May was a conference month. Social media awash with pictures of supply chain professionals attending the Lady Gaga event at SAP’s Sapphire, celebrating with drinks at the Gartner event, or rocking to the ZZ Top performance at JDA’s Icon conference trumpeted excitement. The news from these events? Sadly, the news is no new news.

Meanwhile, in my travels, supply chain discussions are moving to main street. CNN political pundit panels debate supply chain while the impacts proliferate in our personal lives. Supply chain is making headline news as companies struggle to redefine supply chain flows with the increased friction for border crossings. Here are some examples:

- Disruption. Disruption of the flows of goods is daily occurrence. My local Pennsylvania town’s recycling organization no longer accepts cardboard or glass. The market is down due to the issues with Chinese tariffs. Basic economics rule: declining demand and increase in cost due to tariff costs. The Asian markets–traditionally hot for recycling waste–is no longer interested. I shudder as I place recyclables by the curb for landfill.

- Shortening Supply Chains. Shifts in tariffs push us to regional supply chains, which are more in line with corporate social responsibility goals. Imagine the thought of Donald Trump(@realdonaldtrump) and Alexandria Ocasio-Cortez (@AOC) driving the same outcome? I watch in amusement. Meanwhile, turbulence is the norm for manufacturing supply chains. My advice? Invest in network design, what-if analysis and build flexibility into your supply chain.

- Be Careful on Customer Service Automation. Customer service automation is an ongoing opportunity. As companies attempt to eliminate labor, voice automation and bots are technologies du jour. Perhaps success will come later; it is clearly an early stage deployment. The customer experience is rough. I suggest that all supply chain leaders call their support lines and accept responsibility for customer service. For example, Friday, I spent an hour on the phone with Bonvoy (the new Marriott branding) to get disconnected three times. Today, as I tried to get service from a local network provider, the response was, “Sorry. I would love to help you out, but I am a new bot and still learning. I have trouble understanding long questions. Try something like, “What’s my bill?” You can also use one of the options here.” New bots are a waste of everyone’s time, and the voice automated Bonvoy service ineffective a holiday weekend.

- Looming Recession. Two speakers for the Supply Chain Insights Global Summit canceled today due to Q2 travel freezes. In parallel, three more raised their hands to speak on robotic automation in their warehouses focused on the redefinition of channel fulfillment. The chemical industry is the first to feel a recession, and the early travel freezes is a definite caution flag. My forecast? When the recession of 2019-2020 happens, the whiplash will be higher than the 2007 recession. Why? Our supply chains are weaker at planning. Meanwhile, warehouse robotics is staging a market shift.

- Value Network Work Is Stalled. As I sign into the front desk-after-front desk at manufacturers, and open the signature book, I notice a large number of system integrators diligently working on the implementation of traditional enterprise technologies. While visionaries talk John Hagel (@jlhagel) about value networks and ecosystems, today’s organizational focus is squarely on enterprise efficiency. Companies are just too busy implementing yesterday’s technologies to forge new directions to take advantage of emerging technologies. While there are a few stalwarts helping in the redefinition of B2B in the Network of Networks Group—BASF, Corning, Dow, Evonik, P&G, Schneider Electric and HMD Global—most are sitting back and waiting. As I look at the number of companies connected through B2B connectivity—EDI, Supply Chain Operating Networks, and Blockchain—it is shockingly small. Today’s reality is unequal to the rhetoric of the visionaries. What needs to happen? Innovators need to define business cases. The overhyping of blockchain without clear business cases is an impediment to progress.

In my heart, I am a supply chain planning gal. I like change. Unsure how I got here, I am passionate about helping supply chain leaders drive value. Bottom line, we have stalled innovation in the supply chain planning market. I wish this was not the case, but it is. Despite rapid advancements of technologies—machine learning, cognitive computing, relational search, sentiment mining, blockchain, Internet of Things—the consultants working at large companies are largely putting new wrappers on old pigs. Pigs in the blanket of sorts….

While in social media, the discussions are on the technologies not what to do with the technologies. Technology for the sake of technology gets nowhere. The focus shift to solving problems and driving innovation needs to happen. At the end of the day, customers buy based on value not on the cool factor of the technology.

What to Do? The First Step Is To Improve Tactical Supply Chain Planning.

When a client states they are working on “End-to-end supply chain planning.”

I ask, “What does this mean for you?”

When prompted, most will look at me in a dazed state as if to say, “Isn’t it clear?”

They are surprised when I answer, “No. The term has many different meanings.”

