Today, I am reflective.

My last post on the Supply Chain Shaman blog was forty-five days ago. I spent the month of March trying to help business leaders mitigate the impact of the pandemic. My first focus was on China sourcing. Then it was the redefinition of the supply chain for the global shutdowns Sick with the virus; I spent my energies writing and moderating podcasts. My goal was to drive insights for business leaders on Forbes and LinkedIn. As the economy shut down, I sunk in a pit of despair. Sadly, the economy fell to the inevitable community spread.

I firmly believe that the rebound of the economy requires strong supply chains, but to make this happen, we need to turn our backs on historic practices and innovate new ways of working.

Swimming Up Stream

I liken the COVID-19 pandemic containment for the economy to a medically induced coma. Shutdown quickly to prevent the spread of COVID-19, shelter-in-place orders rapidly transformed work into essential and non-essential work environments. As the world for non-essential workers moved to on-line meetings, conference calls, and uncertainty, essential workers redefined the workplace to mitigate risk. As we moved into our new roles, for all supply chains, demand shifted. No doubt about it, we are characters in a supply chain case study searching to define a new normal. We will not find it anytime soon.

Today, we find ourselves in the middle of a risk management case study. News coverage showcases the differences between logistics and supply chain management. An example is a focus on moving and buying ventilators without an assessment of the availability of critical parts and skilled therapists. Another example is testing. What good is a test unit when there are not enough swabs or reagents? Why should states be in a bidding war for test kits? Why is there not a standard for testing? Twenty-to-thirty percent of the COVID-19 tests were false negatives. I could go on and on, but I won’t. I will leave this for the scientists. Let’s learn and apply it to supply chain management.

Time to Know. Time to Act.

What can we learn? For me, it is a heightened respect for time. When did we know what? How quickly could we respond? The virus moved quicker than the ability to test. (For example, I believed that I contracted the virus on April 2nd, and received my results on April 17th. The illness, thankfully, receded. I got better before I got the test results.) The reason? The testing supply chain—reagents, pipettes, and public health contact tracing—could not keep pace with the speed of infection. The healthcare value chain was slow to respond—the majority of Personal Protective Equipment (PPE) was in Chinese warehouses. (China was the source of over 90% of PPE.) I gave thanks when the Patriots jet—championed by Mass General and Robert Kraft (owner of the Patriots)—landed in Boston with a million masks. Operation Air Bridge by the US Government was also a welcome relief.

As I watch the news and work on client documents in my quarantine, I try to manage my emotions. It is tough. I am sure that it is hard for you as well. I continue to think about the COVID-19 recovery and how to help clients. Here I share my thoughts.

Restarting the Supply Chain

Will the start-up of the supply chain be a reboot or a need to reformat? Let’s use your computer as an analogy. While a reboot of a computer rstarts the machine to eliminate the in-memory processing, a reformat erases everything on the computer and starts again. I think that for many supply chain leaders, the plan for the supply chain recovery is a reformat, not a reboot. Let me make my argument.

The supply chain restart will be in waves. It will take time. The shutdown was quicker than is possible with the restart. To adapt, I recommend that companies form two groups:

- Operational/Business Continuity Group. This cross-functional group (sales, procurement, manufacturing, and distribution) is an operational team to manage the day-to-day issues and exceptions in the supply chain. The goal of this team is to minimize disruption.

- Recovery Team. The design of the second group is to analyze and reformat the supply chain for economic recovery. The design of this post is to help this team.

Steps To Take

To drive the reformatting process and re-start critical processes, don’t accept the status quo. Continually question what you do. Start the focus on these six steps:

Step #1. Start With Demand. Get Good at Sensing the Market. A double whammy—economic downturn and the pandemic—are shaping demand. Community spread will drive regional differences as regions move through public health crises. Historically, the supply chain focused on aggregate market sensing with a broad-brushed replenishment. Historic replenishment practices are no longer be sufficient. Replenishment will vary more than ever market-by-market—focus planning models on markets. Throw away the big brush.

