July is my birthday month.

In the middle of busy travel, I made time for the annual physical. The reason? I know that early detection is the key to wellness. It is a familiar ritual. The nurse quickly assesses blood pressure, pulse, blood oxygen, height and weight. Lab work testing follows vital sign analysis. Only when the tests are complete, can I have a meaningful conversation with the physician about my health. In my lifetime, the depth of lab testing plays a greater and greater role in the determination of health.

In my work with manufacturing companies recently, I am thinking a lot about the need for diagnostic testing. While most consultants and technologists want to sell technology, and are eager to slap in a new piece of software, my caution is to slow down and better understand root issues before having a technology discussion. Here I share insights on how to get started using a four-step process.

Time For A Supply Chain Check-Up?

When a company contacts me to help them with their supply chain, the pain is usually a gap in customer service. The symptom is clear, but the root issues are not clear. As I work with leadership teams to understand the “why”, I experience circular discussions. They tend to have many pretty PowerPoint slide decks–full of acronyms, pretty pictures and E2E commitments–but they lack a common definition of supply chain excellence. Ironically, I find organizations easily write big checks for technology implementations, but struggle to drive process improvement.

To complete a supply chain diagnostic, I take these four steps:

Step One. Analyze Past Results in Customer Service. To accomplish this goal, I ask a cross-functional group to audit the past year. We draw a timeline on a conference room wall and using customer shipment and compliance data, we plot the issues with customer service and product outages. As a group, we drill into root issues. I ask, “Do you have data that could be used to alleviate the issue in the future?” Or alternatively, “Is there data that could be sourced to help?”

I am working with a company with issues in delivering customer service. The company is a food and beverage company. When I asked for an analysis of the customer service data with a root cause analysis, it was not available. Six months later based on the work of four hard-working employees, we were able to get the analysis to start to roll-up our sleeves. Most companies cannot get to data by customer on orders shipped incomplete to understand root cause analysis.

Many times useful data exists in marketing or sales groups, but is not shared with the supply chain team. The issue is either trust or awareness. I love getting the two together to explore all forms of unstructured data–weather, rating and review data, warranty claims, and email chatter. Normally, unstructured data is available but it is not considered because traditional supply chain processes only focus on the use structured data.

Recently, I conducted a strategy session was with a major consumer products company selling cosmetics. The company wanted to launch a digital strategy, but the digital supply chain team had never connected with the firm’s digital marketing team to understand how the two groups’ efforts could be intertwined. The organization had a very strong digital team with great data, and the two groups were largely unaware of how they could work together. The result was an endless list of possibilities.

