Yowza: Excitement or approval

Yowza: Excitement or approval

Get a cup of coffee. This is a long post. <Bear with me….>

Here I share a nine-step process in an attempt to help companies unravel the process for buying supply chain planning software.

The genesis for this post stems from frustration. I get the same questions over-and-over again, and see companies making the same mistakes.

Let’s face a hard fact: the supply chain planning market is a mess. Polluted with well-intended marketing messages by over-zealous technology providers and consultants creates confusion. I think that it is time for some straight talk.

Background

In my day-to-day work, the calls stream in. The themes are the same with slight variations. They are a tangled mess from well-intended teams. They center on how to make a good decision in the purchase of supply chain planning solutions. Over 90% of companies have a solution, and only one in two companies have satisfied business users. Frustration abounds. Most have purchased software, but are dependent on Excel spreadsheets. The track record is not pretty.

The most common questions include:

- What should I do about the discontinuation of SAP APO in 2025? Should I migrate to SAP IBP?

- I am uncomfortable about the migration path of the applications of the software aggregators/consolidators. (This includes JDA, E2Open, Infor, Logility, and Oracle.) How do I get to a better place?

- What do I think of the Gartner Magic Quadrant on Supply Chain Planning System of Record? (I know laughable.)

- How do I make the trade-offs on integration? Standardization? Functionality?

Who Am I To Give Advice?

You might ask, “Who is Lora Cecere to share advice?” Let me give you some background. I write for the business leader. I left Gartner because the business model focused on writing for the IT audience. I take pride in the fact that business leaders turn to me to help them buy software. If you are new to this blog, let me share my background. I have followed the supply chain planning market for sixteen years as an analyst. I worked at software companies building planning software for nine years and a business practitioner for fifteen.

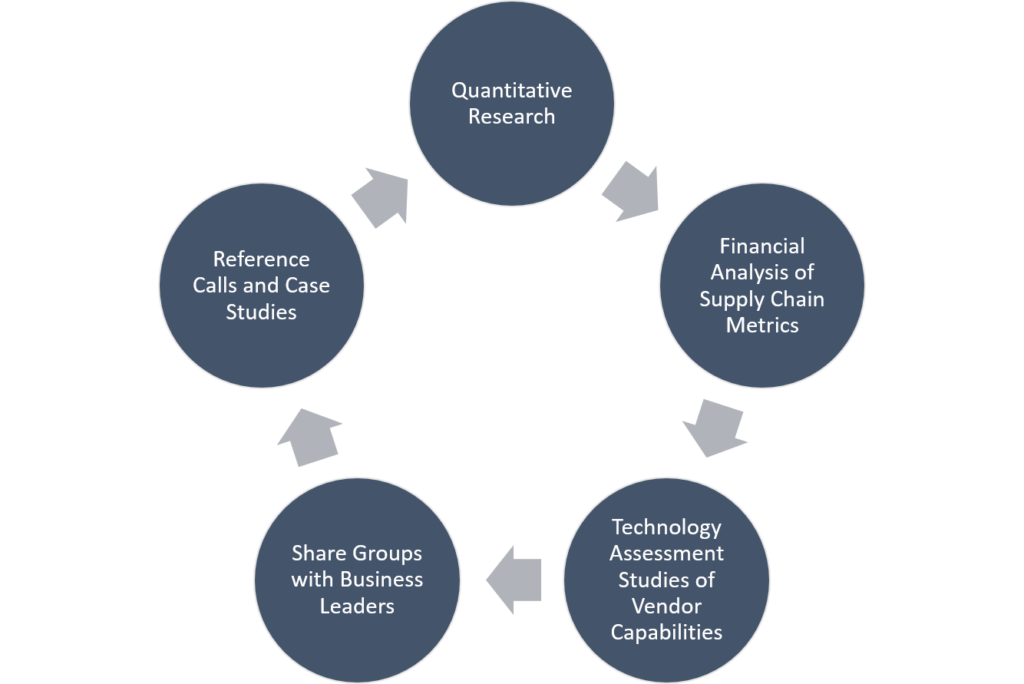

The source of data for this blog comes from market triangulation. I talk to software providers, business users, share my research openly on Linkedin with 283,000 readers, sit on fifteen years of financial data, and conduct over twenty quantitative studies a year. The data base of quantitative data at Supply Chain Insights is now over 9000 responses. ( I share some here to make my points.) I am constantly triangulating the market to understand if technology market claims translate to value. (Research models are always different. I share here to help you understand my perspective.)

