This week, I feel like a bobble-head.

My head is wobbling with announcements, late-night Friday press releases, company name changes, and executive turnover in the supply chain planning market. Is it musical chairs? Or a Merry-Go-Round? I am not sure, but it does not feel good. Here, I give my take.

- Noodle.AI Renames the Company Daybreak. No doubt that the company, Noodle.ai, needed a fresh start after burning through $107M in capital of five rounds of financing. The latest round was $10M on January 11, 2024. Founded by Infosys executives, the company blew through a lot of cash with very little market penetration. Let’s hope that these new executives see the light of a new day.

- Aptean. Last Friday night, Aptean announced a definitive agreement to acquire Logility at $14.30 per share in an all-cash transaction. Logility, a conservative supply chain planning technology company, historically had no debt and cash reserves of more than 80M, is undervalued in this deal. What happens next? A few executives at Logility will do well in the transaction, but make no mistake, this is a market consolidation play. Aptean is orchestrating the Blue Yonder/E2open/Infor playbook of buying undervalued assets and milking the maintenance and Software-as-a-Service contracts with existing customers. Is it any wonder that this press release published late on Friday afternoon?

- OMP: A lot of new chiefs. OMP’s press release this week announced nine new chiefs. When I read it, I scratched my head. I thought, “A lot of chiefs, where are the Indians?” I am waiting for the announcements from the company to rectify the issues with usability and scalability. OMP, like o9 and Kinaxis, benefited from the SAP’s APO migration failure. The company is busy, but not focused on forward-looking initiatives.

- Kinaxis and o9. The leadership teams at both companies are changing. The game of musical chairs is active as supply chain talent shifts between SAP/Blue Yonder/Kinaxis and o9. Take a wait and see approach. It will take a while for the market to calm down.

- New Platforms. Following the acquisition by Thoma Bravo for 10.7B, Anaplan recently outlined $500M multi-year product investment designed to advance category leadership in scenario planning and analysis. In contrast, Blue Yonder is investing $1 billion over three years in the platform for their solutions. Both companies are working on platform upgrades. Will this help drive better value for clients? The jury is out. In short, there is no substitute for visionary leadership. I struggle to find this in either company.

- Manhattan Associates. Shares of Manhattan Associates fell 25.6% following the reporting of fourth-quarter results. The company gave revenue guidance of significant slowdown in demand with full-year revenue guidance short of Wall Street’s estimates. The shares closed the day down 24.5% from previous close. My take? This is a market blip. Manhattan will rise above this short-term impact.

- New Players. Ketteq, launched on the Salesforce.com platform in 2023, promises adaptive supply chain management. Will this change the market? I don’t think so. (The Salesforce.com model is primarily a pipeline management tool suitable for discrete markets but not process manufacturers. The widely-held belief that CRM improves demand management is a misnomer.) In short, new players will change the future market, but I do not think this is the answer.

My Take

As up watch the market, and flurry of press releases. Here are my predictions:

- Daybreak. The Company’s challenge is building market relevance. I know of no successful software company built by consultants. (The models are just too different.) The building of a relevant solution in this changing market will be challenge.

- Logility. Over the next five years, Logility will become less relevant. Customers will migrate off of the Logility platform onto newer flow-based outside-in models. Logility customers should prepare to be self-sufficient while evaluating mid-market solutions like John Galt, Netstock, and Slimstock. OMP remains the strongest solution for production planning.

- Other Players. Legacy players like Adexa, Arkeiva, Gains, E2open, Orchestr8 Solution, and ToolsGroup will be bought and sold with little impact to the market. Relex will continue to do well in the retail market but will struggle to be a serious player in manufacturing due to the lack of thought leadership. This is despite the strengths of the recent purchase of Optimity. (Optimity was a strong technology that emerged in the Australian market for small process-based manufacturers.)

- OMP. The Company will continue to do well in the production scheduling market in process-based companies. The OMP industry-principles will continue to lead the vision for strong industry domain expertise for small, regional players. However, the company lacks the understanding of market requirements for outside-in models and the requirements on how to scale for a more robust platform for the global multi-national. Unless changes occur, the Company will miss the market for the inflection point for building holistic modeling of ship through (the channel) modeling.

- Kinaxis and o9. I predict that these two companies will battle for market share with no clear winner. In many ways the solutions are complimentary. O9’s solution based on graph technology is stronger in the area of demand while the Kinaxis work on Maestro’s in-memory model offers significant advantages in the management of supply. When the dust settles from employee turnover and downsizing, both companies will emerge stronger.

- Manhattan. The strength of the management team and the Manhattan solution will survive this market downturn. The evolution of the e-commerce market and the required transformation of warehouse management to support the shipment of the “each” fueled Manhattan’s rise as a global player. With the maturation of this market, Manhattan will need to rationalize their solutions. I expect the company to move more aggressively into the transportation planning market. I do not see them emerging as a strong player in supply chain planning.

- Blue Yonder and Anaplan. The evolution of the platforming efforts and the rebuilding of market share will be driven by vision. At the current time, I do not see the visionary leadership team to make either of these planning initiatives a success. As a result, proceed with caution.

- SAP. The winner in the next three years with the implementation of RISE will be SAP HANA IBP as a system of record. (Most companies have 7-9 systems of insights and need to ensure a robust system of record to align the organization around a better plan.) SAP will not be successful in delivering the systems of insights. However, the global multinational needs both a system of record and multiple systems of insights.

Summary

You are witnessing the end of the lifecycle of the traditional supply chain planning. The building of inside-out models based on orders and shipments using optimization based on relational database technologies is waning. The evolution of new approaches to use market data and embrace unstructured and streaming data is exciting. The pace of change is limited by talent.