My advice? Push for clarity.

The term end-to-end planning (E2E) is frequently used—bandied about like popcorn at a movie theatre–but, lacks a common definition. For the CFO, end-to-end is a focus on transactional flows like order-to-cash and procure-to-pay. Most are clueless about driving a better-planned order flow from tactical planning to procurement or transportation planning or how to improve forecast-value-added (FVA) processes. When they turn to large consulting firms like Accenture, A.T. Kearney, Boston Consulting Group, Cap Gemini, Deloitte, E&Y, IBM, and McKinsey, they get more of the same. The reason? Too few consultants today understand supply chain planning. Most are pushing billable hours and the sale of large systems.

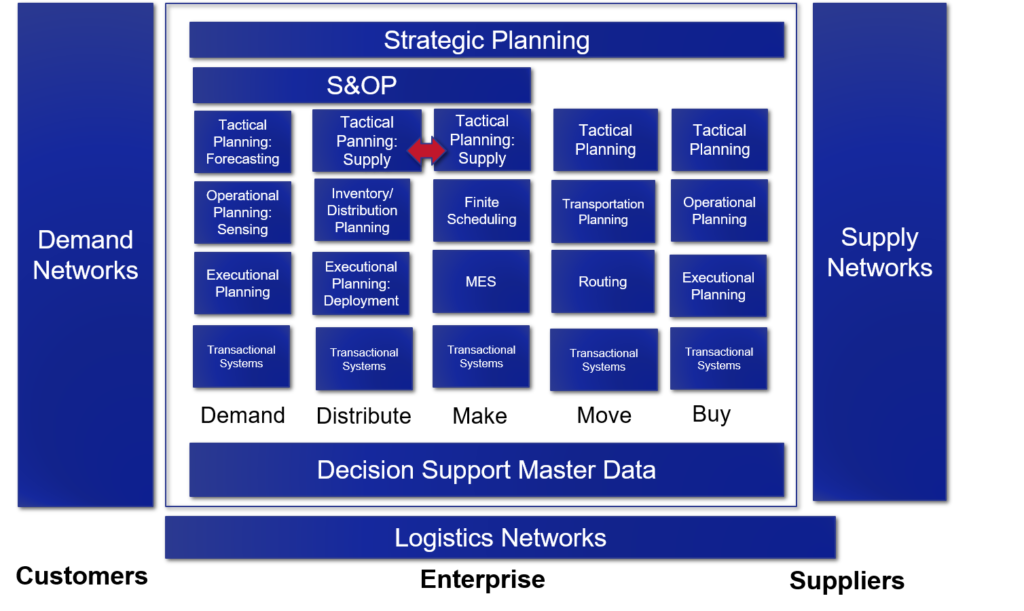

The reality? E2E planning, in today’s market, is a misnomer. Technologies not end-to-end. Instead, planning is a series of optimization engines focused on improving pockets of information within organizational silos. For example, demand planning does not flow to procurement or transportation. There is no logical connection between inventory strategy and logistics optimization or the multiplicity of rules—allocation, ATP, inventory matching, routing—and planning engines.

The focus is enterprise efficiency within an organizational silo. The consumption logic—data movement from silo-to-silo– is downward, not bi-directional, from tactical to executional planning. Trade-offs between source, make, and deliver are possible in the strategic horizon of planning, but not in shorter time durations. Today’s planning solutions are largely the same architectures sold in the 1990s. (This definition evolved from capabilities at the time for in-memory and batch processing. The current designs are distribution-centric. A few solutions optimize distribution and tactical manufacturing supply together through in-memory modeling. Examples include JDA, Kinaxis, and SAP APO.)

Figure 1. Current State of Supply Chain Planning

There is a lack of focus on planning master data, and the evolution of supply and logistics networks are nascent.

