Many companies talk about Supply Chain Excellence, but most leaders struggle to define it. As a goal, it is easier to say than to define. One supply chain leader, in a discussion last week, likened supply chain excellence to fitness. His reasoning? He saw fitness as a goal to work for, and he acknowledged that you can get fitter; but he believed that the state of fitness is elusive. His belief was that fitness as a goal that it is hard to reach. He felt that supply chain excellence was analogous. We agree.

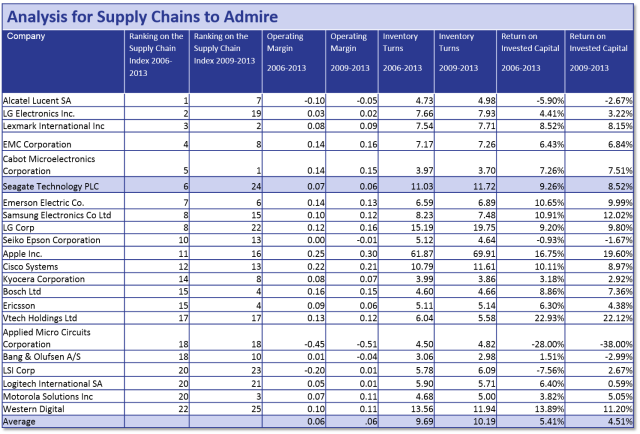

We want to help. One of our goals is to capture and share the stories of supply chain leaders. Our first step was to define the leaders. How? In our work on the Supply Chains to Admire report, we tracked the progress of manufacturing, retailing and distribution companies for the period of 2006 to 2013 and 2009-2013. We then rated companies on their ability to manage and improve a portfolio of metrics: operating margin, inventory turns and Return on Invested Capital (ROIC). Based on the analysis of supply chain improvement (as measured by the Supply Chain Index) and supply chain performance, we ranked the supply chain leaders by industry. The results for the high tech and electronics industry is shown in Figure 1.

Figure 1. Performance of High Tech and Electronics Supply Chains for the Periods of 2006-2013 and 2009-2013

To make the Supply Chains to Admire list, a company had to score above average of their peer group for supply chain improvement as measured by the Index, and drive performance above average in the portfolio of metrics for operating margin, inventory turns and Return on Invested Capital (ROIC). While we often see companies performing well in one of the three metrics, we believe that supply chain excellence defined by ability to drive improvement on the portfolio—all three metrics together.

It is a story of when the going gets tough, the tough get going. In the period of 2006-2013, the high tech and electronics supply chains had more demand and supply volatility than process supply chains; yet, the number of companies making the cut for the Supply Chains to Admire list is higher in the high-tech industries than in the process industries of chemical, consumer packaged goods and food and beverage manufacturers. Apple, Cisco Systems, EMC and Seagate make the list in high tech and electronics while Intel and TSMC make the list in the semiconductor industries.

Figure 2. 2015 Supply Chains to Admire

To understand Seagate’s journey, we interviewed Joan Motsinger, Vice President of Global Operations Strategy at Seagate Technology. Before taking her current position, she served in several capacities including Seagate’s product design and manufacturing facilities in the U.S. and Singapore. Specific responsibilities have included Product Modeling and Design, Component Process Engineering, Offshore Product and Subassembly Operations, Product Line Management, and Supply Chain Development and Operations. Joan holds Bachelors of Science degrees in Mathematics and Mathematics/Computer Science and is a graduate of Harvard’s Program for Senior Executives.

The questions are in bold and Joan’s answers are underneath each question:

How have you defined Supply Chain Excellence?

Our journey for supply chain excellence has changed and evolved over time. We have gone through many stages. When I think back, at the beginning of the decade, it was about designing the product for manufacturing. Prior to that, the priority has chasing lower cost labor in manufacturing and supply chain. Those had a finite length of improvement.

First Phase: 2002-2006

The focus then shifted to matching demand and supply. We were an early adopter of the E2open technology and we experimented on building B2B networks early in 2004. In our value chain, our supply chain is the buffer or the flex-point of the industry. Our first strategy was to align our suppliers by giving them visibility (through technology) to understand the demand signal directly and respond with JIT levels in support of our factories. What emerged was a complex set of supply partners that together with Seagate could meet the changing and growing demand.

Second Phase: 2006-2014

In 2006, with increasing price and commodity pressures, to remain competitive, we needed to prioritized simplifying our supply chain through less SKUs, less complexity, and fewer components. When you are complex, you must have a lot of parts to keep up with demand variation. As we focused on complexity reduction, we developed strong analytical approach to not only cost, but also cost-to-serve and landed cost. The focus on costs had three chapters:

- The first chapter in our journey was reducing the cost of complexity.

- The second chapter was reducing the cost of non-Bill of Material (BOM) costs.

- The third chapter was reducing the cost of direct or bill of material costs.

In each chapter, we asked questions including:

- What is the gross spend and cost per unit, the factors driving it?

- What cost can just be eliminated?

- What design specific costs exist?