Figure 1. Research Process

Current State

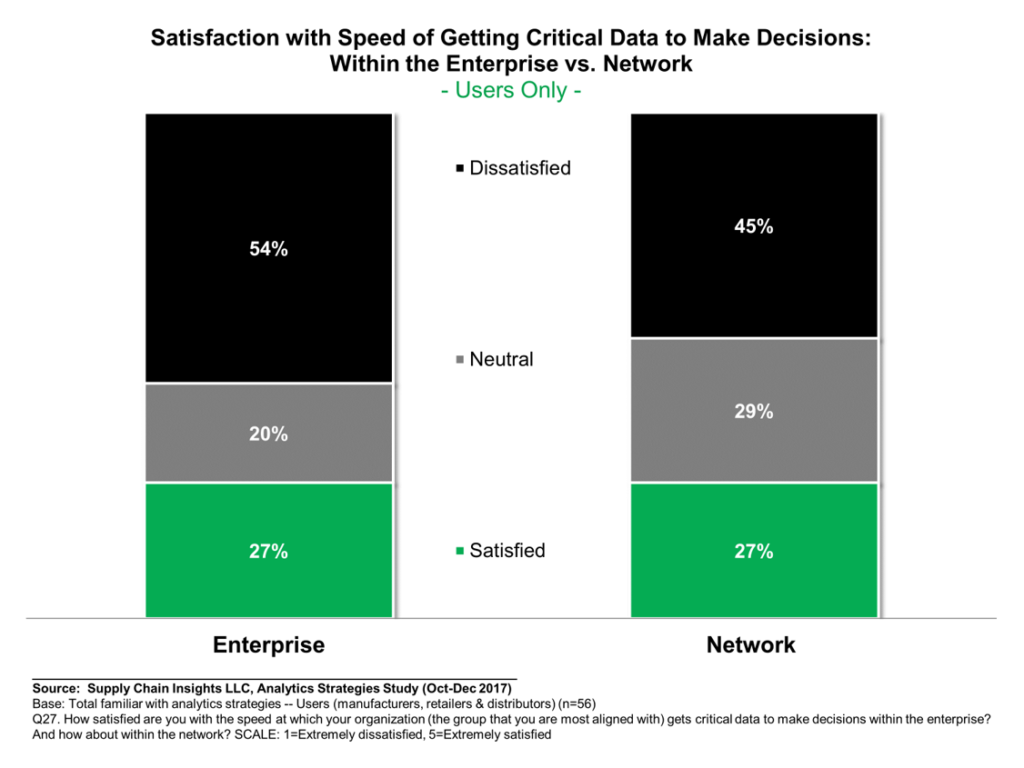

Today, 90% of companies have an ERP solution and over 85% have a supply chain planning system, but as shown in Figure 2, teams struggle to get the data that they need. Satisfied business users are only 27%. Over 50% of these business users have SAP as the backbone ERP system. There is not a significant difference if the ERP solution is from the same technology provider. The problem is that companies do not architect to drive better decisions for supply chain planning. Most of the thinking is “transactional” versus “planning data.” I only know five companies that have adequately designed planning master data systems. (Planning master data includes elements like lead times, cycle times, conversion rates, machine speeds and yield data.)

Figure 2. Current Satisfaction with Ability to Get to Data

When I probe “Why?” Many companies answer that they selected solutions based on IT standardization. There is a belief by the IT organization that the supply chain planning solutions from ERP providers are adequate. For most, they are not. I frequently see companies debating this question in boardrooms, but the answer lies in testing. Sadly, only 7% of companies test before purchase. Most companies, instead, buy based on vendor presentations and consultant recommendations. Few understand that the ERP-based solutions are the most expensive and seldom the best fit. Additionally, consulting providers get a kick-back on these recommendations.