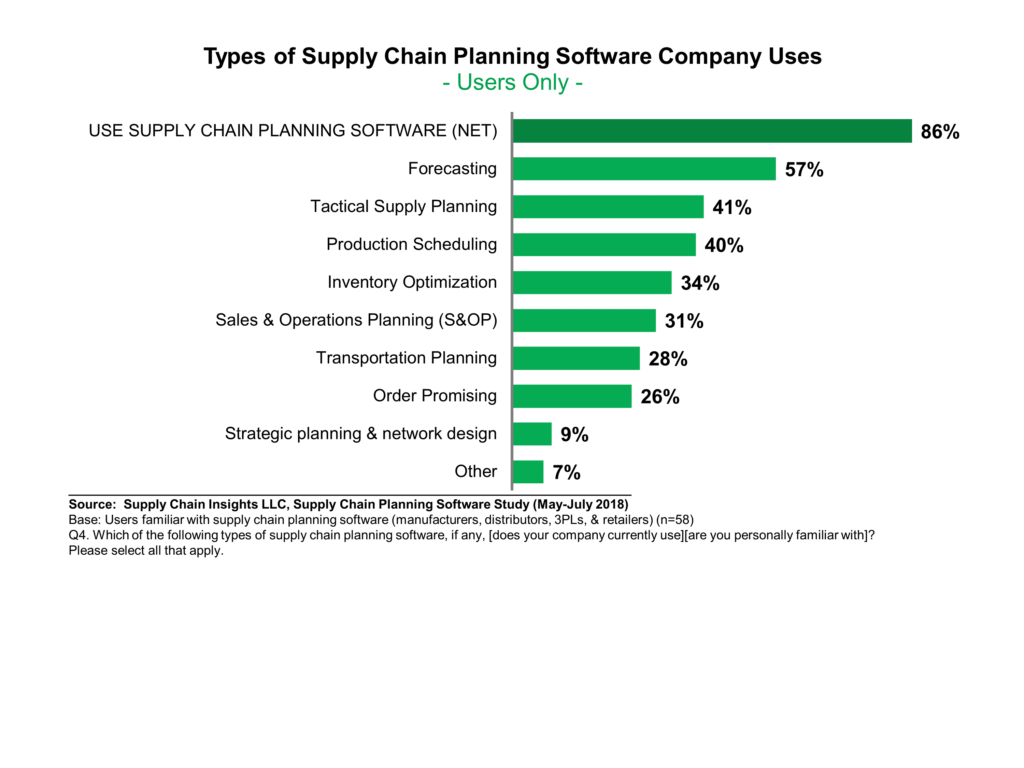

The most commonly deployed supply chain planning module is forecasting. The supply-centric modules, which are very industry-specific, are deployed less frequently. There are fewer specialists in the deployment of supply planning than demand. I find the most effective deployments of supply planning to be specialist boutique consultants like Eyeon, MEB, Spinnaker, Solventure, and Optilon.

Figure 2. Current Deployments are Silo’d

Second Step: Understand the Role of Inventory.

Second Step: Understand the Role of Inventory.

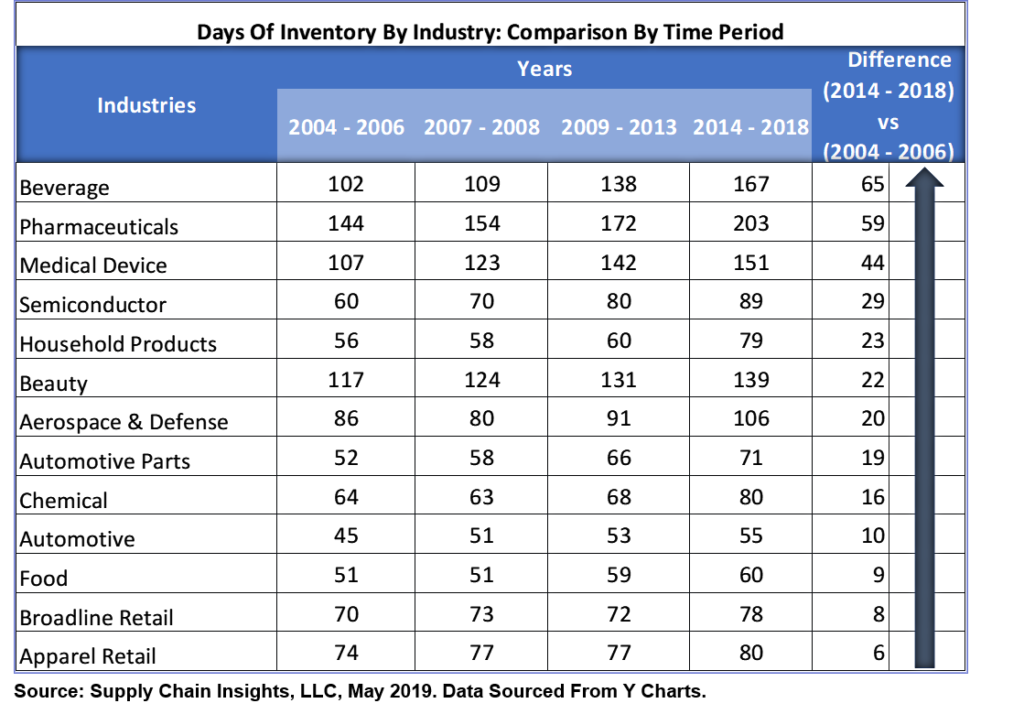

Companies are unsure if inventory is a bad or a good thing. The answer? Inventory is the most important buffer in times of volatility: however, with the current levels of understanding of inventory strategies, most are holding the wrong inventory. Isn’t the rise in inventories, as shown in Figure 3, post-recession shocking?