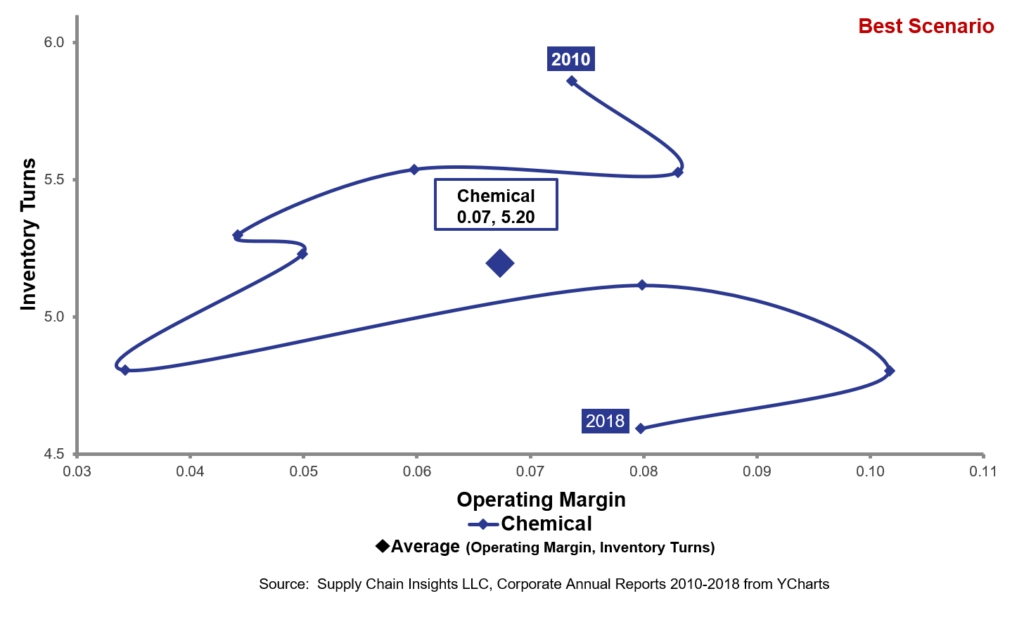

Step Two. Understand Industry Performance. Build an industry peer group and gain insights on major trends. Use the peer group analysis to establish realistic targets. Let’s take an example. In Figure 1, we show the aggregate trend of the chemical industry in an orbit chart format showing year-over-year results at the intersection of two metrics operating margin and inventory turns.. In the period of 2010-2018, within the chemical industry, margins fluctuated, largely driven by the price of crude, but inventory turns plummeted. The average for the industry was 7% profit margin and 5.20 inventory turns. However in looking at the more recent period, should a target of 5.20 for inventory turns define best-in-class performance?

Figure 1. Orbit Chart for the Chemical Industry for the Period of 2010-2017 at the Intersection of Inventory Turns and Operating Marginng Margin

Ecolab was able to overcome the downward trend. At first blush, the pattern in Figure 2, might not appear desirable, but the Company was able to outperfom the peer group while driving performance improvements. 95% of companies fail to achieve this goal.

Figure 2. Orbit Chart for the Period of 2010-2018 for Ecolab Showing the Trend at the Intersection of Operating Margin and Inventory Turns

Set targets based on the industry profile and a review of the industry peer group. Ask the group what is possible? What are reasonable targets based on this discovery? We post the industry analysis and peer group analysis in the annual Supply Chains to Admire analysis for this purpose.

I find companies will often set targets based on false beliefs or short-term goals. Let me give you an example. I laughed at a recent presentation of Mondelez trying to achieve the cash-to-cash performance of Dell. While feasible, the question is would this be desirable? The lengthening of payables by Mondelez will boomerang into rising costs, quality issues and supplier viability concerns.

Step Three. Determine Forecastability and Forecast Value Added (FVA). I am often asked to benchmark demand. Executives will ask, “What is a good target for forecast error?” When I get this question, I laugh. I wish the answer was simple. It is not. The answer is much like how long are a man’s legs. Let me explain. Supply chains are not the same. To understand what is possible in forecasting start by determining forecastability. Profile volume segments by coefficient of variation by demand flow. Customer service issues are normally in the medium-low volume product segments with high coefficient of variation. Divide the analysis into categories:

- High volume, very predictable demand.

- Medium volume products, predictable demand.

- Medium volume, inconsistent demand.

- Low volume, predictable demand.

- Low volume inconsistent demand.

- New product launch.

- Declining volume.

Use this data to understand demand predictability. If demand error is extremely high, traditional demand management techniques are of limited value.

