Today is a writing day. My last post was December 7th, 2023. December was my most extended writing respite since I started this blog in January 2010. Posting the first blog seems like yesterday, but thirteen years and over 540 blogs later, pausing a weekly deadline was severely needed. I give thanks to all my readers, but I relished the break.

The time gave me a good time to reflect and finish the reports that I should have completed in the summer when I recovered from Uterine Cancer. January 2023 started my journey fighting the healthcare system to understand my symptoms, which led to surgery in June. The old saying, “You don’t have anything if you don’t have your health,” rings so true. Today, I wish good health to each of you. May your 2024 be better than my 2023.

Writing and Reflection

Completing the edits on the two reports that will be published soon felt good. The reports took me two months to write. As I wrote, I reflected on the Generative AI hype cycle in the supply chain market and the contribution to noise. In this time of uncertainty, I questioned if supply chain leaders will value data-driven content. My question is, “Will the work make a difference?”

As I write, I think about the ironies:

- We talk about the bullwhip, but we do not measure it or use it in driving optimization. The tight integration of ERP to Advanced Planning amplifies the bullwhip. Does anyone care?

- We talk about the move from functional metrics to a balanced scorecard, but we don’t use a balanced scorecard as an objective function.

- There is a lot of talk on product complexity, but do not measure the impact on forecastability or inventory.

- We speak of data latency but do not measure the impact on performance.

Unfortunately, these items are just talk.

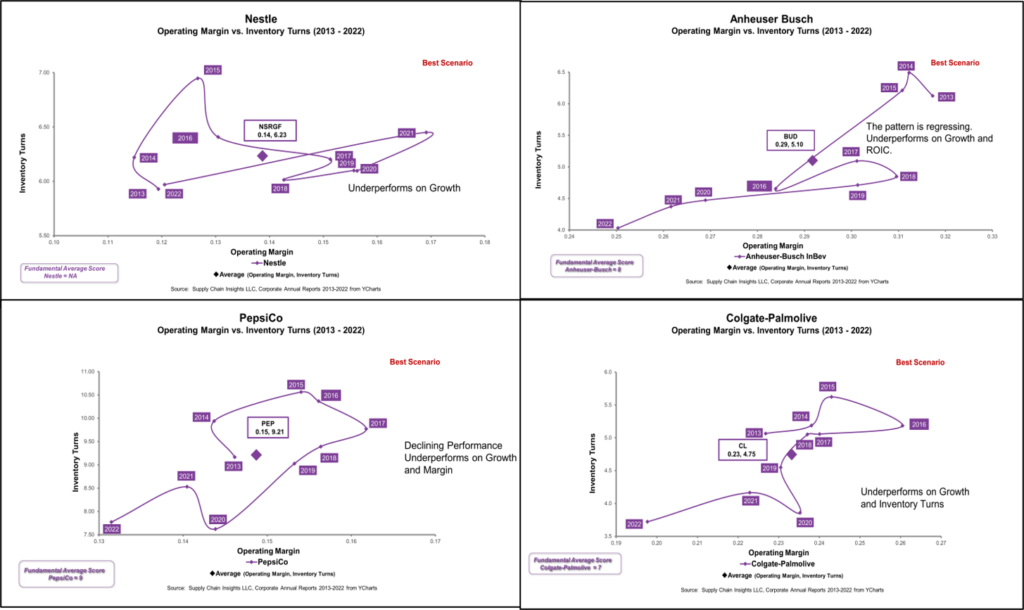

In companies, there are many discussions focused on driving improvement through planning, yet, when I take the client case studies on the websites of leading planning technologies and map the intersection of operating margin and inventory turns, I do not see metric improvement, sustained performance, or an increase in value. For example, let’s take a look at the patterns of Anheuser Busch, Colgate-Palmolive, Mondelez, and Nestle shown in Figure 1. All four of these companies were selected as winners of the Gartner Top 25 award and are mature in planning implementations. Yet all four underperform on growth, and no company is driving improvement at the intersection of operating margin and inventory turns. Collectively, these companies are not resilient. This is despite investment in people and technology. They underperform in their peer groups against companies weaker in planning. As I write, I scratch my head. I ask, “What happened?”

Figure 1. Orbit charts of four companies for the period of 2013-2022 at the intersection of operating margin and inventory turns.

