I love retail research. While some gals would call it retail therapy, I actively converge my days of shopping with supply chain research.

Let me give you an example. Recently, I needed new bowls for French onion soup. So I placed the same order on Amazon, Macy’s and JC Penney’s websites. I had some trepidation. The reviews on Amazon listed “in-transit breakage” as a problem, but I shrugged my shoulders and decided to give it a go. Macy’s had been bragging at conferences about their work on cross-channel fulfillment with progress made in using their stores to ship directly to customers. Penney’s was in a major transformation. When the bowls arrived, I got three different outcomes:

- Amazon Shipment: The bowls were neatly packed and there was no damage. Amazon had fixed the issues with damage in shipment.

- Macy’s Shipment: When the bowls arrived, 60% were broken. The wrapping and packing were poor. I called customer service and complained. Macy’s requested that I ship the damaged bowls back. The box had a return label. It was a mechanical transaction. I received a credit in two weeks. No one said that they were sorry. There were no attempts to improve my brand loyalty.

- Penney’s Shipment: When I received the JC Penney’s shipment, all the bowls were broken. I called customer service. They requested that I give them some times during the day to enable the UPS delivery man to visit my apartment to inspect the damage. Again, it was a very mechanical transaction. The customer service representative uttered no words of “I am sorry.” I will never order a breakable item online again from Penney’s.

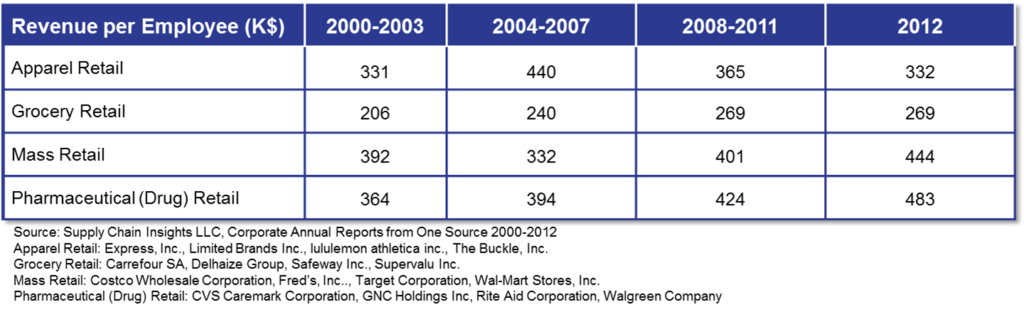

Retail is about people. It is about relationships. It is about seamless and flawless execution. In the case above, Amazon clearly wins. And, while many retailers brag about cross-channel fulfillment and tout their progress on Omni-channel, many retailers are stuck. They are not able to operate effectively cross-channel. As shown in table 1., productivity of bricks and mortar retailers is stalled. More and more companies are struggling to make progress in operating margin and inventory cycles.

Current State

Let’s look more closely to understand the story:

Table 1.

E-commerce is a More Profitable Channel than Traditional Bricks and Mortar Sales. E-commerce is a disruptive business model. There is growth in e-commerce pure plays (e.g., eBay, GiantNerd.com., Zappos) and stagnation in sales in most conventional bricks and mortar retail formats.

Amazon Effect. No one questions that Amazon has had a pervasive impact on retail. Ten years ago, Amazon was an online book retailer, yet today a family can buy a wide variety of items, including groceries with next day delivery. With the introduction of Amazon Prime with free shipping, why do customers need to enter a physical store? To understand the pervasive nature of this change, consider Amazon’s 2012 announcement:

“We now have more than 15 million items in Amazon Prime, this is up 15x since we launched in 2005. Prime Instant Video selection tripled in just over a year to more than 38,000 movies and TV episodes. The Kindle Owners’ Lending Library has also more than tripled to over 300,000 books, including an investment of millions of dollars to make the entire Harry Potter series available as part of that selection”. Amazon 2012 Annual Report

Improving Store Operations is a Major Imperative. As companies face the squeeze from e-commerce models, retailers are attempting to evolve new store formats. They are trying to fight back. To do this, they need to answer the question of “What should be the role of the store in the future?” We recently completed a survey of over 90 retailers to understand this dilemma. As shown in figure 1, all retail formats—grocery, mass merchant and specialty—are struggling with consistency in retail operations.