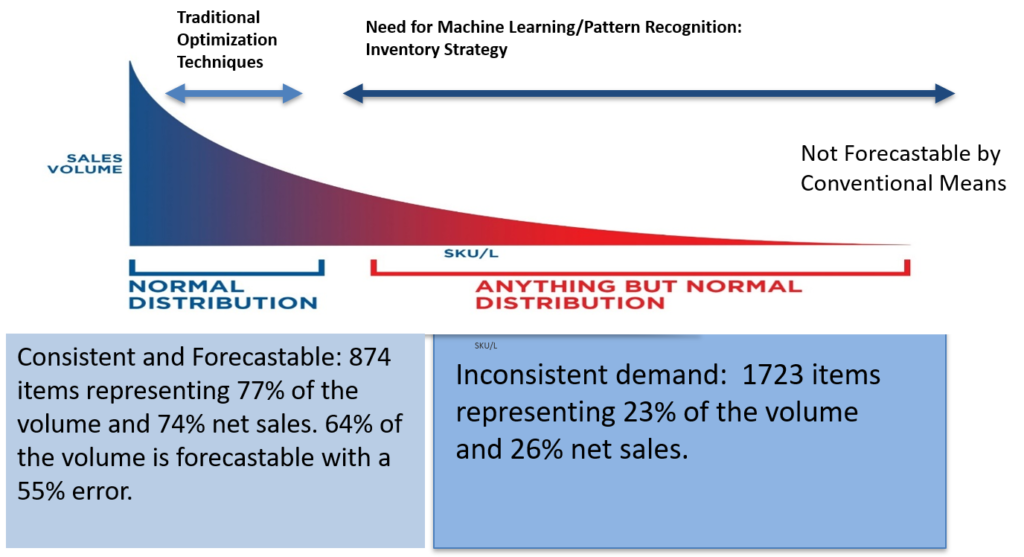

To tie the demand analysis to customer service, map products into categories and plot the long tail of the supply chain. Plot products by sales volume and order frequency. Shown in Figure 3 is a long tail analysis from a client.

Figure 3. Long Tail Analysis

Then overlay the demand stream mapping on the customer service analysis. Determine the root issues of customer service. Traditional demand management techniques are the most suitable for high volume predictable items.

For products in the tail, align the demand technique to the pattern. This requires testing of techniques like attribute-based forecasting, use of channel and weather data, and fine-tuning hierarchies through backcasting. (To backcast, take 2-3 years of history and try to predict the current period.) Sometimes, product variation is so high that demand modeling is not sufficient and inventory strategies are the focus. This includes postponement, platform rationalization, or the design of push/pull decoupling points.

Then analyze Forecast Value Added (FVA). The goal of this analysis is to understand the value of the current demand planning process by demand stream. In my client experiences of the last five years, I find that FVA is getting worse, not better. The reasons are many. My current clients have FVA analysis results of -33%, -14% and -9%. These are brand names with well-established supply chain planning teams. Before we started, the leadership team of each company did not know that there was an opportunity to improve the process. Why? What was the root issue? My guess? Technology implemented without testing and fine-tuning the models. Measurement of demand accuracy incorrectly (comparison of units sold versus units forecasted monthly at a high level in the demand hierarchy). As a result, the Company teams have a false sense of achievement. As a result, the discussions were circular with a lot of finger-pointing.

Why go to this trouble? Supply chain excellence is all about the detail. Companies have multiple supply chains. The answer is different for each based on the rhythms and cycles. Forecasting items/location accurately and understanding the impact of shifts in mix is key to improving customer service. As a result of the analysis, each client has a substantial opportunity to reduce cost and inventory based on the analysis. The work averaged a one-to-two week payback.

Step 4. Analyze Inventory: Muda Versus Buffers. Inventory is largely misunderstood. It is both waste and a critical buffer. Each company has a mix of both. The discussion is analogous to good and bad cholesterol with my physician. Buffer inventory is a shock absorber of demand and supply volatility while too much inventory is waste or Muda. The key to supply chain excellence is focusing on the form and function of inventory and the design of inventory as a buffer in the supply chain while eliminating Muda. This requires analysis using network design and inventory optimization technologies. The analysis takes 6-8 weeks and is a very helpful audit.