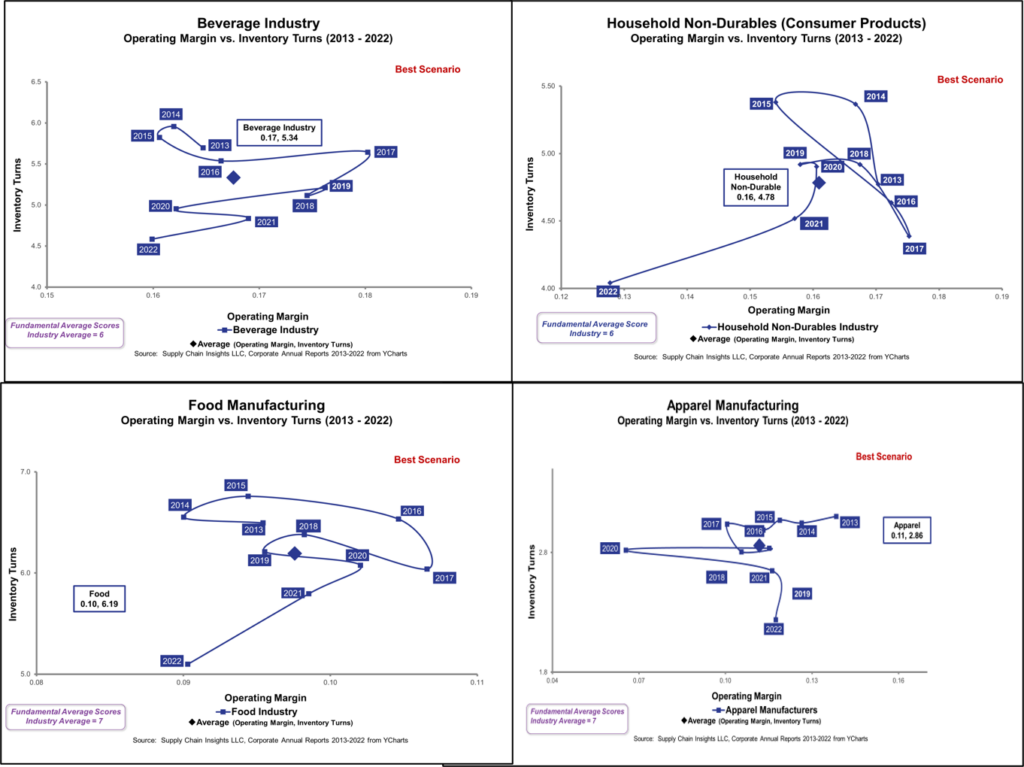

Conventional wisdom focuses on using enterprise data to make the supply chain more efficient. However, lowering the costs in operations does not translate to margin, and with the market volatility as shown in the industry patterns below, can we afford to rely only on enterprise data? And are we solving the right problem or simply making bad decisions faster?

I recently completed qualitative interviews with twenty companies. No one could answer the question of, “What makes a good plan?”

Figure 2. Orbit charts of four industries for the period of 2013-2022 at the intersection of operating margin and inventory turns.

The Tension Between Noise and Content

In my work as an industry analyst, the role of content has changed. True content takes time and resources. Generative AI will make this worse. There is a constant battle between noise and data-driven content. Today, several factors make it hard to wrestle truth from opinion:

- Event Models with a Focus on Sponsorship. Most events are designed to help technologists generate leads. Speaker content is not vetted against a standard. Even reputable publications like the Economist and Reuters have entered the event market. In the event model, companies present case studies and opinions without a factual framework. No one questions if the case study improved the company’s competitiveness in the market. It is just accepted.

- Unvetted Podcasts. The rise of podcasts interviewing speakers with unvetted content adds to the noise. This is another channel to build leads for technologists.

- Aggressive Sales Teams. Many sales teams promise high returns, but there is no sensing in technologies to drive performance.

- Lack of Clarity on Supply Chain Excellence. Few companies are clear on the definition of supply chain excellence and what makes a good plan. We are perpetuating belief statements that I think are no longer applicable. Yet, there is no place for technologists and business leaders to test and learn.