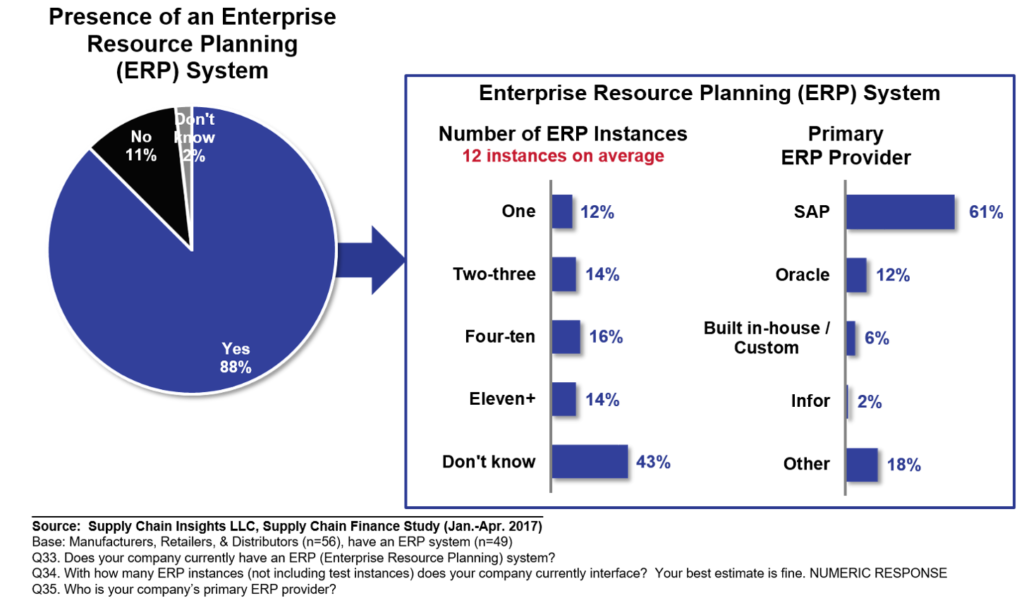

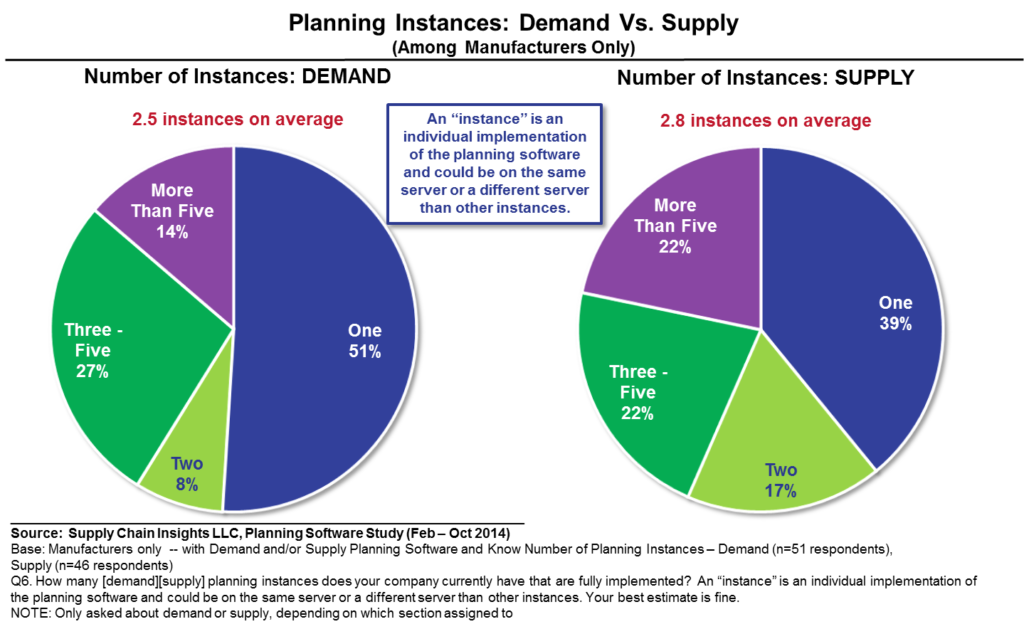

There is always an over-arching question on “integration.” There is a belief that the purchase from an ERP solution provider improves integration. Few understand the fallacy of this argument propagated by ERP providers. The first issue, as shown in Figure 3, is that most companies have not one, but more than four instances of ERP and 4-5 supply chain planning technologies. I work with several companies that operate more than a hundred ERP solutions.