Figure 3. Current Levels of Inventory

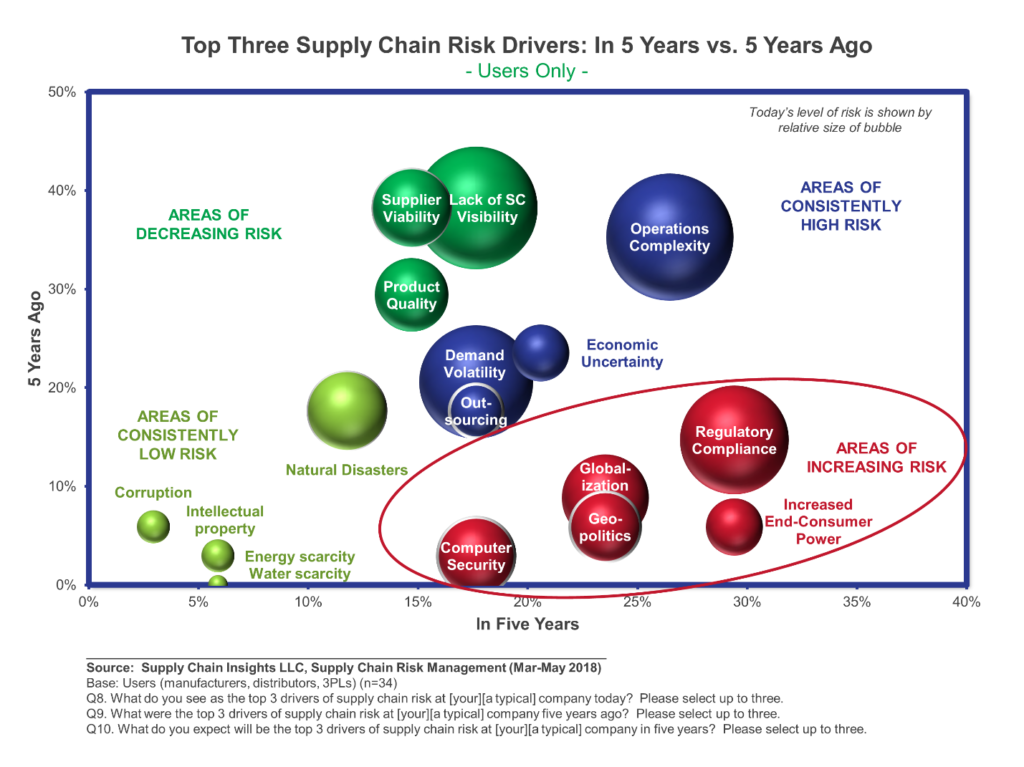

As a result, as shown in Figure 4, operations complexity is rising as a risk for the organization.

Figure 4. Operational Risk Drivers

Third Strategy. Invest In Factory Scheduling. Focus On Schedule Adherence

Third Strategy. Invest In Factory Scheduling. Focus On Schedule Adherence

Invest in what you can control. My recommendation? Deploy finite scheduling to improve manufacturing schedule adherence and customer service levels. Getting good at cycle stock management is vital to break the backsliding in inventory control.

