When you get asked the same question over and over again it is time to take out the pen and write a blog post. Here it goes…

Last week, when I was sharing the recent results of the Supply Chain Insights Sales and Operations Planning study with survey respondents and attendees to our public training, one question kept coming up. It was “How do the change management issues differ by level of S&OP maturity?” Here I answer this question.

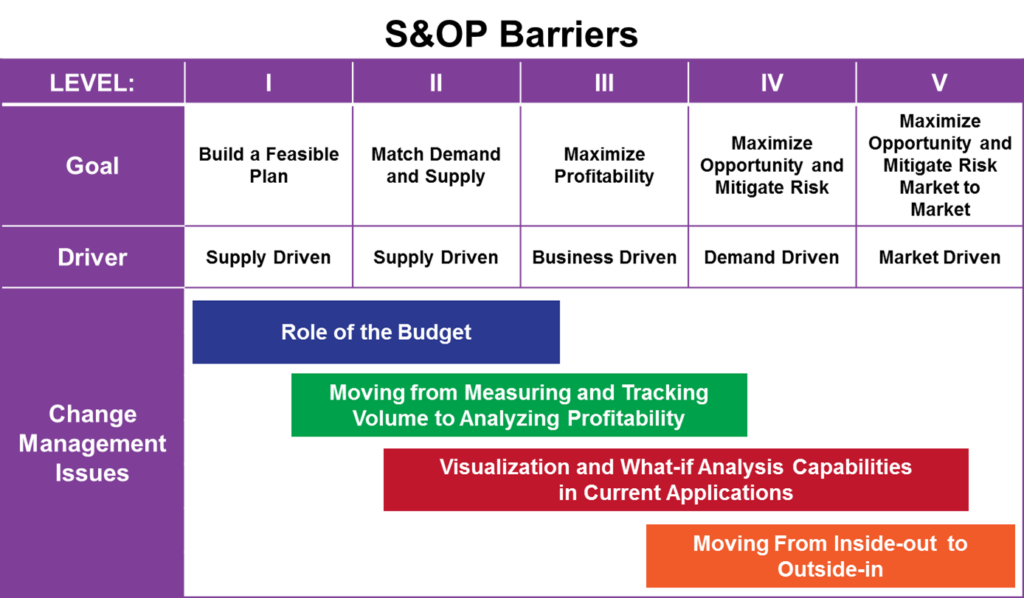

Figure 1.

There are usually four distinct change management stages as shown in figure 1. When companies are early in their infancy in managing an S&OP process, the biggest barrier is typically the role of finance and the integration of the S&OP process to the financial budget. For many organizations, this is a tough obstacle. I have seen financial guys kicked off of the S&OP team. It takes time and education for companies to align. The budget is developed as a planning tool at the first of the fiscal year. It is a guide, but should never be used to constrain the S&OP plan. Instead, the goal becomes maximizing opportunity while mitigating risk. In this process, budget assumptions are aligned to market actuals.

The second barrier is moving from a focus on matching demand and supply (managing volume) to maximizing profitability. The change management issue is that the technologies do not do this well. And, calculating profitability in today’s complicated business environments is not so easy. Only 23% of companies feel that they have systems and processes that enable the translation of volume to profitability analysis. At this stage of the process, which is often called Integrated Business Planning (IBP), companies will usually build something on their own to augment the traditional functionality of Advanced Planning Systems (APS).

As they get more fluent in profitability analysis there will be a thirst for visualization and “what-if ” analysis. Only 11% of companies self-assess as having the ability to complete “what-if” analysis well. Most systems are just too inflexible.

Probably the greatest challenge of all lies in the transformation from inside-out to outside-in to become market driven. This usually requires the reimplementation of technologies and processes and the building of demand and supply networks to connect with market data. I find this stage the most exciting and enjoy helping companies to rethink their processes through the training.

Let me know your thoughts. Did I miss anything?

Failure: a Building Block for Success

As I enter my fifteenth year of trying to help supply chain leaders improve value through supply chain planning software, I answer a challenge by a reader on what is the value of an industry analyst. My reply centers on how I think we can help, and that it takes a village and I hope that he will help as well.