APS integration might be simpler with a single instance of ERP, but his is seldom the case. As a result, the simplistic logic of an APS solution sitting on the top of a single ERP instance is not today’s reality.

Figure 3. Complexity of Supply Chain Architectures

As a result, to close these gaps, over 90% of companies depend on excel spreadsheets. This is problematic in many ways. Excel spreadsheets are woefully inadequate to model a complex, non-linear system. The output– isolated, disconnected and out of sync with the business–spins endlessy. The lack of adequate supply chain planning systems drives maverick behavior in the organization.

Figure 4. Use of Excel Spreadsheets for Planning

How Should You Make a Decision?

How Should You Make a Decision?

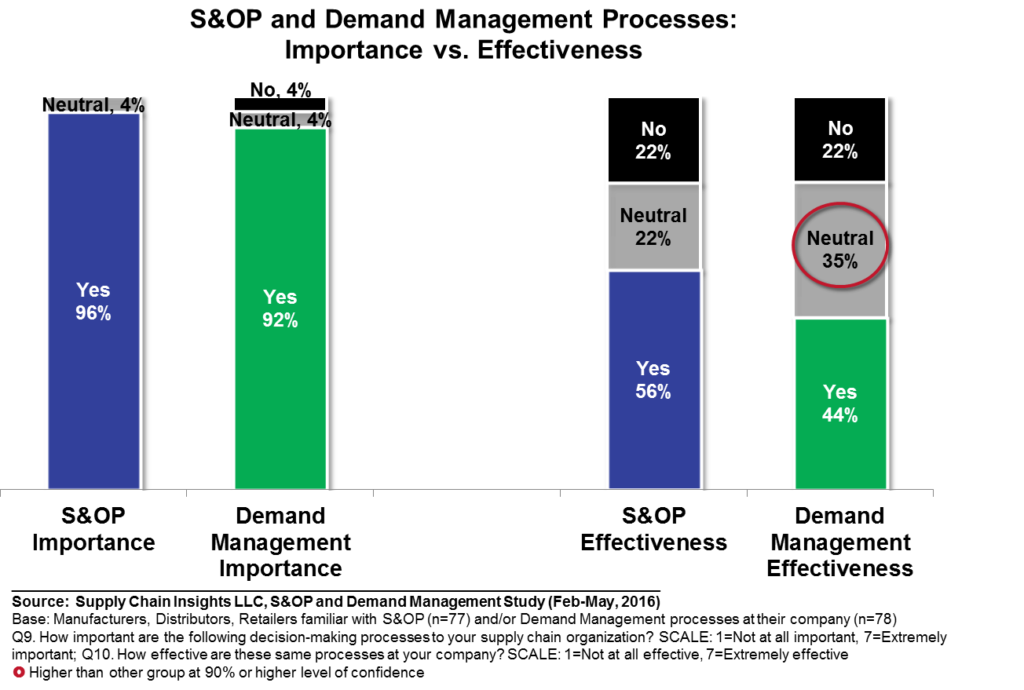

A business decision for supply chain planning should focus on the selection of the technology that can drive better business outcomes. This often in direct opposition with the solution that minimizes the IT budget. For example, there are very few planning pilots where Oracle or SAP beat the competition on capabilities. I often tell clients, “What good is a cheap solution if it does not solve the business problem?” A focus on IT standardization is one of the primary reason for low business user satisfaction in the recent study shown in Figure 5.

