Slowly, more and more companies are waking up to the cold and hard facts. Financial balance sheet improvements cannot be driven by traditional supply chain processes. In the words of a supply chain leader yesterday, “Lora, please give me stories of success. I have personally experienced the failure. Lift my soul by sharing some success stories.” This is my new mission. Through the next two months I am focusing on writing and sharing case studies of success. I will write the case studies here, and share the dialogue with the supply chain leaders in our Straight Talk with Supply Chain Insights podcast series. (This podcast is available on our website, Spreaker, iTunes and on Stitcher. Download the app and listen when you get a chance.) Nick’s episode is available here.

We want to help and drive new insights. In this blog post we share the story of VTech. It is a Q&A interview with Nick Delany, now Chairman of VTech USA Holdings LLC. When I first met Nick he was driving a supply chain transformation at VTech Communications. I followed his journey during the period of 2006-2011, and wanted to check in with him to gain his insights on the selection of VTech as a finalist in the 2016 Supply Chains to Admire research. In my interview, Nick used the bumblebee to describe his journey.

We want to help and drive new insights. In this blog post we share the story of VTech. It is a Q&A interview with Nick Delany, now Chairman of VTech USA Holdings LLC. When I first met Nick he was driving a supply chain transformation at VTech Communications. I followed his journey during the period of 2006-2011, and wanted to check in with him to gain his insights on the selection of VTech as a finalist in the 2016 Supply Chains to Admire research. In my interview, Nick used the bumblebee to describe his journey.

About the Supply Chains to Admire Research

Over the period of 2009-2015, only 88% of companies made improvement on the Supply Chain Metrics That Matter. To meet the criteria for the 2016 Supply Chains to Admire list , companies needed to score better than their peer group average for performance metrics, while driving a higher level of improvement than 2/3 of their industry peer group. The calculation process is:

Over the period of 2009-2015, only 88% of companies made improvement on the Supply Chain Metrics That Matter. To meet the criteria for the 2016 Supply Chains to Admire list , companies needed to score better than their peer group average for performance metrics, while driving a higher level of improvement than 2/3 of their industry peer group. The calculation process is:

- Supply Chain Index. We first calculate the Supply Chain Index to measure supply chain improvement for an industry peer group. A ranking in the top 2/3 of the peer group qualifies a company for further analysis. We eliminate the lower 1/3 of companies for the period from consideration.

- Price to Tangible Book Value. This analysis determines which companies are driving the greatest value. We first throw out the outliers in the PTBV calculation. After the elimination of outliers, we include companies that are at or above the PTBV value (allowing for no more than 5% below the mean for the peer group to account for rounding errors).

Companies passing these two tests are then analyzed against the performance factors for 2009-2015:

- Growth. Higher percentage growth than the industry average.

- Operating Margin. Greater margin performance than the industry average for the peer group for the period studied.

- Inventory Turns. Better performance in inventory turns than the peer group average for the period studied.

- Return on Invested Capital (ROIC). Higher performance on ROIC than the average for their peer group for the period.

In the analysis of the performance factors, companies are divided into two classifications:

- Supply Chains to Admire Winners: In the analysis of the performance factors of growth, operating margin, inventory turns, and Return on Invested Capital, Supply Chains to Admire winners score at or above the industry peer group average for all four of the factors. (Must be within 5% of the mean of the peer group to account for rounding.)

- Supply Chains to Admire Finalists. Companies meeting the Supply Chain Index and the PTBV criteria, but falling below the peer group averages on the performance factors, are ranked as finalists if they are no more than 10% below the industry average for three out of four of the performance factors, and no more than 25% below on any single performance factor.

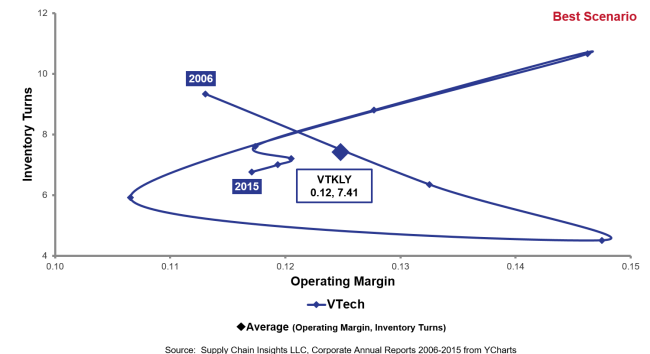

In 2016, VTech is a finalist in the Supply Chains to Admire analysis. To understand the results, follow the year-over-year pattern in the orbit chart in Figure 1, and then look at the results of the consumer electronics industry in Table 1. VTech drove significant improvement in operating margin through the recession of 2007-2009 and then drove improvement in both inventory margin and operating margin for the period of 2010-2012 with some regression in the period of 2013-2015.

