My phone rang. Consultants, technologists and ex-analysts called to challenge my position in my last post focused on control towers. I love this type of debate. As I discussed my views of “visibility” and “control” with my many callers, I discovered that I was not clear in my post. <Sigh. This is not my favorite topic, but there is confusion in the market. The focus of this post is to drive clarity. >

My phone rang. Consultants, technologists and ex-analysts called to challenge my position in my last post focused on control towers. I love this type of debate. As I discussed my views of “visibility” and “control” with my many callers, I discovered that I was not clear in my post. <Sigh. This is not my favorite topic, but there is confusion in the market. The focus of this post is to drive clarity. >

Starting With the Basics

The confusion starts when a supply chain leader states the need for improved visibility without a clear definition. Well-seasoned supply chain leaders understand that visibility is a capability not an IT taxonomy. Design of capabilities needs to align with the goal. As shown in Figure 2, there are many variants of visibility.

What does an IT taxonomy mean? A taxonomy is a well-defined class of applications. Examples include Enterprise Resource Planning (ERP), Warehouse Management (WMS) or Advanced Planning (APS). When you say ERP, the term communicates. In contrast, visibility does not. The IT taxonomy for visibility is supply chain analytics. As a result, when I was a Gartner analyst and technology providers provoked me to write a Magic Quadrant on visibility solutions, I laughed. In 2004-2006, Greg Aimi (now a Gartner analyst) and I worked on a common definition of visibility for over a year. When we started the discussions, we both thought that we were clear. When we ended the discussions, we agreed that visibility is supply chain capability not a well-defined technology classification. (Sometimes when you start a conversation with a clear vision, you shortchange the insights. The key is to be open to the outcome. I learned a lot through the open discussion.) Hopefully, by the end of the article you will agree.

Control tower, by definition, is similar. Control is a capability not an IT taxonomy. As you implement supply chain analytics and use control theory with well-defined reference data with clear bands for control, process improvement ensues.

Why the Focus Today on Visibility?

Supply chains are complex. Current architectures are inadequate. Process gaps are larger in companies greater than 5B$ in annual revenues. Figure 1 is a picture from a client. This team was working on quality improvements and found that the flows crossed 117 disconnected documents in access, excel, and google analytics. These sources while functional are difficult to connect. The team was seeking analytics to monitor process compliance. (This is a form of visibility.) In my experience, usually only 1/3 of data needed for visibility is transactional data. As a result, ERP contribution to visibility projects is smaller than most realize.

Improved visibility allows teams to see information and take action. When done well, a visibility project improves outcomes and collaboration. The caution is that the word “visibility” is overused, and there are many solution options. The market is over-hyped and often companies are not clear in their selection criteria.

Technologies cross a spectrum from project-based to cross-functional enterprise visibility. Most deployments focus on functional excellence–manufacturing, transportation, customer service or procurement. Very few companies focus on improving capabilities within the four walls of the enterprise.

As companies develop mature enterprise visibility capabilities, the focus shifts from integration to data portability between trading partners. I show the spectrum of visibility options in Figure 2.

Figure 2. Visibility Maturity Model

Supply chain analytics capabilities run a spectrum based on analytical insights. Advancement in analytics improves outcomes. The process starts with the definition and the use of the data.

- Descriptive analytics gives business users status. Technologies like Microsoft Power BI, Qlikview, Spotfire and Tableau are forms of descriptive analytics. As companies implement descriptive analytics, they realize that the data needs context to drive meaning. Most companies forget context and data enrichment. This helps with the so what? And, relative importance of the outcomes. In building descriptive analytics, always ask yourself, “What is context?” Focus on the helping other see the relative importance of elements like shipping status, trading relationship (customer or supplier importance) or information on the product.

- Predictive analytics yields exceptions and alerts, but also lacks insight on relative importance. Deployments of advanced planning systems is a form of predictive analytics. Most companies struggle with the mountain of exceptions. The energy to sort through them to understand the best next steps is a daily grind for planners.

- In contrast, prescriptive analytics yields not only the exceptions and the alerts, but also gives recommendations on what steps to take.

- Cognitive analytics–the most advanced analytics–senses, responds and drives actions. It is a step towards the autonomous supply chain. Only 7% of companies are testing these more advanced technologies.

In short, when it comes to visibility, there are many variants. Very few companies move past predictive analytics to drive insights. Similarly, most companies are stuck with a focus on functional visibility capabilities.

Moving Past Enterprise Visibility to Network Visibility

Companies are so consumed with enterprise visibility that few focus beyond the four-walls of the enterprise. Instead, they dabble at the edges. Many will implement portals which are detrimental to improving visibility. Why? A portal lacks a system of record; and as changes happen on the portal, there is no tracking of changes.

As companies move on their journey to build B2B network capabilities, they quickly learn five things:

- Easier said than done. There are no solutions that connect source, make and deliver in many-to-many architectures. Instead, there are industry-specific solutions that are one-to-one and one-to-many. These solutions are proprietary and closed. Today, there is no open disclosure of the process definitions (defined by B2B canonicals).