Figure 1.

Talent issues, supply chain strategy and organizational alignment are also issues for the respondents (as shown in figure 2). Retailers are struggling with the use of data and making demand insights actionable to store performance. It is clear that supply chain matters, but progress on operating margins and cycles are stalled. Based on our research the exceptions are Costco, lululemon, Walmart, and Zara. We will be discussing these trends on our webinar tomorrow at 1:00 p.m.

What Should Retailers DO?

Figure 2.

Embrace Showrooming as an Opportunity. Despite the pressures on store performance, very few companies are looking at a redesign to improve the customer experience. Most see showrooming as a problem versus an opportunity. Recently, I hosted a panel of retail experts to discuss turning showrooming into an opportunity. A couple discussed how they are using technologies like RetailNext to look at the differences between traffic and conversion. The heated discussion was on the use of store displays and experiences to convert shoppers in the store to buy. It is hard for the retailer to embrace the showrooming trip type as an opportunity.

Design the Experience from the Customer Back Considering the Role of Each Channel. Retailers are siloed. While there is talk about omnichannel, we are far away from making it a reality. Most retailers run the channels as distinctly different businesses and profit centers. As a result, companies are unable to operate seamlessly across channels to improve the customer experience.

The traditional metrics within each silo are a barrier. For example, one retailer spoke on the management of returns. The Omnichannel approach that they are implementing encourages shoppers to execute returns at the store; however, the metrics within the store discourages returns. Social and mobile programs are the most closely associated with e-commerce and digital marketing and demand insights are a gap.

To improve the experience, retailers have to focus on changing siloed metrics to cross-functional metrics, and designing the store based on shopper insights and in-store monitoring to better understand and shape conversion.

Make the Store a Destination. In one panel that I recently hosted, a representative from Godiva discussed how they were redefining the role of the store. As their chocolate sales have increased online, they have struggled to improve in-store sales. As a result, they installed a “dipping” station in their stores to allow shoppers to dip fresh fruit into chocolate as part of the in-store experience. The impact on sales was dramatic. So, whether it is an in-store clinic within a drug store, or a pet groomers in a pet store, or a cooking class within a grocery store, retailers are smart to use their store formats to enhance the experience on the use of their product. The goal is to give the shopper a reason to enter the store; and when they do, make the shopping experience seamless so that they will come back.

This is also an opportunity for suppliers. Many do not realize that retailers have a need to make the store a destination. By offering specialized services—make-up specialists in the store, return services for ink cartridges, custom ordering—the supplier can help the retailer redefine the role of the store.

Ensure Excellence in all Forms of Fulfillment. Social and mobile commerce require more customization and single unit shipments. These packages and shipping do not fit well into the traditional warehouse environment, and most store clerks are not trained to handle the packing of shipments within the store. Redesign fulfillment with the goal in mind. Don’t try to force-fit fulfillment processes into situations where they are not a good fit.

Summary

The traditional retailer defined store formats before the world of e-commerce, mobile and social sales. Shoppers want to shop anytime and anywhere, but the retailer has designed their processes to serve the customer within a channel. There is an opportunity to redefine the role of the store to welcome showrooming, improving the experience and making the store a destination. However, as companies move forward, they must first guarantee execution. I still have the memories of my call with JC Penney. It makes a great story on stage.

Join me Thursday, July 25th, at 1:00 PM EST as I discuss these ideas more thoroughly with my friend, and long-term retail expert, Marianne Timmons, previously at Wegmans and now at Cap Gemini. It is still not too late to sign up for the webinar. We hope to see you there!

To access the full report on this study, click on this link.

Additionally, there is still time to sign up for the Supply Chain Insights Global Summit. We cannot wait to share the outcome of the work that we are completing on the Supply Chain Index, and we are proud of our compelling list of speakers. Cannot make up your mind? Check out the post on the five reasons to attend this Global Summit. (Hurry, because the special rates at the hotel end on August 9th. We are almost sold out of the room block at the Phoenician.) We are currently only registering manufacturers, retailers and distributors. The event is limited to 35% technology provider attendees (software and consulting professionals), and all of these seats have been sold.