Financial Reengineering is the radical redesign of business processes and organizational structure in order to achieve significant improvements in performance, such as productivity, cost reduction, cycle time, and quality. It is the basis for many recent developments in management. Sounds good? Right? Think again.

The traditional supply chain leader was only focused on cost reduction. This sounds aligned with financial reengineering. Right? The correct answer is “Wrong.” Let me explain. Financial reengineering focuses on the optimization of short-term results which are usually based on a functional analysis of source, make, or deliver. Few consultants understand the interrelationships between source, make, and deliver.

Reflections

Tonight I am in Frankfurt. Snow fell last night as I worked on my last Supply Chain Metrics That Matter report. This is number 15 in a series that looks critically, industry by industry, to understand relative improvement of peer groups on the Effective Frontier. These have taken us a year to produce.

The concept of the Effective Frontier is that best-in-class companies align functional metrics to balance growth, cost, inventory, and Return on Invested Capital (ROIC) performance while balancing customer service metrics. The goal is to drive year-over-year gains in market capitalization. In contrast, most financial reengineering efforts focus on short-term results. Ironically, most companies are very entrapped in measuring and rewarding functional metrics which degrades overall improvement.

Figure 1. The Effective Frontier

Improving the Effective Frontier is hard work and is often in direct opposition to financial reengineering.

In financial reengineering, some companies wrongly focus on cash-to-cash performance. Cash-to-cash is a compound metric. The smaller the number, the better. It represents the amount of cash required to fund operations. The cash-to-cash definition is:

Cash-to-Cash= Days of Receivables+ Days of Inventory-Days of Payables

Progressively, as inventories grew due to business complexity over the last decade, companies increased payables, thus passing on their costs in the supply chain to their downstream partners. This increased receivables for the supplier. And, to manage cash-to-cash, the supplier increased their payables, passing cost and waste downward in the supply chain. Companies feel good because they have met quarterly objectives, but few step back and take a hard look to evaluate financial reengineering. Let’s take a look at Table 1 which is a summary of cash-to-cash for the semiconductor industry. Note the increase in receivables, inventory and payables, and the small increase in Cash-to-Cash. We see this in industry after industry.

Table 1. Cash-to-Cash Performance of the Semiconductor Industry

![]()

Ironically, money has never been able to move more quickly. ACH, Wire, and EDI all accelerate payments. Likewise, downstream brand owners have a lower cost of capital which they could use to finance the supply chain operations in the value network if they’re truly concerned with risk and reliability. While companies “talk” about collaboration with suppliers, in reality, the procurement organization is doing the opposite due to financial reengineering, placing more responsibility on the role of banks to fund working capital in the value chain.

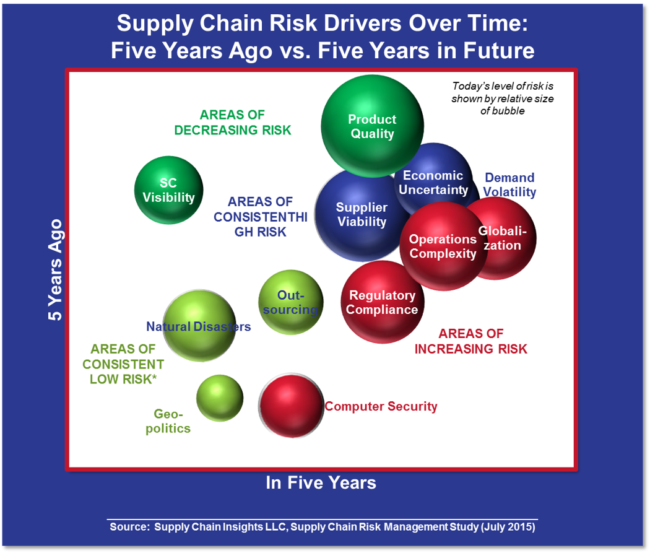

Supplier viability (the health of suppliers) is a growing risk issue; yet, financial engineering reigns. Company by company, we are bloating the supply chain while we Lean-out our enterprise operations. The size of the bubbles in Figure 2 represents the degree of risk. Note the size of the bubbles for product quality and supplier viability. They are closely coupled.