- Consolidation and investment capital strategies are problematic. The purchase of E2open by Insight Venture Capital and GHX and Elemica by Thoma Bravo slowed innovation just as the acquisition of GT Nexus by Infor, GXS by OpenText and Sterling Commerce by IBM diminished market presence. Across the B2B technology market, there is less focus and investment in B2B solutions.

- Organizational talent. Manufacturing organizations struggle to find talent and bandwidth to drive B2B visibility. The resources focused on B2B connectivity (usually located in IT) have little exposure with the deployments in customer sales and procurement teams. As a result, there are usually many misaligned project initiatives. We are currently exploring these issues in our network of networks share group.

- Indirect procurement has little to do with direct material management. Traditionally, deployments focused on indirect procurement. The solutions for direct procurement and indirect procurement have little in common.

- Focus shift from data integration to process portability. While IT projects within the organization focus on data integration, B2B projects need a focus on data portability. This is such a large subject that I explain in a subsequent paragraph.

What Is Data Portability?

Portability focuses on the synchronization and harmonization of data from one company to another. Recently, the evolution of ISO-8000 standards enable the transport of company, item and location data. While in banking there are clear account and bank routing definitions, prior to the release of the ISO-8000 ALEI standards in 2017, there were no equivalents in supply chain management.

Today, every company uses their own definition for company, location and item information. Supplier onboarding for Supply Chain Operating Networks lacks rigor. I received a PO yesterday from an Ariba user. The Company took 12 weeks to create a PO. Everything is manual despite the fact that I am a client of over one hundred other manufacturers using Ariba.

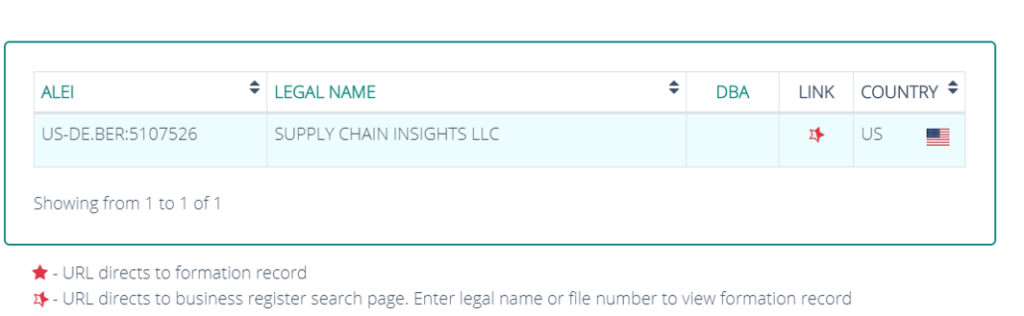

Master data is an ongoing issue. Let’s take an example. What is the right master data designation for P&G? Is it Procter & Gamble? Procter and Gamble? or P&G? Using the ISO 8000 standards, the mapping follows their legal authoritative identifiers termed ALEI. The ALEI for P&G is US-OH BER:792698. Likewise, if you want to send a wire to Supply Chain Insights, the legal authoritative identity is US-DE.BER:5107526. Like a social security number, these authoritative identifiers, are unique based on governmental business registration.

Figure 3. Use of the ALEI Search for Supply Chain Insights

Embrace Disparate Data

Driving value on enterprise analytics requires the combining of structured and unstructured data which leads us down the big data path using data lakes and schema on read. Ironically, the fixed schema of ERP data sets are a barrier to combining structured and unstructured data. In this shift, the legacy SAP Business Warehouse (BW) implementation are especially problematic.

Streaming data and unstructured text mining improve the depth of visibility outcomes. The use of disparate data sources enriches insights. As companies embrace new forms of data, there is a move to open source analytics and schema-on-read architectures. This requires new skill sets and a willingness to challenge today’s architectures. Both can be issues.

In this evolution, there is ongoing tension between data scientists and ERP system architects focused on relational database technologies. They are usually worlds apart. NonSQL technologies are 1/5 the cost of relational database technologies; but most today, are science projects and not used in mainstream processes. Open source analytics offers great promise for visibility projects, but requires exploration.

Summary

As visibility projects mature, the discussions transform from speaking generic mumbo jumbo to clear and concise definitions. This is harder than it seems. The technology landscape is difficult, but easier than the organizational implications.

The journey for supply chain visibility is an evolution based on increasing capabilities to see and take action. In summary, when you hear a discussion on visibility, raise your hand and ask for clarity. In all efforts start with clean data. Adopt the ISO-8000 standards. (In the process, side-step the discussions on control tower. Don’t confuse control and visibility. They are each supply chain capabilities not IT taxonomies.) Getting clear on terms with a focus on improving capabilities will help to drive success.

I hope that this post helps. I welcome your thoughts.

For additional insights, please check out this prior research.

Building B2B Solutions

Supply Chain Visibility in B2B Networks

Update on the Network of Networks