It is about the right balance of the carrot and the stick.

Progress happens when you measure.

Relationships happen faster when there is more carrot than a stick. Over the last decade, scorecards have become more of a stick than a carrot.

Reflections

Some days, in my coverage of consumer value networks, it seems like we are making slow progress. So slow, that I often feel like I am watching paint dry. We talk collaboration, but we automate buy/sell relationships.

Then I go to a conference like Logimed USA, and I get immersed in another industry—like medical devices—which is a decade behind CPG/retail, and I get a reality check. It is useful to get perspective.

In the medical device industry, they have no scorecards with hospitals and they are just starting on the adoption of the GS1 standards. (Reference my article on Throwback Thursday.)

Impacts of Customer Scorecards

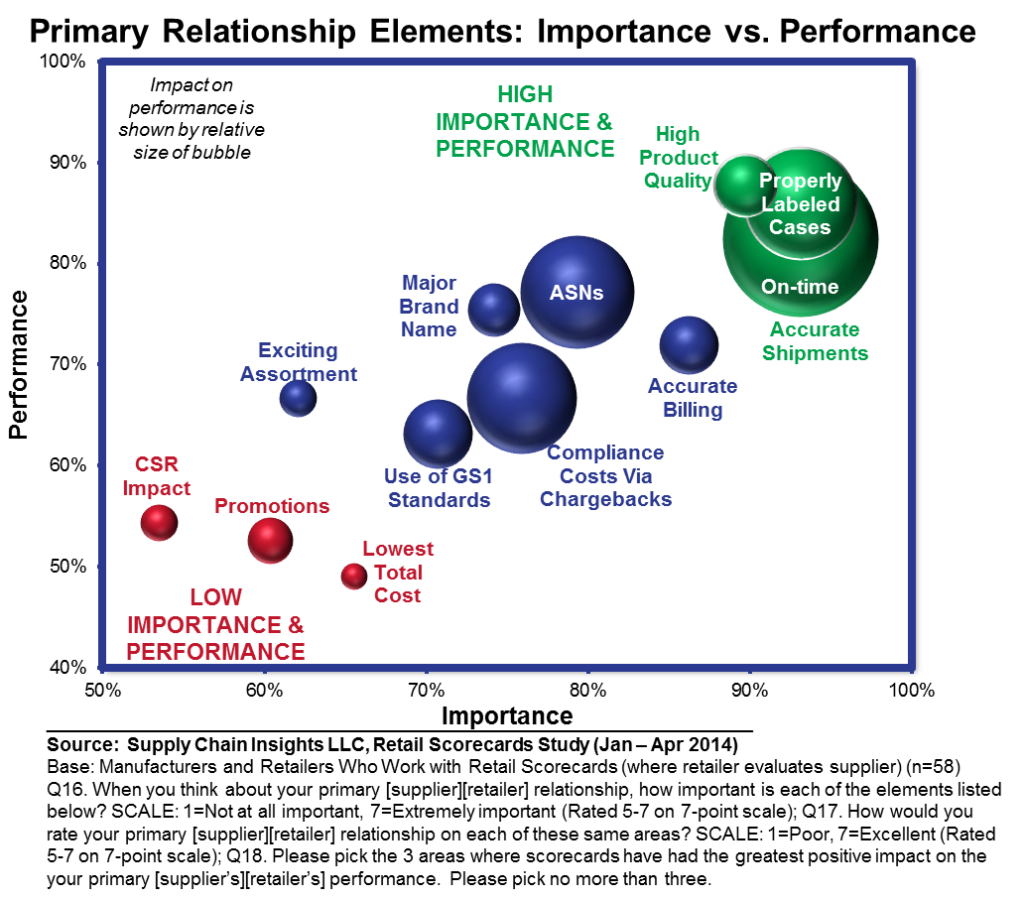

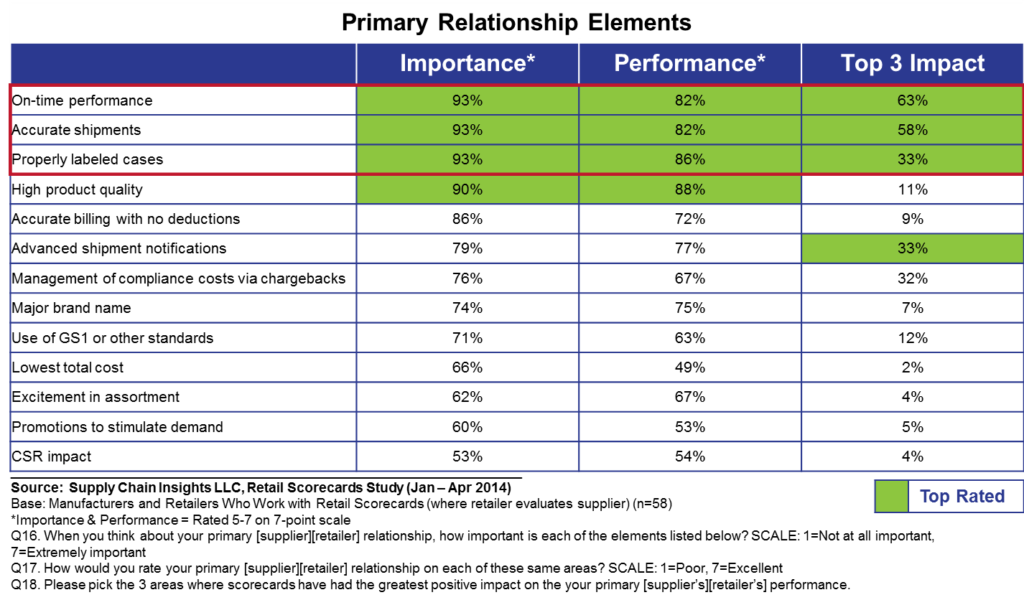

Consumer value networks are now in their second decade of scorecard automation. In most relationships there is more than one scorecard. The most common one is a scorecard for supply chain. Today the focus is on physical movement. As shown in Figures 1 and 2, labeling, on-time shipments, and Advanced Shipment Notification (ASNs) have improved through the use of scorecards.

However, the Scorecards Are Anything but Balanced. The use of scorecards has improved customer service. Shipments are now on-time and there is progress on in-full shipments. Why? Primarily because of better communication on the retail requirements and the tracking of the shipments. However, the use of scorecards has not improved cost or assortment. At a rVCF conference that I attended this week, one of the retailers asked me why an on-time and full shipment was not representative of the lowest cost. Yes, there is still much work to be done.

What Is Preventing Us from Making Greater Progress? In short, it is about alignment and incentives. The gaps between sales and operations is a barrier on the supplier side, and the gaps between merchandising and operations for the retailer are equally as bad. Additionally, the incentives are not aligned to serve the shopper. Consumer packaged goods companies are paid when the goods land in the retailer’s warehouse, not when they cross the register, and trade funds can distort the demand signal. Too much dependency on trade promotions and deep discounts is an addiction and disruptive for some relationships.

The studies for the VMI and the Retail Scorecard surveys are still open. We would love your input. It is our plan to correlate maturity in consumer relationships to the Supply Chain Index over the summer.

We are also finishing up the project on supply chain planning maturity. It is close to completion.We would love your insights. As always, we keep your responses confidential.

This morning, I am writing from Istanbul. The book, Metrics That Matter, is almost finished. I will be speaking at the Integrated Supply Chain Conference on Thursday. Lots of interest in the Supply Chain Index. People cannot get enough on metrics.

Please Don’t AI Stupid

Drip. Drip. Drip. Industry 4.0. DripBig Data. Drip.The Connected Supply Chain. DripDigital Supply Chain. Drip.Autonomous Supply Chain Planning. Drip. Self-Healing Supply Chains. Drip. Touchless Supply