Lemmings are misunderstood. So are supply chain leaders.

What is a lemming? Simply put, a lemming is a small rodent. Active in Arctic tundra ecosystems, they are part of the super family Muroidea, which includes rats, mice, hamsters, and gerbils.

A lemming’s population rises and falls. Sometimes there are large migrations that result in mass drownings. Over the last decade, the sharing of videos of lemmings jumping into the sea emerged as a metaphor for business leaders blindly following a disastrous path. In this blog post, I share quantitative research, mixed with stories, of Sales and Operations Planning (S&OP). Let’s face it folks, we have acted as lemmings over the last decade when it comes to S&OP.

The Preamble

As an industry analyst in the supply chain planning market for fifteen years, this month, I will publish my tenth report on S&OP. The first report was published when I working at AMR Research (now Gartner) in 2004. (Being the original author, I laugh when technology companies attempt to explain the Gartner S&OP maturity model to me in briefings. I get it. If only I knew then what I know now. )

The Research

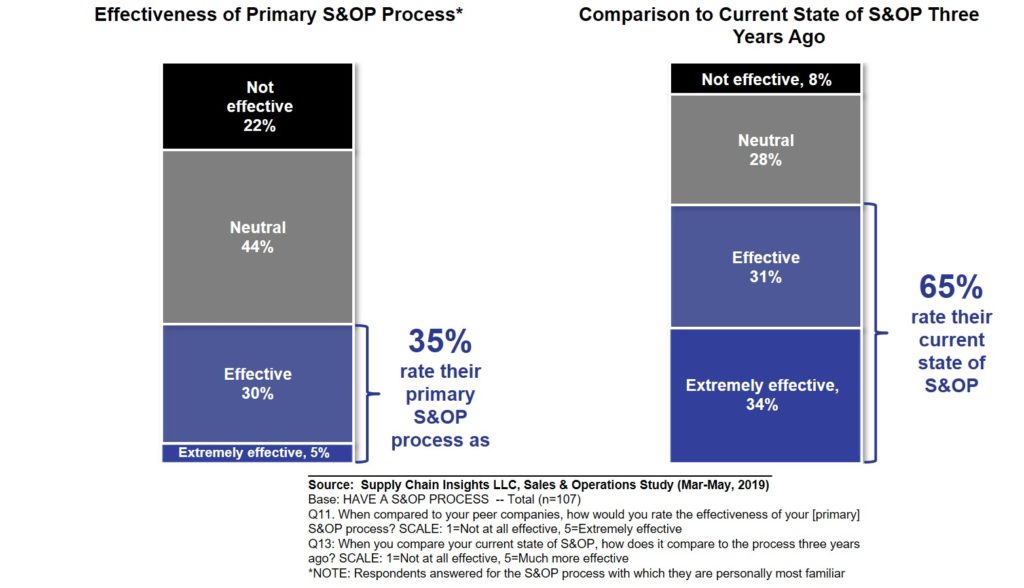

Top line results of recent research on S&OP processes? Manufacturing companies are statistically less satisfied with their S&OP processes in 2019 than they were in 2016 at a 90% confidence level. As shown in Figure 1, progress is stalled. (The slide is precipitous.)

Figure 1. Effectiveness of S&OP Processes in 2019 and 2016

To understand this figure, let me spend a minute sharing some insights on research methods. This research is based on my LinkedIn Group as a research panel. This is very different than the work that I did at AMR Research where the panel was hosted by a third-party firm. The difference? I know all my respondents and I can validate their employment. This was not the case when I worked at Gartner or AMR Research. When a third-party panel is used, the researcher cannot validate the respondent data.

Why is this important? The use of an open panel allows me to triangulate the results to corporate balance sheet information. When I worked at Gartner and AMR Research, I could never triangulate the results to balance sheet information because I did not know the company employment of the respondent.

Research is tough work. Meaningful analysis requires a statistically significant sample with a meaningful population. Let me give you an example. If I only asked my followers, the research would be biased to United States innovators. However, the LinkedIn population is global and is a wider population of supply chain professionals. In this research, I have a sample of 107 manufacturing respondents. This chart reflects their responses to the effectiveness of their 2019 S&OP processes to their perceived effectiveness of their processes in 2016. The comparison comes from the same study with the same population.

In parallel, I have analyzed the 2019 effectiveness to a tracking study. This study of 120 manufacturing respondents was fielded in 2015. In the research, I used the same question on effectiveness. The results are very similar to what is shown in Figure 1 (varying by only 2-3% on effectiveness). So, I feel confident saying that the effectiveness of S&OP declined over the past three years for manufacturing companies greater than 5B$ in annual revenues. The quantitative research also matches my personal experiences with clients.

