Definition: “Someone’s efforts, resolve, or viability are tested; things are meaningfully challenging.“

Wikipedia

The supply chain team’s past thirty-two months of disruption were a long, winding road full of surprises. Navigating through the turmoil is unprecedented: there are no easy reference models to guide behavior. As a result, companies are writing new case studies through their actions or inaction. Business continuity is the overarching issue.

Volatility and disruption are far from over. Based on the current issues with material shortages, labor issues, electrical costs and outages, weather events, and water availability, I forecast an equal level of disruption for the next three years. COVID impacts also continue.

Don’t Be Like Ford

Last week, after booking an additional $1B in unexpected supplier costs in the third quarter, the CFO led the company’s focus on restructuring to “support efficient and reliable sourcing of components and internal development of key technologies and capabilities.” Following the announcement, Ford’s stock closed at the lowest valuation in eleven years.

What is the issue? In this volatile world, efficient procurement led by a CFO is not the answer. The company needs to focus on the design of flows, building outside-in processes, creating an effective supplier development group, reducing complexity, and driving bi-directional orchestration to a balanced scorecard. Make, source, and deliver need to be managed together based on analytics that sense and respond at the speed of business. These capabilities do not exist at Ford. The manufacturing-centric company is used to strangling suppliers and demanding terms. Continuation of the traditional Ford culture will lead to even more significant issues.

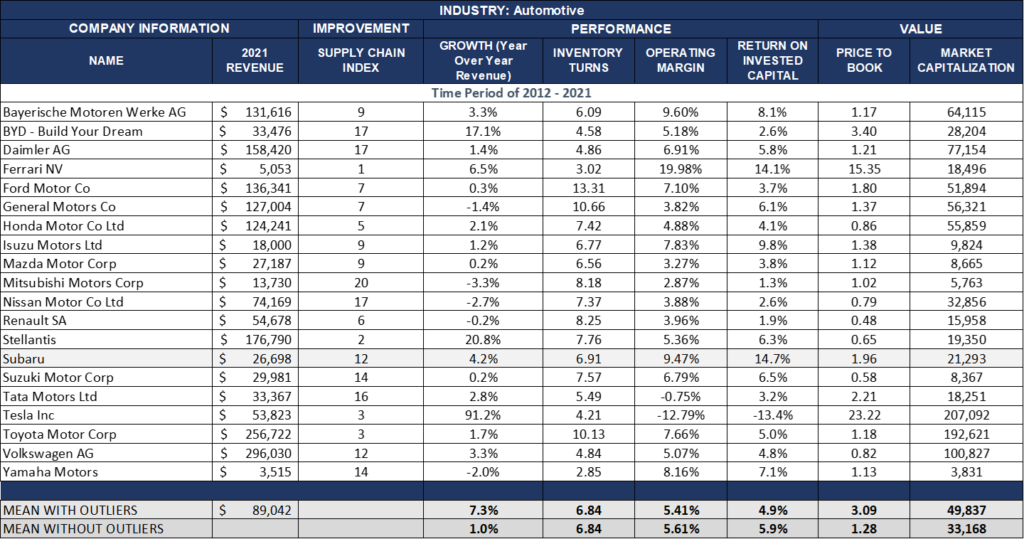

Ford, historically has been an industry laggard in the automotive sector and, with this focus, will continue to be a laggard in the future. The low Return on Invested Capital (ROIC) and the growth below the industry average comes from the lack of network design and organizational alignment between new product development, manufacturing, and procurement. Ford is known for strong-arming suppliers and is less collaborative than its competitors like Subaru and Toyota.

Table 1. Results in the Automotive Industry for the period of 2012-2021

Characteristics of Who Is Navigating Well?