- What manufacturing demands are on cost (inspection, automation,….)?

- What suppliers need help with cost (LEAN, labor, freight,…)?

- What are competitive best practices?

Third Phase: 2013-future

Today, we go further, we focus on designing for total landed cost in balance with throughput and service level. This is more holistic and requires a higher level of modeling, analytics and cross-functional coordination. Our factors spans all those prior priorities, but expands into a higher level of analytics on design cost (simplicity, leverage, supplier input), manufacturing cost (sites, labor, automation,….) ,service costs (freight,…).

Our journey is also maturing. The goal is to become demand driven versus supply driven. In one of the first steps of becoming demand driven, you realize that you have to redesign the relationships with not only with suppliers, but also with customers. In 2009, we took the work that we did with E2open on suppliers and built customer networks to see channel sales and demand signals daily. We are on the journey. We are targeting much improved end-to-end planning in response to multiple demand sources. We are also working on Sales and Inventory Operations Planning (S&IOP). But, I must tell you, when it comes to the management of demand, our work on the demand signal is still evolving. Our current focus is moving through co-planning in the network with suppliers and deploying new forms of analytics.

Make no mistake, cost is always important to us, but we are striving for balance. We want to understand demand drivers. Historically, electricity, water and the BOM decisions drove the costs. Chasing low-cost labor made sense in 80s and 90s, but now we are understanding what makes up total landed costs matters and evaluating alternatives. It is a much more balanced approach.

Another challenge on the horizon is security. Supply chain security is emerging and growing in importance. Today, our customers want proof that we have high integrity products. Securing our inventory are emerging as risks and opportunities. And as we see, the new force shaping supply chain excellence is geopolitical risk and security.

Today, talent is at a premium. We want our supply chain professionals to bring a strong balance of knowledge relative to financials, international business, analytical knowhow, and a sense risk management. Supply chain strategic thinkers are tougher to find.

What does the future look like?

When I think of the future, I think of a thin broad line across design, plan, source, make and deliver. Functional excellence needs to be a focus, but you need the power cross-functional execution excellence. We have also identified and mature the strength of a strategic team to focus end-to-end across functional boundaries and beyond the tactical. The value is in having operations leadership team capable of strong tactical execution muscle and yet balanced by a longer term strategic set of decisions.

Ash clouds, tsunamis and floods create the need for a strong, flexible, sustainable supply chain. We have come a long ways since the late 80’s and our initial supply chain priorities. We are balancing cost, market requirements, human talent and supplier relationships through a longer term lens while meeting the needs of our customers, investors each quarter.

What do you measure?

We strive toward operational excellence. We measure:

- Cost: Cost of Goods Sold, Opex, Capex

- Quality: Both integration quality and long-term reliability

- Flexibility: Utilization of Capacity

- Delivery Metrics: Perfect order delivery although good to continually refine

- Sustainability: Doing the right action for our people, our planet (EICC, Lifecycle analysis of materials, no hazardous materials)

- Technology: Portfolio of technology bets to serve our future demands

We define goals and keep them in place for a couple of years maturing the specific metric more m . The goal is to always measure and evolve. We have strong empirical processes, a strong base of analytics and management controls. Our teams actively use some strong software tools spanning analytics, communications and optimization; accountability emerges through transparency and quantitative understanding of performance.

I know that you endorse principle-based leadership. How have you defined it?

Our tenets are customers, suppliers, cost, risk; and people. The focused metrics are cost, quality, delivery performance, flexibility, sustainability, and technology/strategy. I don’t know that this is much different than what other people do, but we have learned a lot about balance and alignment.

What lessons have you learned?

I can summarize this into three statements:

- Do the right thing (Solving Customers’ problems with the right solutions in the storage industry)

- Do the thing right (Make vs. Buy, Cost, Quality/Reliability, Flexibility, ….)

- Do right for our investors, customers, employees (Electronic Industry Citizenship Coalition (EICC), Green Product/Process, talent development,….)

As a leader, it is important, to continuously look from the outside with a lens of continuous learning, continuous improvement. I am always listening to what other companies are doing. I try to continuously learn. As supply chain leaders, we have to get good at sensing demand and making the right decisions in advance of the order, in advance of the market. It requires an external sense of where you at to guide your value chain. This is my journey, my responsibility.

Thanks Joan. We love your insights! We look forward to hearing more on you and your story at the Supply Chain Insights Global Summit. We look forward to listening to your presentation. In our countdown to the event, we will be showcasing other stories of other supply chain leader’s to Admire stories on this blog. We expect 150 attendees and limit the number of technologists–consulting and software–to 15% of the total attendees. So, when you attend the Supply Chain Insights Global Summit, expect an innovative program and sharing by supply chain leaders without any worries of being accosted by technology vendors trying to sell you products. While other analyst events showcase analysts, this agenda is designed with you in mind. We want to help you IMAGINE the Supply Chain of the Future.

We are also busy cooking up some great research. If you have a supply chain center of excellence or are thinking about starting one, consider participating in our supply chain center of excellence research and joining our roundtable discussion.