Figure 2. Supplier Risk Management

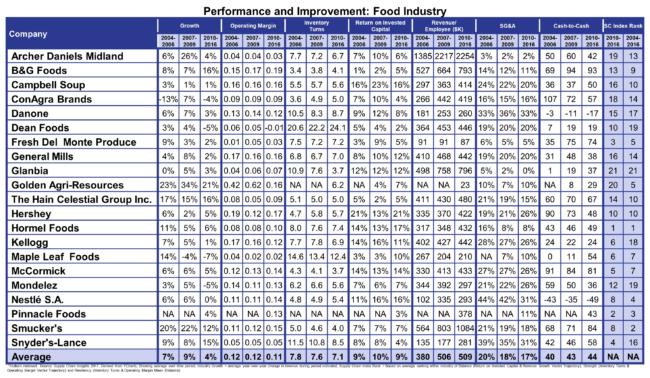

Recently, I presented at the University of Tennessee Supply Chain Forum. The presentation before me was by a supply chain leader from Mondelēz International, Inc. He bragged about the elongation of payables and the improvement on cash-to-cash. His goal was to emulate Dell’s cash-to-cash performance. I struggled to sit in my seat with the flawed logic. He reduced Mondelez’s cash-to-cash metric from 59 to 36 through the increase of Payables. As he spoke I thought of the viability issues of Mondelēz’ packaging and raw material suppliers. Many are in critical condition. I fought to not speak. I wanted to push back. First of all, Mondelēz is not Dell. Mondelēz’ receivables, largely controlled by retailers, are increasing. They are pushing costs back on Mondelēz, while Dell controls a major part of their channel through their direct-ship model. Secondly, I wanted to raise my hand and ask about the decline in inventory turns and ROIC performance as shown in Figure 3. The story was one of financial reengineering versus supply chain improvement.

I expected humility, as 2017 was a tough year for Mondelēz. One of their consulting partners incorrectly recommended using the optimizer in SAP SNP for tactical planning. They, like every other company I have seen trying to implement the optimizer in SAP SNP, failed. (I have never seen any company be successful.) In addition, the company had a major malware issue. I expected a presentation on learning to drive improvement through failure, but this was not the case.

Figure 3. Average Supply Chain Performance in Food Value Chains

When I share the Supply Chain Metrics That Matter research, there is a surprised look on the face of most executives. The general belief is that the implementation of ERP, and advanced planning, improved the management of costs. The decline in food margin and cost management in most of the industries is usually counterintuitive and flies in the face of convention.

Ironically, only 29% of companies with an ERP system can easily see supply chain costs to base their supply chain decisions on orchestration across functions. The balance of lead time, working capital, and costs is not easily understood by finance teams. It requires the use of network-design optimization and discrete-event simulation to show the relationships of the metrics in this complex nonlinear system we call supply chain.

Driving True Improvement

I spent the last week with European clients discussing the upcoming Supply Chains to Admire work. We will publish the results from our fifth year of the analysis in June. We are now pulling the data for 2017.

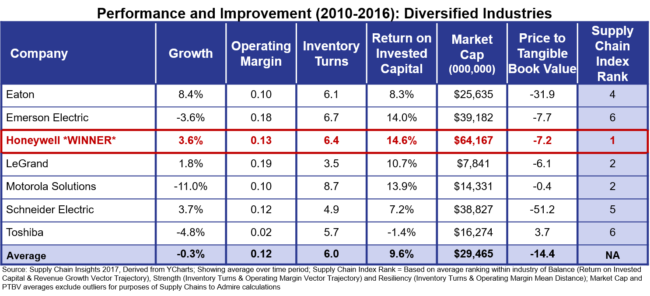

One of the leaders I spent some time with was Mourad Tamoud of Schneider Electric. I am a big fan of both his leadership and that of Annette Clayton, now CEO & President of North America. I think both are great supply chain leaders. But, as Mourad and I spoke, it became clear that the concept of managing a balanced scorecard based on ratios against peer group was a new concept. Schneider has greatly improved inventory positions, but has not moved the inventory ratio by much, and hence the gap in peer group performance as shown in Figure 4. The company was eliminated from the 2017 Supply Chains to Admire evaluation due to underperforming on both inventory turns and ROIC.

Figure 4. Diversified Industry Performance

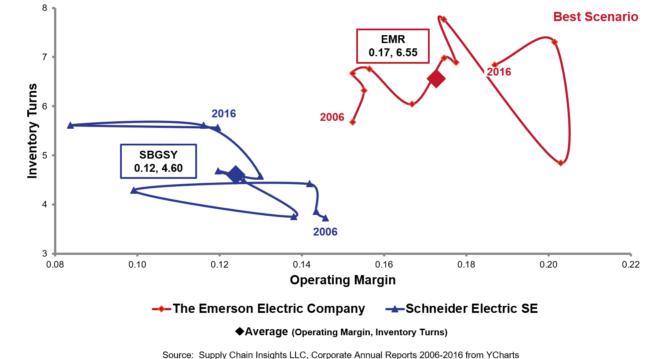

I loved the discussion between the head of Finance (who is quite progressive) and Mourad on the use of ratios and driving overall improvement. As shown in the orbit chart in Figure 5, competitors like Emerson Electric have driven greater improvement than Schneider. However, you cannot see this difference until you study the orbit chart plots. It for this reason that I like the orbit chart methodology.

(A note about the Supply Chain Index: the smaller the index rank number, the greater the company’s improvement for the time studied.)

Figure 5. Comparison of Emerson Electric and Schneider Electric for the Period of 2006-2016

I believe that supply chain leadership is about driving long-term value. I also believe that financial reengineering is about driving short-term results which are often counterproductive to the longer-term vision. Don’t fall into the supply chain reengineering trap. The discussion with Mourad is the right one. Supply Chain excellence is about a purposeful delivery of metrics to win against the competition.

To drive supply chain excellence, we must learn from the past, to unlearn, and then to drive supply chain leadership in driving value. This is the goal of this report series. I look forward to getting feedback from you on this body of work. All the best on your journey, and let us know how we can help.