What Makes a Difference?

These results raise the question of WHY? Was it technology? Process definition? The difference cannot be explained by the type of technology used, or the consulting partner driving the implementation. All companies–with effective and less than effective processes struggle to get access to data, and lack alignment between commercial and operational teams. Effective S&OP takes work. The best results happen with enlightened leadership.

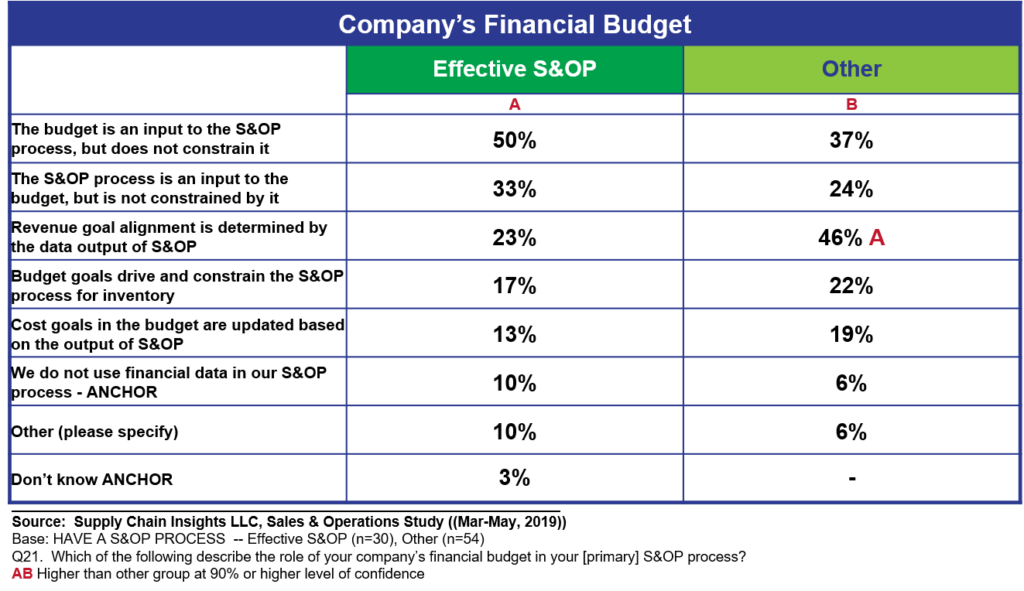

We are still testing the early research findings, but the role of the budget and the impact of financial leadership shows some statistical significance between effective and less successful processes. Shown in Table 1 are the differences. Tight coupling of the budget to the S&OP process is detrimental. The budget is obsolete when published. Why? Markets change. They are not static. S&OP’s role is to maximize opportunity and mitigate risk while following the principles of the budget. What does this mean? For example, instead of integrating cost data, analyze costs based on mix variance against the goals of operating margin. Similarly, analyze inventories based on strategy versus integrating budget data. The focus is on balance sheet performance. Only lemmings tightly integrate financial data to supply chain analysis.

Table 1. Differences Between Effective and Less Effective S&OP Processes.

Businesses are complex. A manufacturing company with annual revenues greater than 5B$ operates seven S&OP processes and is dependent on five technologies. Only one in two companies execute the plan developed in the S&OP process. My take? Opportunities abound. Companies have not improved organizational alignment or S&OP execution over the last decade.

Sharing Stories.

In my interactions with clients, I encounter many scenarios where I shake my head in disbelief. No, I am not surprised by the results of this preliminary research finding. Let me share some stories to help you understand my point of view.

Governance. I work with one company with 27 divisions and complex vertical integration between regions, divisions and third-party organizations. When I started working with this large company, regional commercial teams drove decisions. With the implementation of S&OP, each region defined very different processes–different calendars and planning engine hierarchies. As a result, the company, at the end of the five-year implementation, is unable to roll-up data to a corporate level to analyze the forecast or capacity planning. The gap? The lack of clarity of regional/global governance and the need for consistency in technology deployment.

Modeling. A large system integrator implemented Logility in a chemical company for services of $5.4M without a material balance. (A chemical company’s supply chain backbone is a material balance. Yield, grades, and process flows are essential to the modeling.) As a result, demand translation into supply was not possible. The consultants, with a consumer product industry background, did not understand the concepts of grades, tolling, reverse bill of materials, and envelope flows. As a result, they implemented the wrong model. S&OP is industry specific requiring domain expertise. In contrast, I recently interviewed a successful Logility project implemented for substantially less by internal resources with minimal involvement of Logility. Training, a focus on modeling and leadership goal clarity drove business results.