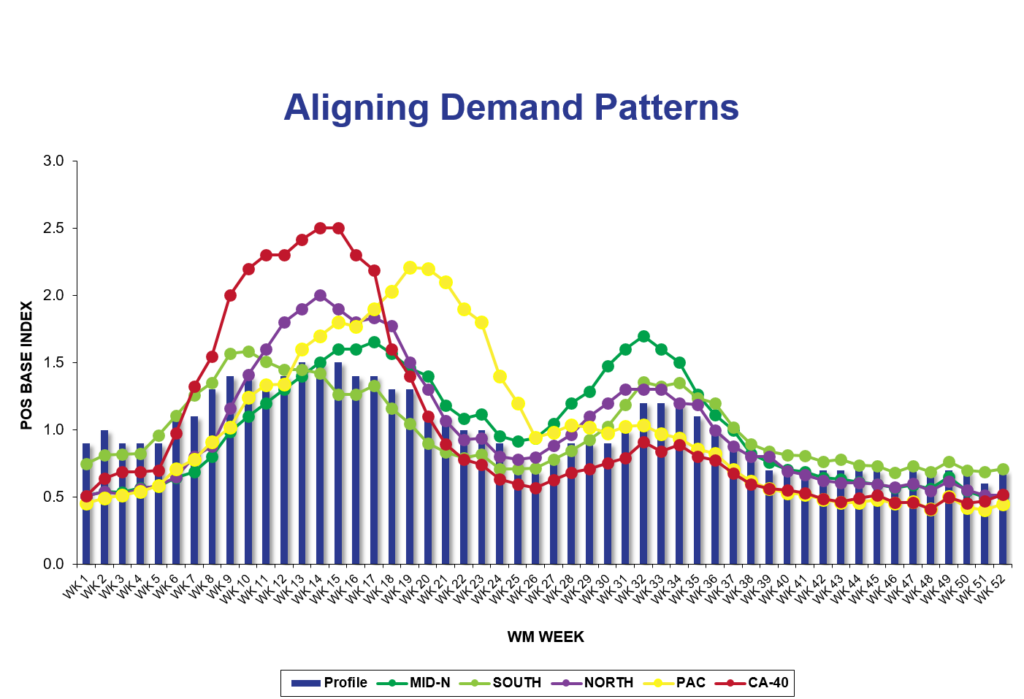

Figure 1 shows a market-by-market planning model by a sinus drug manufacturer. This type of planning needs to be deployed by all consumer manufacturers.

Be open to different forms of modeling. One company that I work with is using COVID-19 levels in sewage to plan recovery curves. Another is looking at hospital bed utilization to predict market baskets. Economic stimulus check disbursement will drive other models. Experiment to find the right data set to evolve regional models.

Figure 1. Model Local Market Trends

For some, the recovery will be V-shaped: fast and furious. There is pent-up demand for teeth cleaning, hair cuts, and elective surgery. For others with one out of ten unemployed demand will plummet. Bottom line? Don’t expect demand to be predictable. In the shutdown, demand surged for toilet paper and guns. In the upturn, not all demand patterns are apparent. For example, how long will it take for the restaurant and food distribution supply chain to restart? The airline industry? How do we help the healthcare supply chain reach a new normal? The answers are mostly unknown. Fundamental to our reformatting of supply chain capabilities is reducing the time to sense channel consumption. Demand latency reduction—time to detect market consumption—will be vital to the supply chain recovery. As a result, companies need to realize that historical processes are not adequate. The order is no longer a good proxy for demand. And, in consumer products industries, the latency of syndicated data is deadly.

For some, the recovery will be V-shaped: fast and furious. There is pent-up demand for teeth cleaning, hair cuts, and elective surgery. For others with one out of ten unemployed demand will plummet. Bottom line? Don’t expect demand to be predictable. In the shutdown, demand surged for toilet paper and guns. In the upturn, not all demand patterns are apparent. For example, how long will it take for the restaurant and food distribution supply chain to restart? The airline industry? How do we help the healthcare supply chain reach a new normal? The answers are mostly unknown. Fundamental to our reformatting of supply chain capabilities is reducing the time to sense channel consumption. Demand latency reduction—time to detect market consumption—will be vital to the supply chain recovery. As a result, companies need to realize that historical processes are not adequate. The order is no longer a good proxy for demand. And, in consumer products industries, the latency of syndicated data is deadly.