Figure 1. Orbit Chart of VTech for the Period of 2006-2015 at the Intersection of Operating Margin and Inventory Turns

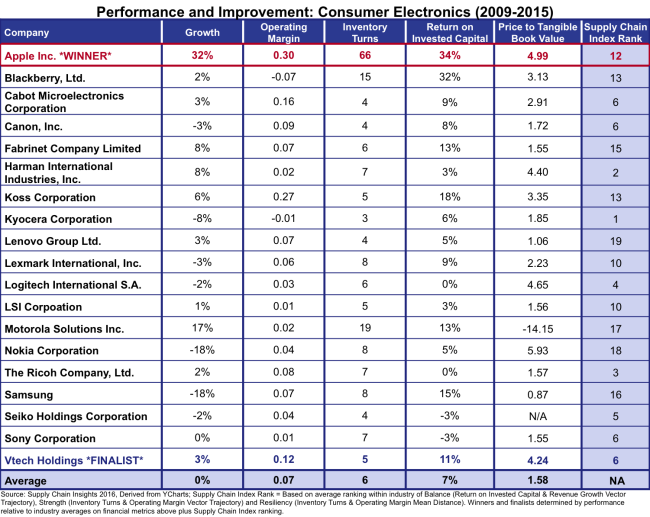

In Table 1, the company is slightly above average on improvement, and outperforms on the Supply Chain Metrics That Matter in all categories but inventory turns. In Table 1, Apple is the winner and VTech is the finalist.

Table 1. Results of the Consumer Electronics Industry for Performance, Improvement and Value

About VTech

VTech holdings, founded in 1976, has its roots in learning products. The company acquired the cordless phone division from Lucent technology in 2000. Initially, this led to operating losses and write-offs and was turned around in 2002. Today the Company’s core businesses are cordless phones, contract manufacturing services and children’s learning products. The North American operation is the top manufacturer in the US cordless market. The Company currently has $1.88 billion in revenues and employs 30,000 people in 10 regions of the world.

Insights from the Interview with Nick Delany

It took me a couple of months to track Nick down in his travels, but last week he approved his case study. I have written it in a Q&A format based on our interview.

“Tell me about VTech’s journey.”

When I got the news of winning the finalist of the Supply Chains to Admire research, I went back into the files and tried to chronicle our journey. I found two presentations that spoke to me. The first, presented in June 2001, outlined where we were in supply chain and what we needed to do. The second presentation, given in 2004, shared the results. In 2001 we were in trouble, but in 2004 we had made a lot of progress. It took us three years to right the ship.

For me the journey started when I was at Stanley before I joined VTech. At that time I attended many conferences. I listened and spoke to vendors. The supply chain stories of P&G and Scotts Fertilizer caught my attention. The big name in software at the time was i2 Technologies. The company was interesting. They were growing fast and were innovative, but my intuition was that their approach was fundamentally flawed.

Then I was working in the mechanical division of Stanley, and we had 50,000 items. We had silos, and different functional areas had competing metrics that prevented progress. Let me give you a simple example. We would sell a toolbox complete with tools. There were 1000 items in the toolbox. We had a factory making 250,000 sockets a day, and ROA drove factory bonus incentives. Our sockets for the kits were items with low volumes, and the manufacturing leader would target for 85% asset utilization. To meet the goal, they would short cycle and not make these low volume items. As a result, the toolboxes would not get delivered; yet, the guy managing manufacturing got rewarded.

When I came to VTtech, it was a greenfield site and we were in trouble. Our market share for cordless phones was 11% and with the acquisition of AT&T phones it went to 22%. When we acquired the rights to the AT&T product there were large inventory write-offs. The AT&T forecasting process at that time was best described as a séance. To get a demand plan would take two days. The team would work hard and make intelligent guesses, but I brought in some process discipline. Over the course of the year we decreased inventory by 75% by improving the base demand processes. We were very open to change. We started with Collaborative Planning Forecasting and Replenishment (CPFR). It was a great idea, but it did not work. Why? The actual retailer orders were different than the retailer forecasts.

My first eureka moment for us was understanding why the CPFR process did not deliver. The answer was simple. The retailer’s plan was never normalized against inventory, and as a result it did not reflect buying behavior. Staples was the first retailer to work with us on our new approach. Working together collaboratively helped us to develop better processes.

Slowly my process thinking evolved. I remember sitting in a doctor’s office waiting room and killing time by drawing processes for the retailer and the manufacturer. At the time I called them circles of influence. The analogy I use is a watch. A watch may have 100 moving parts, but there is a single goal: to tell the precise time. It would not work if a single gear failed. It is the same in Supply Chain Management (SCM ). The overall success is dependent on interconnected processes.