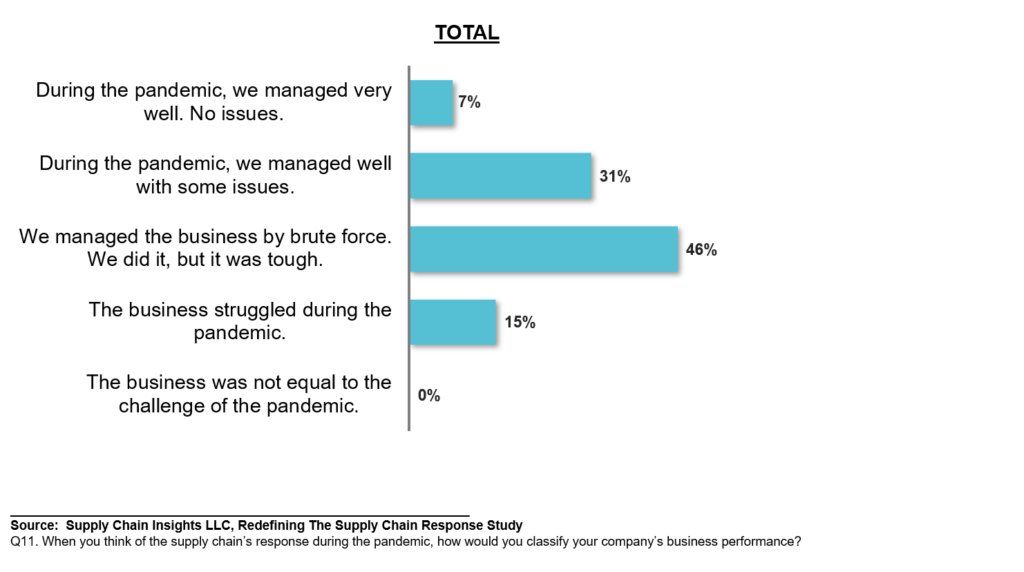

So, what can Ford and others learn from our current research? Four months ago, we used our Linkedin following of 329,000 readers to complete a research project to understand company performance during the pandemic. The goal is to help supply chain leaders to understand which techniques work and which do not. In Figure 1, we show the overall performance of manufacturers and distributors. Overall, 38% managed well or very well, while 62% struggled.

Figure 1. Performance of Manufacturers and Distributors During the Pandemic

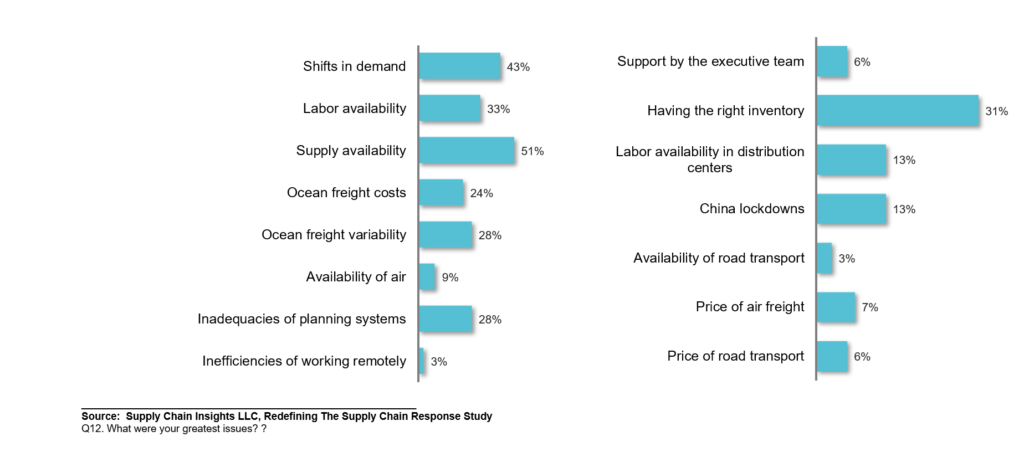

So, you might ask, why? What drove the difference? We find that three factors mattered: organizational alignment, descriptive analytics, and inventory management.

Companies that performed better during the pandemic had better organizational alignment. There was a strong negative correlation (at an 80% confidence level) when companies were not aligned between customer service and transportation. (During the pandemic, transportation costs skyrocketed, creating increasing tension between customer service and price. Companies driven by functional metrics struggled: they could not adapt quickly to the higher transportation costs.)

Excel usage increased during the pandemic. Companies implementing Advanced Planning solutions from ERP technologists augmented the planning applications with descriptive analytics. (There was a negative correlation with companies adhering to tight SAP standardization.) Companies with more advanced modeling technologies and mature planners positively correlated at a 60% confidence level.

Multi-tier inventory management by itself was not sufficient. Companies actively designing their supply chains (focusing on form and inventory function) with a more mature S&OP process performed better. In Figure 2, we show the responses to the question of the greatest issue during the pandemic.

As we brace for the future of continued and unplanned disruption, the knee-jerk reaction is to tighten functional metrics. Executive understanding of the supply chain as a complex non-linear system is unfortunately low, and business leaders will struggle to prevent negative impacts. The answer lies with outside-in modeling using network design and digital twin technologies to show the negative impact to the executive team of the focus on functional metrics throwing the supply chain out of balance.

Unfortunately, there will be more Ford-like announcements as company, after company, realize the impact of disruption and variability. Brace yourself, I think that we are mid-way through this disruption cycle.

My advice? Align the organization against a common vision for supply chain excellence. Design network flows monthly to help leaders see trade-offs. (Where possible use market data to decrease market and demand latency.) Decrease the focus on functional metrics and align to a balanced scorecard.