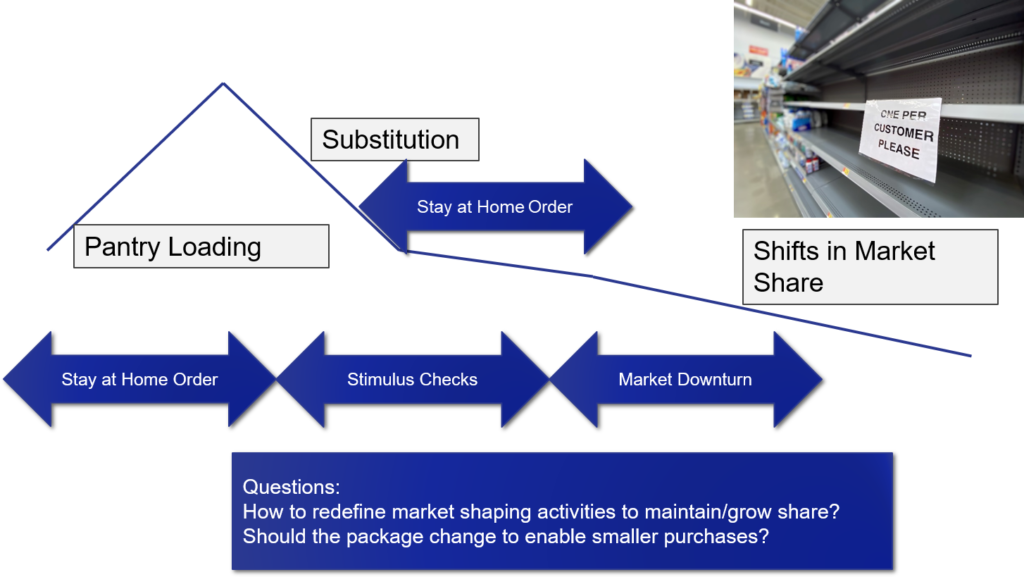

Figure 2 is an example of a potential market signal. The response will be a series of ups and downs. The demand drivers will be anything but constant.

Figure 2. A Sample Demand Pattern for Consumer Goods

he ramp-up, the pre-pandemic assumptions are no longer valid. Expect border friction and logistics to be an issue. Border crossings will be tough, and the infrastructure for the ocean and air freight tumultuous. The only certainty is the level of uncertainty with continued surprise. Historic assumptions are no longer valid.

The answer? There are no easy answers, but here are three actions to take to get started:

- Implement Demand Sensing. Build outside-in processes to use market data/consumption insights with minimal latency. Translate this data into decision support technologies. (For example, abandon the use of logic to translate order signals into Distribution Requirements Planning (DRP). Instead, use demand sensing technologies to detect patterns with minimal latency into inventory requirements. Consider technologies like 1010 Data in consumer goods in conjunction with demand sensing technologies to replace rules-based consumption of demand into an inventory signal.

- Simplify Product Portfolio. The longer the product tail, the more difficult it is to translate demand. A simplified product portfolio is easier to manage in times of uncertainty.

- Minimize Demand Shaping Programs. During the quarantine, I laughed at the recent Instacart add for a buy one get one (BOGO) free promotion for toilet paper. Simplify demand translation by eliminating trade promotion and price management programs. Instead, focus on market presence on contactless forms of shopping. For example, during my quarantine, I was shocked at how few companies had great descriptions and images on Instacart. Form teams to improve online presence.

Step #2. Consider A Redesign? As the economy shifts, restarting the supply chain requires a redesign. The global pre-COVID-19 supply chain was long, outsourced, and complicated.

Historically there was a narrow focus on efficiency. Lowest cost drove decisions. This design is not sufficient for the upcoming time of uncertain demand. As a result, evaluate inventory buffers, location of inventories, and the need for push/pull decoupling points.

What to do?

- Track Supply Chain Planning Data. Build a simple database to track lead time and border crossing shifts. Use this data to improve planning.

- Build Simulation and What-if Capabilities. The supply chain is a complex, non-linear system. As a result, the trade-offs are not clear. Build simulation models to understand the intricacies and assumptions for the restarting of the economy, and bring them into the board room to inform decisions. The best tools for modeling are AIMMS, LLamasoft, and OM Partners. Kinaxis’ in-memory models are also helpful to drive multiple and on-going analysis. Tie this modeling to supply chain execution through technologies like Aera Technology, Celonis and Riverlogic.