Figure 5. Business User Satisfaction

The selection criteria, listed in the order of importance to driving business value, is shared here:

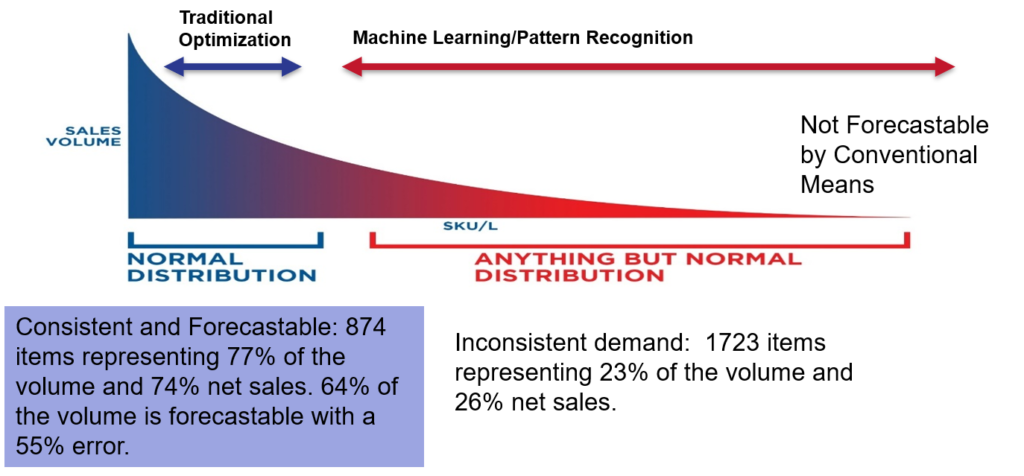

1. Engines. Get clear. What are You Trying to Model? What Is the Best Engine to Model Your Business? What Is Required at Data Model Level? These requirements are industry-specific., and the most important determinant of business value. Before engaging with the technology providers look hard at your data. Get clear on requirements and the problem that you are trying to solve. For example, Kinaxis is the best optimizer for material-centric supply chains with complex bill of materials. This includes A&D and active ingredients for pharmaceutical companies, but lacks constraint-based asset modeling for the process industries of chemical, consumer products and food. Similarly for demand planning, understand the level of intermittent demand, the characteristics of trade promotions/rebates and price, and the impact of the long tail.

Develop a test plan and make a final decision based on testing. Here is an example of demand analysis from a recent client. Extremely long tail supply chains require different techniques. This client was using an excellent forecasting technology, but it was not a good fit for their business; and as a result, was causing degradation of the forecast by 14%. Even worse, the combination of process and technology degraded the forecast by 33%. The team just did not understand how to use demand planning tools and measure/drive continuous improvement. For example. the team did not know how to measure forecast accuracy and forecast-value-add before this pilot.

Due to the complexity of the long tail pattern, I short-listed E2open LDS/DS/MDS, John Galt, and Toolsgroup. SAS would have been a fit if the company was only seeking forecasting, but SAS falls short on the use of point-sale data and demand sensing (use of pattern recognition to replace rules based consumption.) The company found that their primary planning technology were insufficient. We show product portfolios from this pilot in Figure 6.

Figure 6. Example of Data Analysis

2. User Interface Requirements. Different users have different preferences. In testing, understand business user preferences and have business users score the user interface as a part of the pilot. In a recent sales engagement, the company was considering Kinaxis, o9, and OM Partners. The Kinaxis interface scored the highest in testing, but the data model was not a good fit. OM Partners had the depth and breadth of the solution, but did not score as high on system usability. o9 had a great user interface, but lacked breadth of the solution for the requirements. In any software selection, there are trade-offs. This is why it is important to define decision governance and selection criteria before engaging the technology companies.

Funny story. About once a month a client calls with a similar story. After actively studying solutions in the market, the team cannot make a decision. I often see teams with a stalemate. Sometimes the search is over a period of eight-to-ten months. In the end, they cannot discern the differences in the software and ask me to help them to make a decision. I usually laugh. I don’t make these decisions for clients, but I do help facilitate the process.

3. Understand What-if and Collaboration Requirements. Only thirty percent of companies have “What-if Capabilities.” This is a primary driver of agility. What-if optimization and business process simulation are two important techniques. Define requirements for both. The strongest technologies for this requirement are Anaplan and Kinaxis.

4. Explore the Requirements of Downstream and Upstream Partners. Do an audit. Understand requirements mandated by upstream and downstream partners. Focus integration discussions there. The integration with enterprise solutions is less important. The best capabilities are outside-in. For example, if you do business with Wal-Mart, how will you use Wal-Mart Retail Link Data seamlessly? If you have VMI, how will you use this signal? When you focus outside-in, you quickly find that channel data and supplier data is much more important than the Enterprise solutions of CRM and SRM.