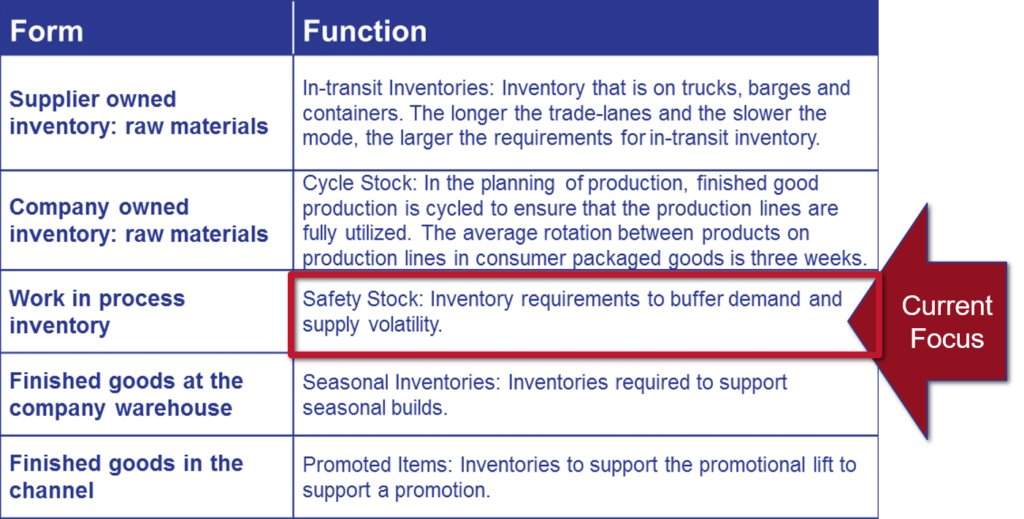

What is cycle stock? The focus on cycle stock management reduces the amount of inventory necessary to cycle through all products in a portfolio in a constrained manufacturing environment. Most organizations only focus on safety stock management. Shift to be more holistic.

Table 1. Form and Function of Inventory

Ten years ago, I worked with a company that drove dramatic results in forecasting, but was not able to see the impact in cost or inventory. So, I started probing to understand WHY? The answer? The Chief Operating Officer’s incentive was to take the factory scheduler that was the most responsive to customer service–changing over lines and jumping through hoops–to lunch once a week. As a result, the factory schedulers competed for the award and did not comply with the output of the factory scheduling system. This increased cost and inventory, and ironically, destroyed customer service. The secret to good customer service is cycle management in production: not jumping through hoops for every order.

Fourth Strategy. Define a Balanced Scorecard and Align the Organization to Drive Value

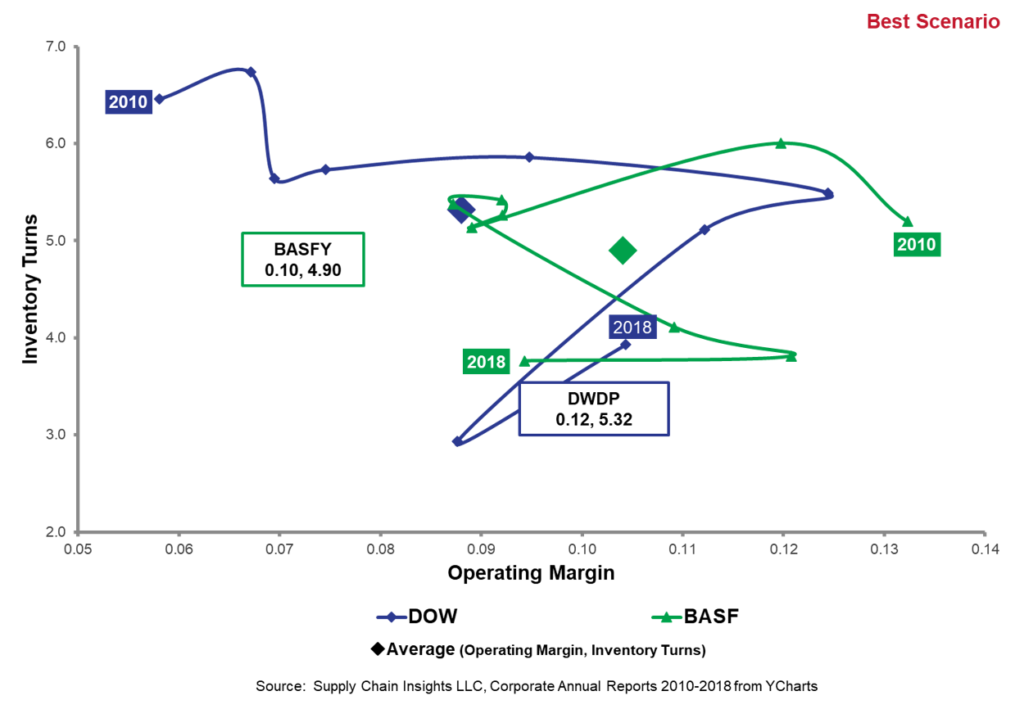

Quarter-after-quarter focus on financial re-engineering without clarity on supply chain strategy results in patterns like those of BASF and DOW. The supply chain is a complex non-linear system with strong relationships between customer service, inventory and cost. Note the backward trend in both inventory turns and margin of BASF and the loss of competitive position to DOW in the orbit chart in Figure 5.

