Warren Buffet, Investor

This week, I finished a report. It will publish next week. The research focuses on lessons to be learned from the past thirty-seven months of disruption. My primary insight is that many of the technology initiatives that were underway at the start of the disruption did not serve us well. This includes digital supply chain transformation and Enterprise Resource Planning (ERP) upgrades.

In contrast, those who outperformed were better at strategy and aligned with outcomes. The use of descriptive analytics along with agile planning techniques (what-if analysis, discrete event simulation, and network design) helped.

Analytics investments are essential. We find that companies with an analytics center of excellence drove progress faster than those with a supply chain center of excellence. The issue? Organizations that embrace and use data outperform. The other issue? While companies build Supply Chain Centers of Excellence, most are not clear on what good looks like. Too few companies that I work with can answer the question, “What defines supply chain excellence?”

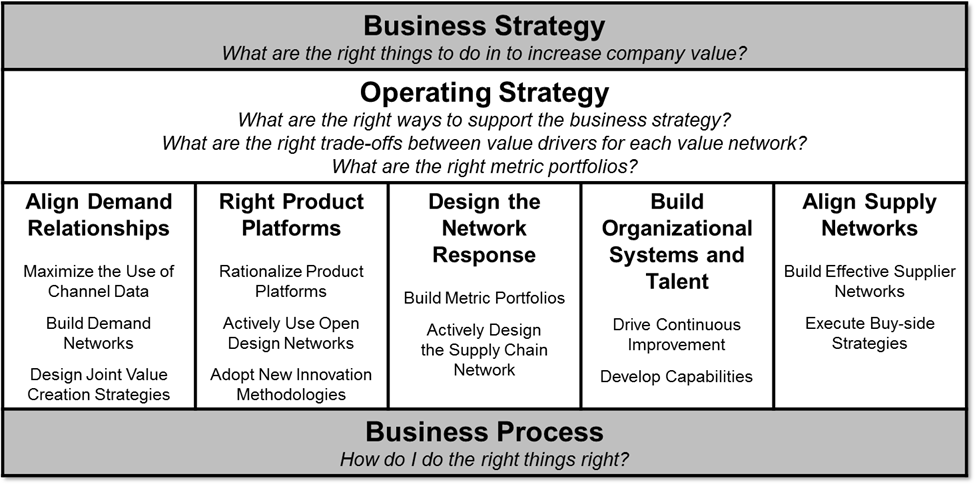

A common mistake is to start the journey of supply chain excellence with a focus on process. Don’t start with the process. For most, this is tough because of the assumption that we have best practices that can be easily adopted. Instead, the starting point, as shown in Figure 1, should start with a clear understanding of business strategy. The operating strategy–a major part of the supply chain strategy–flows from the business strategy. The operating strategy defines the flows of the supply chain.

Figure 1. Define Process Flows by First Defining the Business and Operating Strategies.

Let me give you an example. When you ask, “What defines supply chain excellence?” Four out of five business leaders will reply that the most effective supply chain is efficient. When you ask, “How do you define efficiency?” The answer is usually the lowest-cost supply chain. However, consider the disconnect if the business strategy is growth. If the company drives efficiency in supply chain design, the organization will kill growth.

Now consider that a company typically has four-to-five flows. Each requires design:

- Efficient. An efficient supply chain focused on the lowest cost. This flow is predictable and high volume usually represents 20-30% of the firm’s total output.

- Responsive. The responsive supply chain is all about reducing time. Reducing cycles is essential for products like vaccines, agriculture, seasonal products, and events. The flows of the responsive supply chain will never be efficient. The responsive volume can vary from 5-10% in consumer goods to 80-90% in agroscience.

- Agile. The agile supply chain has low volumes with high demand and supply variability. Certain supply chains like maintenance parts, designer/fashion items, new product launches, and food service items must be managed in an agile supply chain. The techniques to improve agility are improving data transparency/insights, use of attribute-based planning, design of push-pull decoupling points, pooling of inventory, and configure-to-order/make-to-order manufacturing. An aftershock for many following the levels of recent disruption is an increase in demand variability and the shift of products from efficient (easily forecastable products) to products that require more agile techniques. For one company that I am working with, this was an 18% shift in product volume.

- Seasonal. Products that are managed within a season. The pre-build is based on logic based on demand and supply assumptions. Many companies have 30-50% of their volume as seasonal items.