5. Determine Scalability. Get clear. The number of items, parallel usage by business users, and time requirements of batch jobs determine scalability.

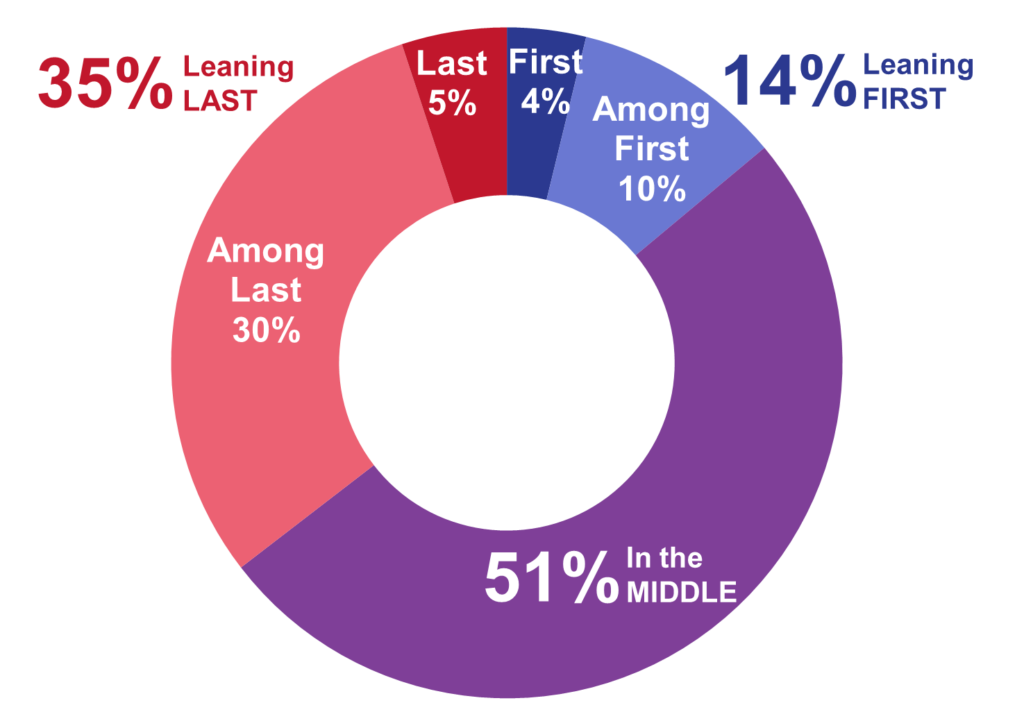

6. Culture. The culture of the solution provider should match that of the buyer. Only 14% of companies rank themselves as innovators. Relationships matter. Today, innovators are testing cognitive computing, artificial intelligence, and open source technologies. The majority of buyers are late adopters. Late adopters should test and learn and follow the innovation of early adopters. I recently worked with a company that had a project named “Spark.” They were attempting to find innovation in the market. However, the company was not an early adopter. Instead, they wanted a solution with a proven ROI and technology references. They wasted months attempting to define a solution that was not in the company’s comfort zone.

Vendor presence and capabilities within a region also make a difference.

Figure 7. Example of Data Analysis

7. Price. Focus on ROI. Enlist finance to understand the business drivers and business opportunities. Before getting started know your budget. Know that the prices of technologies vary widely based on negotiation skills.

7. Price. Focus on ROI. Enlist finance to understand the business drivers and business opportunities. Before getting started know your budget. Know that the prices of technologies vary widely based on negotiation skills.

8. System of Record. As shown in Figure 6, the average company larger than 1B$ operates 4-5 instances of supply chain planning. To keep these solutions synchronized there is a need for a system of record to drive visibility for global decisions. Systems of record in planning are more important in global companies that have a strong need for corporate visibility. It is less important in regional supply chains with less complexity.

The system of record brings planning outputs together to drive corporate planning. However, for this to work, data models need alignment. Let me give you an example. I recently worked with a company with twenty-seven divisions. Over the past two years, the divisions defined demand management with different data granularity, time horizons and frequency. If a system of record capability is important, data consistency is the first step.