Figure 4. Form and Function of Inventory

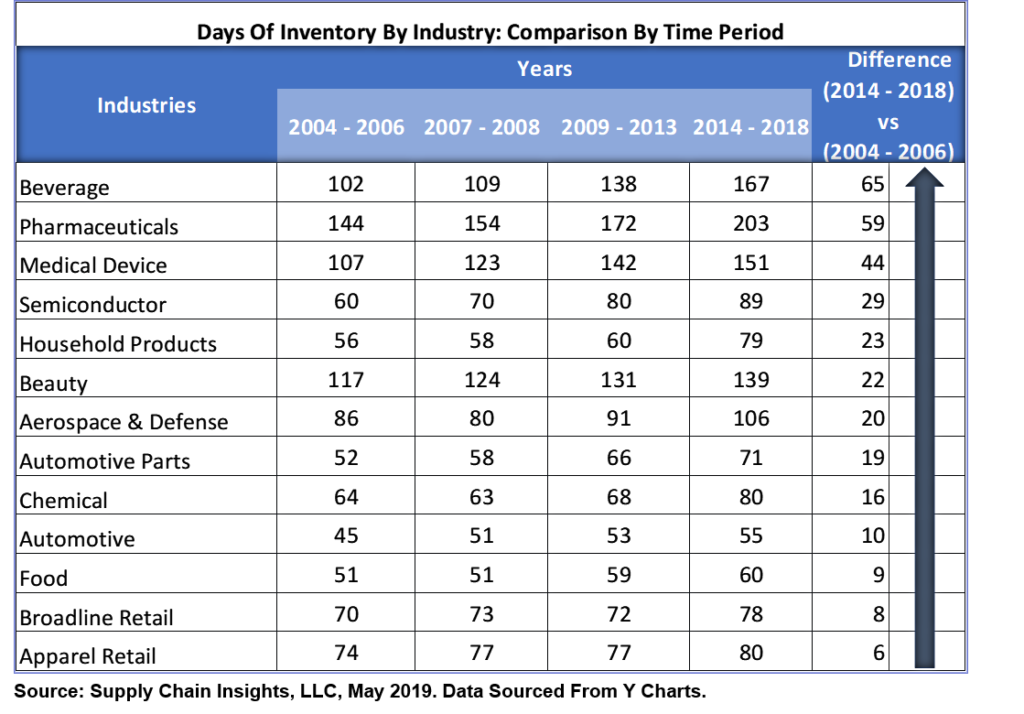

For each client with a negative FVA, there was a multi-million dollar inventory opportunity. I find inventory management and the analysis of buffers is an opportunity at most companies. This is one of the root issues leading to the swell of inventories in company warehouses as shown in Figure 5.

While 85% of companies have an Advanced Planning Solution, I seldom see one working well. In a conversation at a client with a solution deployed in 1995 and never fine-tuned, I asked, “Would you have ever bought a car and ran it for over thirty years and never had an oil change or fine-tuned the engine?” His answer was, “Of course not…” The issue was this was not his mental model.

The mistake is implementing advanced planning solutions as a technology without testing the output on implementation and never fine-tuning and testing the output over time. As a result, many companies unknowingly running systems that are making the forecasting number worse not better leading to increased costs, customer service issues and higher inventory levels.

Figure 5. Comparison of Pre and Post Recessionary Levels of Inventory by Industry Peer Group

After testing in these four areas, companies should engage with technology providers. These insights help to drive the diagnosis.

What do you think? How do you assess the health of supply chain planning. I welcome your feedback.

Struggling to Stay Current?

Technology change is moving faster than process innovation. Many companies struggle to keep pace. If this is you, I welcome you to join our upcoming events. Our goal is simple: to build a guiding coalition to drive value in supply chain processes.

Imagine Supply Chain 2030. Supply Chain Insights Global Summit, September 3rd-6th, 2019, at UI Labs, Chicago, IL. The focus is on Imagining Supply Chain 2030. What is different? The format is unique. The event has no sponsorships, paid speaking sessions or lofty analyst discussions. Designed for extreme networking, I dub this event the unconference. At the event, technologists and business leaders work shoulder-to-shoulder to Imagine Supply Chain 2030. To ensure balance of business and technology leaders, I closed the conference this week to technologists/consultants to ensure the right balance of business and technology leaders. This week, I have added speakers from Dell, Dow, Intel, and Simple Tire. I hope to see you there.

Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

To register for these events, please contact Regina.denman@supplychaininsights.com.