- Low Volume but Predictable Items. The key is to align these product flows with the efficient supply chain flows to minimize cycle stock in manufacturing and maximize transportation assets. The management of these items is an area where supply chain planning excels. Planning enables the achievement of economies of scale.

Today, less than 9% of companies manage, and design supply chain flows. Most companies only use network design technologies to improve asset efficiency. Network design technologies are seldom used in financial decision-making on cash-to-cash or tax efficiency programs. As a result, the finance and operations teams are constantly throwing the supply chain out of balance. Instead, the form should follow function: the process should follow the design.

Increasing Need for Strategy Clarity

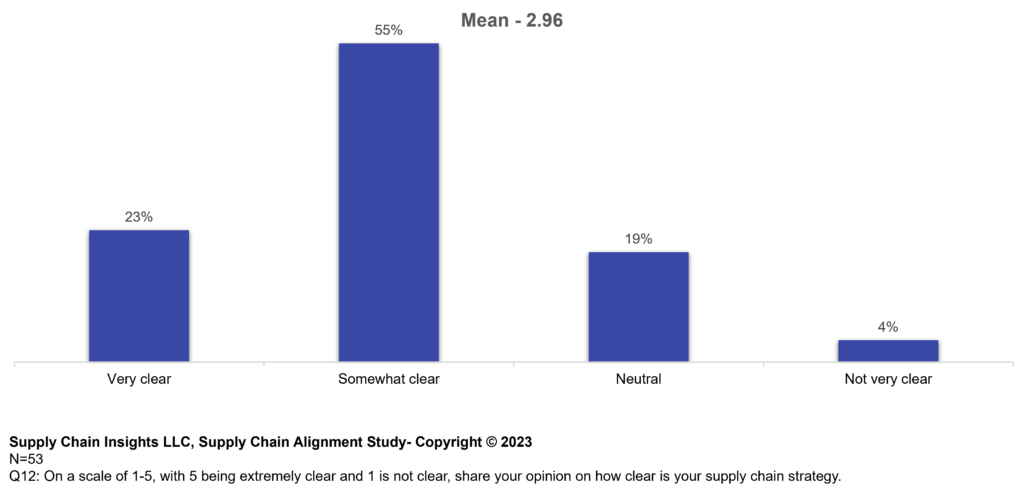

The evolution of GPT and AI crazes the industry. Many erroneously believe that using artificial intelligence will improve supply chain outcomes. I caution that no amount of AI will improve the outcomes if we are unclear on strategy. However, the advancements in AI should be a wake-up call for all to define strategy clearly. Today, this is a problem. As shown in Figure 2, in a recent survey, we find that only 23% of companies are clear on the role of the supply chain as it ties to the business strategy.

Figure 2. Clarity of Strategy

Companies clearer on strategy were more balanced in S&OP and better aligned. They also rate their supply chain performance statistically higher than those struggling to understand the strategy. In developing the strategy, it is important to recognize the drivers of each role on the team. One of the largest hurdles to supply chain excellence remains the executive team’s understanding of supply chain management. In Table 1, I share an example.

| Executive Board Focus | Financial Team | Supply Chain Team |

| Fear. Stabilize the organization in an uncertain market: focus on nominal growth. | Control. Budget development based on historic revenue with assumptions. | Reliability. Review of historical demand levels and capabilities while attempting to rationalize markets. |

| Financial Viability. Let’s make it through a tough market. | Cash. Implement cost controls with a focus on managing cash efficiency. | Cost. Manage supply constraints and inflation cost impacts with wild swings in mix and demand. |

| Frustration. Why can we not fill orders? Alarm at write-offs. | Inventory as Waste. Manage inventory as a liability. | Inventory as a Buffer. Improve resilience and considerations for forward-buying and hedging. |

| Strategic View of Time: M&A, market analysis, and positioning. | Short-term View. Budget-driven discussions and analysis for quarter-to-quarter and year-to-year considerations. | Multi-year View.: with a focus on and outside of lead time. Groups are attempting to align product mix and define capacity requirements. |

Next Steps:

As you take steps to make this actionable, build influence across finance and other functional teams. Educate on the importance of designing flows and aligning metrics. In the process, take these steps:

- Measure demand and supply variability and use it in the design of flow.

- Clarify the required reliability for customer service for each flow.

- Define the operating strategy and identify the proper techniques for each product flow.

- Familiarize finance teams with scenario planning and test product flows for feasibility based on the current levels of variability.

- Move from functional metrics to a balanced scorecard. Focus all functions on a clear definition strategy and align outcomes.

I hope this helps. Let me know what you think of the report.