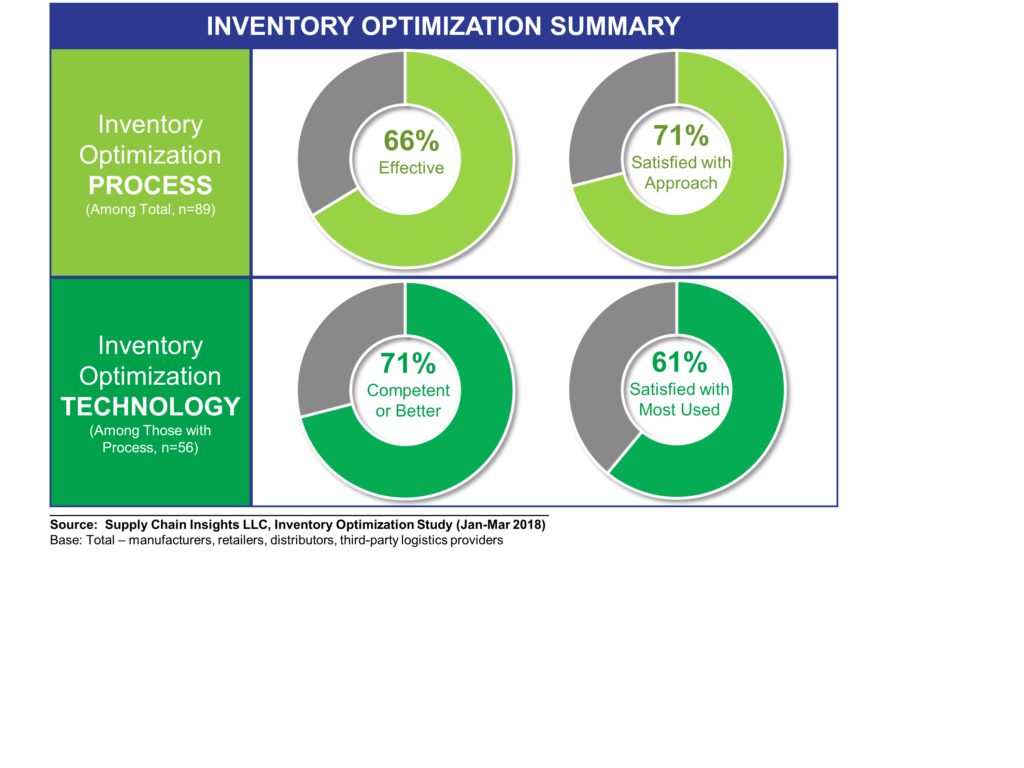

Step #3. Evaluate Inventory. Evaluate inventory health weekly. One thing will be sure on start-up: the current stock in the warehouse will be an incorrect mix. Recommendation? Don’t depend on historic DRP and MRP signals. Translate regional demand models into inventory mix health weekly through the recovery. As shown in Figure 3, while 2/3rds of companies felt that their inventory technologies were effective before the pandemic, I forecast that only 10% will find the same approaches to be effective through the market re-start.

Figure 3. Pre-pandemic Inventory Optimization Satisfaction

Step #4. Improve Visibility/Eleminate Black Holes. Document your supply chain black holes. Redefine Visibility. Visibility means different things to different people. Put butcher block paper on the wall and draw your supply chain from the customer’s customer to the supplier’s supplier and then start to document your black holes or areas where you cannot see supply chain data at the speed of business. Explore alternative analytics and data sources to eliminate black holes.

Step #4. Improve Visibility/Eleminate Black Holes. Document your supply chain black holes. Redefine Visibility. Visibility means different things to different people. Put butcher block paper on the wall and draw your supply chain from the customer’s customer to the supplier’s supplier and then start to document your black holes or areas where you cannot see supply chain data at the speed of business. Explore alternative analytics and data sources to eliminate black holes.

Step #5 Safe Manufacturing. While planning and operational teams can shelter at home, manufacturing groups do not have this luxury. Help the organizations to improve health and safety by minimizing change-overs and schedule changes. Focus on schedule reliability and the delivery of a feasible plan. If you have finite scheduling technologies, use it. Move away from OEE to schedule adherence. Focus the planning team on minimal schedule changes and the operational team on first-pass yield and schedule adherence.

Step #6. Manage Supply. Map End-to-End Supply Networks. Early into the downturn of the economy, we are drawing down inventories. With many manufacturing plants shuttered, map the supply chain to understand the intricacies in your supply chain. A shown in Figure 3, supply chains are complex with multiple suppliers at multiple nodes. Recognize it as a network. Fpr this client there are over 1600 suppliers.

Figure 4. Supplier Mapping

Use your supplier development teams to contact each supplier to understand the current state of asset utilization and plans for the start-up. Map the time for recovery. Use ranges based on supplier feedback. Input these times into the supply chain models to understand the bottlenecks. As you do this work, evaluate options like alternate sourcing, bill of materials, and the discontinuance of products. Work cross-functionally to align supply with demand.

Use your supplier development teams to contact each supplier to understand the current state of asset utilization and plans for the start-up. Map the time for recovery. Use ranges based on supplier feedback. Input these times into the supply chain models to understand the bottlenecks. As you do this work, evaluate options like alternate sourcing, bill of materials, and the discontinuance of products. Work cross-functionally to align supply with demand.

Help suppliers to be financially viable. Back away from the honorous payment plans and invest in recovery. Use your supplier development teams to have the right one on one conversations with suppliers and set-up weekly calls to understand the health of the supplier base. Take ownership of your demand signal and hold the organization accountable for improving supplier flows. In the recovery, you will be competing with many other manufacturers for supplies. Relationships and cash matter.

Summary

These are my thoughts. I welcome yours.

Stay safe. Just as data and science are the best course to improve public health, they are also the best prescription to drive supply chain effectiveness in these uncertain times. I firmly believe that those wed to historic practices will fail.