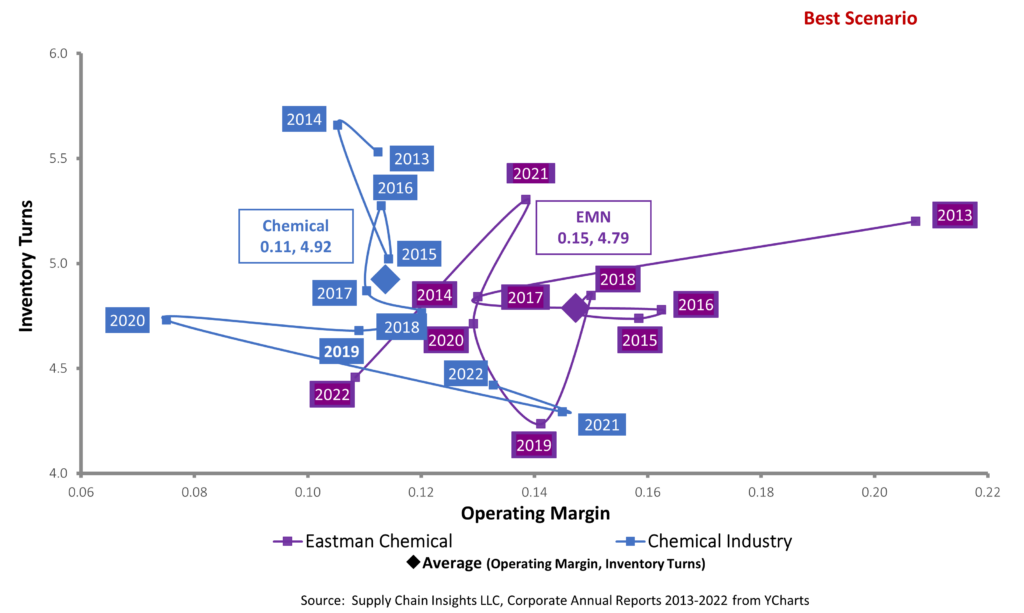

The focus needs to be on outcomes. To make the point, let’s take a look at Eastman Chemical in Figure 1. I first experienced the implementation of OMP and SAP at Eastman Chemical in 2004. Company revenues were $9.2B in 2023. The average size of a chemical company is $13B.

Implementing supply chain planning at a smaller company is easier than at a larger company. I find Eastman to be interesting because the company has fewer systems than their peer group, supply chain leadership is higher than the industries, and it is one of the longest implementations of OMP with extensive work by Deloitte on architypes in S&OP. Note the lack of resilience of Eastman through the pandemic and the negative shift in operating margin and inventory turns since 2018. For me this is a good example of why traditional supply chain planning techniques are not sufficient in a volatile world.

Figure 1. Orbit Chart: Eastman Chemical Versus the Market for the Period of 2013-2022

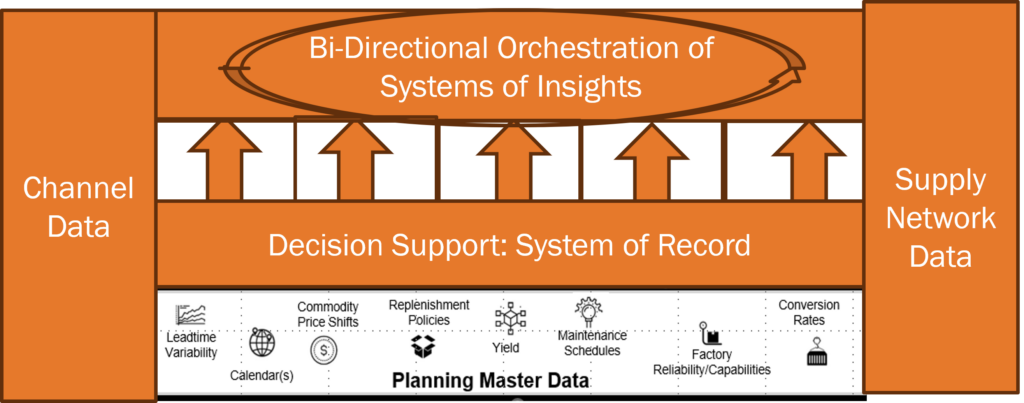

To overcome turbulence, if you are a global manufacturer larger than 5B in annual revenue, consider building a solution as shown in Figure 2. Build a digital twin for planners to analyze what-if scenarios and encourage the use a digital twin in tactical and strategic planning. Accept the fact that you will have multiple planning systems of insights that will need an orchestration layer to move data from demand and supply bi-directionally. You will not have one throat to choke. Companies will need to work with multiple providers. It will not be that simple.

Figure 1. Planning Architecture Evolution

Augment supply chain planning solutions by building a supply chain planning master data layer to ensure the use of the latest data for lead times, conversion rates, commodity price shifts, and quality data in systems of insights and systems of record. Use machine learning and pattern recognition software to mine the patterns in the planning master data layer to understand variability.

While we speak of AI, and the pending revolution of AI influenced technologies don’t expect quick innovation. The market will move slowly. Don’t fall for vendor speak of autonomous supply chains, touchless planning, or AI-based planning. Don’t fall in love with shiny objects. Instead, focus on outcomes. What I find to help the downward slide that you see in the Eastman Chemical orbit chart is a focus on outside-in sensing with translation and bi-directional orchestration across the enterprise.

This is my take. I welcome your thoughts. How did you process all of the market moves this week? Is your head swimming as well?