Figure 8. Planning System Complexity

IT Standardization. To maximize business value, this is the last consideration. The discussion of IT standardization focuses on IT budget maximization versus business value. Without testing it is very difficult to determine the right trade-offs between IT costs and business value. While the IT costs are clear and known, most companies have not completed the testing to understand business value.

IT Standardization. To maximize business value, this is the last consideration. The discussion of IT standardization focuses on IT budget maximization versus business value. Without testing it is very difficult to determine the right trade-offs between IT costs and business value. While the IT costs are clear and known, most companies have not completed the testing to understand business value.

Promising Trends

I am very excited by the level of market innovation happening in the market today. We are at the juncture of software planning redesign. This includes:

- Schema on Read.

- Cognitive Computing.

- What-if Analysis and Redefinition of Planning.

New solutions — Aera, Anaplan, Bluecrux, Enterra, Lokad, O9, Rulex, and — offer new possibilities. I also find the evolution of deeper optimization/machine learning within the John Galt, Gains Systems, Kinaxis, and ToolsGroup solutions promising. We are moving towards the autonomous supply chain and the redefinition of planning. It is a step change.

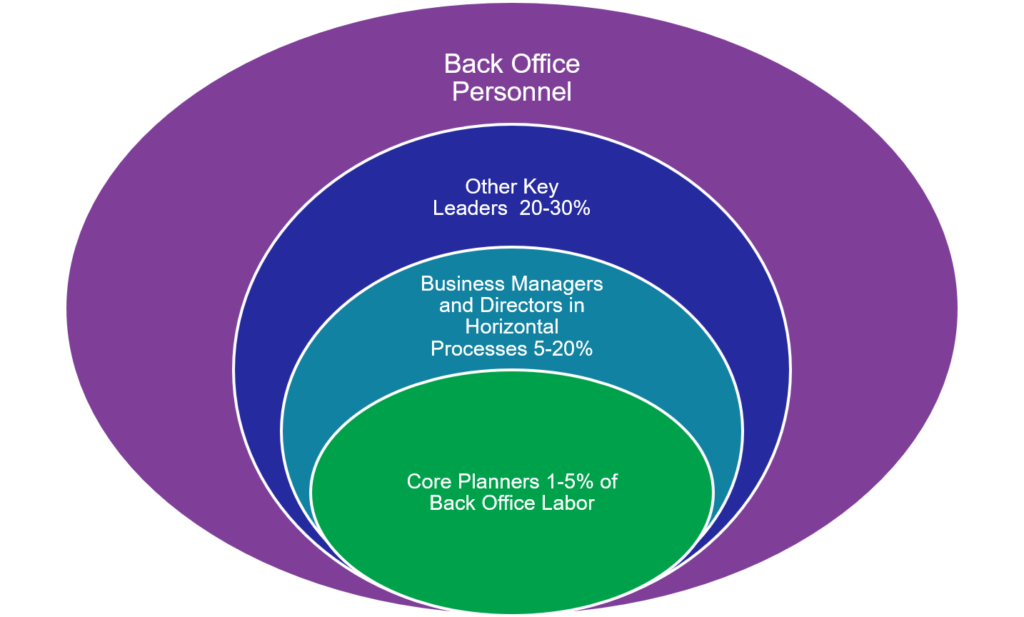

One of the key levers is making planning data available to the larger organization. Unfortunately, planning data today is only accessible only by small groups within the organization. New cloud-based technologies offer the capabilities to unlocking the potential to use planning data more widely to drive better business decisions.

Figure 9. Unlocking the Potential of Planning

Pitfalls and Potholes

With this background, let’s tackle the questions that I get the most frequently:

