Sales and Operations Planning (S&OP) is a business process. When the design is a supply chain-centric design, problems arise. I have tracked maturity levels in S&OP for the past two decades and note that most companies are stuck unable to drive progress. I would like to help. This is the goal of this post.

S&OP Challenges

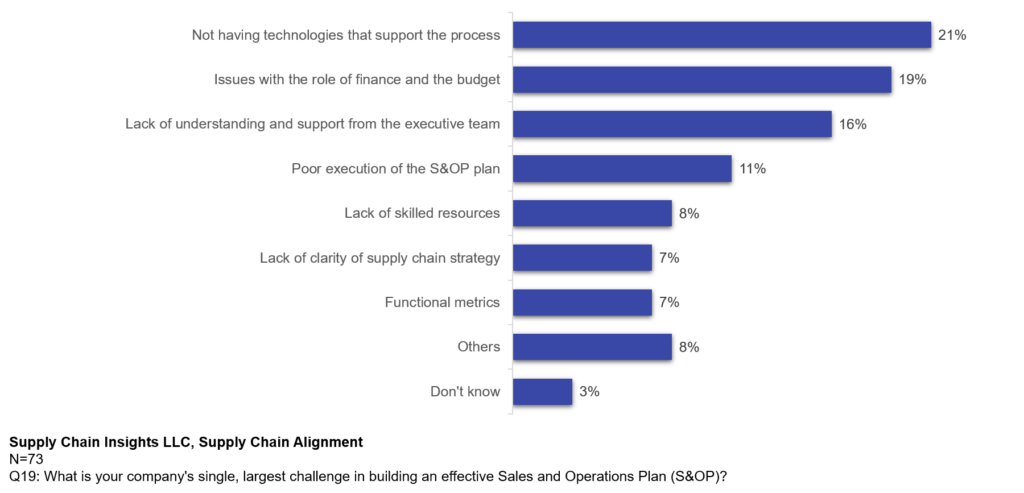

In a recent research study of business executives, the top three challenges were: not having technologies that support the S&OP process, issues with the role of finance and the budget, and the lack of understanding by the executive team. Sound familiar? They should. These issues form the backdrop of S&OP dysfunction, and they are the same issues in the research over the past two decades. We are not making progress. This is the same list I discussed in my research in 2006.

Figure 1. Largest Challenges with S&OP

In this post, my focus will be on the technology selection. I will give advice on the other topics in later posts.

Choosing Software for S&OP

Selecting supply chain planning software is tough. There is no clear roadmap. Each planning solution is different. As a result, an analysis like the Gartner Magic Quadrant, becomes an exercise to discuss the types of beans in minestrone soup. The issue? It just does not help. The solutions are just too different to be explained in a limited four box quadrant, and the buyer should approach the market with a clear goal in mind which I do not see in most RFPS.

I have tried several approaches to help the market. Even though I have tried, I faced obstacles. I do believe that the advice should be more available than through the analyst community.

- Democratize. My first attempt was to democratize and socialize performance using a community-based rating and review format. I was excited at the time. Everyone would want to share, right? Wrong. The sad reality is business leaders are uncomfortable openly sharing feedback on their planning solutions. The other reality is that within an organization there are multiple points of view. The IT group and business leaders usually have divergent points of view (POV). The third issue is legal language in software performance contracts. So, I scrapped the idea in 2014. My POV, rating and review approaches will not help.

- Industry Analysis. My next step was to write a report, an overview of the market. I named this format, Putting Together the Pieces. The framework attempted to recognize the cultural considerations of organizations, outline a process for selection, and highlight technology differences. I wrote this report three times over the last decade. My take? It did little to help. I also believe that in today’s market that it would help less. The reason? You see what you understand, and the general understanding of supply chain planning by business leaders is the lowest I have seen in two decades as an analyst. The reason? I am not sure, but I believe that the turnover in the industry coupled with technology marketing hype, and the lack of thought leadership at industry consortia adds to the confusion. The answer is to invest in training. What is the role of planning in driving/improving supply chain results? What is a feasible plan? Focus on answering these questions.

- Quantitative Survey Analysis on User Satisfaction. My recent attempt was to share a comparison of user satisfaction between technology leaders based on a survey gathered from LinkedIn survey data from my 320,000 followers. The survey was taken from the field in 2023. It is recent with over 100 respondents. Bottomline, the satisfaction levels with planning technologies are low, with growing gaps between ERP Expansionists (Infor, Oracle and SAP) and best of breed companies (examples are Kinaxis, o9, and OMP), and the lowest for market consolidators (examples are BlueYonder and E2open). New players have a low response rate, but the data is promising (examples are Board and Garvis). I will continue this work. (Currently, I can only group the data for statistical significance between these three groups. I do have a sample of 70 respondents for the market leader SAP.) However, I question if this helps, because the writing is mis-used by sales groups. Instead of using the data for the technology company to ask how to use the insights to improve their solutions, the writing is propelled into a sales teams’ pitch deck to bash another solution. This is not my goal. View any research used out of context with skepticism.

So What To Do?

Get clear on your requirements. Don’t waste your time with the Gartner Magic Quadrant. Triangulate the market. Don’t assume that the references that the technology vendors give you are going to be helpful. Most of these references are groomed to be positive. Try to gather information from conferences, forums, and LinkedIn.

Do a Google search on the press release announcements by technology companies and try to network with these companies on LinkedIn. I recently had a discussion with a company that failed with four different planning technologies. I find LinkedIn to be a great source to get data.

Use your network to gather information. Informal networking is invaluable. Let me explain the process.

For example, this is recent feedback from a knowledgeable consultant on the SAP work on IBP:

- SAP is in a product transition, from APO to a combination of IBP, S/4HANA aATP, and various Analytics applications. There is no clear roadmap.

- SAP Sales and Sales Support do not clearly understand where specific functionality is covered (if it’s covered) ex. For example, where do you set the plant / product availability substitution rules?

- The IBP, S/4HANA aATP, and Analytics applications require significant integration… For example, integration from IBP to S/4HANA, Distribution to S/4HANA aATP, IBP to Analytics applications, and Analytics applications to S/4HANA requiring a myriad of iFlows, and CPI / CPI-DS interfaces. This needs a tremendous amount of work from SAP.

- The IBP, S/4HANA aATP are still maturing. The rules engine in the aATP requires a custom application to calculate and select the lowest landed cost to serve for a Customer Sales Order.

- The IBP requires its own master data over and above the S/4HANA transaction system.

After getting this type of feedback, consolidate it, and ask the technology vendor to explain their point of view. Try to get as much detail as possible. In this process push, past the technology vendor sales teams to get answers from the technology provider’s product marketing, and solution architects. I hope this helps.

Don’t waste your time talking about the nature of beans in Minestrone soup pot…

(A note about the research. When I tender a study, I know, but do not share the names or attribute company information for respondents. This is different than most research studies where the data is tendered to a panel and the names of the respondents are not known. This was the case when I worked for Gartner and AMR Research.)