What do you think?

Customer-Centric Benchmarking

Interested in benchmarking your supply chain on customer-centric strategies? We would love to have you participate in our new research study. In return for taking the survey, you will be able to participate in a virtual roundtable discussion and network with others. This allows you to use the research as a backdrop for a great conversation with others on how to develop and implement customer-centric strategies. (We keep all company and respondent names confidential and report data in aggregate. Results to be shared in our October newsletter. )

Interested in benchmarking your supply chain on customer-centric strategies? We would love to have you participate in our new research study. In return for taking the survey, you will be able to participate in a virtual roundtable discussion and network with others. This allows you to use the research as a backdrop for a great conversation with others on how to develop and implement customer-centric strategies. (We keep all company and respondent names confidential and report data in aggregate. Results to be shared in our October newsletter. )

Take Us With You on Your Last Summer Holiday

![]() Sadly the summer is coming to a close. If you are taking a last-minute vacation, take us with you. Listen to our podcast using our apps for iOS and Android. Download the Straight Talk with Supply Chain Insights app and listen to the testimonials of this year’s Supply Chain to Admire winners as you travel. We are now on our 190th podcast. During the next two weeks we will be sharing the interviews of 2016 Supply Chains to Admire winners and speakers for the Supply Chain Insights Global Summit.

Sadly the summer is coming to a close. If you are taking a last-minute vacation, take us with you. Listen to our podcast using our apps for iOS and Android. Download the Straight Talk with Supply Chain Insights app and listen to the testimonials of this year’s Supply Chain to Admire winners as you travel. We are now on our 190th podcast. During the next two weeks we will be sharing the interviews of 2016 Supply Chains to Admire winners and speakers for the Supply Chain Insights Global Summit.

Like the Shaman blog? Check out the new Shaman’s Journal. Each year we organize the best-read posts in a more readable format and publish a softcopy book. Order your copy today through Amazon to learn more about our research on building the global supply chain. Tuck it into your bag as you leave on your summer vacation.

Continue the Discussion at the Supply Chain Insights Global Summit

We will continue this discussion at the Supply Chain Insights Global Summit. (Registration is open for the first 125 participants.) At the conference we will be challenging supply chain leaders to focus on Supply Chain 2030 through a programmatic focus on five themes:

- Supply Chains to Admire. Financial Results. A critical look at supply chain processes impacting financial results through the Supply Chains to Admire research.

- Economic Vision of Supply Chain 2030. It is hard to know where we are going if we are not clear on the end state. Join us for a critical view of supply chain 2030 through the insights of leading economists.

- New Business Models. Making the Digital Pivot. Sit back and listen as companies share insights on the adoption of robotics, the Internet of Things, 3D printing, manless vehicles, new forms of analytics, and the emergence of new business models.

- Supply Chain 2030. Building Outside-In Processes. Experience the difference between traditional inside-out and new outside-in processes through the use of new forms of analytics and the network of networks.

- Building Supply Chain Talent and Leadership. Insights on leadership, continuous improvement, and talent development for emerging markets.

We hope to see you there!

About Lora:

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn or push for supply chain excellence.

Lora Cecere is the Founder of Supply Chain Insights. She is committed to building global supply chains and redefining the industry analyst model to make it friendlier and more useful for supply chain leaders. Lora has written the books Supply Chain Metrics That Matter and Bricks Matter, and is writing her third book, Leadership Matters. She also actively blogs on her Supply Chain Insights website, at the Supply Chain Shaman blog, and for Forbes. When not writing or running her company, Lora is training for a triathlon, taking classes for her DBA degree in research, knitting and quilting for her new granddaughter, and doing tendu(s) and Dégagé (s) to dome her feet for pointe work at the ballet barre. Lora believes that we are never too old to learn or push for supply chain excellence.