- What should I do about the discontinuation of SAP APO in 2025? Should I migrate to SAP IBP? The SAP APO product, when launched, was inferior as an optimization engine to best-of-breed products. The CIF interface was problematic on release, but overtime became a strength. Over the last decade, satisfaction of APO software users and the use of the APO solution lagged competitors. The concept of integrated workflows only fit a smaller, regional supply chain with a single instance. As shown above, most companies have multiple instances with complicated workflows and requirements making SAP’s integration promise less valuable. As for SAP IBP, my reference calls go like this. Tell me about your SAP IBP experience. We purchased SAP IBP on the recommendation of our consulting partner. We wanted to standardize on a common platform. How do you like the SAP IBP product? It is not ideal, but through 4-6 months of customization, we are able to make it work. What did it cost you? The costs are 2-3X best-of-breed solutions and deployments that are 3-4X longer. Companies are paying for customization for a solution that has marginal user satisfaction. Recently, I worked with a chemical company that had a single SAP ERP instance, and was being heavily courted by SAP to implement SAP IBP. I connected the team to current IBP deployments and they found out for themselves that while the architecture is easier for the IT team (a common platform), that line-of-business users were not satisfied. The tools could not model the business of a food manufacturer with multiple divisions. As a result the chemical company, they told SAP, “We would not use IBP if you gave it to us.”

- I am uncomfortable about the migration path of the applications of the software aggregators/consolidators. This includes JDA, E2Open, Infor, Logility, and Oracle. How do I get to a better place? I smile and answer, “You should be uncomfortable. I know of no case where the purchase of software and the aggregation of solutions improved the outcome of the planning solution for business users. It usually causes confusion and delay in product development.” Recently, I spoke to a company that did not heed my advice to implement Fygir an Infor application. My concern is that the Fygir product today is not as strong as it was a decade ago. At one time, it was the best solution in the market for tank scheduling, but the integration into the Infor suite delayed product innovation and created turnover of the original team. At the recent Supply Chain Insights Global Summit, he told me that my advice was the best he ever got from an analyst. Over a beer, I heard stories of a long project that underperformed. If you have one of these solutions expect development to lag the market. And, in software migration, use Ronald Reagan’s advice, “trust but verify.”

- What do I think of the Gartner Magic Quadrant on Supply Chain Planning System of Record? (I know laughable.) From the model listed above, flaw in the methodology is obvious. The system of record is only one of nine factors involved in the selection process, and it is of lower importance. If you follow the magic quadrant methodology, you have a strong likelihood to buy the wrong software product. (As a prior Gartner analyst, I would give this a 95% probability.)

- How do I make the trade-offs on integration? Standardization? The answer to this question boils down to, “Will the solution give you a better answer for your business? And, what is the value of this better answer? “This requires testing. The most important factor to consider in the solution is the fit of the data model, the suitability of the engines and the fit of the user interface. Integration is seldom the issue in planning deployments.

What Should I Do Next?

Find Out What You Have. Maximize Your Current Assets. Most clients that I work with are not aware of the solutions that they have. Start by doing an assessment of licenses and deployments. Recently, I was on a panel with Peter Bolstorff, Executive Director of Corporate Development, APICS. In that session, Peter shared that companies are only using 33% of their current licensed software. I agree. There is a lot of shelfware in the market.

Bide Your Time. The market is in transition. Stabilize current investments and carefully watch the development of the autonomous supply chain. The choices in 2022 will be radically different from 2018. I have never seen a more promising set of best-of-breed solutions evolving. Move at a comfortable pace. Today they are only a good fit for early adopters.

Educate the Team. Over the last decade, employee turnover, market hype and over-zealous sales teams diluted the fundamentals of supply chain planning. When companies call, I find that most organizations are unclear on the fundamentals and lack alignment on terms. Get started by learning together. Avoid acronyms. When you hear a term ask for clarity and definition. When you hear vendor claims, be a skeptic.

Network With Others. Get beyond the market hype. Discover the perspective from others in your industry. Don’t take conference presentations at face value. Instead, network and get the straight scoop from business users. In this process realize that the perspectives of business leaders and IT professionals differ greatly.

Market consolidation adds complexity requiring greater investigation. For example, if a company says that they use a solution. Find out which solution and version and the level of customization.

Focus on Solutions With a Data Model That Fits Your Industry. For material-centric supply chains this is Kinaxis. For process-centric supply chains try Arkeiva or OM Partners. If you need forecasting at the top-end provider consider SAS. If you need forecasting and inventory optimization consider Gains Systems, John Galt, and ToolsGroup.

What do you think? I look forward to getting your input.

For additional reading consider these prior blog posts and articles:

What Happened to Demand Driven?

Side-step Religious Arguments

Anaplan

Why SAP Is a Risk To Your Business

Supply Chain Analytics