Focus on Planning Excellence. A large food manufacturing company has fourteen poorly implemented JDA instances. The technologies, implemented by a large system integrator, degraded the forecast by 31%. The implementation focused on implementing the technologies versus driving process excellence. The demand technology lacked backcasting testing (use of history to tune the forecasting engines), and the organization was not holding themselves accountable for Forecast Value Added measurements. The leadership team openly admitted that they did not know how to measure and manage demand.

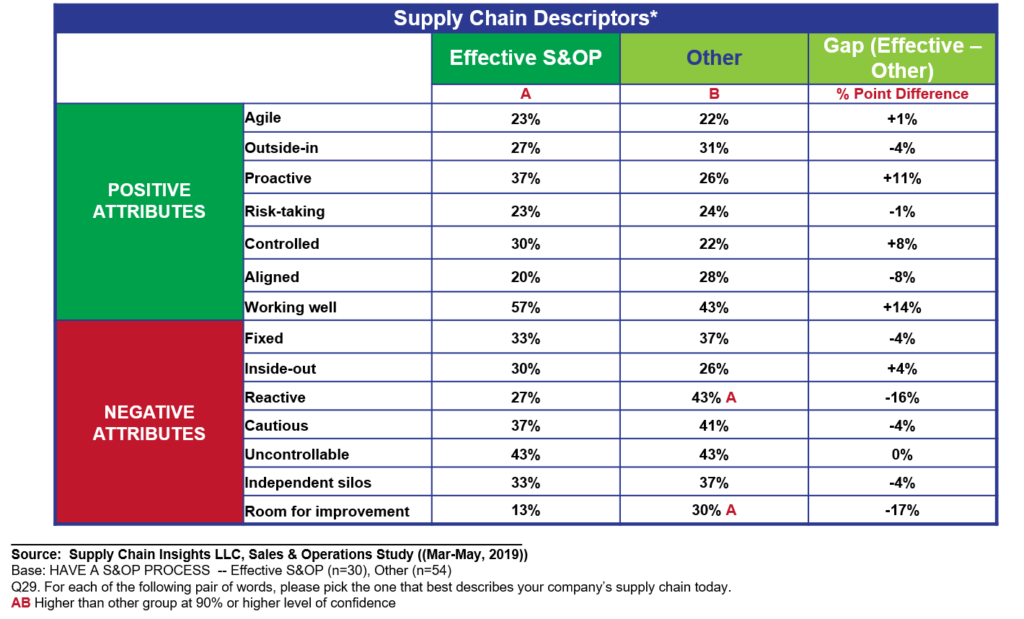

Fire Fighters. A supply chain team improved forecast accuracy by 22%, but did not improve inventory or customer service. The reason? Internal measurements rewarded firefighting and reactive behavior. The COO had a monthly reward system for the most responsive plant scheduler. He asked customer service each month which plant scheduler was the most responsive to customer demand and invited this plant scheduler to lunch at the corporate office. There were 35 plants in a global organization and having lunch with the COO was a big deal. The program may sound good, but what happened in reality was short-cycling of the manufacturing equipment. A knowledgeable supply chain leader knows that 100% order completion is unrealistic and that the translation of tactical planning into finite scheduling is critical for overall supply reliability, the management of inventory cycle stock and the improvement of costs. When organizations are reactive, S&OP performance is statistically less effective. The COO effectively built a program to reward fire fighting.

Figure 2. Characteristics of Effective S&OP Processes When Compared to Less Effective Processes