So, getting back to the story, at the time there were at least three different forecasts (sales/financial/production) and none were the same, and how would they be reconciled? Legacy technology applications were completely unaligned. I asked, “How do we align these?” We realized there was a need for a single trigger. Point-of-Sale data needed to drive all processes. If you knew what the retailer was going to sell (POS) then the calculation as to what the retailer would buy was a simple mathematical calculation. The way that we got there was to abandon the push forecast for pull demand and replenish what the retailer wants to sell. We went from push planning to pull-based demand planning over the course of a year.

Our chairman in September 2001 announced business write-downs in our interim results, and committed that supply chain would be a strategic imperative. He never wavered from this position. Through the crisis he had become intimately involved with the supply chains and then realized being good at supply chain was a strategic asset.

Figure 2. VTech Strategy

Our phrase at the time was “inventory kills.” In talking to our chairman, and educating the executive team, we got competitive advantage. In 2001 there were three of us in planning. We were responsible for determining what the customer needed. It was essential to our strategy as shown in Figure 2.

Our phrase at the time was “inventory kills.” In talking to our chairman, and educating the executive team, we got competitive advantage. In 2001 there were three of us in planning. We were responsible for determining what the customer needed. It was essential to our strategy as shown in Figure 2.

Taking steps. The use of Point-of-Sale data.

When faced with making change, our starting point was a discussion of, “How did you drive the understanding that sales should not prepare the forecast?” As a group we determined that the key data was the retail POS forecast. At the time we had up to 85% of our revenue stream with available retailer POS data sharing through EDI transactions through an 852 signal. We would aggregate the data into a data warehouse and we would then chart it and identify the trends. We would then take the 852 data and use it as an input into a simple forecasting process using Bayesian statistical modeling technologies. We forecasted each retailer sales for every item for every week. We had data for 15 retailers for 120 items. We would import the retailers’ forecasts and then build our forecast through the use of point-of-sale data We would then compare the two. Our rule was that we would drive the business based on the retailer forecast because it was a more reliable demand signal.

Redefining a process

We then tackled inventory. To accomplish this goal, and decrease total system inventory, what we needed to understand was the retailers inventory policy. We adjusted the inventory by each customer. We used a common plan based on retailer Point-of-Sale data and inventory targets. We eventually reduced total retail inventory from 17 weeks to 7 weeks today, and our own inventory by 75%.

“Why do you think more people do not use Point-of-Sale data?”

Over and over again, people would tell me that things would not work or it could not be done. I then would bring up the analogy of the bumblebee. If we used physics, the laws or aerodynamics, and other scientific principles, we would say that the bumblebee could not fly; but fortunately the bumblebee does not know that. At the time, I did not know how different our method was. I think ignorance helped. I was just trying to solve the problems that I saw.

Over and over again, people would tell me that things would not work or it could not be done. I then would bring up the analogy of the bumblebee. If we used physics, the laws or aerodynamics, and other scientific principles, we would say that the bumblebee could not fly; but fortunately the bumblebee does not know that. At the time, I did not know how different our method was. I think ignorance helped. I was just trying to solve the problems that I saw.

To make it happen, I got off my butt and I went to talk to retailers one-on-one. They appreciated it. Very early on I made it mandatory for all supply chain leaders to study Six Sigma to a green belt level. It became a language for them to talk to each other. Analytics would lead us to the core problems and root cause thus allowing us to make significant & impactful changes with confidence. No matter what process you use–CPFR or S&OP processes–it starts with the customer. I included the retailer directly into the process.

I remember September 2007 very well. I tracked the market indicators and forecasted the economic downturn. Every time new housing starts stop, there is a pattern that the market will tank in six months. In April 2007 new housing starts collapsed. In August 2007 we discussed this with our senior executives and developed a very conservative forecasting and inventory model. Because we were aware, we drove impressive results through the recession.

I know why we did it. We had a greenfield site. There was a need, and it made sense. I think most companies struggle because they don’t have a greenfield site, and the need to drive change is not as great. As a result, there is complacency to rethink demand processes.

“What is next?”

I took early retirement in March 2014, but the chairman asked me stay on. With new acquisitions, I share the concepts and apply the same techniques. As a result, a completely new team got the same results in our educational division. It is a repeatable result even in a completely different business environment.

POS analysis and forecasting is such a powerful technique it can have material beneficial impacts to SCM, product development, marketing, sales and financial management.

I don’t think most companies understand the concept or source of profit leakage. I believe the difference between good and bad supply chain practices in consumer goods companies in the USA can impact the net operating profit result up to 7%.