What Defines Supply Chain Excellence

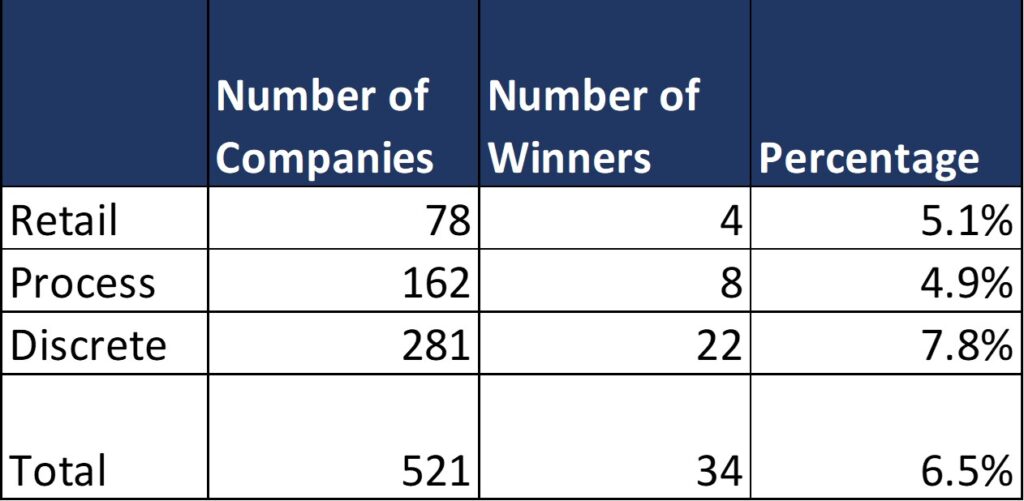

In my writing, I try to be fact-based. In the Supply Chains to Admire report publishing next week, we see 34 companies beating their peer groups for the period of 2013-2022. The winning companies are not driving aggressive digital transformation. Instead, the focus is on customer-focused innovation and leadership.

Table 3. Supply Chains to Admire Winners

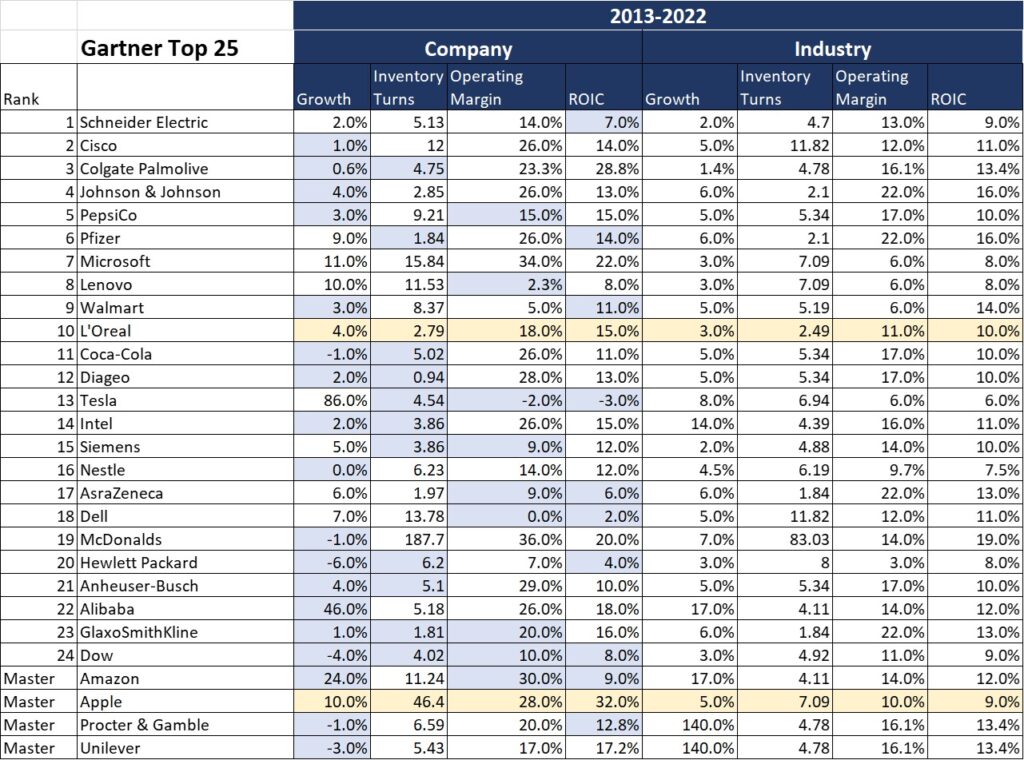

Some might ask about the Gartner Top 25 and how this compares to the Supply Chains to Admire? Our analysis shows that 67% of the Gartner Top 25 companies underperform their peer group on growth, 44% on operating margin, and 41% on inventory turns. The blue in Table 4 highlights underperformance, while the yellow highlights mark the companies meeting the criteria for both analyses. In the 2023 analysis, Apple and L’Oreal are the only companies that meet the requirements for these two very different techniques to assess supply chain excellence.

Table 4. Gartner Comparison to the Industry Peer Group

For more on the methodology, check out the PowerPoint summary online. As always, I value your feedback. Please let me know what you think of the current content.