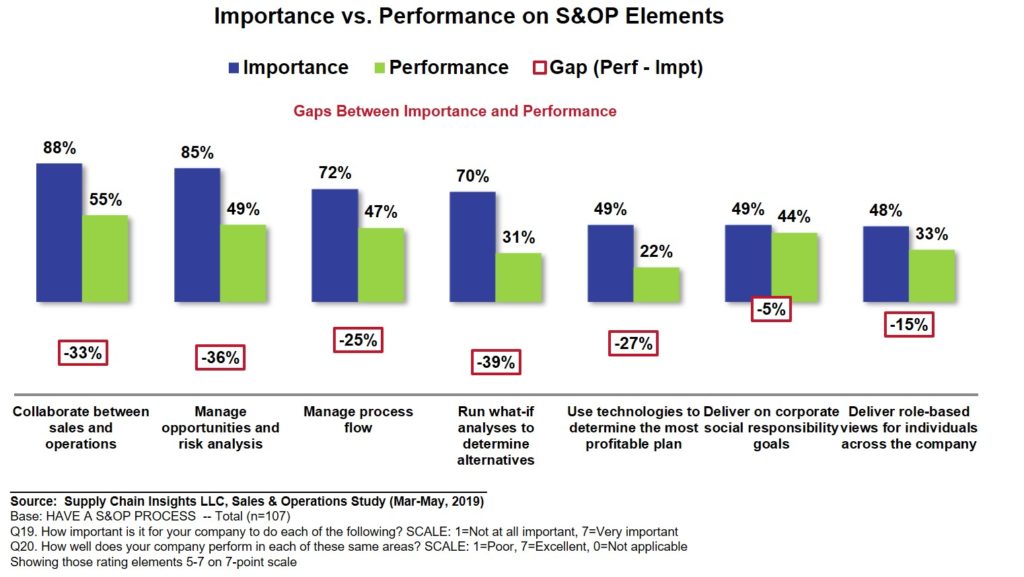

Fads. In the supply chain, there are many fads that drive the Lemming cycle. One alive and well today is the concept of the connected Supply Chain. A large beverage company implemented Anaplan. The data from sales and finance was tightly connected, but they could not understand the implications of mix variation, or model a feasible plan. Anaplan is a great collaboration technology, but a poor modeling solution. Connecting data is easy. Effective modeling–simulation and development of playbooks– is more difficult. One of the largest process gaps of S&OP processes is “what-if modeling.” To understand the gaps for the respondents check out the gaps in Figure 3.

Figure  3. Process Gaps

3. Process Gaps

Conclusion

This research is independent: funded and developed by Supply Chain Insights based on a panel group of 308,000 LinkedIn followers. (If you helped with the study, let me start with a heartfelt THANKS!) All of this research is shared based on the principles of open content. We want you to share the research freely with colleagues, market presentations and board discussions. We believe that research should not be locked behind a firewall. All we ask for is for attribution. Our hope is to help companies drive supply chain performance through independent research in a market full of noise, hype and hyperbole.

I hope that at the end of this article you can agree that most companies are moving backwards in S&OP process effectiveness due to the lack of leadership, clarity of supply chain strategy, definition of governance, and the lack of modeling capabilities. As companies act like lemmings– believing that large technology projects drive supply chain excellence–we will perpetuate this trend. Instead, small projects implemented by knowledgeable supply chain leaders drives competitive advantage. The answer? S&OP is 60% change management, 30% process and 10% technology. Don’t blindly follow the crowd. Avoid large projects from big system integrators. Focus. Align and be aggressive in driving process excellence to build sustaining value. It matters in shifting the back office from a cost to a value focus. An effective S&OP process is one of the few supply chain processes that correlate to value (price to tangible book).

Let me know what you think. I welcome your feedback.

Struggling to Stay Current?

Technology change is moving faster than process innovation. Many companies struggle to keep pace. If this is you, I welcome you to join our upcoming events. Our goal is simple: to build a guiding coalition to drive value in supply chain processes.

We release our annual research on the 2019 Supply Chains to Admire analysis on June 20 th at 1:00 PM. In this research, we analyze over 600 public companies. The focus is to understand which companies are able to drive better performance, while accelerating improvement, than peer group on a balanced scorecard of growth, operating margin, inventory turns and Return on Investment Capital (ROIC). Register for the webinar using this link. (We do monthly complimentary webinars and record them and share them on Linkedin.)

th at 1:00 PM. In this research, we analyze over 600 public companies. The focus is to understand which companies are able to drive better performance, while accelerating improvement, than peer group on a balanced scorecard of growth, operating margin, inventory turns and Return on Investment Capital (ROIC). Register for the webinar using this link. (We do monthly complimentary webinars and record them and share them on Linkedin.)

Imagine Supply Chain 2030. Supply Chain Insights Global Summit, September 3rd-6th, 2019, to be held at UI Labs, Chicago, IL. The focus is on Imagining Supply Chain 2030. What is different? The format is unique. The event has no sponsorships, paid speaking sessions or lofty analyst discussions. Designed for extreme networking, I dub this event the unconference. At the event, technologists and business leaders work shoulder-to-shoulder to Imagine Supply Chain 2030. To ensure balance of business and technology leaders, I closed the conference this week to technologists/consultants to ensure the right balance of business and technology leaders. This week, I have added speakers from Dell, Dow, Intel, and Simple Tire. I hope to see you there.

Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

To register for these events, please contact Regina.denman@supplychaininsights.com.