Figure 5. DOW and BASF Orbit Chart at the Intersection of Inventory Cycles and Operating Margin for the Period of 2010-2018

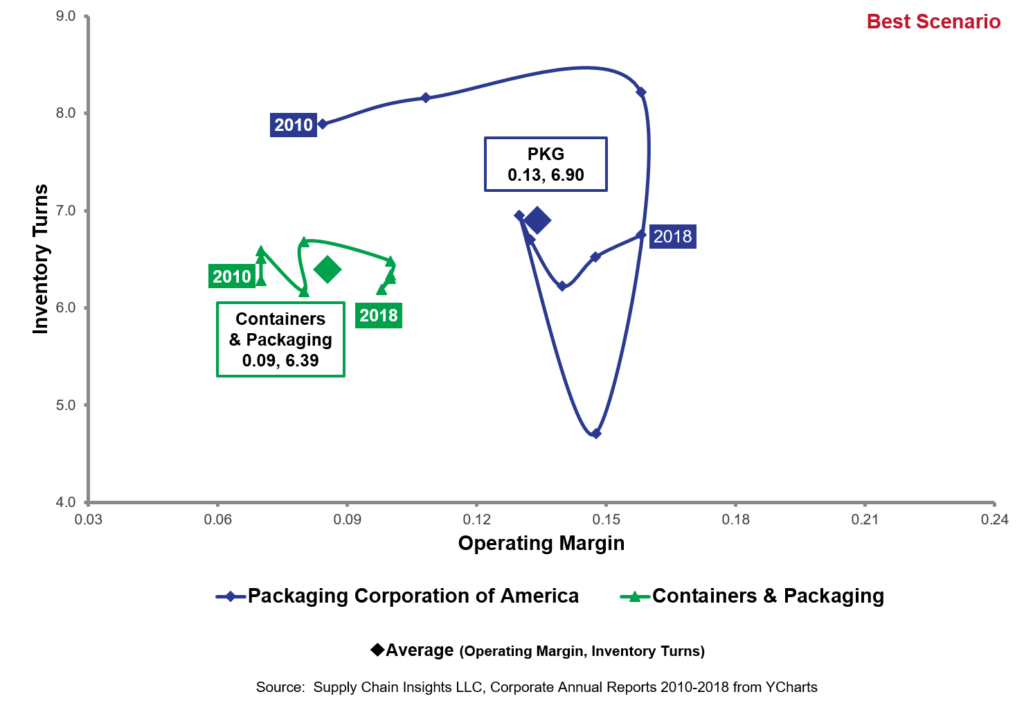

In contrast, a focus on balanced portfolio management helps companies to outperform. Analyze the patterns. Compare Packaging Corporation of America (PCA) to the packaging industry average in Figure 6. This is an example of managing a company through balanced scorecard leadership.

Figure 6. Packaging Corporation of America Versus Industry Peer Group

For more on Supply Chain Excellence, and which compan ies are doing well, join our Supply Chains to Admire Webinar.

ies are doing well, join our Supply Chains to Admire Webinar.

For additional insights on Supply Chain Excellence, consider joining our upcoming events:

Imagine Supply Chain 2030. Supply Chain Insights Global Summit, September 3rd-6th, 2019, to be held at UI Labs, Chicago, IL. The focus is on Imagining Supply Chain 2030. What is different? The format is unique. The event has no sponsorships, paid speaking sessions or lofty analyst discussions. Designed for extreme networking, I dub this event the unconference. At the event, technologists and business leaders work shoulder-to-shoulder to Imagine Supply Chain 2030. To ensure balance of business and technology leaders, I closed the conference this week to technologists/consultants to ensure the right balance of business and technology leaders. This week, I have added speakers from Dell, Dow, Intel, and Simple Tire. I hope to see you there.

Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

Network of Networks. This share group is now in its sixth year. We will host our first public events in Antwerp at the Antwerp Management School on November 26th-27th and at UI Labs in Chicago on December 3rd-5th. At this conference, we will focus on the trading partner index (a scoring system for B2B connectivity), definition of quality blockchains and interoperability between supply chain operating networks. (A supply chain operating network is a class of technologies designed to improve data flows between a brand owner and their trading partners. It includes technologies like Ariba, E2open, Exostar, Elemica, and SupplyOn.) The event focus? The agenda shares case study work by members on blockchain, supplier onboarding, and sharing of data.

To register for these events, please contact Regina.denman@supplychaininsights.com.